👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Pony Ai in one minute

Pony AI is an autonomous driving company founded in 2016 by ex-Baidu executive James Peng. Unlike traditional automakers, Pony AI is intensely focused on merging cutting-edge robotics with deep, strategic partnerships, particularly its close collaboration with Toyota. Those alliances, along with its advancements in robotaxis and robotrucks, are core pillars of its competitive edge.

The challenge for Pony AI will be to assure investors that autonomous driving can be commercialized safely and sustainably. But the company’s growth is hard to ignore: it’s rapidly expanding in both the U.S. and China, two of the world’s most critical mobility markets. Backed by some of the industry’s biggest players, Pony AI is driving toward a future of fully autonomous urban and freight transportation.

To understand how Pony AI’s technology compares to rivals and why its robotruck program could reshape logistics, keep reading.

Introduction

It might have seemed a long shot at first: a small team, with little more than ambition and an idea to make fully autonomous cars a reality. But Pony AI has always been more than just another tech startup. "Pony isn’t about making cars; it's about making the future of transport accessible to everyone," says co-founder Dr. Jun Peng.

Since its 2016 founding, Pony AI has surged ahead of its competitors, with rapid robotaxi and robotruck deployments in China's Tier-1 cities. From these initial test beds, the company has set its sights on commercializing self-driving technology at scale, leaning on deep partnerships with giants like Toyota. But transforming dense city streets into navigable grids for autonomous vehicles requires more than just sleek algorithms. Pony's vision, "to rewrite urban and freight transport," hinges on advancing not only technology but also a culture of resilience in a highly competitive and regulated industry.

Investors are now watching closely as Pony AI nears a public debut. Yet, questions loom: Can the company, despite regulatory hurdles, volatility, and technical challenges, bring large-scale autonomous driving to market? The answer may depend on Pony AI's ability to execute its plans in China and the U.S., sustaining both growth and credibility in a field where tech and trust intersect.

Risky bet?

It’s standard for companies to spell out business risks when going public. But Pony AI’s S-1 reads like a masterclass in covering all the bases, with over 60 pages of what-ifs and why-nots.

One big red flag? Pony’s recent scramble to hire enough staff trained in U.S. GAAP (Generally Accepted Accounting Principles) for proper SEC compliance. The company insists this gap has been closed by late 2023, but recent history has shown how fatal such oversight can be for a young business. Just look at Fisker, the EV upstart that spiraled into bankruptcy after missing its own SEC filing deadline last year.

And then, of course, there’s the looming regulatory oversight from the People’s Republic of China—a familiar foe for companies like Zeekr. As Pony puts it, “PRC regulatory authorities have significant oversight over our business and may influence our operations as they deem appropriate to further economic, regulatory, political, and societal goals.”

But Pony’s risks don’t end there. The company flagged a potential issue with its limited U.S. testing of robotaxis, which may soon face regulatory restrictions on Chinese-connected vehicles. Pony has a permit for AV tests with a driver in California, but here’s the kicker: U.S. operations contributed less than 1% of total revenue in 2023 and the first half of 2024.

Pony’s ability to navigate these hurdles is uncertain. Developing autonomous driving technology involves high-stakes challenges: achieving regulatory approval, maintaining partnerships, securing funding, and complying with complex laws. For example, issues such as predicting unexpected behavior on the road remain challenging. Additionally, Pony’s limited operating history complicates forecasting future growth, as it’s difficult to predict demand and adoption rates within a market still in its infancy.

Key risks also stem from Pony's dependence on partners. OEMs and logistics companies provide critical resources and support, but any disruptions or partner withdrawals could significantly impact Pony’s operations and reputation. Moreover, regulatory uncertainties, particularly in China and the U.S., threaten the company’s plans, with evolving laws around autonomous driving posing potential setbacks.

Market competition is intense, with established players and new entrants competing on technology, safety, and reputation. Traditional transport companies may resist the shift to autonomous systems, and larger automotive firms may develop competing technologies with greater resources. These dynamics could impact Pony’s ability to attract customers and partners, potentially harming its financial results.

