- Partner Grow

- Posts

- Pine Labs: Point-of-Sale to Public Markets

Pine Labs: Point-of-Sale to Public Markets

Pine Labs IPO Deep Dive

👋 Hi, it’s Rohit Malhotra and Welcome to the Premium edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Thursday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Interested in sponsoring these emails? See our partnership options here.

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

IPO Deep Dive

Pine Labs in one minute

Pine Labs is quietly redefining how merchants in India and Southeast Asia power commerce—across payments, loyalty, and financing. Founded in 1998, Pine Labs began as a point-of-sale (PoS) hardware provider and has evolved into a full-stack merchant commerce platform used by retailers, brands, and banks to acquire, retain, and monetize customers.

Its ecosystem spans PoS terminals, gift cards, BNPL (Buy Now, Pay Later), EMI at checkout, prepaid instruments, and digital payment infrastructure—touching both physical and online channels. From small kiranas to large retailers, over 500,000 merchants now rely on Pine Labs across India, Malaysia, and the UAE.

Operating with a diversified model—fintech infrastructure, SaaS-like payments, and value-added services—Pine Labs turned profitable in FY25 and is now targeting a $6–8B IPO. With investors like Peak XV, Mastercard, and PayPal partially exiting, this IPO marks a generational shift for Indian fintech.

Pine Labs is no longer just a payments company. It’s becoming the OS for merchant growth in an increasingly digital-first India.

Introduction

Pine Labs operates across three foundational pillars: an omnichannel merchant platform, a suite of embedded financial services, and a rapidly expanding international footprint. Together, they form a commerce operating system purpose-built for India and emerging Asia—one that helps merchants grow revenue, improve retention, and offer seamless consumer experiences across offline and digital touchpoints.

Pine Labs’ platform was designed to unify fragmented merchant workflows—from accepting UPI, cards, and wallets to enabling BNPL, EMIs, prepaid instruments, gift cards, and loyalty programs. Merchants no longer juggle multiple providers. Instead, they run payments, financing, and customer engagement on one integrated stack—reaching over 500,000 merchants and 2.5 million PoS devices as of FY25. This model not only improves unit economics but deepens Pine Labs’ position as the rails for consumer commerce across categories like electronics, fashion, QSR, fuel, and healthcare.

