👋 Howdy to the 27 new friends who joined this week!

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are of some of our recent editions.

Rubrik Inc. S1 Breakdown

Rubrik Inc., a leader in cloud data management and backup solutions, is currently traded on the NYSE under the ticker symbol RUBR. Here are some key metrics based on the latest available data:

Current Price: $35.10 (as of market close)

Market Cap: $6.22 billion

52-Week Range: $28.34 - $40.00

IPO Details:

Rubrik went public earlier this year with an IPO price of $40 per share, raising approximately $1.2 billion. The stock experienced a strong debut, closing at $55.78 on its first day, marking a 39% increase from its IPO price. Since then, RBRK has experienced fluctuations, with the stock currently trading around $31.05. The company is currently operating at a loss, with negative earnings per share, which is a common scenario for growth-focused tech companies.

Company Overview:

Rubrik specializes in cloud data management and backup solutions, providing services that help enterprises manage, protect, and secure their data across various environments. The company has established a strong presence in the market with its innovative approach to data management, which combines cloud-native solutions with traditional backup strategies.

Recent Developments:

Strategic Partnerships: Rubrik has recently announced partnerships with major cloud service providers, enhancing its integration capabilities and expanding its market reach.

Product Innovations: The company has launched new features aimed at improving data security and disaster recovery, positioning itself as a critical player in the data management sector.

Expansion Initiatives: Rubrik is actively expanding its product offerings and global presence, targeting new markets to drive growth.

Investment Considerations:

Investors have mixed opinions on RUBR's outlook. Proponents highlight the company's strong market position, innovative technology, and growing demand for cloud data management solutions. They believe Rubrik's ability to secure strategic partnerships and drive product innovation could lead to significant future growth.

Critics, however, point to the company's ongoing losses and the high valuation as potential risks. The complex landscape of data management and backup solutions, along with competitive pressures, adds to the uncertainties surrounding the company's future performance.

As with many newly public tech companies, RUBR represents a high-risk, high-reward investment opportunity. Its future success will likely hinge on its ability to scale its operations, improve profitability, and continue delivering value to its enterprise customers.

History: From a Vision to Reality

In the realm of data management, few companies have carved a niche as swiftly and definitively as Rubrik. Founded in 2014 by a group of visionary entrepreneurs—Bipul Sinha, Arvind Nithrakashyap, Soham Mazumdar, and Arvind Jain—Rubrik began with a simple yet ambitious goal: to revolutionize the data management industry. The founders, leveraging their vast experiences from companies like Google, Facebook, and Oracle, aimed to address the inefficiencies and complexities of legacy data protection systems. What started as a bold idea in a modest Palo Alto office has now transformed into a powerhouse, reshaping the landscape of data management and protection.

Market Opportunity: Tapping into a Burgeoning Industry

The data management market has been ripe for innovation, with an ever-increasing volume of data generated by businesses worldwide. As enterprises grapple with the challenges of data sprawl, compliance, and security, the demand for robust, scalable, and intelligent data management solutions has skyrocketed. Rubrik's entry into this space couldn't have been more timely. The company's approach to converging backup, recovery, and data management into a single, seamless platform tapped into a market hungry for simplicity and efficiency, propelling Rubrik to the forefront of the industry.

Rubrik's market opportunity is substantial and poised for significant growth in the coming years. According to estimates from Gartner® research, Rubrik's total addressable market (TAM) for its platform is projected to reach approximately $36.3 billion by the end of 2024 and approximately $52.9 billion by the end of 2027, representing an average compound annual growth rate (CAGR) of 13%.

Market Segments Breakdown:

Data Management:

2024 Estimate: $12.9 billion

Backup and Recovery Software: $11.1 billion

Archive Software: $1.9 billion

2027 Estimate: $15.4 billion

Backup and Recovery Software: $13.3 billion

Archive Software: $2.1 billion

Security:

2024 Estimate: $23.4 billion

2027 Estimate: $37.5 billion

Rubrik's growth strategy involves leveraging this market opportunity by expanding its SaaS solutions, growing its customer base, enhancing product offerings, and extending its global footprint. The company is well-positioned to capitalize on the rising need for comprehensive data security and management solutions amidst an evolving cybersecurity landscape.

