👋 Hi, it’s Rohit Malhotra. Welcome to Partner Growth Newsletter, my weekly newsletter that does deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Squarespace in one minute

Squarespace is the creative entrepreneur’s secret weapon—a powerful, all-in-one platform for building stunning websites, launching online stores, and scaling digital brands. Born in a college dorm room in 2003, Squarespace has evolved into a billion-dollar tech powerhouse with over 4 million active subscriptions. The platform’s appeal lies in its blend of world-class design, intuitive tools, and robust e-commerce capabilities, enabling users to create and grow with confidence.

For Squarespace, design is its ethos and its edge. The company’s focus on aesthetic excellence and user empowerment forms a unique moat, setting it apart in a crowded market. Its challenge? Convincing investors that its growth trajectory can keep pace with its aspirations. But the numbers tell a promising story: with a Total Addressable Market (TAM) projected to surpass $25 billion by 2030, Squarespace sits at the heart of a burgeoning creative economy.

To explore Squarespace's rise from dorm room dream to digital design juggernaut, its competition with Shopify, and the evolution of its product ecosystem, keep reading.

Introduction

It wasn’t the most obvious path to revolutionizing creativity online, but perhaps that’s what makes Squarespace’s story so compelling. Founded in 2003 by Anthony Casalena in a college dorm room, the company wasn’t born of bombastic promises or wild valuations. Instead, it was quietly built on the belief that empowering people to showcase their ideas beautifully could change the way the world interacts with the web.

And yet, Squarespace and its founder make a similar argument to the more flamboyant tech visionaries of our time: culture, design, and ethos are worth something. A platform, they suggest, isn’t just about tools and functionality—it’s about values.

In its rise to becoming a billion-dollar company with over 4 million active subscriptions, Squarespace has leaned into a philosophy that combines creativity, simplicity, and power. Where others might prioritize scale or features, Squarespace has always been about something deeper: creating a seamless digital presence that feels as intentional as it is impactful.

This focus is evident not only in its products but in its ethos, too. Squarespace doesn’t just enable design; it embodies it. And like all great design, its value often feels intangible yet undeniable.

But how does one quantify such things? Can an obsession with world-class aesthetics and an unwavering commitment to user empowerment serve as a competitive moat?

History

Squarespace journey began with Anthony Casalena, a University of Maryland student who wanted to build websites effortlessly. Dissatisfied with the clunky tools available, he coded his own platform in 2003 and began offering it to friends. By 2004, Squarespace had its first paying customers.

Key milestones in its evolution:

2009: Squarespace received its first round of funding—$38.5 million from Index Ventures.

2014: Introduced e-commerce functionality, enabling users to sell online.

2018: Surpassed $500 million in annual revenue.

2021: Listed publicly via a direct listing on the NYSE, debuting at $50 per share.

2024: Expanded globally, with users in over 180 countries and a growing presence in markets like Australia, France, and Germany.

Market Opportunity

The market for website-building and e-commerce tools is booming, with a Total Addressable Market (TAM) projected to surpass $25 billion by 2030. Website-building solutions, like those Squarespace provides, are growing at an 11% CAGR, expected to rise from $9 billion in 2024 to $15 billion by the decade's end. E-commerce is on a similar trajectory, fueled by small businesses and creators who demand scalable, visually stunning digital storefronts.

Small Businesses

In the U.S. alone, over 33 million small businesses form the backbone of the economy, yet more than 40% lack a strong online presence. Squarespace steps into this gap, not just as a platform but as a growth partner. Its affordable, accessible tools allow these businesses to compete on a global stage. Beyond the U.S., opportunities multiply. With a foothold in the U.K., France, and Australia, and expansion into high-growth markets like Asia-Pacific and Latin America, Squarespace is poised to capitalize on international demand, which is increasing at 25% year-over-year.

Freelancers and Creators

The creator economy, now valued at $104 billion, represents another pillar of Squarespace’s market. For freelancers, influencers, and content creators, Squarespace isn’t merely a tool—it’s a springboard. With its easy-to-use templates and seamless e-commerce integrations, the platform enables creators to monetize their work, grow their audience, and build connections effortlessly.