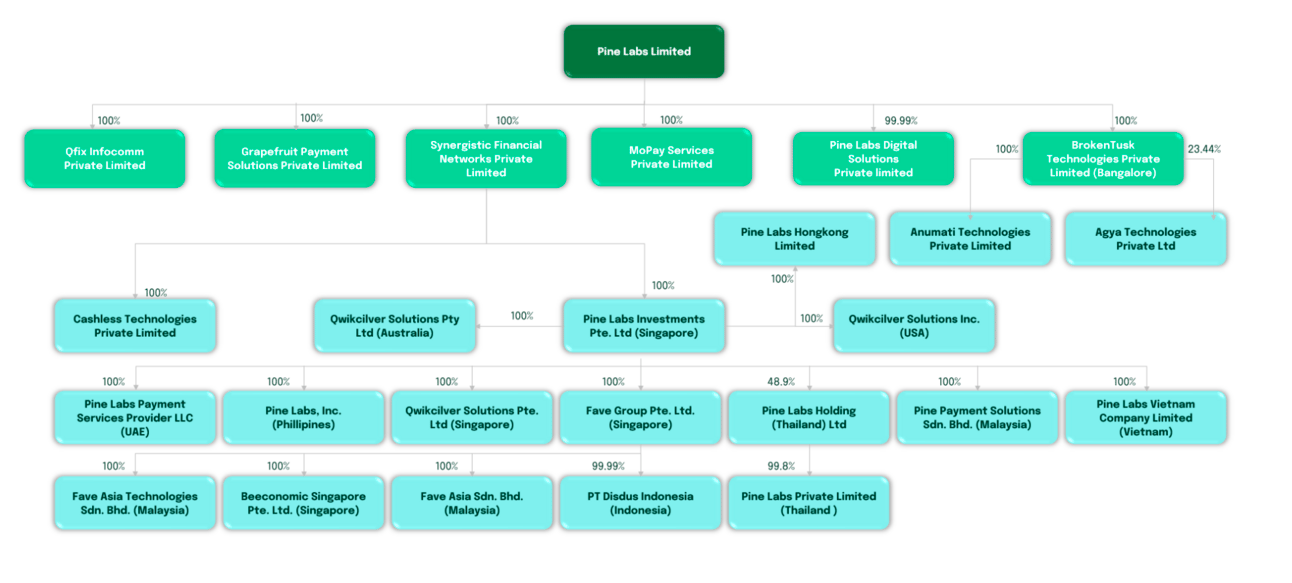

The core business has evolved significantly. What began as PoS hardware has grown into a full-stack merchant solution spanning Pine Labs PoS, QwikCilver (gift cards), Setu (embedded APIs for banks and fintechs), and Fave (consumer loyalty and deals). These acquisitions reflect a deliberate move from standalone tools to an integrated infrastructure platform for commerce—especially in geographies where formal digital adoption is still accelerating.

Pine Labs’ growth engine combines a broad merchant base with deep fintech monetization. Its largest revenue lines—merchant payments and prepaid instruments—are complemented by rising contributions from software, embedded finance, and platform fees. With positive EBITDA, strong retention, and a $6–8B IPO in motion, Pine Labs is now stepping into public markets with global ambition.

At the heart of Pine Labs’ thesis is this belief: that commerce enablement in Asia isn’t just about payments. It’s about building an infrastructure layer that powers how the next billion transact, borrow, and earn loyalty—online and off.

History

Pine Labs began in 1998 as a provider of point-of-sale (PoS) solutions for Indian merchants. Over the next two decades, it steadily evolved from hardware to software, from offline to omnichannel, and from India to Southeast Asia—becoming a full-stack commerce platform powering digital payments, prepaid instruments, and embedded finance.

The company’s first major inflection point came in 2005 with the launch of Plutus, a PoS solution that enabled merchants to accept card payments with integrated EMIs, loyalty programs, and promotions—setting the foundation for value-added commerce infrastructure in India.

By 2013, Pine Labs introduced PayLater, one of India’s earliest Buy Now, Pay Later (BNPL) products. This was followed by PinePerks in 2014, a customizable rewards and corporate gifting platform that would eventually become part of its fast-growing prepaid vertical.

International expansion began in 2017 with entry into Malaysia, signaling ambitions beyond India. In 2019, Pine Labs acquired Qwikcilver, a leading gift card company, cementing its leadership in prepaid instruments. That momentum continued in 2020, when it invested in and later acquired Fave, a consumer loyalty and payments app operating across Southeast Asia.

Between 2021–2023, Pine Labs transformed into a full-stack fintech platform through a series of strategic acquisitions:

Plural (now Pine Labs Online): Entry into online payments and omnichannel checkout.

QFix: Fee collection and event management for educational institutions.

Mosambee: Deepening its presence among mid-market and enterprise retailers.

Setu: Embedded finance APIs powering integrations with banks and fintechs.

Credit+: Expanding merchant credit capabilities.

In 2025, the company consolidated its structure by merging with its Singapore-based parent, unifying global operations under a single entity. This paved the way for its IPO and reinforced its position as one of Asia’s most comprehensive merchant commerce platforms.

From a PoS vendor in 1998 to a public-ready fintech in 2025, Pine Labs has executed a deliberate and strategic evolution—built through product innovation, acquisitions, and regional scale.

Subscribe to Partner Grow to read the rest.

I spend 10+ hours decoding S-1s so you don’t have to. Upgrade to support this work and gain access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Subscriber only posts

- • Post comments and join the community

Reply