Its market opportunity is expansive, driven by several key segments within the broader data security and protection landscape.

Key Drivers

Accelerated Digitization: The rapid shift towards digital operations across industries increases the volume of data generated, driving demand for robust data security solutions.

Cloud and SaaS Adoption: As organizations migrate to cloud and SaaS environments, the need for secure data protection across these platforms grows significantly.

Increasing Data Value: The critical importance of data for business operations and competitive advantage makes its protection a top priority.

Rising Cyber Threats: The growing sophistication and frequency of cyberattacks necessitate advanced data security measures to safeguard sensitive information.

Segment-Specific Opportunities

Enterprise Data Security: With large enterprises constantly under threat from cyberattacks, the need for comprehensive data security solutions is paramount. Rubrik's Zero Trust Data Security approach is particularly attractive to this segment.

SMB Market: Small and medium-sized businesses are increasingly targeted by cyber threats, creating a significant opportunity for cost-effective and scalable data security solutions.

Public Sector: Government and public sector organizations are focusing on enhancing their cybersecurity measures, presenting a robust market for Rubrik’s solutions.

Healthcare and Financial Services: These industries, which handle vast amounts of sensitive data, are key target markets due to stringent compliance and data protection requirements.

With an expanding TAM and increasing demand for sophisticated data security solutions, Rubrik is well-positioned to capitalize on these opportunities and continue its growth trajectory in the years ahead.

Product Overview: Simplicity Meets Power

Rubrik's flagship product, Cloud Data Management, redefines how enterprises manage data. It offers a comprehensive suite of services, including backup, recovery, archival, and data analytics, all within a unified platform. The beauty of Rubrik's solution lies in its simplicity—automated workflows, instant recovery, and a user-friendly interface that eliminates the need for complex and time-consuming manual processes. With Rubrik, businesses can protect their data across hybrid cloud environments, ensuring security, compliance, and peace of mind.

The Rubrik Security Cloud (RSC), is a cutting-edge, cloud-native SaaS platform designed to ensure unparalleled data protection and resilience across enterprise, cloud, and SaaS applications. Let’s dive into what makes RSC a game-changer in data security.

Key Features:

Cyber Posture:

Continuous Assessment and Monitoring: RSC continually evaluates your data security posture, identifying and mitigating risks to maintain peak security levels.

Cyber Recovery:

Advanced Recovery Tools: In the face of cyber incidents, RSC's advanced tools ensure your data remains intact and available, facilitating swift recovery and maintaining operational continuity.

Data Resilience:

Robust Protection Measures: RSC safeguards your data against loss, corruption, and unauthorized access, ensuring business continuity and data availability no matter the challenge.

Observability and Remediation:

In-Depth Monitoring: RSC provides comprehensive monitoring of your data security status and potential threats, with automated remediation processes that swiftly address vulnerabilities and issues.

Product Strengths:

Zero Trust Principles: RSC operates on Zero Trust principles, assuming no entity—inside or outside the network—should be trusted by default. This minimizes the risk of data breaches and unauthorized access, ensuring your data is always secure.

Cloud-Native SaaS Platform: As a cloud-native SaaS platform, RSC offers unmatched scalability, flexibility, and ease of deployment, making it the perfect fit for diverse IT environments.

AI and ML Integration: RSC leverages artificial intelligence and machine learning to analyze data security threats and deliver predictive insights, empowering you with proactive security management.

Comprehensive Coverage: RSC provides end-to-end data security, covering enterprise data centers, public and private clouds, and SaaS applications, ensuring no aspect of your data is left unprotected.