A Post-Pandemic World

The pandemic permanently altered how businesses operate. By 2023, 60% of small businesses in North America identified their website as their primary sales channel, up from 42% in 2019. Squarespace became the go-to solution for entrepreneurs navigating this digital-first shift, cementing its relevance in a transformed economy.

Capturing Mobile Commerce

Mobile commerce, projected to reach $5.2 trillion by 2028 with a 27% CAGR, presents another massive opportunity. With mobile-first design tools, Squarespace empowers businesses to thrive in this mobile-dominated world, where over 60% of web traffic now originates from smartphones.

Squarespace isn’t just competing for market share—it’s cultivating trust and loyalty. By providing professional, sleek designs, the platform gives users confidence and pride in their online presence. From boutique retailers to personal blogs to thriving e-commerce ventures, Squarespace transforms ambition into achievement.

Product

Squarespace empowers millions of creative entrepreneurs to design, grow, and monetize their digital presence through its sophisticated, all-in-one platform. It offers tools that seamlessly combine website creation, e-commerce, marketing, and analytics into a unified ecosystem. By focusing on design-first principles, Squarespace aims to be the foundation upon which individuals and businesses build their online identities.

The Squarespace Platform

At its core, Squarespace is about enabling users to showcase their creativity and ambition with minimal technical friction. Each feature contributes to a cohesive system designed to turn ideas into impactful online experiences.

Website Builder: The Foundation

Squarespace’s website builder is its flagship product, anchoring the platform with professional-grade design capabilities.

Templates: With over 100 customizable and mobile-optimized templates, Squarespace caters to industries ranging from photography to retail. These designs prioritize responsive aesthetics, ensuring a flawless mobile-first experience.

Ease of Use: The drag-and-drop interface makes web design accessible to non-technical users, while advanced features like custom CSS and HTML editing serve power users.

Global Reach: Supporting over 2.3 billion monthly views and handling 45,000 requests per second, Squarespace’s infrastructure delivers reliable performance on a global scale.

E-Commerce: A Growth Driver

E-commerce is central to Squarespace’s growth, supporting businesses of all sizes with a robust suite of features.

Revenue Engine: In 2020, Squarespace processed $3.9 billion in Gross Merchandise Value (GMV), a 90.7% increase from 2019.

Key Tools: From secure payment processing (via Stripe, PayPal, and Square) to subscription billing, inventory management, and abandoned cart recovery, Squarespace equips users to drive sales and streamline operations.

Analytics: Detailed insights on customer demographics, sales trends, and marketing campaigns help users refine their strategies and optimize performance.

Marketing and Branding Tools

Squarespace elevates its users' ability to attract and retain customers through comprehensive marketing tools:

Email Campaigns: Customizable templates, audience segmentation, and performance analytics bring professional email marketing capabilities directly into the platform, competing with standalone solutions like MailChimp.

SEO Optimization: Every Squarespace site is built with SEO best practices, integrated with Google Search Console to provide actionable performance data.

Social Media Integration: Seamless syncing with platforms like Instagram and Pinterest ensures brand consistency and effortless content sharing.

Beyond Websites: Expanding Utility

Squarespace’s strength lies in its ability to meet diverse needs beyond traditional website building.

Scheduling Tools: The 2019 acquisition of Acuity Scheduling added appointment booking and class management, integrated with tools like Zoom for virtual interactions.

Member Areas: A premium feature for creators and educators, Member Areas allow gated content such as virtual classes, paid newsletters, or private podcasts, unlocking new revenue streams.

Domains and Hosting

Squarespace simplifies the technical aspects of domain management and hosting:

Custom Domains: Users can purchase domains directly or connect existing ones with ease.

Performance: With 99.95% uptime and sub-second latencies, Squarespace ensures reliability for critical operations.

Data-Driven Insights

Analytics is at the core of Squarespace’s value proposition, enabling users to understand and optimize their performance.

Unified Dashboard: A consolidated view of website traffic, e-commerce performance, and email campaigns provides actionable insights.

