- Partner Grow

- Posts

- Jamf Going Private: $2.2B Buyout by Francisco Partners

Jamf Going Private: $2.2B Buyout by Francisco Partners

Jamf buyout deepdive

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Startups who switch to Intercom can save up to $12,000/year

Startups who read beehiiv can receive a 90% discount on Intercom's AI-first customer service platform, plus Fin—the #1 AI agent for customer service—free for a full year.

That's like having a full-time human support agent at no cost.

What’s included?

6 Advanced Seats

Fin Copilot for free

300 Fin Resolutions per month

Who’s eligible?

Intercom’s program is for high-growth, high-potential companies that are:

Up to series A (including A)

Currently not an Intercom customer

Up to 15 employees

Interested in sponsoring these emails? See our partnership options here.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

JAMF acquisition

Introduction

The Francisco Partners–Jamf deal isn't just another private equity take-private—it's a cold, hard lesson in what happens when the market reprices growth. At $2.2 billion in cash, this marks one of the starkest reversals in recent SaaS history. On the surface, it reads like a win: a 50% premium, talk of "strategic flexibility," Francisco Partners praising Jamf's "enviable position." But peel back the spin, and the numbers tell a brutal story.

Jamf IPO'd in July 2020 at $26 per share. The stock popped to $51 on day one, hitting a $4.6 billion market cap—nearly double the targeted range. Fast forward five years. Francisco Partners is paying $2.2 billion. Less than half the day-one valuation.

And that "50% premium"? It's measured against a stock that had been obliterated—down 83% from its November 2021 peak of $47.97.

Here's the kicker: Jamf more than tripled its ARR from $225M to $710M over five years. Revenue grew at a 27% CAGR. The fundamentals were fine, even good.

But the multiple collapsed. From ~10x ARR at IPO to 3.1x at acquisition. When the market reprices SaaS from 15x to 3x, you lose half your value even as you triple revenue. That's not failure—that's just gravity.

History

Founded in 2002 by Chip Pearson—a University of Wisconsin-Eau Claire systems administrator frustrated by the lack of good Apple management tools—Jamf began life solving a problem no one else cared about: how do you manage hundreds of Macs at scale?

At the time, this was a niche within a niche. Apple was barely clinging to relevance in enterprise IT. Windows dominated. The idea of building a business around Apple device management seemed almost comically narrow. But Pearson saw something others missed: Apple's products were better, and eventually, enterprises would figure that out.

Jamf didn't chase trends. It built deep. The company became the go-to platform for managing MacBooks, iPads, and iPhones across corporate and educational networks—long before "mobile device management" became a category investors understood. By focusing relentlessly on Apple's ecosystem, Jamf carved out a defensible position. They weren't just better at managing Apple devices—they were the only ones who really understood how.

The strategy worked. By the time Vista Equity Partners acquired majority control in 2017 for $733.8 million, Jamf was managing devices for more than 20,000 customers worldwide. The company had become the standard—not just a vendor, but the infrastructure layer that made Apple viable in enterprise IT.

When Jamf IPO'd in July 2020, it wasn't just capitalizing on a hot market. It was betting that Apple's enterprise footprint would only grow—and that being the best Apple MDM in the world would be enough. For a while, it was. The stock popped to $51 on day one. Vista's stake was suddenly worth over $3.6 billion. The company now serves over 75,000 customers and manages millions of devices globally.

But being indispensable in a niche has limits. Microsoft started bundling Intune with everything else they sold. Cross-platform providers like VMware and Cisco muscled in. Growth rates began to slip—from 35-40% at IPO to 10-15% today. The layoffs came: 6% of staff in January 2024, another 6.4% in July 2025.

