👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Saturday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to Life Self Mastery podcast which gives you a guide on how to get funding and allow your business to have rocketship growth. Previous guests include Guy Kawasaki, Brad Feld, James Clear, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

The Arm Holdings Story: From a Tiny Cambridge Office to World Domination

Imagine this: It’s 1990, and in a cozy little office in Cambridge, UK, a few brilliant minds from Acorn Computers, Apple, and VLSI Technology are huddled around a table. Their goal? To create a super-fast, super-efficient chip that the whole world would want to use. No pressure, right?

Fast forward to 1998, and guess what? Arm Holdings is no longer just a startup dream—it's a publicly traded company on both the London Stock Exchange and Nasdaq! They were on their way to changing the world… but the real magic happens in 2016. SoftBank Group comes in with a jaw-dropping $32 billion deal to take Arm private. Why? So Arm could go even bigger and bolder, without the prying eyes of the public markets watching every move.

Fast forward again, and now Arm’s chips are in… well, pretty much everything! Over 250 billion chips are out there today, from the tiniest sensors to the most powerful supercomputers. And, fun fact: 99% of the world’s smartphones? Yep, they’re powered by Arm.

But hold on... Arm isn’t just sitting back and admiring its success. Oh no, the story is far from over!

Arm Holdings (ARM) Stock Overview

Current Price: $49.00 (as of market close)

Market Cap: $50.4 billion

52-Week Range: $45.00 - $55.00

EPS (TTM): $0.35

IPO Details:Arm Holdings made its highly anticipated return to the public markets in September 2023, with its initial public offering (IPO) priced between $47 and $51 per share. The IPO raised approximately $4.9 billion, giving the company a valuation of $50.4 billion. This marked a significant milestone for Arm, which had been taken private by SoftBank in 2016 in a $32 billion deal.

The IPO garnered substantial attention from major players in the tech industry, with companies like Apple, Google, and NVIDIA expressing keen interest. Together, these tech giants subscribed for around $735 million worth of Arm shares, signaling strong confidence in the company’s future prospects and its critical role in powering everything from smartphones to cloud computing systems.

For SoftBank, which retained a significant stake in Arm following the IPO, the public offering was a strategic move aimed at solidifying Arm’s position as a leader in the rapidly evolving AI and semiconductor sectors. As demand for AI-driven technologies continues to grow, particularly in areas like autonomous vehicles, data centers, and IoT, Arm’s energy-efficient chip designs place it in a pivotal role. The IPO was not only a financial success but also a crucial step in ensuring Arm’s long-term leadership in shaping the future of global computing.

Company Overview:Arm Holdings, a UK-based semiconductor powerhouse, plays a pivotal role in the global tech landscape by licensing its cutting-edge processor designs to technology companies across the world. Renowned for its energy-efficient architecture, Arm's chips are embedded in over 250 billion devices, making the company a cornerstone of modern computing. Its processor designs power 99% of the world’s smartphones, making Arm technology indispensable to mobile devices across all major operating systems.