Finally, Pony faces operational risks tied to its supply chain, with key components sourced from third-party suppliers. Disruptions or price fluctuations could hinder Pony’s ability to scale its robotaxi and robotruck fleets effectively. Heavy investments in R&D may not yield the expected technological advancements or financial returns, especially in a competitive market where new technologies rapidly become obsolete. Without steady revenue and continued funding, Pony may struggle to maintain the high cash outflows required for its ambitious growth and expansion plans.

Toyota investment

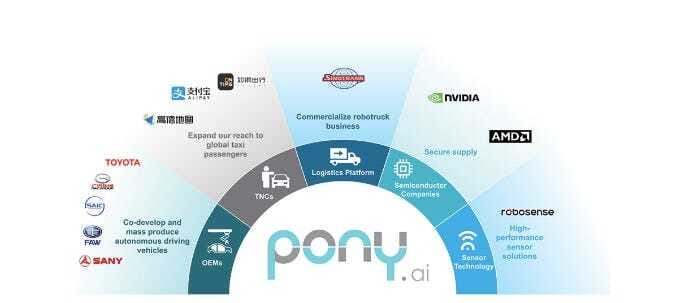

Pony AI has captured the attention of heavyweights like Toyota and Sequoia Capital China. Backers view Pony as a pioneer in the race for autonomous mobility, aiming to tap into the massive, growing demand for driverless transport. To optimists, Pony's dual-pronged strategy — robotaxis for city passengers and robotrucks for freight — is the ideal combination for scaling up in both urban and logistics markets. They also note Pony’s proprietary AI and navigation technologies, which enhance real-time obstacle detection and fleet management, as major strengths.

Beyond technology, Pony’s strategic alliances set it apart. Partnerships with Toyota, among others, bolster Pony's credibility, while also promising avenues for collaborative advancements. As a player already field-testing on roads in China and the U.S., Pony is seen by bulls as well-positioned to ride the autonomous wave globally.

But not everyone is convinced Pony has cracked the code for self-driving success. Critics argue the company’s dependence on high R&D investments — totaling net losses of $125.3 million in 2023 alone — could spell trouble. While alliances with Toyota lend legitimacy, they come with potential restrictions around production capacity and IP sharing that could constrain Pony’s agility in the long term.

Then, there’s China’s regulatory terrain. Though initial policies have favored autonomous vehicle (AV) development, the landscape is volatile. Any policy shift could pose hurdles for Pony’s plans. And even beyond regulation, skeptics caution that the AV market remains nascent, with timelines for mass adoption still unclear. For now, Pony's long-term profitability is uncertain, leaving investors to weigh the potential for high returns against equally high risks.

History

Pony AI didn’t just enter the autonomous vehicle race—it charged into it, backed by visionaries Dr. Jun Peng and Dr. Tiancheng Lou, who co-founded the company in Silicon Valley in 2016. The goal? To bring fully autonomous driving from science fiction into everyday life. The big leap came in 2018 when Pony secured a breakthrough: one of the first permissions to test autonomous vehicles on public roads in China, a key milestone that set the stage for rapid growth and tech advancements.

From there, the pace only quickened. Pony rolled out robotaxi and robotruck solutions that have since logged over 33.5 million autonomous kilometers and drawn heavyweight investors, notably Toyota, who saw Pony’s potential and backed it. By 2021, Pony AI wasn’t just testing anymore; it launched a fully driverless, fare-charging service across China’s Tier-1 cities, marking its evolution from pilot programs to real revenue-generating operations in Beijing, Shanghai, Guangzhou, and Shenzhen.

Today, Pony AI stands at the forefront of autonomous mobility, no longer merely a bold upstart but a serious contender for global expansion, set on transforming the way the world moves.

Market Opportunity

The autonomous vehicle (AV) market is teetering on the edge of rapid expansion, forecasted to hit $96.87 billion by 2030, with China leading the charge. Expected to capture $63.6 billion of this growth, China’s push for AV technology is driven by urban transportation demands and government-backed regulatory support. In this emerging landscape, Pony AI’s dual focus on robotaxis and autonomous trucks aligns it well with two high-growth segments: urban mobility and logistics.