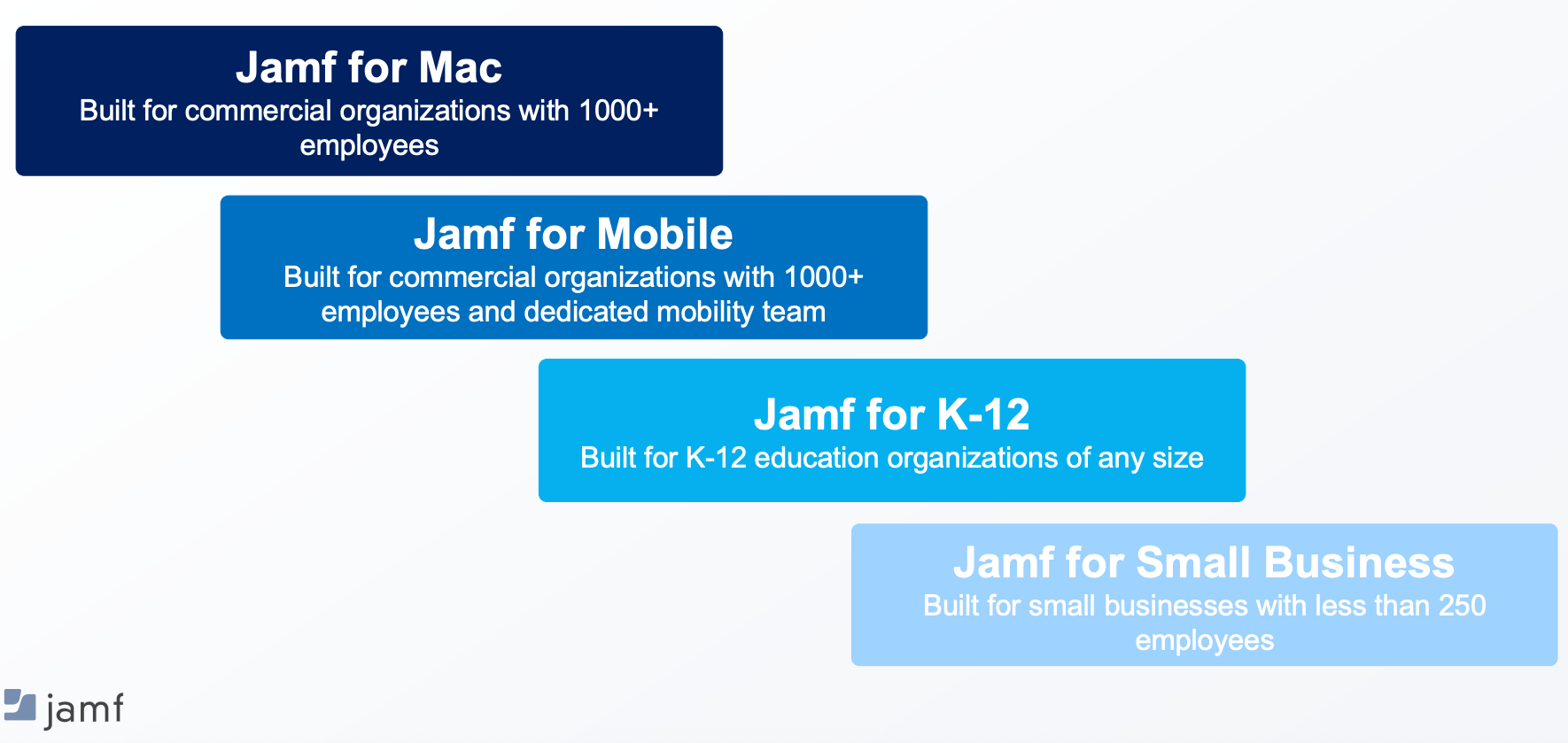

JAMF GTM plan

Jamf's go-to-market strategy isn't about being everywhere—it's about being indispensable in one place. While competitors like Microsoft, VMware, and Cisco chase cross-platform sprawl, Jamf doubled down on a singular bet: own the Apple ecosystem so completely that no enterprise can deploy Macs, iPads, or iPhones at scale without you.

It's a strategy built on vertical depth, not horizontal breadth. And for two decades, it worked.

Apple-Only, All the Way Down

Jamf's GTM motion starts with a radical constraint: they only do Apple. No Windows support. No Android. No hedging. This isn't a limitation—it's the entire value proposition. By obsessing over Apple's ecosystem, Jamf builds features, workflows, and integrations that cross-platform tools can't match. Automated device enrollment through Apple Business Manager. Zero-touch deployment for remote workers. Native support for every macOS and iOS security feature Apple ships.

The pitch is simple: if you're serious about Apple, you need Jamf. And increasingly, enterprises are serious about Apple.

Education as the Wedge

Jamf's early growth came from education—schools and universities managing fleets of iPads and MacBooks for students. It was an underserved market, starved for tools that actually worked. Jamf became the standard, managing devices for thousands of K-12 districts and higher-ed institutions worldwide.