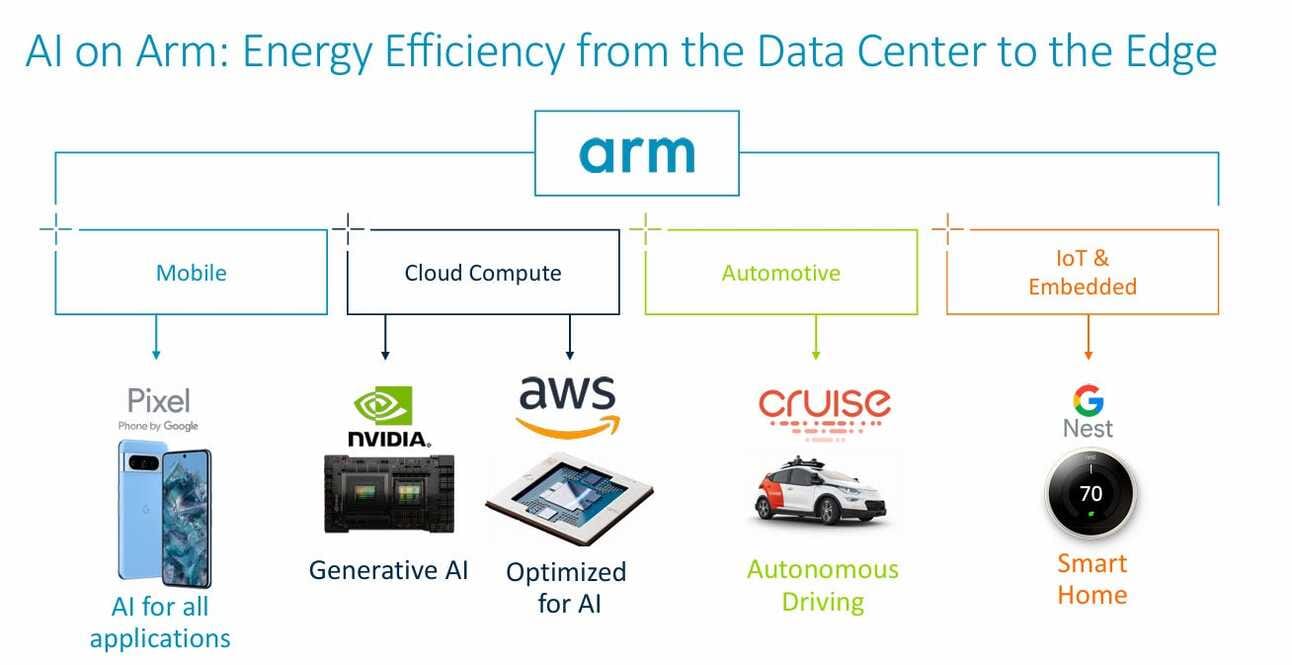

However, Arm’s influence goes far beyond mobile phones. The company’s chip designs have become integral to a wide range of industries, including the Internet of Things (IoT), where connected devices rely on Arm’s low-power processors for everything from smart home gadgets to industrial sensors. In the automotive sector, Arm technology is driving innovations in advanced driver-assistance systems (ADAS), in-vehicle infotainment (IVI), and even autonomous driving.

More recently, Arm has gained momentum in AI and cloud computing, where its highly scalable and efficient processors are being used in data centers and edge computing applications. As AI technologies advance and demand for cloud services grows, Arm is positioned as a critical player, providing the energy-efficient computing power needed to fuel these next-generation innovations.

History: From Humble Beginnings to Global Dominance

Founded in 1990 in Cambridge, UK, Arm Holdings began as a joint venture between Acorn Computers, Apple Computer, and VLSI Technology. The goal was ambitious: to develop a high-performance, power-efficient processor architecture that could be widely adopted. By 1998, Arm had gone public on the London Stock Exchange and the Nasdaq Stock Market. In 2016, Arm was taken private by SoftBank Group for $32 billion, a move that allowed it to focus on strategic growth without the pressures of the public markets

Since its inception, Arm has continued to revolutionize the semiconductor industry, enabling over 250 billion chips used in devices ranging from the smallest sensors to the most powerful supercomputers. The company’s processors power 99% of the world's smartphones, proving essential to the mobile revolution and beyond

Market Opportunity

Arm Holdings’ total addressable market (TAM) is projected to grow from approximately $202.5 billion in 2022 to around $246.6 billion by 2025, with a compound annual growth rate (CAGR) of 6.8%. Here’s a breakdown of key segments:

Mobile Applications Processor Market: Expected to grow from $29.9 billion in 2022 to $36.0 billion by 2025 (CAGR of 6.4%). Arm has maintained a market share exceeding 99% in this segment, driven by the pervasive use of its architecture in all major mobile operating systems.

Other Mobile Chips Market: Estimated to remain steady at around $17.6 billion in 2022 and $17.5 billion by 2025, reflecting a minor decline at a CAGR of -0.2%.

Consumer Electronics Market: Including products like digital TVs, tablets, and wearables, this market is set to grow from $46.9 billion in 2022 to $53.2 billion by 2025 (CAGR of 4.3%).

Industrial IoT and Embedded Market: Projected to grow from $41.5 billion in 2022 to $50.5 billion by 2025 (CAGR of 6.7%). Arm's market share in this segment grew from 58.4% in 2020 to 64.5% in 2022.

Networking Equipment Market: Expected to grow from $17.2 billion in 2022 to $18.2 billion by 2025 (CAGR of 1.8%). Arm’s market share has increased from 18.8% in 2020 to 25.5% in 2022.