Growth Segments

Robotaxi Market: Projected to surge from $5 billion in 2023 to $35 billion in China by 2030, the robotaxi sector has significant momentum. Pony AI’s early presence in China’s Tier-1 cities, along with partnerships with platforms like Alipay and Amap, positions it strategically to benefit from this shift toward autonomous, shared mobility solutions.

Globally, the passenger mobility market is enormous, valued at $4.4 trillion in 2023 and expected to reach $5.1 trillion by 2035, with China commanding a 32% share. As autonomous options gain traction, Pony AI’s established urban mobility services could capitalize on this upward trend.

Robotruck Market: With the logistics sector poised for autonomous disruption, the robotruck market alone is estimated to exceed $10 billion by 2030. Pony AI’s joint ventures with major logistics companies like Sinotrans anchor its place in this segment, ready to meet the growing demand for autonomous freight solutions.

Licensing and Applications: Valued at $12.3 billion in 2023, the licensing and applications market for autonomous driving is projected to soar to $64.7 billion by 2030. China will continue to drive this expansion, expected to capture nearly 48% of the market by 2030. Pony AI’s focus on licensing its Level 4 autonomous tech offers a path to diversify revenue and stay competitive as AV adoption rises.

Market Drivers and Future Trends

Rising Customer Acceptance: As consumers recognize the safety and efficiency of autonomous technology, demand for higher-level automation is increasing, prompting automakers to accelerate investment in AV software and hardware.

Vehicle Electrification: Electric vehicles (EVs), with their high precision and lower latency, are ideal platforms for AV technology. The shift toward EVs supports AV adoption, as they inherently support the control and redundancy required for driverless systems.

Advances in Software and Hardware: Cutting-edge sensors and processors with high computing power are paving the way for advanced AV functions, enabling more accurate perception and control.

Industrial Collaboration: Deep collaboration between AV companies and OEMs is essential for seamless integration of autonomous systems during vehicle production. Through these partnerships, companies like Pony AI can reduce costs and improve reliability, strengthening their competitive edge.

As the AV sector evolves, Pony AI’s diversified approach, encompassing both passenger and freight solutions, positions it as a leading contender. With established partnerships, a focus on Level 4 autonomy, and a foothold in China’s burgeoning market, Pony AI is primed to capitalize on the autonomous transportation wave, even as competition intensifies and new challenges emerge.

Product

Pony AI’s core product lineup—robotaxis and robotrucks—showcases its ambitious pursuit of autonomous transport. Armed with Level 4 autonomous technology, Pony’s fleet of 250+ robotaxis and 190 robotrucks aims to redefine mobility for urban passengers and freight operators alike.

Robotaxis

Pony AI’s robotaxis, accessible via the PonyPilot app, deliver a driverless ride that rivals traditional services. With over 250 vehicles in service across Tier-1 Chinese cities, the company has logged more than 3.9 million driverless kilometers, proving its readiness to tackle the dense and often chaotic urban streets. Engineered to handle congestion, unpredictable traffic, and diverse weather, Pony’s robotaxis provide a safe and seamless ride experience. This fleet serves as a viable, tech-forward alternative to traditional ride-hailing and positions Pony AI as a leader in automated urban transit, with global expansion in sight.

Robotrucks

Meanwhile, Pony AI’s robotrucks are rewriting logistics. In 2023, these autonomous trucks logged 767 million ton-kilometers, covering high-demand routes through a partnership with Sinotrans. Designed for long-haul routes, the robotrucks excel in fuel efficiency and safety. Equipped with LiDAR, radar, and high-definition cameras, they seamlessly navigate various terrains and weather, proving versatile enough for both rural and urban networks. With major partnerships in logistics, Pony’s autonomous trucks are set to enhance supply chain management, promising efficiency from rural hubs to urban delivery routes.

Pony AI’s strength lies in the robustness and versatility of its autonomous tech across both passenger and freight sectors. As the AV industry advances, Pony is positioned to capitalize on an array of market opportunities, defining the future of transport for both commuters and supply chains.