But education was never the endgame. It was the wedge. As Apple devices proliferated in enterprise—driven by BYOD policies, executive preference, and the iPhone's consumer dominance bleeding into corporate IT—Jamf rode that wave upmarket. Today, the company serves over 75,000 customers globally, including major corporations, healthcare systems, and government agencies.

The GTM playbook scales across both: sell to IT admins who need deployment tools, then expand into security, identity management, and compliance. Land with device management. Expand with Jamf Protect, Jamf Connect, and threat defense. It's a classic enterprise motion—just hyper-focused on one platform.

Direct Sales, Channel Partners, and the Apple Store Effect

Jamf runs a multi-channel sales engine: direct enterprise sales for large accounts, channel partners for mid-market, and a self-service freemium tier (Jamf Now) for small businesses. The company also benefits from what you might call the "Apple halo effect"—when enterprises commit to Apple, they're already primed to buy the tools that make Apple deployments work.

Jamf doesn't compete on price. It competes on being the only tool that actually understands Apple. Microsoft bundles Intune for free with Microsoft 365, but Intune treats Macs like second-class citizens. Jamf treats them like the entire world.

The Security Expansion Play

Recognizing that device management alone isn't enough, Jamf has aggressively expanded into security. Security ARR hit $203 million in 2025, up 40% year-over-year, and now represents 29% of total ARR. This isn't just upsell—it's survival. As zero-trust frameworks and endpoint security become table stakes, Jamf positions itself as the only vendor that secures Apple devices without compromising user experience.

The acquisition of Identity Automation in April 2025 signals where Jamf is headed: beyond MDM into identity, access management, and compliance. It's a necessary evolution. The TAM for Apple device management has a ceiling. The TAM for securing and governing the Apple experience across hybrid workforces? Much bigger.

The Microsoft Problem

But here's the brutal reality: Jamf is fighting Microsoft's bundling machine. Intune isn't better—but it's free if you're already paying for Microsoft 365. For cost-conscious IT departments managing mixed fleets, that's a compelling reason to consolidate. Jamf's response? Be so much better that price doesn't matter. Lean into the Apple faithful—the companies and schools that have made Apple their standard, not just an option.

It's working, but it's hard. Growth has slowed from 35-40% at IPO to 10-15% today. The layoffs—12% of staff over 18 months—signal a company optimizing for profitability rather than growth at all costs.

What Francisco Partners Gets

Francisco Partners isn't buying Jamf despite its GTM challenges—they're buying it because the GTM is fixable under private ownership. Remove the pressure of quarterly earnings. Invest in M&A to expand the platform. Deepen integrations with Apple's latest enterprise features. Push harder into security and identity without Wall Street questioning every margin point.

Jamf has 75,000 customers, deep product-market fit, and a brand that's genuinely beloved in the Apple community. The GTM just needs to evolve—from device management vendor to end-to-end Apple security and identity platform.

Going private gives them the runway to make that pivot. Whether they execute is the $2.2 billion question.

Why is JAMF going private

Francisco Partners isn't rescuing Jamf—it's betting it can do what public markets won't tolerate: invest for the long term without the quarterly earnings theater. At $2.2 billion, this isn't a distressed sale. It's a calculated exit from a system that stopped rewarding Jamf for what it actually is—a profitable, defensible niche player—and started punishing it for what it isn't: a hyper-growth SaaS darling.

The Public Market Mismatch

Here's the problem: Jamf grew revenue 3x, built a $710 million ARR business, and remained the undisputed leader in Apple device management. But its stock got obliterated—down 83% from peak—because the market only cares about one thing: growth rate acceleration.

Jamf's growth rate went from 35-40% at IPO to 10-15% today. That's not failure—it's maturity. But public markets don't price maturity. They price momentum. And when your multiple collapses from 10x ARR to 3x, even solid execution feels like defeat.

The company tried to respond. It pushed into security (40% ARR growth). It acquired Identity Automation to expand TAM. It laid off 12% of staff to improve margins. None of it mattered. The market had already decided: slow-growth SaaS in a niche market doesn't deserve a premium valuation.

The Microsoft Bundling Problem

Jamf also faces a structural headwind it can't talk away: Microsoft. Intune isn't better at managing Macs—but it's free if you're already paying for Microsoft 365. For enterprises managing mixed fleets, consolidation beats best-of-breed. Jamf can't compete on price. It can only compete on being dramatically better—and that's a hard sell when CFOs are cutting SaaS budgets.