Cloud Compute Market: Anticipated to grow from $17.9 billion in 2022 to $28.4 billion by 2025 (CAGR of 16.6%). Arm’s share in this segment rose from 7.2% in 2020 to 10.1% in 2022.

Automotive Market: Estimated to expand from $18.8 billion in 2022 to $29.1 billion by 2025 (CAGR of 15.7%). Arm's share in automotive chips grew from 33.0% in 2020 to 40.8% in 2022, driven by growth in ADAS, IVI, and autonomous driving technologies

Product Overview

Arm offers a wide range of CPU products based on its proprietary architecture. These CPUs are designed to be highly energy-efficient, versatile, and scalable, allowing them to be used in various applications across multiple sectors.

Arm’s product lineup includes:

CPUs: The backbone of Arm's offerings, these processors are built on Arm's instruction set architecture (ISA) and are known for their high performance and energy efficiency. Arm’s CPUs are used in over 250 billion devices worldwide, from smartphones to supercomputers.

GPUs: Arm’s graphics processing units are optimized for providing high-quality visual experiences on a range of devices, from mobile phones to gaming consoles.

System IP: This includes design components like memory controllers and on-chip interconnects that facilitate communication between different parts of a system-on-chip (SoC).

Compute Platforms: Arm integrates its CPUs, GPUs, and System IP into comprehensive compute platforms optimized for specific end markets such as automotive, data centers, and IoT.

Development Tools and Software: Arm provides a suite of tools and software to aid developers in creating and deploying applications on Arm-based devices. This ecosystem includes support for leading operating systems like Android, Windows, and Linux, and partnerships with software giants like Adobe, Microsoft, and Google

Product Strengths:

Arm's products are favored for their power efficiency, performance, scalability, and compatibility with a vast ecosystem of developers and partners. Arm's flexibility allows its products to be used in multiple applications, ensuring they remain relevant across various markets.

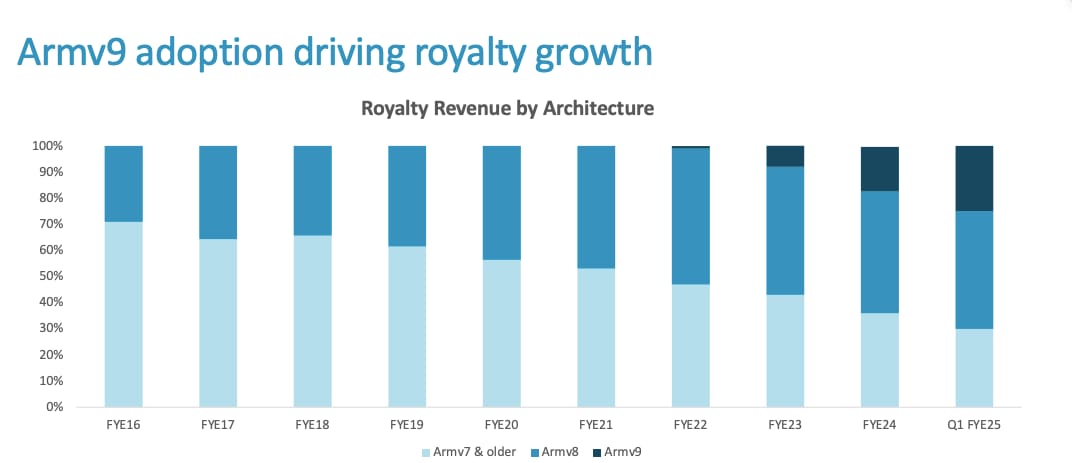

Armv9 adoption

Armv9 commands a higher royalty per chip than its predecessors due to its advanced capabilities and efficiency, making it more valuable to manufacturers and tech companies.

The adoption curve shows a steady increase in Armv9’s share of royalty revenue, reflecting its critical role in supporting next-generation technologies, particularly as companies demand more performance in AI, machine learning, and edge computing.

The shift toward Armv9 architecture demonstrates Arm's ability to innovate and evolve its technology to meet the growing complexity and performance demands of the modern tech ecosystem.

Armv9’s success is driving royalty growth and reinforcing Arm Holdings' leadership in semiconductor design, paving the way for future advancements in various cutting-edge industries.