Traffic and Sales Metrics: Reports on visitor behavior, geographic data, and conversion rates help users make data-driven decisions.

Squarespace’s strength lies in its ability to harmonize simplicity and sophistication.

Award-Winning Design: The platform’s templates are celebrated for their aesthetic appeal, helping users create sites that stand out.

Scalability: From personal projects to enterprise-level e-commerce, Squarespace adapts to users’ needs with tiered pricing and flexible tools.

Unified Experience: By offering an all-in-one solution, Squarespace eliminates the need for multiple service providers, saving users time and money.

Business Model

Squarespace operates a subscription-driven business model supplemented by commerce and ancillary services, ensuring consistent revenue streams and scalability. The company has strategically diversified its offerings into three primary segments: website subscriptions, commerce solutions, and add-on services. Together, these components provide a seamless, all-in-one digital platform for creators and businesses worldwide.

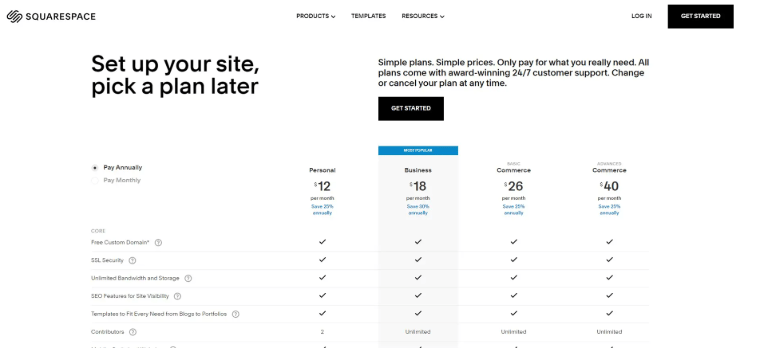

Subscription Revenue:

Subscriptions form the core of Squarespace’s revenue, accounting for over 94% of total revenue in recent years. The company offers tiered pricing plans ranging from $12 to $49 per month, with approximately 70% of customers opting for annual billing, which aids in predictable revenue generation. By Q2 2024, the company had achieved an Annual Run Rate Revenue (ARRR) of $1.18 billion, a 20% year-over-year increase, reflecting the growing adoption of its services. With over 5.2 million unique subscriptions, Squarespace continues to attract a broad spectrum of users, from small business owners to large enterprises.

Commerce:

Commerce services contribute significantly to Squarespace’s growth. The platform processed $3.9 billion in Gross Payment Volume (GPV) in 2020, demonstrating its effectiveness in serving online merchants. Revenue from commerce has grown steadily, with Q2 2024 commerce revenue hitting $81.4 million, up 8% year-over-year. This segment includes tools for online stores, subscription billing, appointment scheduling, and even Member Areas, which allow users to monetize gated content such as virtual classes and private podcasts.

Add-On Services:

Squarespace offers a range of supplementary services, including custom domains, email campaigns, and advanced analytics. These add-ons enable users to expand their digital presence and optimize performance. Notably, the company’s acquisition of Acuity Scheduling brought robust scheduling tools into the fold, enabling businesses to manage appointments and classes seamlessly.

Future Growth Drivers

The company’s focus on expanding international markets and enhancing commerce tools positions it for continued growth. Additionally, the recurring nature of subscription revenue ensures stability even amid market fluctuations. Squarespace’s ability to adapt its pricing and add-on offerings allows it to capture diverse customer needs, from individuals to small and medium-sized businesses.

This multifaceted business model not only generates sustainable revenue but also solidifies Squarespace’s position as a leader in the digital presence and commerce market.

Management Team:

Anthony Casalena: Founder and Chief Executive Officer

Anthony Casalena founded Squarespace in 2003 from his college dorm room at the University of Maryland, where he earned a B.S. in Computer Science. Initially, he was the sole developer, designer, and support provider for the platform, which has since evolved into a leading design-first website builder.

Marcela Martin: President

Joining Squarespace in November 2020, Marcela Martin has over 25 years of experience in finance and operations at global technology and media firms.