Going private removes the pressure to show quarterly revenue beats while fighting a bundling war against one of the most powerful companies in tech. Francisco Partners doesn't need Jamf to grow 30% next quarter. It needs Jamf to stay dominant, expand intelligently, and hit profitability targets over 3-5 years.

What Private Ownership Unlocks

Under Francisco Partners, Jamf gets breathing room to make moves that would spook public investors:

M&A without scrutiny. Acquisitions take time to integrate and often depress near-term margins. Public companies get punished for that. Private companies can execute multi-year platform expansions without worrying about analyst downgrades.

Margin optimization without growth theater. Jamf can focus on real profitability—not "adjusted EBITDA profitable"—without having to defend every headcount reduction or sales efficiency initiative on an earnings call.

Product investment cycles that don't fit quarterly narratives. Building a true security and identity platform around Apple takes years. Public markets want results in quarters.

Strategic focus over stock price management. No more investor relations theater. No more guidance games. Just build, sell, and execute.

The Vista Exit

Vista Equity Partners, which took control in 2017 for $733.8 million, is cashing out at a profit—but not the windfall it once had. At IPO, Vista's stake was worth over $3.6 billion. At $2.2 billion total enterprise value, they're exiting with solid but not spectacular returns.

That's the tell. Vista knows the public markets have repriced SaaS permanently. Growth-stage multiples aren't coming back. The IPO worked—Vista made money—but the next leg of value creation happens in private.

What This Means for SaaS

Jamf's go-private isn't an isolated event. It's part of a broader reset. The 2020-2021 SaaS bubble inflated valuations beyond what fundamentals could support. Now, companies growing 10-15% at $700M ARR are trading at 3x revenue—below the median for private SaaS.

For companies stuck in that zone—too big to get acquired by strategics, too slow-growing for public market love—going private is the rational move. Francisco Partners, Thoma Bravo, and others are building entire portfolios around this thesis: buy profitable SaaS companies at compressed multiples, optimize operations, and exit in 5-7 years when markets stabilize or through strategic M&A.

Jamf isn't broken. The public markets just don't have room for what it's become: a great business in a constrained TAM, fighting bundling dynamics, with solid but unspectacular growth.

Private ownership doesn't fix those dynamics. But it removes the pressure to pretend they don't exist.

Challenges and Risks

Francisco Partners isn't buying Jamf on a whim—it's betting $2.2 billion that it can extract value where public markets couldn't. But even strategic, well-capitalized take-privates carry execution risk. From navigating a TAM ceiling to managing competitive pressure, this deal presents several challenges that could undermine its long-term success if not addressed with precision and speed. Here's what could go sideways.

The TAM Problem Doesn't Disappear

Jamf's entire business is predicated on one bet: that Apple's enterprise footprint will keep expanding. But Apple's enterprise market share, while growing, still trails Windows massively. Jamf is the best Apple MDM in the world—but "best in a niche" has a ceiling.

Going private doesn't magically expand the addressable market. If Apple's enterprise penetration stalls, or if BYOD policies shift back toward standardized Windows fleets, Jamf's growth engine sputters. Francisco Partners can optimize margins and improve product, but it can't manufacture TAM out of thin air.

The company is trying to expand beyond device management into security and identity—Security ARR hit $203M, up 40% YoY—but those markets are viciously competitive. CrowdStrike, Okta, Microsoft, and Cisco aren't ceding ground easily. Jamf may own Apple MDM, but it's fighting established giants in adjacent categories.

Integration and Execution Risk

Francisco Partners isn't buying a broken company—but it's buying one that just laid off 12% of staff over 18 months. That's not a sign of operational excellence. It's a sign of a company struggling to balance growth, profitability, and margin pressure.

The risk? Post-acquisition execution stumbles. Key talent leaves. Product roadmaps slip. Customer support degrades during the transition. Jamf has 75,000 customers who expect the platform to just work—any integration hiccups, leadership turnover, or strategic missteps could trigger churn, especially among mid-market customers who have cheaper alternatives.

Private equity firms excel at financial engineering and operational optimization. But product-led growth and deep technical innovation? That's harder. If Francisco Partners focuses too much on margin improvement and not enough on R&D and customer success, Jamf could lose the loyalty that's kept it dominant for two decades.

M&A Gambles

One reason to go private is M&A freedom—Francisco Partners can pursue acquisitions without quarterly scrutiny. But M&A is risky. Jamf acquired Identity Automation in April 2025 to expand into identity management. That's smart strategy on paper. But integrating acquisitions is hard, especially when you're simultaneously navigating a take-private transition.