Rubrik Security Cloud (RSC) is more than just a product; it’s a revolutionary solution that blends advanced technology with robust security principles.

Business Model: Innovation at its Core

Rubrik's business model is centered around delivering value through innovation. The company operates on a subscription-based model, providing customers with flexibility and scalability. This approach not only aligns with modern enterprise needs but also ensures a steady stream of revenue. Rubrik's commitment to customer success is evident in its continuous investment in R&D, driving the development of new features and enhancements that keep the product ahead of the curve.

It provides Rubrik Security Cloud (RSC) platform to customers through direct sales and an extensive partner network. This model is designed to generate recurring revenue, ensuring a steady income stream while fostering long-term customer relationships.

Revenue Streams

Subscription Revenue

Annual Recurring Revenue (ARR): This is the cornerstone of Rubrik’s revenue model. ARR includes recurring charges for software licenses, support, and maintenance services.

Subscription Growth: As of January 31, 2024, Rubrik reported a subscription ARR of $784.0 million, up from $532.9 million the previous year, representing a 47% year-over-year increase.

Professional Services

Rubrik also generates revenue from professional services, which include consulting, implementation, and training services provided to customers. While this is a smaller portion of their overall revenue, it helps ensure customer success and drives higher subscription renewals.

Sales Strategy

Rubrik employs a "land and expand" strategy:

Land: Initially secure a specific type of data or workload (e.g., private cloud, enterprise NAS, cloud, or SaaS applications) through direct sales efforts or channel partners.

Expand: Grow within the customer’s environment by expanding to additional data types, increasing data volumes, and upselling additional features and products. This strategy is evidenced by Rubrik’s high subscription dollar-based net retention rate of 133% as of January 31, 2024.

Customer Acquisition and Retention

Direct Sales Team

Rubrik has a dedicated direct sales team responsible for acquiring new customers and expanding existing accounts. This team works closely with large enterprises and high-value clients.

Partner Network

Rubrik leverages a robust network of channel partners, including resellers, system integrators, and managed service providers, to reach a broader market. These partners play a critical role in customer acquisition and service delivery.

Customer Success and Support

Ensuring customer satisfaction and success is pivotal to Rubrik’s business model. The company offers comprehensive support and professional services to help customers maximize the value of their investment, leading to high renewal rates and customer loyalty.

Management Team: Visionaries Steering the Ship

At the helm of Rubrik is a dynamic and experienced management team:

Bipul Sinha – Co-Founder & CEO

Bipul Sinha, who co-founded Rubrik in 2014, leads the company with a vision shaped by his B.Tech from IIT Kharagpur and an MBA from Wharton. His prior role as a Partner at Lightspeed Venture Partners gave him deep insights into enterprise software, which now guides Rubrik’s strategic direction.

Arvind Nithrakashyap – Co-Founder & CTO

As Rubrik’s Chief Technology Officer, Arvind Nithrakashyap drives the company's technology strategy. With an MS in Electrical Engineering from Stanford and experience as a Distinguished Engineer at Oracle, Arvind’s expertise is key to Rubrik’s tech innovations.

Arvind Jain – Co-Founder & VP of Engineering

Arvind Jain, VP of Engineering and a Rubrik co-founder oversees the company’s engineering teams. His B.Tech from IIT Kanpur and previous experience optimizing Google’s search infrastructure are instrumental in developing Rubrik’s high-performance products.

Murray Demo – CFO

Joining Rubrik as Chief Financial Officer, Murray Demo brings a wealth of financial management experience. With a BA from Stanford and an MBA from Harvard, he has previously served as CFO at Atlassian, Adobe, and Dolby, enhancing Rubrik’s financial strategy.

John W. Thompson – Chairman of the Board

John W. Thompson chairs Rubrik’s Board of Directors. His extensive leadership background includes roles as CEO of Symantec and Chairman of Microsoft. Holding a BA from Florida A&M and an MBA from MIT Sloan, his guidance is invaluable to Rubrik’s executive team.