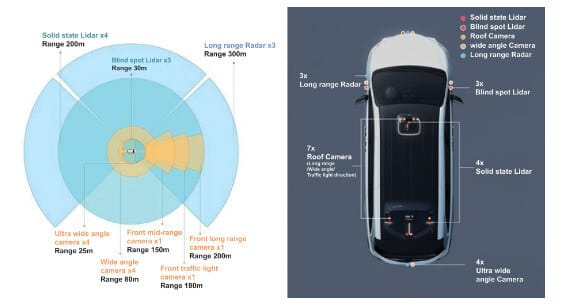

Pony.ai’s multi-sensor suite, featuring LiDAR, radar, high-resolution cameras, and GNSS/IMU, offers precise 360-degree environmental perception.

Its autonomous driving computation unit (ADCU), built on NVIDIA’s DRIVE Orin processors, ensures resource efficiency and high-performance data processing for real-time autonomous navigation.

Pony.ai's AI-driven architecture combines end-to-end (E2E) learning, large multimodal models, and game theory for precision and safety. Using real-time sensor data, the system achieves "zero critical missing" perception, anticipating all object trajectories with low latency. Planning and control modules, trained on real-world human feedback, navigate complex scenarios and optimize safety.

Business Model

Pony AI’s revenue model hinges on two core pillars: autonomous passenger services and logistics.

Robotaxi Services: Pony AI collaborates with popular platforms like Amap and Alipay, offering fare-based autonomous rides to the public. Through these partnerships, Pony taps into an existing customer base while planning to roll out premium options, subscription models, and larger fleets to meet rising demand. This strategy not only generates steady fare revenue but positions Pony to eventually introduce its own direct-to-consumer ride-hailing channels, gaining greater control over pricing and user experience.

Robotruck Services: In logistics, Pony AI’s joint venture with Sinotrans and other logistics firms is driving revenue through autonomous freight transport, including both long-haul and last-mile deliveries. In 2023 alone, Pony AI’s robotruck operations brought in over $24 million, with planned expansions poised to significantly boost future earnings. By leveraging a well-established logistics network, Pony is positioned to become a key player in autonomous freight.

This dual revenue model allows Pony AI to serve both individual consumers and enterprise clients, diversifying its income streams and creating a solid foundation for long-term profitability. As Pony scales, its dependency on external ride-hailing platforms diminishes, allowing it to build a fully autonomous service ecosystem under its own brand.

Management Team:

Pony AI’s executive team combines expertise from tech giants and autonomous pioneers:

Dr. Jun Peng, CEO: With extensive AI experience, Dr. Peng oversees company strategy and partnerships, particularly focusing on regulatory approvals and global expansion initiatives.

Dr. Tiancheng Lou, CTO: A leader in AI and robotics, Dr. Lou is responsible for Pony’s technological innovations and oversees product development, from advanced algorithms to sensor integration.

Dr. Haojun Wang, CFO: Dr. Wang leads Pony AI’s financial strategy and human resources, previously contributing to Baidu and IBM. His leadership in financial planning has been pivotal during Pony’s funding rounds.

Mr. Ning Zhang, VP, Autonomous Driving: Heading the autonomous driving behavior department, Mr. Zhang brings expertise from Google, where he worked on AI projects under the mentorship of China’s sole Turing Award winner, Yao Qizhi.

Dr. Luyi Mo, VP, Robotaxi Division: Leading the Guangzhou and Shenzhen operations, Dr. Mo’s background includes engineering work at NetEase, specializing in robotics for urban transport applications.

Mr. Hengyu Li, VP, Robotruck Division: With a background in engineering at Baidu, Mr. Li manages the robotruck division, overseeing the development and operations of Pony’s long-haul freight solutions .

Investors and Ownership

Pony AI has received substantial investments from high-profile investors, with valuations and funding rounds progressively increasing as the company expands. Here’s a breakdown:

2018: Pony AI secured its Series A funding, raising $102 million led by Morningside Venture Capital and Legend Capital, valuing the company at $1 billion.

2020: Toyota invested $400 million in Pony AI, elevating its valuation to $3 billion. This strategic partnership aimed to accelerate AV technology and support robotaxi development.