If Jamf makes the wrong bets—overpaying for assets, misreading product-market fit, or botching integrations—it could end up with a bloated, incoherent product suite that confuses customers and alienates the Apple purists who made Jamf successful in the first place.

The Profitability Pressure Cooker

Private equity thrives on leverage and returns. Francisco Partners didn't buy Jamf to be patient—it bought Jamf to generate IRR over a 5-7 year hold period. That means pressure to hit profitability targets, improve margins, and eventually exit at a higher valuation.

The risk? Short-term optimization that sacrifices long-term competitiveness. Jamf is still losing money on a GAAP basis—$68.46M in losses in 2024. The gap between GAAP and non-GAAP profitability is $48M per quarter in stock comp, amortization, and other adjustments. That's real dilution. That's real cash burn.

If Francisco Partners cuts too deep—reducing R&D, trimming sales, skimping on customer success—Jamf could slide from market leader to "good enough" alternative. And in enterprise software, "good enough" is where you go to die.

The Exit Question

Francisco Partners will eventually need to exit this investment. The obvious paths: sell to a strategic acquirer (Apple? Microsoft? Google?) or take Jamf public again in 5-7 years when SaaS multiples recover.

But what if neither path materializes? What if Apple decides to build its own enterprise management tools? What if SaaS multiples never recover to pre-2022 levels?

What Success Looks Like

None of these risks are insurmountable. Jamf has deep customer loyalty, a defensible product, and a brand that's genuinely beloved in the Apple community. Going private removes the quarterly earnings pressure and gives the company room to invest strategically.

But execution matters. Francisco Partners needs to expand Jamf's platform beyond MDM, deepen integrations with Apple's enterprise features, and build a security offering compelling enough to justify premium pricing.

If they pull it off, Jamf emerges stronger, more profitable, and ready for a strategic exit or re-IPO at a much healthier valuation. If they don't, this becomes another case study in how even dominant niche players can't escape the gravitational pull of TAM constraints.

Market Opportunity

Device management alone is no longer enough. Enterprises now demand secure, compliant, zero-trust Apple deployments—managed at scale, governed by policy, and integrated with identity and threat defense. As hybrid work becomes permanent and Apple devices proliferate across corporate networks, IT departments face mounting pressure to secure endpoints without compromising user experience, enforce zero-trust policies, and maintain compliance with evolving data privacy regulations.

Jamf's platform is built for this exact paradigm. With over 75,000 customers worldwide and millions of devices under management, Jamf isn't chasing the trend—it's defining what enterprise Apple looks like.

Apple's Enterprise Momentum

Apple's enterprise presence has shifted from niche curiosity to strategic imperative. The iPhone's consumer dominance bled into corporate IT. Executives demanded MacBooks. Remote work accelerated BYOD policies. And suddenly, IT departments that spent decades optimizing for Windows found themselves managing fleets of Apple devices—whether they liked it or not.

Apple's installed base of active devices surpassed 2 billion globally, with enterprise adoption growing steadily across Fortune 500 boardrooms, hospital systems, and government agencies. Apple devices are no longer exceptions—they're infrastructure.

And when enterprises commit to Apple, they need tools that actually work. Generic MDM platforms bolt on Apple support as an afterthought. Jamf is the only vendor that obsesses over the Apple ecosystem completely—and that focus is the entire moat.

Security as the Growth Engine

Here's where the opportunity gets interesting. Device management is table stakes. The real TAM expansion is in security, identity, and compliance—adjacent markets where Jamf is aggressively pushing.

Security ARR hit $203 million in 2025, up 40% year-over-year, now representing 29% of total ARR. This isn't just upsell—it's category expansion. As zero-trust frameworks become mandatory and ransomware attacks target endpoints, enterprises need security tools that integrate natively with their device management stack.

Jamf Protect (endpoint security), Jamf Connect (identity and access), and the acquisition of Identity Automation in April 2025 signal where Jamf is headed: from managing devices to securing and governing the entire Apple experience across hybrid workforces.

Global TAM: $15B+ and Expanding

The total addressable market for Apple device management, security, and identity is projected to exceed $15 billion by 2028, spanning enterprise device management ($5B+), endpoint security and threat defense ($6B+), and identity and access management ($4B+).

Jamf is already embedded across these layers—powering mission-critical infrastructure for schools, corporations, healthcare systems, and government agencies in over 100 countries.