This leadership team's synergy and shared vision have been instrumental in Rubrik's rapid ascent and ongoing success.

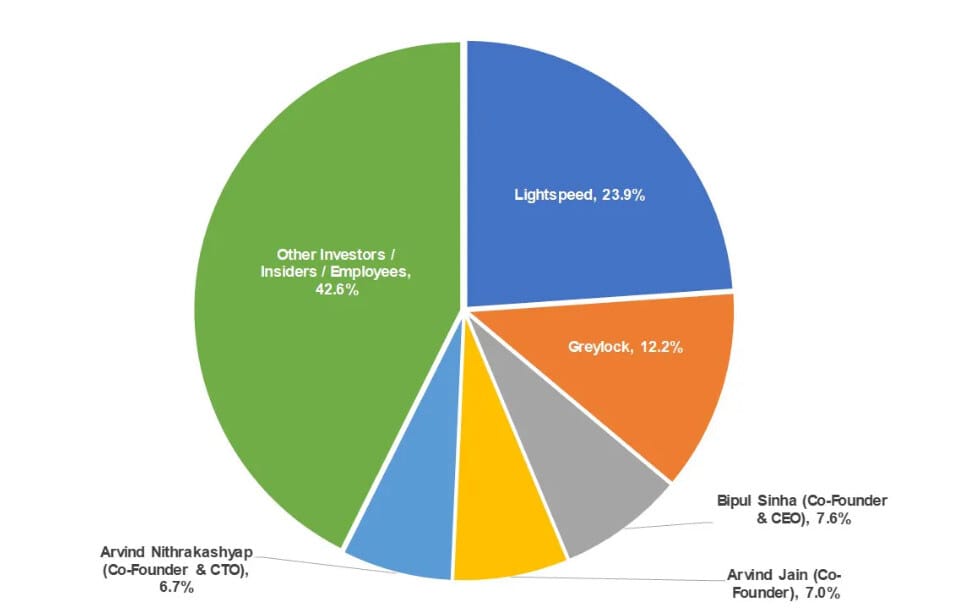

Investors and Ownership: Backed by the Best

Rubrik's meteoric rise has been supported by a cadre of top-tier investors. With backing from firms like Greylock Partners, Lightspeed Venture Partners, and Bain Capital Ventures, Rubrik has secured substantial funding to fuel its growth. This strong financial foundation has enabled Rubrik to expand its product offerings, enter new markets, and consistently innovate. The confidence and support from such esteemed investors underscore Rubrik's potential and credibility in the tech landscape.

Key funding rounds include:

Series D (2017): $180 million at a $1.3 billion valuation, led by IVP.

Series E (2019): $261 million at a $3.3 billion valuation, led by Bain Capital Ventures.

Series F (2021): $275 million at a $3.75 billion valuation, led by Greylock Partners.

Series G (2023): $500 million at a $5 billion valuation, led by T. Rowe Price.

Stakeholder chart:

Competition: Navigating a Crowded Market

In the competitive world of data management, Rubrik stands out, but not without formidable competitors. Companies like Cohesity, Veeam, and Commvault vie for market share with their own unique offerings.

Rubrik operates in a competitive landscape, facing challenges from various incumbents and new entrants:

Traditional Backup Vendors: Veritas, Commvault, Dell EMC.

Modern Data Management Vendors: Cohesity, Veeam, Druva.

Public Cloud Providers: AWS, Google Cloud, Microsoft Azure.

However, Rubrik's edge lies in its holistic approach to data management, seamless integration across environments, and relentless focus on customer satisfaction. These differentiators have helped Rubrik carve out a loyal customer base and maintain its competitive advantage.