Business Model

Arm operates on a licensing model, where it licenses its CPU designs to semiconductor companies. These companies, in turn, manufacture chips based on Arm’s designs and pay Arm royalties for every chip sold. In 2022, Arm reported a licensing revenue of $1.68 billion, accounting for 62.7% of its total revenue, while royalties contributed $1.0 billion (representing 37.3% of total revenue)

The royalty rates are typically based on a percentage of the average selling price (ASP) of each chip or a fixed fee per unit. Arm's royalties have grown as it introduces more advanced and diverse CPU products, which attract higher royalties due to their increased value.

Arm Holdings generates revenue through several key channels:

Licensing Processor Designs: Arm licenses its processor designs to chip manufacturers, who then produce and sell chips based on those designs. Arm earns a royalty fee for each chip sold.

Selling Software Development Tools: Arm provides a suite of software development tools that assist chipmakers in designing and developing chips using its processor architectures.

Offering Technical Support: Arm offers technical support to its customers, helping them debug designs and optimize chips for specific applications. This support is an added service for chipmakers using Arm's technology.

Selling Additional Intellectual Property (IP): Beyond processors, Arm sells other valuable IP, such as graphics processing units (GPUs) and machine learning accelerators, broadening its portfolio and revenue streams.

This diverse business model allows Arm to maintain a strong foothold in the semiconductor industry.

Diversification in markets

In FYE16, mobile royalties accounted for the vast majority of Arm's revenue, with over 50% of the royalties coming from this sector. At that time, Arm's dominance in smartphone chips was its primary revenue driver, with much of its business centered around mobile applications.

However, by FYE24, the company had significantly diversified its revenue base. While smartphone application processors still represent a substantial portion of its royalties at 40%, Arm has expanded into multiple new sectors. Notably, IoT and embedded systems now contribute 20% of royalty revenue, reflecting the growing demand for connected devices and embedded computing across industries. The automotive market, which accounted for only 8% of royalties, is also an area of increased focus, with Arm's technology being used in applications such as autonomous driving, infotainment, and advanced driver-assistance systems (ADAS). Additionally, the cloud and networking sector has grown to represent 10% of royalties, driven by the increasing demand for efficient computing power in data centers.

Arm has successfully transitioned from a predominantly mobile-centric business to a more diversified operation, leveraging its energy-efficient processors in emerging markets like IoT, automotive, and cloud computing.

Key Numbers:

Arm had over 260 companies reporting they had shipped Arm-based chips in FY 2023.

Arm has more than 8 million apps running on Arm-based devices, built by over 15 million developers.

In FY 2023, Arm generated a gross profit margin of 96% and an operating income margin of 25%.

Management Team

Industry veterans lead arm’s management team with significant experience in technology and business leadership:

Rene Haas (CEO): Appointed CEO in February 2022, Rene has a rich background in semiconductors and IP licensing, having previously served as the President of Arm’s IP Products Group. Rene’s vision is to extend Arm’s market leadership across all segments of computing.

Inder Singh (CFO): With extensive experience in financial leadership, Inder joined Arm in 2019 and has been pivotal in driving Arm’s financial strategy and preparing for its IPO.

Simon Segars (Executive Vice Chairman): Former CEO of Arm, Simon Segars has been a part of Arm since its early days. He now serves as Executive Vice Chairman, focusing on strategic initiatives and partnerships.

Paul Williamson (SVP and GM, IoT Business): Leads Arm’s IoT Business and has been instrumental in expanding the company's footprint in IoT markets. Previously, Paul held senior roles at Arm and other semiconductor companies, bringing deep expertise in embedded systems.

Dipesh Patel (Chief Operating Officer): Oversees operations, product development, and customer engagement strategies. Dipesh has over 20 years of experience at Arm, contributing to the company’s success in various leadership roles.

Investor and Ownership

Key Investments and Acquisitions by Arm Holdings

Artisan Components (2004)

Valuation: $913 million.

Purpose: Expanded Arm's physical IP portfolio, enhancing its ecosystem and supporting broader adoption of Arm architecture.

Allinea Software (2016)

Valuation: Not disclosed.

Purpose: Acquired to strengthen Arm's position in high-performance computing (HPC) with advanced tools for parallel applications.

Treasure Data (2018)

Valuation: $600 million.

Purpose: Boosted Arm’s IoT services with end-to-end data management solutions, combining Treasure Data's expertise with Arm’s IoT hardware.

Stream Technologies (2018)

Valuation: Not disclosed.

Purpose: Enhanced Arm’s IoT connectivity management services, enabling secure and efficient connectivity for billions of devices.