What's Next

As Apple's enterprise footprint expands, the biggest challenge isn't adoption—it's security, compliance, and governance at scale. With deep product-market fit and a clear expansion path into security and identity, Jamf isn't just participating in Apple's enterprise growth—it's enabling it.

Going private gives Francisco Partners the runway to accelerate that expansion without quarterly earnings pressure. The question isn't whether the opportunity exists. It's whether Jamf can execute before competitors bundle their way in—or before Apple decides to build these tools itself.

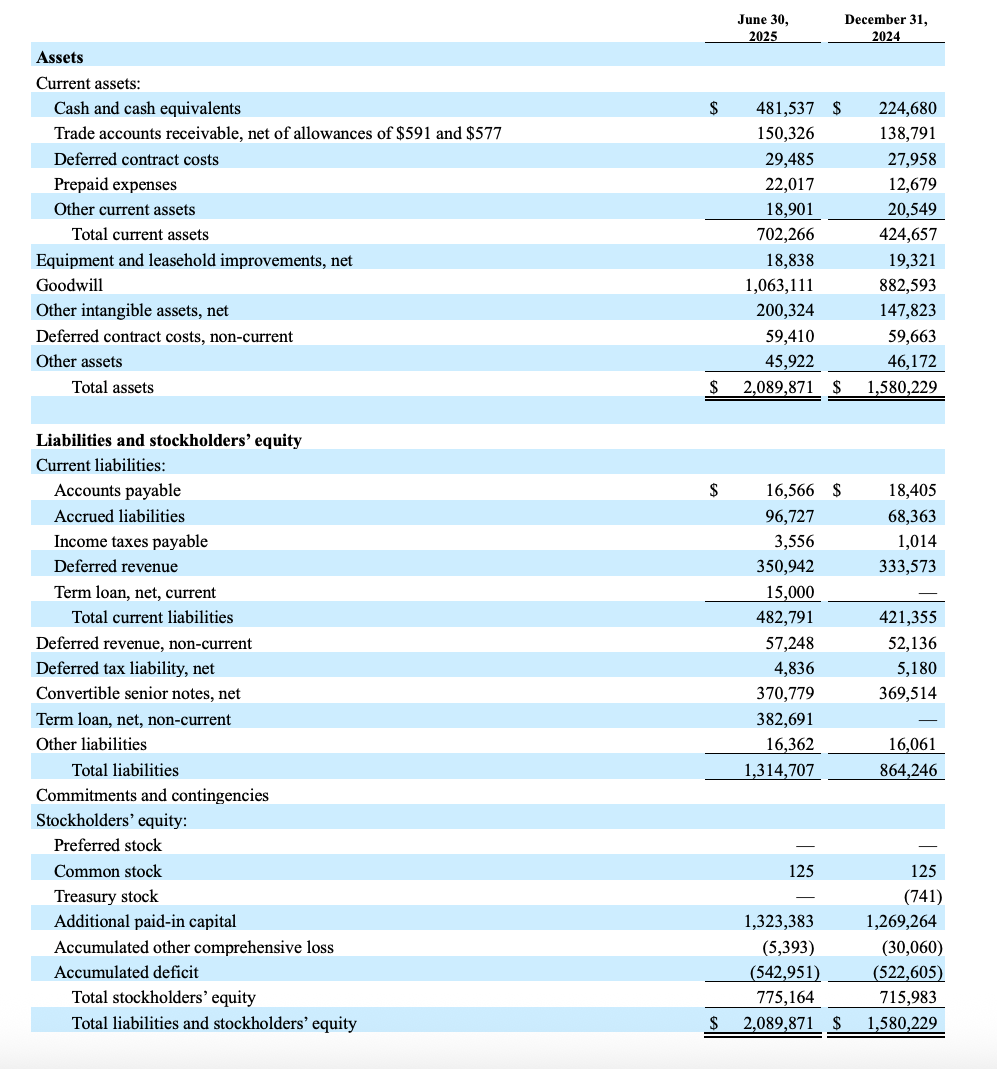

Financials

With disciplined execution across its Apple-focused platform, Jamf has built a device management and security business that's scaling with enterprise demand—delivering steady growth, improving cash flow, and expanding security ARR. But the gap between GAAP losses and non-GAAP profitability reveals a company still navigating the long road to sustainable operating leverage.