Rubrik Security Cloud (RSC) stands out in the market with several unique competitive advantages. Its Zero Trust architectural design ensures top-tier data security by not trusting any entity by default. The platform quickly identifies and surfaces data security incidents for swift action by security operations, maintaining operational continuity seamlessly following cyberattacks and other security incidents. RSC secures data across diverse hybrid multi-cloud environments and detects and analyzes anomalies, sensitive data, user risks, and security threats. It orchestrates complex recoveries automatically, preventing malware reinfection. Furthermore, RSC offers radical simplicity at scale, ensuring ease of use across even the most complex environments. As a fully extensible, API-first platform with broad ecosystem compatibility, RSC enhances flexibility and integration, making it a powerful, user-friendly, and resilient solution for modern data security challenges.

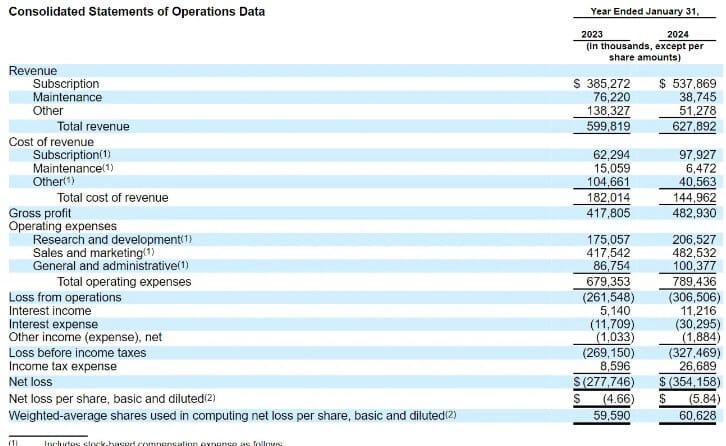

Financial Stats: A Snapshot of Success

Rubrik's financial trajectory mirrors its operational success. With a valuation soaring over $3.3 billion and annual revenue growth consistently in the double digits, Rubrik has demonstrated robust financial health, driven by its innovative products and strong market demand:

Revenue Growth: Rubrik’s total revenue increased from $599.8 million in the fiscal year ended January 31, 2023, to $627.9 million in the fiscal year ended January 31, 2024.

Subscription Annual Recurring Revenue (ARR): Grew from $532.9 million as of January 31, 2023, to $784.0 million as of January 31, 2024, a 47% increase.

Net Losses: $(277.7) million in fiscal 2023 and $(354.2) million in fiscal 2024.

Operating Cash Flow: $19.3 million in fiscal 2023 and $(4.5) million in fiscal 2024.

Free Cash Flow: $(15.0) million in fiscal 2023 and $(24.5) million in fiscal 2024.

Revenue Growth

Rubrik's revenue has consistently grown over the past few years, reflecting its successful market penetration and expanding customer base.

Fiscal Year 2021: $387.6 million

Fiscal Year 2022: $506 million (30.53% YoY growth)

Fiscal Year 2023: $599.82 million (18.51% YoY growth)

Fiscal Year 2024: $627.89 million (4.68% YoY growth)

Customer Metrics

Customer Base

As of January 31, 2024: Over 6,100 customers

Net Retention Rate

As of January 31, 2024: 133%

The company boasts a diverse customer base, including Fortune 500 companies, and has consistently achieved impressive growth metrics. This financial stability reinforces investor confidence and ensures Rubrik's ability to continue its innovation journey.

Final Thoughts

Rubrik's journey from an on-premise appliance business to a cloud-native subscription powerhouse underscores its commitment to evolving with the cybersecurity landscape.

Despite facing challenges such as net losses and a fluctuating stock price since its IPO, Rubrik's strong product adoption and impressive subscription metrics highlight its potential for sustained growth. The company's strategic partnerships and focus on enterprise clients have been crucial in driving revenue, even as economic headwinds elongate sales cycles.

As Rubrik continues to expand its market presence and innovate within the cybersecurity space, its vision of securing the world's data remains clear. With a growing addressable market and a robust product suite, Rubrik is well-positioned to navigate the complexities of the cybersecurity industry and deliver long-term value to its shareholders.