👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

HashiCorp in one-minute

HashiCorp is a cloud infrastructure automation leader founded by Mitchell Hashimoto and Armon Dadgar. Unlike traditional IT vendors, HashiCorp thrives on its open-core model, blending open-source community roots with enterprise-grade solutions. For HashiCorp, open-source is a moat.

HashiCorp’s challenge is convincing enterprises to bet on a multi-cloud future, but its numbers are compelling. With $211M in revenue for FY2021, +75% YoY growth, and adoption by 300+ Forbes Global 2000 companies, HashiCorp has become critical to digital transformation. Its flagship products—Terraform, Vault, Consul, and Nomad—power everything from infrastructure provisioning to zero-trust security and workload orchestration.

Winners include venture heavyweights like Mayfield Fund and GGV Capital, who backed HashiCorp’s vision of replatforming IT.

To learn more about HashiCorp’s cloud operating model, its $100K+ ARR customers, and its position in the cloud wars, keep reading.

Introduction

HashiCorp (HCP) Stock Overview

Current Price: $33.78Market Cap: $6.883 billion52-Week Range: $20.42 - 34.21

It wasn’t the start of a cloud revolution, though in hindsight, it felt like one. When HashiCorp’s founders, Mitchell Hashimoto and Armon Dadgar, described their vision, they didn’t lead with product features or market numbers. Instead, they invoked something bigger, something transformative:

“HashiCorp isn’t just building tools. It’s redefining how organizations operate in the cloud.”

The claim might have sounded audacious—cloud computing already had its titans and buzzwords. But this wasn’t about buzzwords. It was about enabling enterprises to move beyond legacy IT workflows, to harness the full potential of distributed, dynamic infrastructure, and to embrace a cloud operating model built for scale, security, and speed.

To understand HashiCorp, you can’t simply look at the millions of Terraform downloads, the hundreds of Forbes Global 2000 companies using Vault, or the staggering $211M in revenue for FY2021. These numbers signal success but don’t capture the whole story.

For HashiCorp, success lies in something deeper: the vision of a world where infrastructure isn’t a bottleneck but a driver of innovation. A world where infrastructure provisioning is as seamless as writing code, where secrets management implements zero-trust security by default, and where networks and workloads adapt in real time.

This isn’t about building the most features or chasing fleeting trends. It’s about creating foundational technologies—Terraform, Vault, Consul, and Nomad—that power the critical workflows of the digital age. Technologies that don’t just integrate with the cloud but enable enterprises to own it, across public, private, and hybrid environments.

If you believe the future of business is cloud-first—if you believe that infrastructure automation is the key to unlocking innovation—then it’s worth asking which company is building that foundation.

Market

The cloud is no longer just an IT solution—it’s a cornerstone of modern business. By 2024, the global public cloud services market is projected to reach $676 billion, more than doubling its 2020 size of $312 billion. Yet this rapid growth has introduced unprecedented complexity. Enterprises aren’t merely adopting the cloud—they’re embracing all the clouds. Multi-cloud strategies now dominate, with 75% of organizations utilizing providers like AWS, Microsoft Azure, and Google Cloud.

