In partnership with

Getting compliant doesn’t have to take months.

With Delve, it takes 15 hours.

SOC 2, HIPAA, ISO, and more, automated with AI.

That’s why 500+ of the fastest-growing AI companies (Lovable, Cluely, Wispr Flow) already run compliance on Delve.

But compliance is only half the battle. The other half is enterprise reviews.

At Delve, we’ve sat through 100s of hours of security questionnaires.

We’ve seen every pointless checkbox, every SaaS-era question, every deal stalled because of them.

So today, we’re publishing something different: a manifesto with Bland AI on how security questionnaires should work in the age of AI.

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Interested in sponsoring these emails? See our partnership options here.

Transform Customer Support with AI Agents

How Did Papaya Scale Support Without Hiring?

Papaya cut support costs by 50% and automated 90% of inquiries using Maven AGI’s AI-powered agent - no decision trees, no manual upkeep. Faster responses, happier customers, same team size.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Netskope in one minute

Netskope is quietly redefining security and networking for the era of cloud and AI—where every digital interaction, from a dispersed workforce to automated AI agents, must be both fast and secure. Founded to solve one of enterprise IT’s biggest bottlenecks—the tradeoff between security and performance—Netskope built a unified, cloud-native platform from the ground up that protects sensitive data, stops threats, and accelerates digital experiences without compromise.

From safeguarding SaaS applications and AI prompts to optimizing global traffic flows through its NewEdge private cloud network, Netskope’s technologies are already transforming how the world’s largest organizations operate. Its Netskope One platform delivers real-time, context-aware visibility across data, devices, and applications—coaching users in the moment, blocking threats at the edge, and ensuring regulatory compliance at scale.

The opportunity is massive: based on IDC data, the converged security and networking market is projected to reach $138.9 billion by 2028, with AI security adding another $30.8 billion. Netskope is uniquely positioned at the intersection of this shift, already securing more than 30% of the Fortune 100 and 18% of the Forbes Global 2000.

At the core of its innovation is a unified architecture—security, networking, and analytics—running across 120+ global edge data centers. This makes Netskope both resilient and high-performance, able to deliver zero-trust security and blazing-fast connectivity at the same time.

As the world moves from legacy appliances to cloud- and AI-driven operations, Netskope is becoming a foundational layer of the modern internet. With a mission to make digital interactions secure, performant, and intelligent, Netskope isn’t just protecting data—it’s building the infrastructure for the next era of enterprise security and networking.

Introduction

Netskope’s mission is clear: make the modern internet fast, secure, and intelligent. That starts with data. Netskope One, its cloud-native platform, is the first unified architecture to converge security, networking, and analytics—proving that enterprises no longer need to trade performance for protection. With ARR at $707M, 75% gross margins, and 4,300+ customers including 30% of the Fortune 100, Netskope has already shown its ability to redefine enterprise security at scale.

But Netskope is more than a security company. Its NewEdge private cloud network—120+ full-compute edge data centers across 75 regions—brings advanced protection and blazing-fast connectivity directly to users and devices everywhere. Netskope One delivers contextual intelligence in real time, detecting sensitive data flowing into AI prompts, blocking threats at the edge, and enabling enterprises to embrace the cloud and AI era without friction.

The opportunity is massive. The converged security and networking market is projected to reach $138.9B by 2028, with AI security adding another $30.8B. Netskope is uniquely positioned at the intersection of this shift, with deep penetration in the enterprise and strong net revenue retention at 118%.

At the heart of Netskope’s differentiation is its unified technology stack—security, networking, and analytics built from the ground up to work together. This architecture not only accelerates performance and lowers complexity, but also gives enterprises the precision, visibility, and control they need as digital interactions grow more distributed and AI-driven.

As security moves from fragmented, legacy appliances to converged, cloud-native platforms, Netskope is building the backbone for the next era of enterprise protection—where security is fast, seamless, and built for the AI age.