Paul Gubbay: Chief Product Officer

Paul Gubbay leads Squarespace’s product development, ensuring the platform remains innovative and customer-focused.

David Lee: Chief Financial Officer

As CFO, David Lee manages Squarespace’s financial operations, ensuring fiscal discipline and strategic growth.

Permira Acquires Squarespace for $7.2 Billion

In October 2024, the British private equity firm Permira finalized its acquisition of Squarespace, taking the company private in a deal valued at $7.2 billion. The acquisition marks a pivotal moment for Squarespace, which has been a publicly traded company since its 2021 direct listing on the New York Stock Exchange. This transaction not only underscores the enduring value of Squarespace's design-first platform but also highlights Permira’s confidence in its growth potential.

The Acquisition Journey

Permira initially announced its intention to acquire Squarespace in May 2024, offering $44 per share, which valued the company at approximately $6.6 billion. After negotiations and discussions with shareholders, the firm raised its offer to $7.2 billion in October 2024, reflecting a significant premium over Squarespace’s average trading price.

This move to privatize Squarespace aligns with Permira’s broader strategy of investing in high-growth technology and digital infrastructure companies. It also follows Permira’s successful investments in companies like Mimecast and Zendesk, further solidifying its footprint in the tech space.

The acquisition was driven by Squarespace’s strong fundamentals:

Financial Performance: By Q2 2024, Squarespace reported $1.18 billion in Annual Run Rate Revenue (ARRR), with a consistent gross margin exceeding 75%. The platform’s recurring subscription revenue model, which accounted for 94% of total revenue, provided stability and scalability.

Market Opportunity: Squarespace operates in a rapidly growing digital presence and e-commerce market, projected to exceed $25 billion by 2030. Its foothold in global markets and ability to attract over 5.2 million unique subscriptions make it a valuable asset for any investor.

Growth Potential: Permira likely sees untapped opportunities in Squarespace’s international expansion, advanced e-commerce tools, and AI-driven design capabilities.

Under Permira’s ownership, Squarespace is expected to accelerate its product development and global growth strategies. Being private will allow the company greater flexibility to innovate and expand without the short-term pressures of public markets. With Permira’s support, Squarespace could enhance its offerings, deepen its presence in emerging markets, and solidify its position as a leader in the digital solutions space.

Investor and Ownership

Squarespace has undergone several notable investment rounds throughout its growth, reflecting both its increased valuation and the strategic investors involved.

2006 (Initial Funding): Anthony Casalena, the founder, started Squarespace with his personal savings and small investments. No specific public investors were involved at this stage.

2010 Series A: Squarespace raised $38 million from Accel Partners and General Catalyst Partners. This round helped solidify its position as a leading website-building platform.

2014 Series B: The company raised $40 million in a Series B round, but investors at this stage remain unlisted in available public records.

2017 Series D: General Atlantic invested $200 million, bringing the company's valuation to $1.7 billion. This round supported Squarespace's expansion into e-commerce and additional tools.

2021 Series F: In a pivotal round, Squarespace raised $300 million, with Dragoneer, Tiger Global, and D1 Capital Partners joining returning investors like Accel and General Atlantic. This round valued Squarespace at a remarkable $10 billion.

Ownership

Competition

As Squarespace prepared for its IPO, it faced fierce competition in the crowded DIY website builder market. The biggest rivals include Wix, Weebly, WordPress, Shopify, and newer players like Webflow and Duda.

Wix and Weebly- Wix, with its customizable drag-and-drop builder and AI-powered design tools, is a major competitor, attracting small businesses and entrepreneurs. Weebly, acquired by Square, focuses on small business solutions with an integrated payment system, but lacks the design sophistication that Squarespace offers.

WordPress-As the world's most used CMS, WordPress offers unmatched customization, but its complexity makes Squarespace’s simpler, all-in-one platform more appealing to those seeking ease of use.

Shopify- Shopify dominates e-commerce with its specialized tools for online stores, posing a challenge to Squarespace’s e-commerce offerings.

Webflow and Duda -Webflow stands out for its high customization and professional design features, while Duda targets agencies with its collaborative platform. Both present emerging threats to Squarespace’s market position.