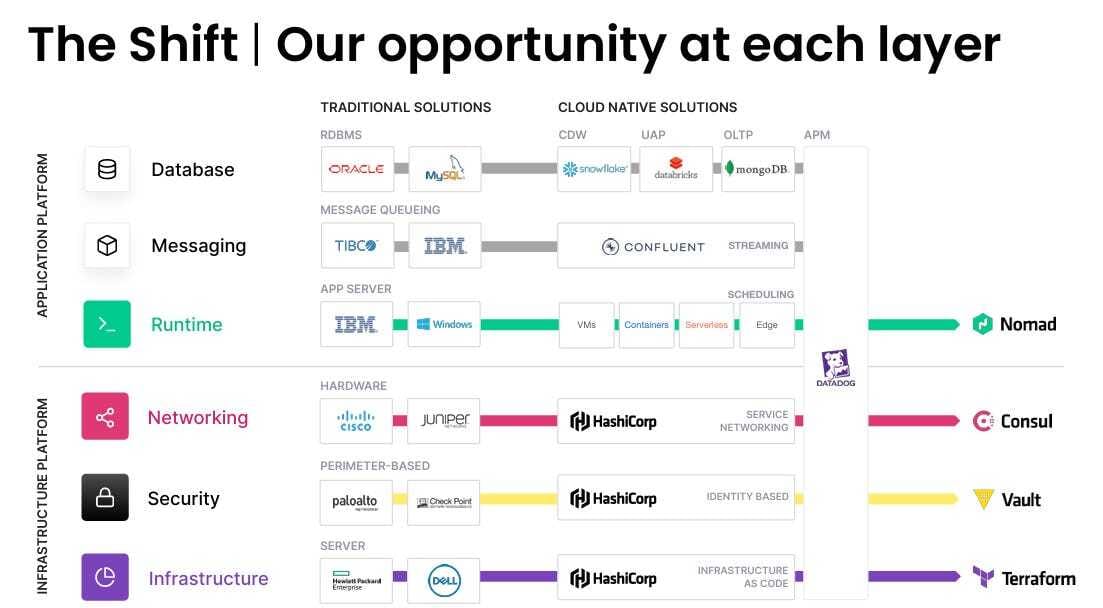

This proliferation creates a fundamental challenge: managing and scaling infrastructure across a fragmented ecosystem. Enter HashiCorp, whose tools simplify the chaos by acting as a unifying layer across these disparate platforms.

The rise of multi-cloud strategies has created a maze of infrastructure challenges. HashiCorp offers a solution: tools that turn chaos into code.

Take Terraform, the company’s flagship product, which has surpassed 100 million downloads. It allows organizations to codify their infrastructure, enabling them to manage resources across multiple clouds with a single configuration file. It’s not just a tool—it’s a new standard for infrastructure management.

But Terraform is just one part of the story. HashiCorp’s portfolio targets four key markets, each poised for significant growth:

Infrastructure Automation

Valued at $2.1 billion in 2021, projected to grow to $12 billion by 2026.

Driven by the need for faster, more scalable solutions.

Terraform’s role: empowering teams to automate and standardize infrastructure deployment.

Secrets Management

With data breaches on the rise, this market, worth $16.3 billion in 2021, is set to grow to $20.8 billion by 2026.

Vault, HashiCorp’s solution, enables zero-trust security models, safeguarding sensitive data in increasingly complex environments.

Networking Automation

In a multi-cloud world, connecting applications securely is mission-critical. This market is projected to grow from $22.6 billion in 2021 to $30.9 billion by 2026.

HashiCorp’s Consul ensures seamless networking across diverse infrastructures.

Application Orchestration

Although the smallest market at $0.7 billion in 2021, it’s expected to skyrocket to $8.8 billion by 2026.

The rise of edge computing and containerized applications fuels demand for tools that streamline orchestration.

When combined, these four markets represent a $41.7 billion TAM in 2021, projected to reach $72.5 billion by 2026. Unlike niche competitors, HashiCorp’s end-to-end portfolio addresses the entire lifecycle of cloud infrastructure management.

This breadth gives HashiCorp a unique edge. The company’s open-source ethos has fostered widespread adoption, making its tools indispensable for organizations of all sizes. More than just a participant, HashiCorp is a defining force shaping the cloud ecosystem.

HashiCorp isn’t just solving today’s challenges—it’s positioning itself for the future. As edge computing gains momentum and distributed architectures become the norm, the demand for automation and orchestration will only accelerate.

By addressing the complexities of multi-cloud management, HashiCorp transforms cloud operations from fragmented chaos into a seamless, scalable system. In doing so, it’s not merely riding the wave of cloud growth—it’s shaping its direction, carving out a vital role in the evolving IT landscape.

Product

HashiCorp transforms the complexity of multi-cloud environments into streamlined, scalable operations. The company’s suite of tools—Terraform, Vault, Consul, and Nomad—is designed to tackle the core challenges of modern infrastructure: provisioning, securing, connecting, and orchestrating. Together, they deliver a unified approach to infrastructure management, positioning HashiCorp as an orchestrator in the cloud era.