History

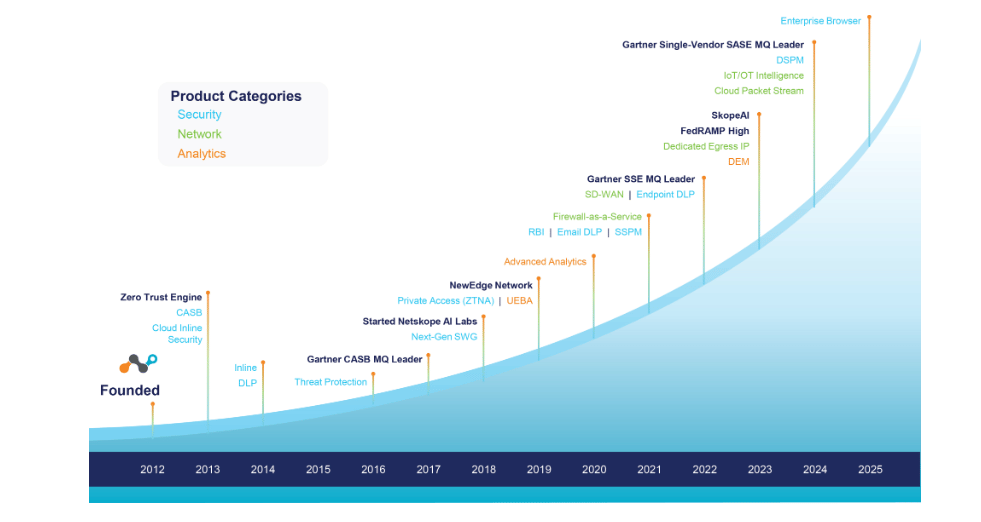

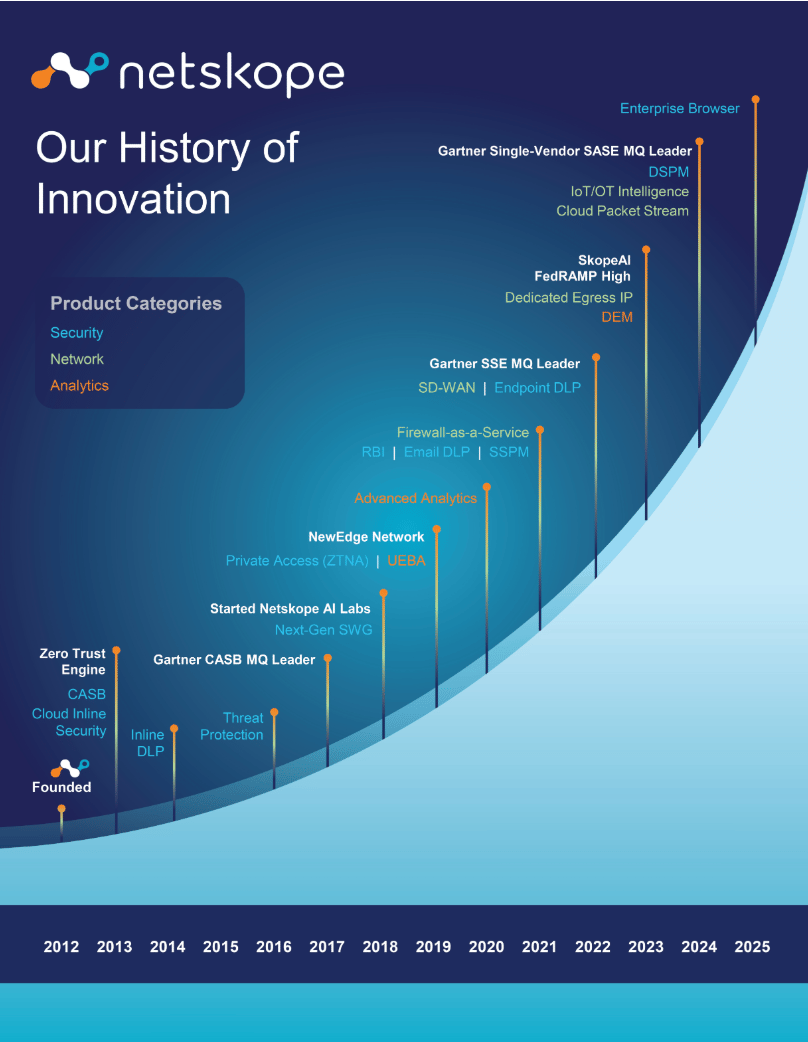

Netskope began in October 2012 with a bold vision: to secure the modern internet in an era where cloud and mobility were rewriting how people worked. At a time when security was still dominated by hardware appliances and perimeter firewalls, Netskope charted a different course—building a cloud-native platform that could provide visibility and protection for users, devices, and data no matter where they lived.

Born out of the belief that the enterprise would no longer be defined by on-premises IT, but by a highly distributed mix of SaaS, cloud, and mobile access, Netskope pioneered the Cloud Access Security Broker (CASB) category. Those early years were focused on solving the “shadow IT” problem—giving organizations a lens into the unsanctioned SaaS apps their employees were adopting. As adoption grew, Netskope expanded into secure web gateways (SWG), zero trust network access (ZTNA), and cloud firewall capabilities—laying the groundwork for what would become Secure Access Service Edge (SASE).

The early milestones were marked by bold technology bets. Netskope built its NewEdge private cloud network—a global footprint of edge data centers delivering security services closer to the user than legacy backhaul networks ever could. This wasn’t just about speed; it was about eliminating the tradeoff between protection and performance that had defined enterprise security for decades. By 2019, Netskope had become recognized as one of the leaders defining the SASE architecture, converging networking and security into a unified cloud-delivered stack.