2021: Pony AI raised $367 million in a Series C round, backed by Ontario Teachers' Pension Plan and Fidelity, valuing the company at approximately $5.3 billion.

2022: The company reached a $8.5 billion valuation after a $100 million extension from investors such as FAW Group to expand its autonomous trucking division.

Each of these rounds reflects Pony AI’s ambitious goals and growing reputation in the autonomous driving industry.

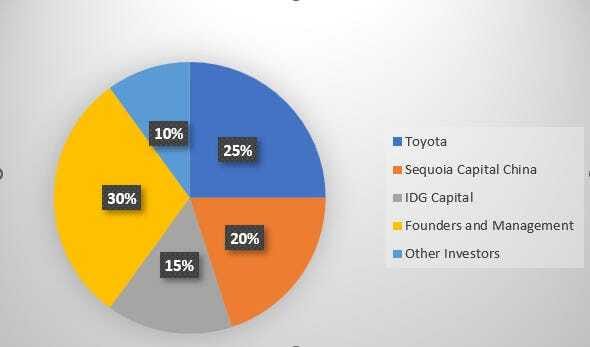

Pony AI’s investor base includes industry giants who believe in its transformative potential:

Toyota: 25%

Sequoia Capital China: 20%

IDG Capital: 15%

Founders and Management: 30%

Other Investors: 10%

Toyota’s strategic investment has not only provided capital but also catalyzed joint R&D efforts, furthering Pony’s capabilities in scaling both its robotaxi and robotruck divisions.

Competition

In the crowded autonomous driving sector, Pony AI competes with well-funded and technically advanced companies like Baidu Apollo, AutoX, Didi, Waymo, and Cruise. Yet, Pony distinguishes itself with a unique, dual-focus strategy, targeting both robotaxi and robotruck markets. This approach enables Pony to serve both individual and commercial segments, tapping into diverse revenue streams and aligning with rising demand across urban mobility and logistics.

Where most competitors prioritize one segment, Pony AI’s dual focus gives it a substantial competitive edge. In the robotaxi market, Pony leverages partnerships with major consumer platforms like Amap and Alipay, expanding its reach to millions of potential users in China’s largest urban centers. The company’s robotaxi fleet, already deployed across Tier-1 cities like Beijing, Shanghai, Guangzhou, and Shenzhen, offers accessible, autonomous rides and is strategically positioned to scale nationwide as demand for driverless mobility grows.

In the logistics arena, Pony AI stands out with its dedicated robotruck services, an offering that many competitors lack. This robotruck fleet, developed in collaboration with Sinotrans and other leading logistics providers, operates autonomously on long-haul routes and provides end-to-end logistics solutions for various industries. By integrating autonomous trucking into its operations, Pony AI addresses a critical demand within supply chains, offering cost-effective, fuel-efficient, and safe alternatives to traditional freight. This dual-market approach also positions Pony AI to capture both daily commuter traffic and the robust commercial freight sector, which is expected to grow rapidly as industries seek autonomous solutions to reduce labor costs and increase operational efficiency.

Pony AI’s strong regulatory foothold across all major Chinese cities further amplifies its advantage. Unlike many of its competitors, which are still navigating complex regulatory landscapes, Pony has secured permits in all of China’s key urban hubs, including complete regulatory approval for public-facing, fare-charging services. This broad regulatory clearance not only allows Pony to operate robotaxis and robotrucks at scale but also provides a unique level of operational flexibility compared to competitors constrained by localized restrictions. These clearances signify Pony’s strategic alignment with Chinese regulators, giving it a favorable position as China continues to invest heavily in autonomous vehicle infrastructure and policy support.

With its focus on both consumer and commercial markets, Pony AI’s approach is geared toward long-term growth and resilience. By diversifying its offerings, it reduces reliance on any single revenue source, making it better equipped to adapt to shifting market demands and regulatory changes. In an industry where scalability and market access are critical, Pony AI’s comprehensive regulatory permissions, combined with its innovative dual-market strategy, make it one of the most versatile and competitive players in the autonomous driving sector.