Terraform

Terraform is the foundation of modern infrastructure management. By enabling teams to define and provision resources across multiple clouds with a single configuration file, it simplifies operations at every scale.

Its declarative approach reduces errors, ensures consistency, and automates manual tasks. With over 100 million downloads and 1,400+ integrations, Terraform is not just a tool; it’s the industry standard for Infrastructure-as-Code (IaC). It empowers organizations to move from chaos to clarity in their infrastructure practices.

Vault

In an era where zero-trust security models are essential, Vault provides dynamic secrets management that keeps sensitive data safe. It generates, stores, and revokes credentials on demand, eliminating the risks associated with static passwords in codebases.

Vault’s ability to enforce and audit security policies across cloud and legacy systems makes it indispensable. With the secrets management market expected to grow from $16.3 billion in 2021 to $20.8 billion by 2026, Vault’s relevance continues to rise.

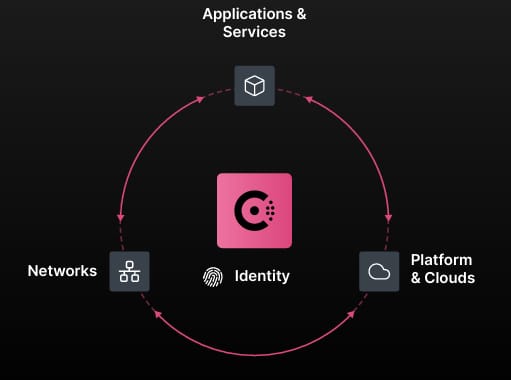

Consul

Networking in the cloud is notoriously complex, especially in multi-cloud environments. Consul addresses this challenge by automating service discovery, traffic encryption, and network segmentation.

Its service mesh capabilities streamline connectivity, ensuring secure and efficient communication between applications. As the networking automation market grows from $22.6 billion in 2021 to $30.9 billion by 2026, Consul is positioned as a critical tool for cloud-native organizations.

Nomad

While Kubernetes dominates the container orchestration landscape, Nomad offers a simpler, more lightweight alternative. It handles containers, legacy applications, and batch jobs without the overhead often associated with Kubernetes.

Nomad excels in hybrid environments, from edge devices to data centers, making it an ideal choice for organizations that value flexibility and simplicity. With orchestration tools expected to play a key role in the rise of edge computing, Nomad is primed for growth.

The Power of Integration

HashiCorp’s products don’t just solve individual problems—they work together to create a seamless ecosystem. Terraform provisions, Vault secures, Consul connects, and Nomad runs. This integration provides unparalleled efficiency and visibility across the entire lifecycle of cloud infrastructure.

With 700+ partners and 1,400+ integrations, HashiCorp ensures its tools fit into existing workflows, meeting users where they are. This approach strengthens HashiCorp’s position as a trusted partner in cloud infrastructure management.

A Platform for the Multi-Cloud Era

HashiCorp isn’t just building tools—it’s creating a philosophy of infrastructure management that prioritizes simplicity, scalability, and automation. In a world increasingly dependent on distributed systems, HashiCorp’s product suite addresses the most pressing challenges of the multi-cloud era.

By combining best-in-class solutions with deep integrations, HashiCorp transforms cloud infrastructure management into a cohesive, efficient process—helping organizations not just navigate the cloud but thrive within it.

Business Model

HashiCorp operates on an open-core business model, balancing free adoption with enterprise monetization. This strategy has transformed the company from a developer-focused toolmaker into a leader in enterprise infrastructure, fostering community-driven growth while generating significant revenue.

Open-Core Model

HashiCorp offers free, open-source versions of its tools—Terraform, Vault, Consul, and Nomad—designed to solve critical challenges in cloud infrastructure. These tools are accessible to anyone, driving grassroots adoption among developers and small teams.

Developer Adoption: By allowing teams to use HashiCorp’s tools at no cost, the company ensures its products become integral to workflows early on.