Total Revenue and ARR

Jamf continues to demonstrate predictable, subscription-led revenue performance with accelerating momentum in security:

Q3 2025 Total Revenue: $183.5 million (+15% YoY)

ARR: $728.6 million (+16% YoY)

Security ARR: $216 million (+44% YoY, now 30% of total ARR)

The security expansion is the headline story. Driven by platform solutions and the Identity Automation acquisition, security ARR is growing nearly three times faster than the core business—signaling Jamf's successful push beyond device management into endpoint security, identity, and compliance. This isn't just upsell—it's category expansion that increases customer lifetime value and defensibility.

Operating Leverage

The company is extracting meaningful progress toward profitability, but the GAAP/non-GAAP gap remains substantial:

GAAP Operating Loss: $(3.4) million (-2% margin)

Non-GAAP Operating Income: $47.2 million (26% margin)

Gross Profit: 76% GAAP, 81% non-GAAP

Non-GAAP margins look strong—26% operating income is respectable for a $700M+ ARR SaaS business. But the $50M+ gap between GAAP and non-GAAP reflects stock-based compensation, amortization, and acquisition-related expenses that are real costs, even if adjusted out for investor presentations.

The positive momentum? GAAP operating losses narrowed significantly year-over-year, from $(15.9)M in Q3 2024 to $(3.4)M in Q3 2025. That's progress—but it also explains why public markets weren't willing to pay a premium multiple. Growth is solid, but true profitability remains elusive.

Net Income and Cash Flow

Jamf's cash generation story is improving dramatically:

Net Loss: $(4.5) million (-2% margin, down 63% YoY)

Adjusted EBITDA: $49.6 million (27% margin, +68% YoY)

Operating Cash Flow (TTM): $117.1 million (17% of revenue, +213% YoY)

Unlevered Free Cash Flow (TTM): $147.5 million (21% of revenue, +82% YoY)

This is where Jamf's underlying business quality shows through. Despite GAAP losses, the company is generating real cash—$147M in unlevered free cash flow on $700M+ ARR is a 21% FCF margin. That's attractive for a private equity buyer looking for cash-generative businesses to optimize.

The 213% year-over-year growth in operating cash flow suggests Jamf is finally extracting operational leverage—collections are improving, working capital is tightening, and the business model is proving durable even as growth moderates.

Closing thoughts

The Francisco Partners–Jamf acquisition marks a sobering moment in the evolution of B2B SaaS valuations. At $2.2 billion, this deal isn't just a financial transaction—it's a recalibration of what the market will pay for solid but mature growth. For Jamf, it offers breathing room to invest beyond quarterly earnings cycles, expand through M&A without scrutiny, and build the security platform public markets wouldn't wait for. For shareholders, it's a premature exit from what was supposed to be a long-term growth story. And for Francisco Partners, it's a calculated bet that private ownership can extract profitability and strategic value that public markets refused to recognize.

Jamf's journey—from Mac lab management tool to $700M ARR enterprise platform—wasn't flashy or sensational. It was methodical, product-focused, and built on deep customer loyalty across education, healthcare, and corporate IT. That discipline kept the company dominant even as growth decelerated and competition intensified. But public markets don't reward discipline when growth rates compress and profitability remains elusive.

This deal sends a clear signal to the broader SaaS ecosystem: multiples have reset permanently. The winners won't be companies chasing hyper-growth at any cost—they'll be platforms that balance growth with operating leverage, expand TAM strategically, and generate real cash flow. Jamf isn't failing—it's just fighting dynamics (TAM constraints, bundling pressure, margin challenges) that public markets no longer tolerate.

For Francisco Partners, this is more than an acquisition. It's a margin optimization play with strategic optionality. For Jamf, it's the start of a new phase where execution matters more than stock price. And for SaaS founders watching, it's proof that the IPO isn't the finish line—it's just the beginning of a much longer, harder road where fundamentals eventually win.

Here is my interview with Aabhas Khanna, General Partner at MyAsiaVC, a venture syndicate and fund with $125M AUM backing 250+ companies, including 5 unicorns.

In this conversation, Aabhas and I discuss:

-How does Aabhas evaluate Total Addressable Market (TAM) in Asia’s fragmented landscape?

-What’s the philosophy on portfolio construction—spray and pray, or concentrated conviction?

-Are there product or strategy mistakes that founders are repeatedly making

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Buy my NEW book: Buy my book on How to value a company

And that’s it from me. See you next week.

Reply