Apical Ltd. (2016)

Valuation: $350 million.

Purpose: Added advanced imaging and computer vision capabilities to Arm's portfolio, strengthening its position in IoT and smart devices.

Arm China Joint Venture (2018)

Valuation: $775 million (for 51% stake).

Purpose: Localized Arm's operations in China, aligning with domestic semiconductor development priorities.

SoftBank Vision Fund Stake Acquisition (2023)

Valuation: $16.1 billion.

Purpose: Consolidated SoftBank's control of Arm before the IPO, reflecting Arm's strategic value in the semiconductor industry.

Arm is primarily owned by SoftBank Group, which holds approximately 90% of Arm’s equity following the acquisition of the stake held by SoftBank Vision Fund. The remaining 10% is expected to be owned by other public shareholders post-IPO.

SoftBank Group: ~90% ownership

Public Shareholders: ~10% ownership (post-IPO)

This ownership structure allows SoftBank to maintain significant control over Arm’s strategic direction while benefiting from the public capital markets

Softbank made things difficult

Arm's IPO has faced challenges, with SoftBank lowering the offering price to between $47 and $51 per share. SoftBank is selling 95.5 million shares through American Depositary Receipts (ADRs) without raising capital for Arm itself, as all proceeds go to SoftBank. Major tech players like Apple, Google, and Nvidia are subscribing to $735 million worth of shares. Notably, Qualcomm is absent due to ongoing litigation with Arm. Economic pressures are causing consumers to delay phone upgrades, reducing chip shipments and royalties for Arm. While Arm has potential in AI, it is not yet perceived as an AI company like Nvidia.

Competition: A Unique Position in a Crowded Market

Arm faces competition from companies like Intel, AMD, and NVIDIA, particularly in high-performance computing and data centers. However, its extensive ecosystem of more than 1,000 partner companies gives it a unique advantage. Key partnerships include tech giants like Amazon, Google, and Microsoft, all of which use Arm technology in their data centers or products.

Arm's focus on energy efficiency, scalability, and the broad adoption of its architecture across industries make it a formidable player in the semiconductor market. Arm's products dominate the mobile processor market and are rapidly gaining ground in new markets like automotive and cloud computing

Financials

Arm has shown consistent financial growth and stability over the years:

FY 2021: Revenue of $2.03 billion, gross profit margin of 93%, and net income of $544 million.

FY 2022: Revenue of $2.70 billion (up 33%), gross profit margin of 95%, and net income of $676 million.

FY 2023: Revenue of $2.68 billion, gross profit margin of 96%, operating income margin of 25%, and net income of $524 million

Q1 FYE25: Record Quarterly Revenue:

Record total revenue: $939m up 39% YoY

License and other revenue: $472m up 72% YoY driven by multiple high-value license agreements and the increased demand for Arm’s technology in AI-related applications

Royalty revenue: $467m up 17% YoY with strong smartphone sales and increased Armv9 penetration

Arm’s revenue streams are well-diversified across licensing and royalties, ensuring a steady flow of income. The company’s focus on expanding its market share in high-growth segments like cloud computing and automotive is expected to drive future revenue growth.

Closing thoughts

Arm Holdings' journey from a small office in Cambridge to a global semiconductor powerhouse is a testament to its visionary leadership, strategic partnerships, and unwavering commitment to innovation. What started as a collaboration among a few tech pioneers has transformed into a company whose technology powers 99% of the world’s smartphones and over 250 billion devices globally. Arm's consistent growth, fueled by its energy-efficient chip designs and a robust licensing model, has cemented its dominance across diverse sectors like mobile, IoT, automotive, and cloud computing. The 2016 acquisition by SoftBank provided Arm the freedom to scale even further, positioning it as a key player in emerging markets like AI and autonomous vehicles.

With its 2023 IPO, Arm signaled its ambition to continue leading the semiconductor industry, particularly in high-growth sectors such as AI and cloud computing. As it enters its next chapter, Arm remains focused on expanding its market share while leveraging its extensive ecosystem of partners and developers. The future promises more technological breakthroughs, ensuring Arm's story of innovation and leadership continues well into the next generation.

Tweets of the week

Onlyfans had 42 employees with $1.3B as a net revenue figure in 2023

Life (and business) is about long-term relationships

Here’s how I can help

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you next week.