Enterprise Upgrades: Once organizations scale, they often require premium features, which are available through paid enterprise editions. These features include governance, scalability, and multi-tenancy.

Terraform Enterprise: Adds policy enforcement and collaboration for larger teams.

Vault Enterprise: Includes dynamic credential rotation and performance replication.

Consul Enterprise: Supports advanced network segmentation and observability.

This dual-tier strategy allows HashiCorp to cater to both individual developers and Fortune 500 companies, maintaining relevance across the spectrum.

Monetization

HashiCorp’s revenue strategy follows a land-and-expand model, where customers start with one product and later adopt additional tools or premium features.

Revenue Growth: $211.9 million in FY 2021, representing 75% year-over-year growth.

High-Value Customers: 558 enterprise customers contribute $100,000+ in annual recurring revenue (ARR), up from 419 the previous year. These customers represent 87% of total revenue.

Net Dollar Retention Rate: A robust 131%, reflecting HashiCorp’s success in expanding revenue from existing clients.

Once organizations integrate HashiCorp’s tools into their workflows, the cost of switching becomes prohibitive, ensuring long-term retention and opportunities for upselling.

HashiCorp Cloud Platform (HCP)

HashiCorp’s recent introduction of the HashiCorp Cloud Platform (HCP) offers fully managed versions of its tools, lowering the barrier to entry for new customers.

Consumption-Based Pricing: HCP’s pay-as-you-go model appeals to smaller teams and startups, while providing scalability for enterprises.

Operational Simplicity: HCP eliminates the need for customers to manage their own infrastructure, freeing teams to focus on innovation.

As consumption-based pricing becomes more prevalent, HCP is poised to become a significant revenue driver, especially among organizations adopting cloud-native solutions.

Ecosystem and Partnerships

HashiCorp’s extensive ecosystem of 700+ partners and 1,400+ integrations amplifies its business model, ensuring seamless interoperability with key enterprise systems and cloud providers.

Cloud Partnerships: Terraform integrates with AWS, Azure, and Google Cloud, enabling multi-cloud provisioning.

DevOps Integrations: Vault works with tools like Jenkins and GitHub to secure CI/CD pipelines.

Enterprise Security: Vault integrates with identity management platforms like Okta and Active Directory.

These partnerships create a network effect, increasing adoption and embedding HashiCorp’s tools into essential enterprise workflows.

Management Team

Mitchell Hashimoto – Co-Founder & CTOMitchell Hashimoto, co-founder of HashiCorp, is the visionary behind tools like Terraform and a key architect of the company’s approach to infrastructure automation. Known for his deep technical expertise and developer-first design philosophy, Mitchell has driven the strategic direction of HashiCorp’s product suite. As CTO, he leads product vision and oversees R&D and engineering teams, ensuring that HashiCorp’s offerings remain at the forefront of cloud infrastructure innovation.

Armon Dadgar – Co-Founder & Chief Product OfficerArmon Dadgar, HashiCorp’s co-founder, is the mind behind Consul and Vault and has been instrumental in shaping the company’s approach to distributed systems. With a background in computer science and a focus on simplifying complex cloud challenges, Armon’s strategic product thinking has propelled HashiCorp’s tools to widespread adoption. As Chief Product Officer, he directs the development of the product suite, aligning it with user needs and market trends.

David McJannet – CEODavid McJannet joined HashiCorp as CEO in 2018, bringing leadership experience from GitHub and VMware. With a strong background in scaling tech companies, David has guided HashiCorp’s growth from a startup to a publicly traded enterprise. Under his leadership, HashiCorp has expanded its market reach and successfully navigated its 2021 IPO. As CEO, David oversees the executive team and drives strategic growth and operational direction.

Navam Welihinda – CFONavam Welihinda, CFO of HashiCorp, has extensive experience in corporate finance, having worked at VMware and Salesforce. His expertise lies in financial planning, investment management, and operational strategy, making him well-suited to oversee HashiCorp’s financial health. In his role, Navam manages financial strategy, reporting, and investor relations, ensuring that the company remains on a solid financial footing as it scales.