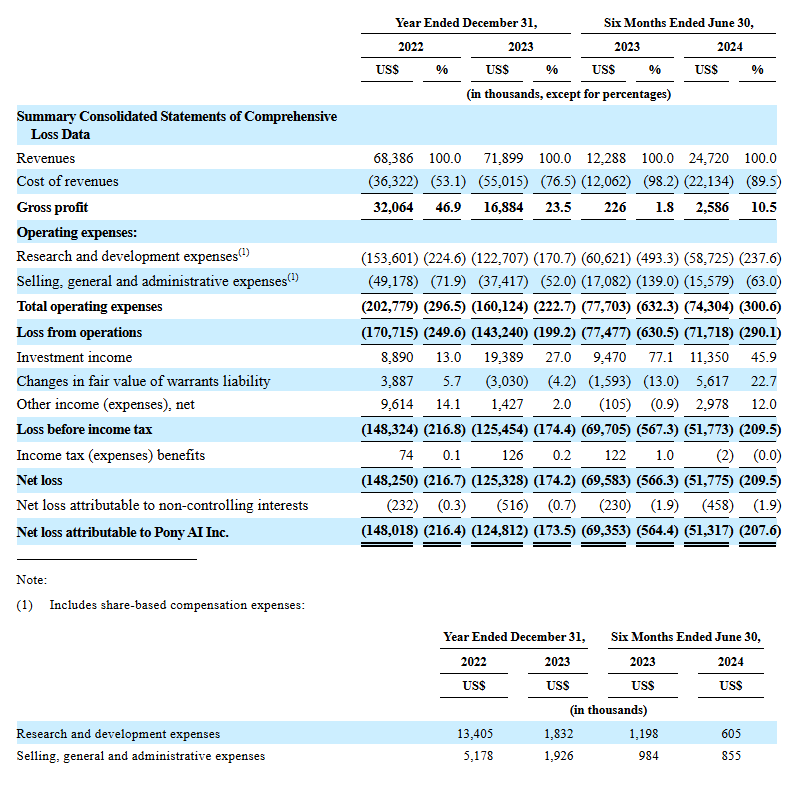

Financials

Pony AI has made significant strides towards commercializing autonomous mobility solutions, reflected in their growing revenues, particularly from the robotruck and licensing segments. Total revenues grew by 101.2% in the first half of 2024 compared to the same period in 2023, fueled by:

Robotruck Services: The robotruck division increased by 62.4% in revenue in the first half of 2024, largely due to growing operations through Cyantron, a joint venture with Sinotrans. With rising mileage and a scaling fleet, this segment is a core growth driver.

Licensing and Applications: This segment saw a remarkable jump, growing from $0.6 million to $5.5 million year-over-year, boosted by new contracts and expanding demand for vehicle domain controller products and V2X technology.

The robotaxi division, though generating a smaller share of revenue, has grown by 86% in the same period as it scales operations across Tier-1 Chinese cities. By targeting both robotaxi and robotruck markets, Pony AI positions itself to capture diverse revenue streams, appealing to both consumer and commercial segments.

Revenue Model and Diversification

Pony AI’s revenue is divided into three main categories:

Robotaxi Services: Revenue in this area is generated through fare-based rides and AV engineering solutions. The fleet operates across Tier-1 cities, which lays the groundwork for sustained growth as adoption rises.

Robotruck Services: Pony AI earns revenue by offering freight transport services to logistics firms, with service fees tied to mileage and tonnage. This division contributed significantly, making up over 70% of total revenue in the first half of 2024.

Licensing and Applications: This segment focuses on offering intelligent driving solutions, data analytics, and V2X products to OEMs and other industry participants. Though accounting for a smaller share in 2024, it saw the highest growth and provides a promising revenue source as contracts with OEMs scale.

While the robotruck services dominate revenue contributions, the diversification into licensing and applications and robotaxi services offers Pony AI a balanced, resilient income stream, positioning it to capture the evolving demand for autonomous driving solutions.