The years that followed validated Netskope’s model. The company grew to protect some of the largest enterprises in the world, expanding into over 75 regions with more than 120 full-compute edge data centers. Along the way, Netskope raised over $1.5 billion in funding from Lightspeed, ICONIQ, and Accel, reaching $707M in ARR by 2025 and securing more than 30% of the Fortune 100 as customers. Its flagship platform, Netskope One, became the foundation enterprises relied on to navigate the explosion of SaaS, AI, and globally distributed workforces.

Today, Netskope stands as one of the largest pure-play cloud security companies, positioned at the center of a market projected to exceed $138B by 2028. From its CASB roots to its SASE leadership, Netskope has consistently pushed the boundaries of what modern security can be: fast, context-aware, and built for the AI era.

Throughout its history, Netskope has stayed true to a single ambition: to secure data and digital interactions without slowing them down. As the internet evolves into an AI-driven, always-connected fabric, that founding vision is no longer just a differentiator—it’s becoming the standard.

Risk factors

Netskope operates at the convergence of cloud security, networking, and analytics—an attractive but highly competitive market characterized by rapid innovation, significant capital intensity, and shifting enterprise IT priorities. As the company enters the public markets, several key risks could materially impact its growth trajectory, financial performance, and long-term positioning.

1. Limited Profitability Track Record

Netskope has never achieved profitability. The company reported net losses of $344.9M in FY2024 and $354.5M in FY2025, with an accumulated deficit of $2.1B as of July 2025. Despite improving operating leverage, ongoing investment in sales, marketing, R&D, and public company infrastructure will likely sustain operating losses in the near term. Profitability depends on scaling ARR faster than costs—a dynamic that remains uncertain.

2. Revenue Growth Deceleration

Netskope’s ARR reached $707M in 2025, growing ~33% year-over-year. While robust, this growth rate has slowed compared to prior years. Future expansion could be impacted by competitive intensity, customer budget pressures, or slower adoption of cloud-native security platforms. A continued deceleration in growth would make it harder to justify premium valuation multiples in the public markets.

3. Stock-Based Compensation Headwinds

Following the IPO, Netskope will recognize significant stock-based compensation tied to RSUs triggered by the listing. If the offering had been completed as of July 31, 2025, Netskope would have recognized ~$315.8M of expense in a single quarter. This one-time event will negatively impact reported profitability and could create volatility in investor sentiment post-listing.

4. Customer Retention and Expansion Risk

Netskope’s business model relies heavily on subscription renewals and expansion from existing enterprise customers. Contracts typically run one to three years, and customers are not obligated to renew. Even modest churn or contraction could materially impact ARR given concentration among large accounts (111 customers contribute $1M+ ARR each, representing 37% of total ARR).

5. Partner Ecosystem Dependence

Roughly one-third of Netskope’s revenue flows through its top five channel partners and affiliates. While this strategy extends reach, it also creates dependency. Partners can prioritize competing platforms, consolidate, or alter strategies with little notice—introducing volatility into Netskope’s go-to-market execution.

6. Market Adoption Uncertainty

Cloud-based security platforms are still a relatively new paradigm compared to entrenched on-premises solutions. Many large enterprises have deep investments in legacy appliances and may be slow to transition. If the broader SASE/SSE market does not expand as forecast, or if hybrid work adoption declines, Netskope’s long-term TAM could fall short of expectations.

7. Operating Expense Intensity

Future growth requires sustained investment in global sales, marketing, and R&D. Netskope’s 2,910 employees—65% based outside the U.S.—will drive rising payroll, facilities, and compliance costs as the company scales internationally. Any misalignment between spending and revenue realization could materially affect margins.

8. Sales Cycle Complexity

Selling into large enterprises and governments entails lengthy, unpredictable cycles. These require extensive technical validation, budget approvals, and integration testing. Despite FedRAMP High certification, government wins are particularly resource-intensive and uncertain. Slippage in large deals could materially affect quarterly revenue visibility.

9. Competitive and Pricing Pressure

The cloud security market is crowded, with incumbents (Palo Alto Networks, Zscaler, Cisco) and startups all vying for share. Price competition, bundling strategies, and new feature releases could pressure Netskope’s margins and limit its ability to expand ARR per customer.

10. Macroeconomic and Geopolitical Exposure

As enterprises reassess IT budgets amid inflation, interest rates, and global instability, discretionary security projects may be delayed. Netskope also faces execution risk in high-growth international markets like India, where currency fluctuations, regulatory changes, or political instability

Market Opportunity

Netskope operates at the center of one of the fastest-growing transitions in enterprise IT: the convergence of security, networking, and analytics into unified, cloud-native platforms. As enterprises adopt SaaS, cloud, and AI at scale, traditional perimeter-based models are breaking down—creating demand for architectures that are secure, high-performance, and data-aware.