Jennifer E. Johnson – CMOJennifer E. Johnson, HashiCorp’s Chief Marketing Officer, is a seasoned leader with experience at Salesforce and Google Cloud. Known for her strategic marketing acumen, Jennifer has played a vital role in enhancing HashiCorp’s brand and global presence. As CMO, she directs the company’s marketing strategy, focusing on brand positioning, demand generation, and customer engagement to solidify HashiCorp’s reputation as a leader in cloud infrastructure.

Leena Joshi – CPOLeena Joshi, Chief People Officer at HashiCorp, brings a wealth of experience from her time at Salesforce and Oracle, where she specialized in building high-performing teams and fostering company culture. Leena’s expertise in human resources and organizational development is key to managing HashiCorp’s talent strategy. As CPO, she oversees talent acquisition, employee engagement, and company culture, ensuring that HashiCorp attracts and retains top talent as it continues to grow.

Investors

HashiCorp has successfully raised a total of $349.5 million through equity financing, with notable investors including GGV Capital, IVP (Institutional Venture Partners), Bessemer Venture Partners, Redpoint Ventures, True Ventures, Mayfield Fund, TCV, and Franklin Templeton. Among institutional investors, the largest shareholders are Mayfield (18.6%), GGV (18.5%), Redpoint (11.1%), and True Ventures (8.6%), each holding more than 5% of the equity.

CEO Dave McJannet, who joined as CEO in 2016 and is not a co-founder, owned 4.0% of the company before its public offering. These ownership percentages are based on the current count of common and preferred shares.

The company’s most recent funding round was a $175 million Series E in March 2020, led by Franklin Templeton, which valued HashiCorp at $5.27 billion post-money or $28.92 per share. In May 2020, HashiCorp conducted a tender offer and sold approximately $124 million worth of shares at $26.03 per share, slightly below the Series E valuation. The cap table for major shareholders is outlined below.

Competition

HashiCorp operates in a crowded and competitive environment, contending with cloud providers, legacy software, and specialized tools across multiple domains. Despite this, HashiCorp’s modular and platform-neutral approach has helped it carve out a unique niche in the multi-cloud era. Let’s break down its competition across key categories:

Cloud Providers

The most direct competitors to HashiCorp come from the giants of the cloud industry—AWS, Microsoft Azure, and Google Cloud. These providers offer their own infrastructure tools, such as AWS CloudFormation and similar Terraform-like services. However, their tools are inherently tied to their ecosystems, lacking the multi-cloud flexibility that is central to HashiCorp’s value proposition.HashiCorp thrives as a neutral solution, enabling enterprises to orchestrate resources across multiple clouds without vendor lock-in.

Legacy Tools

Legacy configuration management tools like Puppet and Chef remain competitors, particularly in automating server deployments. However, their focus on configuration rather than infrastructure provisioning limits their scalability compared to Terraform.Ansible, known for its simplicity, appeals to smaller teams but doesn’t offer Terraform’s robust capabilities for full-stack provisioning.

Networking

In the realm of service mesh and networking, Istio and Linkerd offer alternatives to Consul. However, these tools are often more complex to implement and manage. For simpler networking needs, tools like NGINX and HAProxy provide basic traffic management but lack the comprehensive service mesh features that Consul delivers.Consul’s ability to simplify multi-cloud networking and integrate with HashiCorp’s broader product suite gives it a clear edge in enterprise environments.

Orchestration

Orchestration remains one of the most competitive categories. Kubernetes dominates the space, particularly for containerized applications, but its complexity makes it daunting for many organizations.Nomad, in contrast, offers a lightweight alternative for hybrid workloads, handling containers, legacy applications, and batch jobs with far less overhead. Competitors like Docker Swarm and Apache Mesos have lost relevance, leaving Nomad as a compelling option for enterprises seeking simplicity.

Security

In secrets management, AWS Secrets Manager and CyberArk are key competitors to Vault. However, Vault’s advanced capabilities, including multi-cloud support and dynamic secrets management, set it apart.Vault’s appeal is further amplified by its alignment with zero-trust security models, ensuring scalability for modern enterprises.