Cost Structure and Efficiency

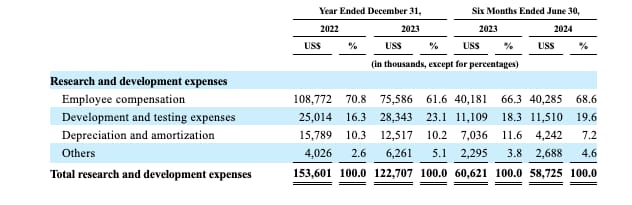

Pony AI’s cost structure is heavily influenced by its fleet operations, R&D investments, and employee compensation:

Fleet Operations: Fleet costs represent the largest component of the cost of revenues, especially for the robotruck segment, which requires substantial fuel, maintenance, and toll expenses. In 2024, fleet operation expenses rose by $6.6 million year-over-year, primarily due to the scaling robotruck fleet.

Employee Compensation: A critical cost factor, personnel expenses increased by $2.8 million in 2024 to support the growing deployment needs. However, R&D costs decreased by 3.1%, reflecting improved efficiency and reallocations as commercialization accelerates.

Operating Expenses: R&D expenses are substantial, with 79% dedicated to R&D in the first half of 2024, reinforcing Pony AI’s commitment to maintaining technological leadership. Selling, General, and Administrative (SG&A) expenses saw an 8.8% reduction due to cost optimization, supporting the company’s move towards operational efficiency.

While gross margin improved from 1.8% to 10.5%, indicating some positive trends in cost management, profitability remains challenging as Pony AI continues scaling its services and enhancing its technology. The operating loss narrowed from $69.6 million to $51.8 million in the first half of 2024, thanks to income from investments and streamlined expenses.

Profitability Potential

Although Pony AI currently operates at a loss, investment income, improved cost controls, and a favorable shift in gross margin suggest a pathway to profitability:

Investment Income: Investment income rose from $9.5 million to $11.4 million, driven by returns on bank deposits and wealth management products, adding resilience to the company’s financial base.

Gross Margin Improvement: Gross margin reached 10.5% in the first half of 2024, up from 1.8% in 2023, suggesting that higher-margin revenue streams and cost efficiencies are gradually enhancing the financial outlook.

Strategic Partnerships and Licensing Growth: Increased partnerships with OEMs and licensing revenues are anticipated to contribute more meaningfully, particularly as V2X and domain controller products grow in adoption.

Pony AI’s financials highlight its ambition and capacity to scale in a competitive, high-investment industry. Revenue growth is robust, and diversification across robotaxis, robotrucks, and licensing underpins its growth strategy. However, high R&D and fleet operational costs continue to challenge near-term profitability. With strategic cost management, gross margin improvement, and expanding partnerships, Pony AI appears positioned to capitalize on its dual focus and advance toward a more sustainable financial model as the autonomous vehicle market matures.

Closing thoughts

Pony.ai is gearing up for a major move in the autonomous vehicle market, aiming to seize the rapidly expanding opportunities in both passenger and freight mobility. As the industry’s appetite for innovative, high-growth tech solutions reaches new heights, Pony.ai is well-positioned to capitalize on this demand with its advanced autonomous technology and strong strategic partnerships. Much like recent public offerings in other tech-driven fields, Pony’s potential market debut could capture significant investor attention, driven by its dual-pronged approach of robotaxi and robotruck solutions.

Backed by Toyota and other industry giants, Pony.ai is more than a tech startup—it’s a carefully built entity with a robust operational framework and a powerful vision for the future of transportation. By building its technology on a foundation of scalability, regulatory foresight, and high-performance data infrastructure, Pony.ai aligns perfectly with the surging demand for autonomous driving, especially in China, where regulatory support is driving rapid adoption.

In the face of complex regulatory landscapes, operational hurdles, and strong competition, Pony.ai’s strategic partnerships and proprietary AI and Virtual Driver technology offer a unique edge. With the robotaxi and robotruck sectors projected to scale rapidly, Pony.ai's approach is methodical, timely, and positioned to make the most of an ideal market window. For investors looking to be part of a high-potential, future-oriented narrative in autonomous mobility, Pony.ai is a company to watch as it picks up momentum in a dynamic and fiercely competitive market.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Holds true for most of us!

Do fewer things but really well

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.