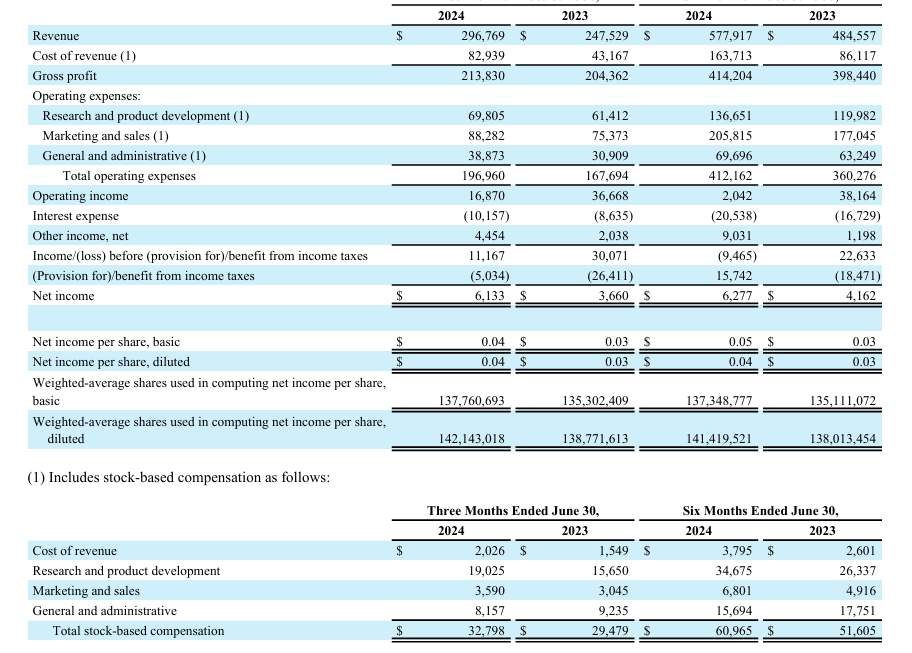

Financials

Squarespace is a prototypical subscription-driven platform, combining product-led growth with a strong focus on design and commerce. Over the years, Squarespace has maintained steady revenue growth, high gross margins, and disciplined cash flow generation, solidifying its position as a leader in digital presence solutions. Let's dig into the numbers and key drivers.

Growth

Squarespace’s revenue trajectory highlights consistent expansion and resilience, even in challenging macroeconomic conditions.

2019: Revenue reached $484 million, driven by the platform's core website subscription business.

2020: Despite pandemic challenges, revenue grew 28.3% YoY to $621 million, as small businesses and creators pivoted online.

2021: Squarespace recorded $754 million in revenue, a 21.4% increase, fueled by surging e-commerce adoption.

2022: Revenue surpassed the $1 billion milestone, hitting $1.14 billion with a 51.2% YoY increase, reflecting strong subscription retention and commerce expansion.

2023: Revenue totaled $1.32 billion, up 15.8% YoY, showcasing resilience amid economic headwinds.

2024 (Projections): By Q2 2024, revenue reached $577.9 million for the first half, reflecting a 20% YoY growth. Annualized projections estimate revenue to hit $1.4 billion, driven by growth in subscriptions and international markets.

Three growth levers stand out:

Subscription Expansion: Squarespace continues to grow its subscription base, reaching over 5.2 million unique subscriptions in 2024, up 21% YoY from 2023.

Commerce Capabilities: E-commerce adoption has been a significant driver, with Gross Merchandise Value (GMV) rising 90.7% YoY in 2020 and continuing to scale through integrated tools like inventory management, subscription billing, and payment processing.

International Markets: With 25% YoY growth in demand for digital tools outside the U.S., Squarespace has successfully expanded its footprint in regions like the U.K., France, and Asia-Pacific.

Margins and Profitability

Squarespace maintains consistently high gross margins, a hallmark of its asset-light SaaS business model.

2020: Gross margins stood at 75.8%, reflecting strong operational efficiency.