HashiCorp’s Competitive Edge

HashiCorp’s open-source foundation, multi-cloud compatibility, and modular tool design give it a significant advantage. By offering platform-neutral solutions, HashiCorp appeals to enterprises looking to avoid vendor lock-in while adopting flexible, scalable infrastructure strategies.

Unlike competitors locked into specific ecosystems or workflows, HashiCorp thrives as a bridge across diverse environments—a position that becomes increasingly valuable as enterprises navigate the complexities of multi-cloud and hybrid infrastructure. While competitors excel in specialized niches, HashiCorp’s strength lies in its ability to provide a comprehensive, integrated solution for the entire cloud lifecycle.

Financials

HashiCorp’s financials reveal a company focused on long-term dominance in multi-cloud infrastructure, balancing robust revenue growth, strong gross margins, and strategic investments. Despite ongoing losses, the numbers reflect a disciplined approach to scaling its operations while addressing the complexities of enterprise infrastructure.

Let’s start with growth, which remains solid. HashiCorp’s ability to scale is reflected in its revenue trajectory, driven by enterprise adoption and upselling efforts.

FY2022: Revenue hit $349.3M, a notable 64% year-over-year (YoY) increase fueled by strong enterprise adoption and expanded usage of its tools.

FY2023: Revenue climbed further to $520.7M, with 49% YoY growth, demonstrating sustained momentum as HashiCorp continued to deepen its foothold in the enterprise market.

FY2024 (est.): Revenue is projected at $599.1M, reflecting a more modest 15% growth. While slower, this signals HashiCorp’s transition to a more mature phase in the market lifecycle.

The deceleration isn’t surprising—companies nearing market saturation often experience similar trends. Still, maintaining double-digit growth in a highly competitive space speaks to HashiCorp’s resilience and strong positioning.

What’s clear is that HashiCorp is evolving from a fast-growth disruptor to a stable market leader, a natural progression for a company prioritizing long-term value over short-term spikes.

Enterprise Customers

HashiCorp’s enterprise customer base—those contributing $100,000+ in annual recurring revenue (ARR)—forms the backbone of its subscription model.

FY2022: 734 enterprise customers.

FY2023: 797 enterprise customers.

FY2024: 897 enterprise customers, a 12% YoY increase.

These high-value accounts now represent a significant portion of HashiCorp’s revenue, underscoring its success in upselling and cross-selling. With a net dollar retention rate (NDR) of 115% in FY2024, existing customers continue to deepen their engagement with the platform.

Gross Margins

HashiCorp’s SaaS business model delivers exceptional gross margins:

81%+ gross margins consistently over the past three fiscal years.

FY2024: Margins reached 82%, reflecting the scalability of its subscription-based approach.

These figures highlight operational efficiency and provide room to reinvest in growth.

Cash Position

HashiCorp boasts a robust cash position:

FY2024: $923.6M in cash and cash equivalents, up from $763.4M in FY2023.

This liquidity provides ample runway for ongoing investments in R&D and GTM strategies, ensuring the company can scale efficiently without compromising stability.

Closing Thoughts

HashiCorp’s journey from an open-source innovator to a multi-cloud infrastructure leader reflects the company’s ability to align its deliberate growth with a rapidly evolving market opportunity. The company’s decision to prioritize long-term market leadership over immediate profitability is underscored by its robust financials: $599M in projected FY2024 revenue, 82% gross margins, and steady growth in high-value enterprise customers.

HashiCorp’s timing in scaling its operations couldn’t be more aligned with industry trends. As enterprises increasingly adopt multi-cloud strategies, the demand for platform-neutral tools like Terraform, Vault, Consul, and Nomad continues to rise. The company’s open-core business model ensures widespread adoption among developers while creating a pipeline for enterprise upgrades, locking in long-term customers and high retention rates.

With nearly $1B in cash reserves and a strong market presence, HashiCorp is poised to navigate the complexities of multi-cloud management and shape the next phase of cloud infrastructure. It’s not just building tools—it’s defining the future of IT.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Believe in yourself!

Obsess on fundamentals

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.