Today, Netskope One addresses this shift with a platform that spans security, networking, analytics, and AI security, delivering protection and visibility wherever users, devices, and data reside. Based on IDC estimates, the company defines a total addressable market (TAM) of $138.9B by 2028, growing at a 16.8% CAGR (2024–2028). An additional $30.8B AI security market—still nascent but accelerating—brings the total opportunity to nearly $170B by 2028.

$170 Billion Addressable Market

Netskope’s TAM spans four interconnected categories:

Security Products: $24.4B → $43.2B (15.3% CAGR)

Cloud inline security, CASB, DLP, ZTNA, next-gen SWG, SaaS/DSPM, and advanced threat protection. Netskope’s platform offers consistent inspection across these categories, including AI/ML-driven malware detection, insider risk analytics, DNS protection, and recursive sandboxing.

Networking Products: $40.7B → $78.4B (17.8% CAGR)

Traditional VPNs, proxies, and firewalls are hitting performance and refresh bottlenecks. Netskope NewEdge addresses this with SD-WAN, FWaaS, IoT/OT intelligence, and enterprise-grade connectivity features, enabling secure, high-performance access across hybrid environments.

Analytics Products: $9.2B → $17.1B (16.7% CAGR)

With attackers constantly adapting, organizations need real-time insight into anomalies and threats. Netskope provides advanced analytics and UEBA, cloud-native XDR, digital experience management, and integrations with hundreds of IT partners to drive proactive threat detection and remediation.

AI Security: $30.8B (emerging)

Generative AI and enterprise AI tools introduce sensitive data exposure risks. Netskope is building solutions for secure AI adoption—application access control, data leakage prevention, and real-time user guidance—creating an incremental $9.9B TAM by 2028.

Where the Opportunity Lives

The shift toward cloud and AI-native enterprises creates multiple expansion vectors for Netskope:

Enterprise Security Modernization: Large organizations are actively replacing legacy appliances with cloud-native SSE/SASE platforms—driving predictable, subscription-based ARR.

Networking Transformation: With NewEdge deployed across 120+ global data centers, Netskope is positioned to capture enterprises migrating away from MPLS and legacy WANs.

Analytics-Driven Operations: As security and IT converge, Netskope’s analytics capabilities provide deep visibility across user, app, and network activity—areas of rising spend.

AI Trust Layer: The AI era requires contextual security controls that safeguard data flowing into AI prompts and models. Netskope’s early investments here position it to be a category leader.

Securing the AI-Cloud Era

By converging security, networking, and analytics into one unified architecture, Netskope is addressing one of the most durable shifts in enterprise technology in decades. With a TAM approaching $170B by 2028, strong penetration among Fortune 100 customers, and an early lead in AI security, Netskope is positioned at the front end of a generational market transition—where every enterprise will need fast, secure, and intelligent access to the cloud and AI.

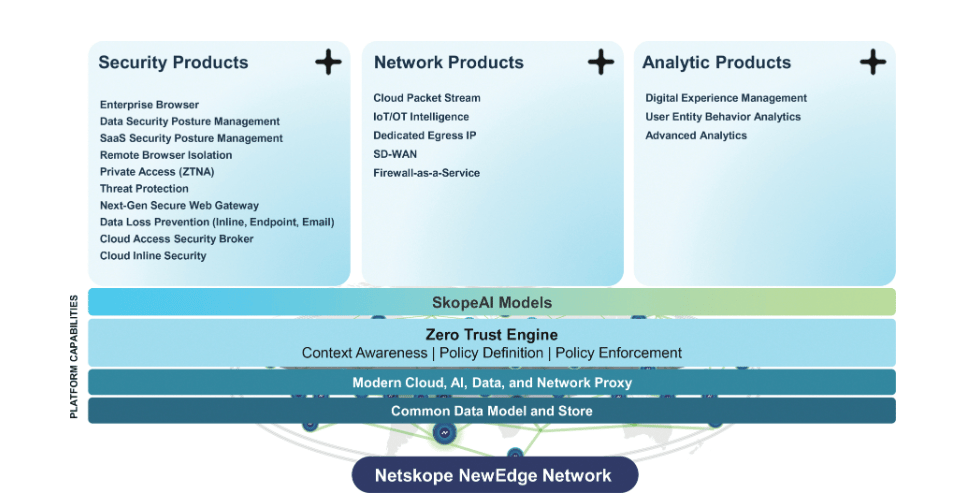

Product

At the core of Netskope’s offering is a unified SASE platform, designed to converge security, networking, and analytics into a single architecture. Every product runs on the same Zero Trust Engine, NewEdge global network, and policy framework—eliminating tradeoffs between security efficacy and network performance. This shared foundation enables faster deployment, lower costs, and consistent controls across users, devices, and data everywhere.

Zero Trust Engine

Context-based inspection and control of traffic across cloud, AI, internet, and private applications.

Distinguishes between human and non-human identities, sensitive vs. non-sensitive data, and low vs. high-risk behaviors.

Delivers real-time, situation-specific actions such as coach, encrypt, quarantine, or redirect.

Powers use cases from preventing exfiltration of sensitive designs in GitHub to securing AI prompts in Gemini.

NewEdge Network

One of the world’s largest private security clouds, with 120+ data centers across 75 regions and 200+ localization zones.

Each data center runs the full product suite locally—ensuring low-latency, in-region processing for all customers.

Backed by 10,000+ network adjacencies and direct peering with AWS, Azure, Google Cloud, and leading SaaS providers.

Provides 99.999% uptime guarantees with global consistency and minimal latency.

SkopeAI

Suite of 160+ AI/ML models developed by Netskope AI Labs, protected by 40+ patents.

Applied across classification, anomaly detection, malware prevention, insider threat analytics, and real-time user coaching.

Enables advanced use cases like contextual AI policy enforcement—governing generative AI interactions safely.

Continuously trained and iterated to stay ahead of new attack vectors and data risks.

Unified Data Security

End-to-end visibility and control of structured and unstructured data, across in-motion, in-use, and at-rest states.

Equipped with 3,000+ data identifiers, 2,000+ file types, and 40+ compliance templates.

Real-time discovery, classification, and least-privilege access reduce data leakage and compliance risk.

Proprietary AI models augment traditional DLP, enabling accurate detection and minimizing false positives.

Netskope One Gateway

A thin, lightweight edge platform consolidating SD-WAN, FWaaS, and local network services.

Deployable in physical, virtual, cloud, or client form factors.

Eliminates the need for disparate appliances while optimizing site-to-site and site-to-cloud performance.

Extends SSE and SD-WAN into a true SASE architecture, delivering secure, optimized connectivity globally.

Platform Advantage

Netskope’s greatest differentiator is its converged architecture: a single engine, client, network, and policy framework across 20+ products. This creates:

Faster Deployment – Rapid rollout without replacing legacy systems.

Lower Complexity – Consolidation of point solutions into one unified platform.

Higher Performance – No compromise between speed and security.

Future-Readiness – Native support for AI-era traffic, protocols, and risks.

By unifying security, networking, and analytics at the global edge, Netskope isn’t just replacing firewalls and VPNs—it’s building the backbone of enterprise security in the AI-cloud era.

Business Model

Netskope operates a vertically integrated, cloud-delivered security platform model built around a single policy engine, client, gateway, and global NewEdge network. By unifying 20+ products on one architecture, Netskope captures value across the full lifecycle of secure access—from identity- and data-aware policy to high-performance delivery at the edge—while selling multi-year subscriptions into the world’s largest enterprises.

This integrated approach lets Netskope monetize a broad control plane (SSE/SASE) with consistent policies and analytics, while partners extend reach across geographies and segments.

Revenue Model

Subscriptions (Core Revenue Stream)

99% of revenue from cloud subscriptions to the Netskope One platform.

Contracts are 1–3 years, priced primarily per user and by products deployed.

Revenue recognized ratably over the subscription term (billings may be more front-loaded than GAAP revenue).

Professional Services

~1% of revenue, tied to deployment, migration, and integration.

Supports time-to-value and partner delivery, but not margin-accretive.

Land → Expand flywheel: most customers start with 2+ products; expansion adds modules like DLP, ZTNA, RBI, Next-Gen SWG, SSPM/DSPM, and analytics. Utilization of the NewEdge network and premium capabilities drives tiered pricing.

Go-to-Market (GTM)

Channel-Led at Global Scale

Vast VAR/MSP/distributor ecosystem handles the majority of contracted revenue.

Top five partners accounted for ~32% (FY’24) and 33% (FY’25) of revenue; 35% in 1H FY’26—efficient reach, but concentration risk and looser end-user feedback loops.

Direct Enterprise Sales

Classic field-sales motion selling top-down to CIO/CISO across 90+ countries.

Focus on Major Accounts and Enterprise; long, complex cycles; assisted by customer success for adoption and expansion.

Packaging & Pricing

20+ SKUs offered as bundles or standalone; seat-based and usage/context adders.

Opaque, enterprise-grade pricing (normal in security) to accommodate audits, compliance, and procurement layers.

NewEdge premium (e.g., dedicated egress IP, performance SLAs) functions like a paid fast lane for critical traffic.

Platform Advantage

One Architecture, Many Products: single Zero Trust Engine + NewEdge lets Netskope introduce new controls without deploying new appliances—lower CAC-to-expansion and faster upsell velocity.

Policy Consistency: uniform controls across web, SaaS, AI, private apps, endpoints, IoT/OT reduce complexity vs. multi-vendor stacks—consolidation ROI strengthens win rates.

Analytics Everywhere: shared telemetry fuels UEBA, Advanced Analytics, DEM, making add-ons compelling and sticky.

Commercial Mechanics

Multi-year terms with upfront billings common in enterprise; GAAP revenue is ratable, creating natural smoothing (billings momentum can diverge from revenue).

NRR/GRR strength (recently 118% / 96%) underscores expansion and resilience in large accounts.

Seat + scope + network levers: more users, more modules, deeper data controls, plus NewEdge performance tiers.

Competitive Strengths

Consolidation narrative: replaces legacy VPN, SWG, CASB, ZTNA, point DLP, and discrete analytics—fewer vendors, one policy.

Edge-delivered performance: 120+ full-compute POPs in 75+ regions—security without the latency penalty.

AI-native posture: SkopeAI (160+ models) drives classification, anomaly detection, and safe AI usage—a differentiated upsell in GenAI workflows.

Growth Levers

Product Expansion: attach DLP/DSPM/SSPM, ZTNA, RBI, FWaaS, SD-WAN, Analytics/DEM across existing logos.

AI Trust Layer: monetize safe-AI controls (prompt governance, data protections, model access policy).

Network Monetization: premium NewEdge features (egress IP, localization, interconnects) as performance adders.

Geo & Segment Scale: deepen EMEA/APJ growth with channel; invest in public sector post-FedRAMP High.

Consolidation ROI: capitalize on appliance refresh cycles and budget shifts from multi-vendor stacks.

Management Team:

Sanjay Beri – Co-Founder, Chief Executive Officer & Chairman

Sanjay Beri co-founded Netskope in 2012 and has served as Chief Executive Officer and Chairman of the Board since inception. A veteran of the networking and security industry, he previously held executive roles at Juniper Networks, most recently as Vice President and General Manager of the Access/Security and Pulse Business Unit. Earlier in his career, he co-founded Ingrian Networks, a data protection company acquired by SafeNet. Sanjay holds an Honors BSc in Computer Engineering from the University of Waterloo, an M.S. in Electrical Engineering from Stanford University, and an M.B.A. from UC Berkeley’s Haas School of Business.

Andrew Del Matto – Chief Financial Officer

Andrew Del Matto has served as Chief Financial Officer of Netskope since 2019. He brings over two decades of financial leadership in public cybersecurity and enterprise software companies. Prior to Netskope, Andrew served as CFO at Citrix Systems and Fortinet, and spent more than a decade at Symantec in various finance leadership positions, including Acting CFO. He began his career at KPMG as a certified public accountant. Andrew holds a B.S. from Ohio University and an M.B.A. from Golden Gate University. At Netskope, he oversees financial strategy, operations, and capital planning.

Raphaël Bousquet – Chief Revenue Officer

Raphaël Bousquet was appointed Chief Revenue Officer in 2024, after serving as Netskope’s Executive Vice President of Worldwide Sales and Channel. He previously held senior go-to-market leadership roles at Palo Alto Networks, including Vice President for EMEA South, Israel, and the Alps. Raphaël holds a Master’s degree in Management from Grenoble École de Management in France. He leads Netskope’s global sales, channel, and customer success organizations, driving enterprise adoption across 90+ countries.

Investment

Netskope was founded with a conviction that cloud and AI would fundamentally reshape enterprise security and networking. Backing that vision has been a deep syndicate of venture capital firms, growth investors, and global institutions who have committed more than $1.44 billion across nine funding rounds. Each raise has been tied to a clear inflection point—expanding platform scope, scaling go-to-market, and preparing for global reach.

Foundational Rounds (2013–2015)

Netskope’s earliest financings provided the technical and commercial foundation for its cloud-native platform. A $5.5M Series A in 2013, led by Social Capital, gave the company its initial runway to validate cloud security architectures. That was followed by a $15.9M Series B with Lightspeed and Social Capital later in 2013, enabling early product development and first enterprise deployments. By 2014 and 2015, Accel joined the syndicate through Series C and Series D rounds, as Netskope raised $110.9M across the two financings—capital that allowed the company to build a channel-first sales model and scale into Fortune 500 accounts.

Institutional Backing and Scale-Up (2017–2020)

From 2017 onward, Netskope attracted large institutional investors as demand for cloud security accelerated. The $100M Series E (2017) and $169M Series F (2018) rounds brought in Sapphire Ventures, Geodesic Capital, Base Partners, and Social Capital alongside existing investors. By 2020, Netskope had reached late-stage scale, closing a $340M Series G financing led by Sequoia, PSP, and CPP Investments. This infusion expanded the company’s global presence and accelerated development of the Netskope NewEdge network, positioning it as a unified platform for both security and networking.

Growth Capital and Valuation Peak (2021–2023)

In July 2021, Netskope secured its landmark $300M Series H round at a $7.5B post-money valuation, led by Iconiq Capital with participation from Accel, Lightspeed, Sequoia, and others. At the time, Netskope’s ARR multiple exceeded 230x—reflecting investor conviction in its leadership position in secure access service edge (SASE) and zero trust markets. In January 2023, Netskope raised its largest round to date: a $401M Series I, led by Morgan Stanley with Goldman Sachs Asset Management, Ontario Teachers’ Pension Plan, and CPP Investments. This financing ensured balance sheet durability through macro uncertainty and underscored Netskope’s position as one of the most well-capitalized private cybersecurity companies in the world.

Through each stage, Netskope has paired large-scale capital raises with measurable milestones: launching Netskope One, expanding its threat intelligence and DLP modules, and building a global partner ecosystem that today drives one-third of revenue. Its syndicate blends Silicon Valley venture firms (Accel, Lightspeed, Sequoia, Social Capital) with global institutional investors (CPP Investments, Ontario Teachers, Morgan Stanley), providing both technical expertise and long-term capital stability.

As Netskope enters the public markets, it does so with one of the strongest private financing histories in enterprise security—$1.44B raised, a broad base of institutional backers, and a proven ability to convert capital into platform scale, enterprise adoption, and durable revenue growth.

Competition

Netskope competes in a rapidly evolving cloud and AI security landscape shaped by the convergence of networking, security, and analytics. As enterprises accelerate digital transformation, migrate workloads to the cloud, and adopt generative AI applications, demand for unified, zero trust platforms has surged. This has created both opportunity and intensifying pressure across the industry.

Independent Security Vendors

Netskope faces competition from pure-play cybersecurity companies such as Fortinet, Palo Alto Networks, and Zscaler, all of which offer overlapping solutions across secure web gateway, firewall, and zero trust network access. These companies benefit from established customer portfolios, large sales teams, and strong brand recognition.

Netskope differentiates itself by delivering a single-pass, cloud-native architecture that unifies inline security, data protection, and private access on a global low-latency network—eliminating the patchwork integration often required by competitors’ portfolios.

Large Networking and IT Vendors

Major incumbents such as Cisco and Broadcom bundle security capabilities into broad networking or infrastructure offerings. Their advantage lies in entrenched distribution, procurement relationships, and large installed bases of network hardware and appliances.

Netskope’s advantage lies in born-in-the-cloud design, which bypasses the refresh cycle constraints of legacy hardware and provides elastic performance for cloud and AI workloads. This cloud-first model enables faster innovation and lowers total cost of ownership compared to appliance-driven models.

Point Solution Providers

A wide range of companies compete with specific modules of the Netskope One platform: CASB, sandboxing, advanced threat protection, DLP, encryption, and VPN replacement. While these players can offer depth in narrow use cases, they lack the extensibility and unified architecture that enterprise CIOs and CISOs increasingly demand.

Netskope’s land-and-expand model leverages this dynamic. Customers often adopt one or two modules—such as DLP or ZTNA—and expand over time to embrace multiple products, with 72% already using 3+ modules.

IT Security Services and Emerging Entrants

Beyond established vendors, new entrants are embedding security features into adjacent markets—whether observability, AI, or SaaS operations tools. Netskope’s open ecosystem of integrations, coupled with AI-driven anomaly detection, insider threat prevention, and real-time policy enforcement, positions it to stay ahead of adjacent competitors who may attempt to pivot into cloud security.

Competitive Factors

Across security, networking, and analytics, the principal factors shaping competition include:

Delivering zero trust security from the cloud, regardless of user or device location

Platform extensibility and ability to consolidate multiple point solutions

Reliability, scalability, and performance of the global network

Speed of deployment and continuous innovation

Total cost of ownership and economic ROI

Brand reputation, trust, and customer experience

Strength of channel and partner ecosystems

Netskope’s Differentiation

Netskope’s position is unique at the intersection of security, networking, and AI. Its Netskope NewEdge network enforces policies and accelerates traffic globally, while its Netskope One platform delivers end-to-end visibility, threat protection, and data security across cloud, web, SaaS, private applications, and AI use.

In a market where many competitors are either appliance-heavy incumbents or narrow point-solution vendors, Netskope’s defensible moat is its cloud-native, unified, and partner-driven model—purpose-built for the hybrid, multi-cloud, and AI era.

Financials

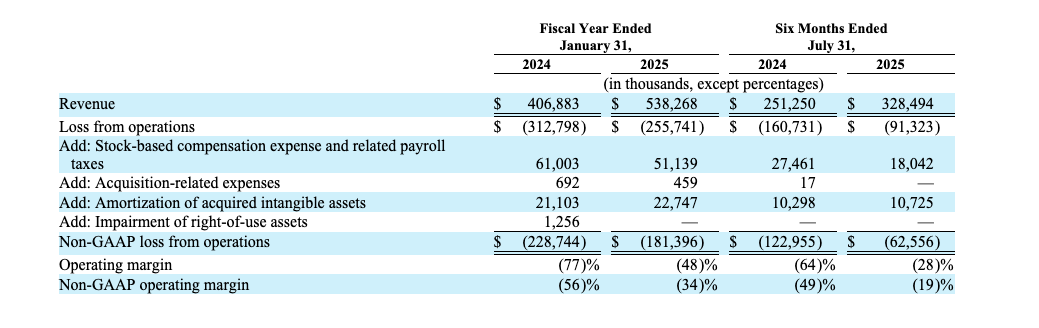

Top-Line Growth & Mix

Netskope delivered strong subscription-driven growth, with revenue rising from $406.9M in FY’24 to $538.3M in FY’25 (+32% YoY).

In the latest period, 1H FY’26 revenue reached $328.5M (+31% YoY), with growth fueled by both new customers (46%) and expansion (54%).

Platform adoption continues to deepen: customers with 3+ / 4+ / 5+ products climbed to 72% / 51% / 35% as of July 31, 2025 (vs. 52% / 29% / 18% in Jan 2022). Large-customer mix expanded to 111 customers >$1M ARR (37% of ARR) and 1,372 >$100k ARR (86% of ARR). ARR reached $707M (+33% YoY).

Profitability Metrics

Gross profit expanded from $243.3M to $347.9M in FY’25, with gross margin up 500 bps to 65%.

In 1H FY’26, gross profit hit $232.8M, and GM stepped up to 71% (from 62% a year ago), reflecting data center & cloud efficiency and scale benefits from NewEdge.

Operating leverage improved materially:

Loss from operations improved from $(312.8)M (–77% margin) in FY’24 to $(255.7)M (–48%) in FY’25.

In 1H FY’26, operating loss improved to $(91.3)M (–28%) from $(160.7)M (–64%).

Net Losses & Non-Cash Volatility

GAAP net loss was $(344.9)M in FY’24 and $(354.5)M in FY’25; 1H FY’26 net loss narrowed to $(169.5)M (vs. $(206.7)M).

A key optical headwind is the fair value accounting of convertible notes, which increased the loss on change in FV from $(38.6)M → $(98.6)M (FY) and $(45.1)M → $(77.4)M (1H). These are non-operational and can mask underlying improvement.

IPO-linked SBC: If the offering had closed as of July 31, 2025, Netskope would recognize ~$315.8M of one-time SBC for RSUs—creating a near-term GAAP margin dip without changing cash economics.

Cash Flow & Liquidity

Operating cash flow improved sharply to +3% margin for the six months ended July 31, 2025 (vs. –42% in the prior-year period).

Balance sheet shows ~$211M cash and ~$519M in convertible note principal & accrued PIK interest.

Financial Trajectory

Netskope remains in a loss-making phase, but trajectory highlights:

Consistent 30%+ top-line growth with rising multi-product penetration and NRR at 118%.

Sustained gross margin expansion (+900 bps in 1H) as NewEdge scale and cloud efficiency compound.

Clear path to operating leverage, evidenced by a 36-point YoY improvement in 1H operating margin.

Closing thoughts

Netskope’s FY’25 and 1H FY’26 results reflect a company scaling into its role as a next-generation security and networking leader. With revenue growth consistently above 30%, gross margin expansion of 900bps in the latest half, and improving operating leverage, Netskope is demonstrating the economics of a cloud-delivered, multi-product platform with deep enterprise penetration.

Bull Case:

Netskope’s financial profile is improving with scale. Rising gross margins highlight strong unit economics as the NewEdge network matures, while customer expansion metrics (118% NRR, 37% of ARR from $1M+ customers) underscore strategic stickiness. Geographic growth in EMEA (+37% YoY) and APJ (+33% YoY) provides diversification, and an LTV:CAC above 10x suggests highly efficient go-to-market motion. If this trajectory continues, Netskope can emerge as the category leader in secure access and zero trust networking.

Bear Case:

Despite progress, profitability remains elusive. Net losses are still material at $(354.5)M in FY’25, compounded by volatility from convertible note accounting. IPO-related stock-based comp will weigh on near-term optics, and operating expenses remain elevated at 112% of revenue. Competition from Zscaler, Palo Alto, and Cisco remains intense, with peers investing heavily in platform convergence. Sustaining differentiation while balancing cost discipline will be a critical execution challenge.

In sum:

Netskope is proving its ability to pair sustained growth with margin expansion while deepening strategic relevance among Fortune 100 and Global 2000 enterprises. The path forward hinges on balancing scale with discipline—turning strong customer economics and product breadth into durable operating leverage. If executed well, Netskope is positioned to define the next era of cloud security and networking.

Here is my interview with Cesare Pesci, a Junior Associate at YOBE Ventures, where he combines a background in investment banking, sustainable finance, trading, consulting, and sales to support growth-stage and tech founders.

In this conversation, Cesare and I discuss:

What qualities or metrics does a VC look for when evaluating a Seed or Series A startup?

How to approach financial modelling and due diligence for early-stage investments where data is often sparse or uncertain?

How can sustainability and green finance be integrated with early-stage VC investing?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow like a rocketship.

And that’s it from me. See you next week.