2021: Margins improved slightly to 76.4%, supported by higher Average Revenue Per User (ARPU).

2022: Margins dipped to 74.5% due to increased investments in infrastructure and customer acquisition but remained robust.

2023: Margins stabilized at 74.8%, demonstrating Squarespace’s ability to balance growth with cost control.

Operating expenses have grown as the company invests in product development and customer acquisition. However, Squarespace’s focus on cost discipline has driven consistent improvement in operating income:

2023: Operating income rose to $76 million, up from $58 million in 2022, fueled by revenue scaling and strategic cost management.

Cash Flow

Squarespace’s subscription-based model ensures predictable, recurring revenue, supporting strong cash flow generation:

2020: Free Cash Flow (FCF) was $73 million, or 11.8% of revenue.

2022: FCF climbed to $138 million, representing 12% of revenue.

2023: FCF reached $154 million, equating to 11.6% of revenue, bolstered by strong bookings and deferred revenue.

Q2 2024: Operating cash flow rose 15% YoY to $60.6 million, while unlevered FCF totaled $65.4 million, or 22% of revenue.

Key Metrics

Several metrics underline Squarespace’s strong performance:

Average Revenue Per Subscription (ARPU): ARPU increased to $225.45 in 2024, up 3% YoY, reflecting rising adoption of premium plans and services.

Annual Run Rate Revenue (ARRR): ARRR reached $1.18 billion in 2024, a 20% YoY increase, underpinned by sustained demand and high retention rates.

Debt and Liquidity

Squarespace’s balance sheet reflects financial strength and flexibility:

Cash and Investments: As of mid-2024, the company held $270.4 million in cash and $52 million in marketable securities.

Net Debt: Total debt stood at $545 million, offset by cash and investments, leaving a net debt of $222.6 million.

Acquisitions: Liquidity has enabled strategic acquisitions, such as Google’s domain portfolio in 2023, further expanding Squarespace’s service offerings.

Squarespace’s commitment to innovation and user experience drives its continued growth:

Product Development: Investments in features like Member Areas, advanced analytics, and mobile-first design tools cater to evolving user needs.

Marketing: Strategic campaigns targeting small businesses and creators enhance brand visibility and subscriber growth.

E-Commerce Innovation: By expanding its commerce capabilities, Squarespace captures a growing share of the creator economy and small business market.

Closing thoughts

Squarespace’s financial performance and strategic trajectory showcase a business well-positioned for sustained growth and resilience in the competitive landscape of digital presence solutions. The company’s ability to blend high-quality design, robust e-commerce capabilities, and an intuitive user experience has fueled consistent revenue growth, with 2024 projections surpassing $1.4 billion. This trajectory highlights Squarespace’s success in capturing a broad and growing market, from small businesses seeking their first online storefronts to creators and enterprises expanding their digital reach.

Key to Squarespace’s success is its subscription-driven model, which ensures predictable, recurring revenue while fostering high customer retention rates. Over 5.2 million active subscriptions, a 21% year-over-year increase, underline the platform’s broad appeal and ability to scale. Complementing this growth are strong gross margins consistently above 74%, demonstrating operational efficiency even as the company invests heavily in product development, infrastructure, and customer acquisition.

Strategic initiatives like expanding international markets, acquiring Google’s domain portfolio, and enhancing e-commerce tools position Squarespace for continued relevance in a rapidly evolving digital economy. Additionally, its robust cash flow and healthy balance sheet enable the company to fund growth initiatives while maintaining financial flexibility.

Looking ahead, Squarespace is poised to capitalize on increasing global demand for digital presence solutions, driven by the rise of mobile commerce, the creator economy, and digital-first businesses. By continuing to innovate and invest in its platform, Squarespace is not just a tool for building websites—it is a comprehensive solution for empowering users to achieve their ambitions online, solidifying its position as a leader in the space.

Here is my interview with Nick Moran, the founder and General Partner of New Stack Ventures.

Tweets of the week

The only person you should compare is you!

A reminder for everyone

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Amplify Labs: We help you grow your audience on LinkedIn, X (formerly Twitter), and newsletters.

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders