👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my bi-weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday and Friday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Turo in One Minute

Turo is the world’s largest car-sharing marketplace, founded to solve a big, costly problem: the 1.5 billion cars that sit unused most of the time. Unlike traditional rental car giants, Turo’s model turns idle vehicles into income-generating assets for car owners, or “hosts,” while giving travelers flexible, on-demand access to a unique selection of cars around the globe. For Turo, flexibility is a competitive advantage, and their mission—to put the world’s cars to better use—reflects a vision that goes beyond traditional car ownership.

Turo’s biggest challenge? Shifting consumers’ mindset away from owning cars to sharing them. But as more people choose access over ownership, Turo’s model seems tailor-made for the changing landscape. With a 207% growth in net revenue for the nine months ending September 2021, Turo’s expanding footprint suggests it’s striking the right chord with today’s mobile-first, cost-conscious consumer. As of 2021, the platform has over 85,000 active hosts and 1.3 million guests, supporting rapid growth across the U.S., Canada, and the U.K.

To learn about Turo’s unique host-guest dynamics, the competitive car-sharing landscape, and how they plan to redefine mobility, read on.

Introduction

It wasn’t the end of the car rental industry, but perhaps it should have been. Turo’s founders believed that if you looked beyond the numbers, you’d see something fundamental shifting in how people move, travel, and live.

“Turo isn’t just about renting cars,” they argued. “It’s a vision of mobility that redefines access and freedom.”

This ethos drove Turo from its earliest days. The founders didn’t come from a car-rental background; they came with a disruptive idea: unlock the world’s idle cars and let anyone share in that value. Like other ambitious startups, Turo has had its missteps—an early struggle for insurance partnerships, the challenge of market education, and the occasional doubt about its peer-to-peer approach. Yet, these hurdles have only underscored the uniqueness of Turo’s vision.

In its current form, Turo is much more than an Airbnb for cars. While others clamor to fill airports with fleets of generic vehicles, Turo’s marketplace is shaped by culture—a belief in empowerment, choice, and mobility as a shared resource. Hosts can list anything from family minivans to Ferraris, while guests can find the perfect vehicle for their adventure. This is a platform where every interaction is shaped by trust, community, and an alternative to ownership itself.

For Turo, cars are a means to an end, and that end is freedom. The company’s commitment to this vision has driven its explosive growth, with over 85,000 hosts sharing their cars across the U.S., Canada, and the U.K. and enabling guests to go where traditional car rental companies can’t. In a world increasingly drawn to experiences over ownership, Turo’s vision for mobility—a vision that challenges the boundaries of car ownership—is resonating.

What’s it worth? The numbers tell one story. But for Turo, the true value may lie somewhere deeper, in a shift away from ownership towards shared access—something they believe could change transportation as we know it.

Turo’s History

Turo didn’t start out as the global peer-to-peer car-sharing giant it is today. Founded in 2010 as RelayRides, Turo began with a simple mission: unlock the world’s 1.5 billion cars to give travelers flexible, cost-effective options while helping car owners earn extra cash. With a tech-powered platform and a bold vision, Turo began disrupting the car rental industry, adding a layer of connection and flexibility that traditional companies couldn’t offer.

Fast forward to the present, and Turo has grown far beyond its early vision. Operating in the U.S., Canada, and the U.K., Turo’s marketplace has become home to more than 85,000 hosts and 1.3 million active guests. With Turo, you can book a family-friendly SUV, a luxury sports car, or even a rugged truck for off-road adventures. And for car owners, Turo offers a unique income opportunity—whether listing a single vehicle to cover ownership costs or managing a small fleet for a full-time business.

But what makes Turo more than just a car-sharing app? It’s the community. Hosts and guests alike benefit from Turo’s trust-based system, with built-in protections, streamlined booking, and the assurance that the car you book is the one you’ll drive away in. Hosts get the flexibility to adjust prices, availability, and offer extras—like bike racks and prepaid fuel—making every trip as convenient as possible for guests.

With a mission to redefine mobility, Turo isn’t just a marketplace; it’s a platform that embodies a vision of shared access, sustainability, and economic empowerment. As Turo expands, its founders hope the company will do more than make travel easier—they want to change how we think about car ownership altogether.

Growth and Expansion

User Growth: As of September 2021, Turo reported 1.3 million active guests and over 85,000 active hosts.

Revenue Milestones: The company’s revenue grew substantially, reporting $149.9 million in 2020 and $330.5 million for the nine months ending September 30, 2021.

Key Partnerships: Turo has developed insurance and protection partnerships with major providers, including Travelers and Economical Insurance, to ensure safety and reliability for users.

Market

The car rental industry is undergoing a seismic shift, and Turo’s marketplace is set to capitalize on this transformation. In a world where flexibility and on-demand options are increasingly valued, Turo’s peer-to-peer model brings car-sharing to a market traditionally dominated by rigid, corporate rental structures. The car-sharing industry, buoyed by consumer preference for access over ownership, has a massive total addressable market (TAM) valued at $230 billion. Turo’s focus? Converting idle cars into earning assets and putting choice back into the hands of travelers.

Turo’s Serviceable Addressable Market (SAM) focuses on long-distance, high-value trips, sidestepping ultra-short rides that align more with ridesharing. Priced at a daily average of $44, Turo’s rentals are often more affordable than traditional rental companies, with a per-mile cost of $0.23 compared to the $0.58 per mile of personal car ownership. And Turo isn’t just competing with rental giants; it’s defining a new category by turning everyday cars into accessible, rentable assets.

North America remains Turo’s largest growth driver, with a projected market value of $134 billion by 2025. As vehicle ownership costs rise alongside urban living expenses, Turo’s low-commitment rentals provide an attractive alternative, especially in major urban centers where car ownership is financially and practically challenging. With more urban dwellers embracing car-sharing, Turo taps into a shifting mindset that favors flexibility, environmental impact, and cost efficiency.

Europe’s market potential is projected to grow to $65 billion, driven by Turo’s alignment with environmental regulations and urban consumers’ desire for sustainable alternatives. Cities across Europe, from London to Berlin, are increasingly restrictive on car ownership, prioritizing low-emission zones and public transportation. Here, Turo’s platform offers an eco-friendly way to access vehicles, helping urban consumers minimize their environmental impact. Turo’s model appeals directly to European sensibilities, with electric vehicles making up around 7% of its listings—substantially higher than the general U.S. market’s EV penetration rate.

Densely populated, traffic-heavy regions in Asia-Pacific and Latin America offer Turo a compelling $31 billion opportunity. In markets like Brazil and Australia, where high congestion and urban density make traditional car ownership costly and cumbersome, Turo’s model promises a flexible alternative for daily commutes, weekend trips, and everything in between. As Turo scales in these regions, it’s poised to meet demand from consumers seeking affordable and adaptable travel options.

Ownership is no longer the default. Car prices rose 21% between 2016 and 2021, and rising maintenance and insurance costs are pushing consumers to consider alternatives. Turo’s marketplace taps into a broader trend: consumers are shifting toward temporary access over long-term ownership, allowing them to enjoy the benefits of a car without the financial and environmental weight. This change isn’t just about cost; it reflects a broader move towards a lifestyle where flexibility, sustainability, and convenience are paramount. Turo’s growth is positioned right at this intersection, as it offers consumers the ability to book a vehicle for a day, week, or month without the burdens of ownership.

Economic and environmental factors are both powerful drivers of Turo’s growth. Rising car prices and maintenance costs are pushing consumers away from ownership, making Turo a timely alternative. In parallel, consumers increasingly prefer eco-friendly options; Turo’s car-sharing model helps reduce the environmental impact of car ownership, and with a growing fleet of EVs, it’s poised to support sustainable travel. This shared, environmentally conscious approach appeals to today’s consumers, who are seeking to lower their carbon footprint and access clean energy vehicles without the high costs.

The pandemic has reshaped travel preferences, with road trips and local travel surging in popularity. Turo’s platform, offering access to a range of vehicle options from rugged SUVs to luxury sports cars, is particularly appealing to travelers seeking unique, customizable experiences. As traditional travel gives way to individualized, on-demand options, Turo’s flexible approach to rentals places it at the center of this shift.

Turo’s hosts are integral to its success. From individuals seeking to offset the cost of ownership to entrepreneurs building small fleets, Turo’s platform enables users to generate income from underutilized vehicles. This entrepreneurial opportunity is a key differentiator, attracting hosts eager to build income streams without the capital burden of traditional fleet-based rentals. Turo’s model allows anyone to become a “rental entrepreneur,” building a small business while avoiding the asset-heavy model that hinders traditional car rentals.

As the car rental industry shifts, Turo’s $230 billion TAM and $146 billion SAM reflect a substantial market ready for disruption. Turo’s growth strategy—built around a tech-driven, environmentally conscious platform—addresses the demands of a new consumer base. From flexible rentals to sustainable options, Turo’s vision for the future is clear: redefine mobility to favor access over ownership, empowering users to travel without limits.

Product

Turo’s platform isn’t just a car-sharing service; it’s a powerful marketplace for hosts and guests alike, blending technology and convenience to create a unique vehicle rental experience. By positioning itself as a flexible alternative to traditional rental companies, Turo is reshaping how consumers access cars, whether for local errands or long-distance travel.

Booking Flexibility and Instant Access

Turo’s goal is to make vehicle access seamless. The app and website allow users to browse, book, and drive away within minutes, without the hassle of rental counters or hidden fees. Central to this experience is Turo Go, a digital key that enables guests to unlock vehicles without meeting the host in person. Currently available on about 8% of active vehicles, Turo Go enhances convenience and supports contactless rentals. For users accustomed to on-demand services, this feature is a clear step toward a more streamlined rental experience.

Dynamic Pricing and Search Filters

Turo takes a tech-forward approach to pricing. Hosts have access to dynamic pricing tools, which adjust rates based on demand, location, and trip duration. For guests, search filters allow browsing by vehicle type, price, and even use case. These capabilities ensure that users find vehicles matching their needs and budgets while hosts can maximize their earnings—on average, Turo’s dynamic pricing boosts host income by around 15%.

Personalized User Experience

Turo’s platform customizes the experience for both guests and hosts. Guests are matched with cars based on location and preferences, ensuring a quick path to booking the ideal vehicle. Meanwhile, hosts benefit from a Host Hub that streamlines listing management, with tools to adjust availability, optimize visibility, and track guest demand. The Host Hub also features Turo’s Carculator, an analytics tool that offers earnings estimates and insight into guest preferences, helping hosts make data-driven decisions to increase their income.

Comprehensive Host Support

Turo isn’t just a booking platform; it’s a comprehensive toolset designed to support hosts from onboarding to scaling. Listing Management tools allow hosts to adjust pricing, set pick-up locations, and manage vehicle availability with ease. Turo’s Protection Plans add an extra layer of security, offering insurance coverage, third-party liability, and roadside assistance options tailored to host needs. For those aiming to build a business, the platform’s tools facilitate growth, whether for casual hosts or those managing fleets.

Hosts can also participate in Power Host and All-Star Host programs, which boost visibility, increase guest engagement, and offer priority support. This means that whether someone is looking to offset car ownership costs or run a professional fleet, Turo provides the resources and community support to grow.

Product Strengths: A Unique and Flexible Marketplace

Turo’s standout feature is its unique vehicle selection. With over 160,000 listings, the platform offers vehicles that range from economy sedans to exotic sports cars and vintage classics—options that go beyond what traditional rental companies typically provide. Approximately 10% of listings are luxury vehicles, meeting the demand for experiential rentals and niche markets. Guests are not limited by category constraints, and the car they book is the car they drive—an uncommon promise in the rental industry.

Flexible Rental Periods and Diverse Use Cases

Unlike traditional rentals, Turo supports rental periods from a few hours to several months, catering to a wide array of use cases. Nearly a third of Turo’s bookings fall into the long-term rental category (7+ days), demonstrating the platform’s appeal to users looking for extended options without the commitment of ownership. This flexibility is key, meeting the needs of guests with varied transportation requirements—from local errands to month-long travel.

Core User Base and Adaptable Scenarios

Turo’s users are primarily millennials and Gen Z, who represent over 60% of its customer base. These users, who prefer flexibility and affordability, are drawn to Turo’s wide selection and affordable pricing. Turo supports several distinct use cases:

Local Rentals: Turo’s pricing model and flexibility make it ideal for locals looking for short-term rentals, with 42% of trips lasting less than seven days.

Destination Rentals: For travelers seeking unique vehicle options or better rates than traditional rental agencies, Turo offers an attractive alternative.

Experiential Rentals: Turo’s selection includes luxury and unique cars for special occasions, providing an experience-oriented rental option.

Extended Rentals: A significant portion of bookings are between 7 to 30 days, fulfilling the needs of users seeking a car for longer periods, such as month-long road trips or extended visits.

A Platform Designed for the Modern User

As vehicle ownership costs rise and sustainability concerns push consumers to reconsider personal car ownership, Turo’s platform emerges as a fitting solution. For hosts, it transforms idle vehicles into income-generating assets, with the average host earning $545 per month. For guests, Turo offers variety, affordability, and ease—whether they’re looking for a short-term commuter or an adventure-ready 4x4. Turo’s platform capabilities, combined with its flexibility and unique offerings, are positioning it not only as an alternative to car rental but as a leading player in the future of shared mobility.

Business Model

Turo generates revenue through a diversified and well-optimized model designed to capture value from both hosts and guests, ensuring profitability and flexibility for users. While booking fees and protection plans form the backbone of revenue, add-ons and other optional services provide a steady stream of supplemental income. Turo's revenue model is anchored by multiple income streams, each aimed at maximizing the value of its marketplace.

Booking Fees and Service Charges

A significant portion of Turo’s revenue comes from booking fees charged to both guests and hosts. Guests typically pay between 10-35% of the booking value, with fee variations based on trip duration and chosen protection plans. Hosts, meanwhile, pay service fees ranging from 15-25%. This dual-fee structure allows Turo to monetize each transaction comprehensively, aligning with the business model of a marketplace. Notably, Turo’s fee structure is optimized to benefit both casual users and frequent hosts, encouraging engagement across different user profiles and trip types.

Insurance and Protection Plans

Turo has positioned insurance as a core feature, integrating protection plans to provide peace of mind to hosts and guests alike. These plans, which vary in coverage from basic to comprehensive, come at a cost of 8-40% of the booking value, depending on the level of coverage selected. Insurance and protection represent a critical element in Turo's revenue structure, accounting for approximately 12% of total revenue in 2021. By offering four distinct protection tiers, Turo caters to a wide array of risk preferences among hosts, adding a unique value proposition that traditional rental companies often lack.

Add-Ons and Extras

To further enhance both revenue and user experience, Turo has introduced optional services—from prepaid fuel and extra mileage to car delivery. These add-ons contribute an additional 6-8% to each booking’s value and have proven popular among users seeking convenience or customization. For hosts, offering these extras often results in higher booking rates—an increase of roughly 18% on average—thereby driving greater engagement and potentially fostering loyalty among guests. These add-ons not only diversify revenue but also serve as upselling opportunities that enhance Turo's profitability per transaction.

Key Financial Performance Metrics

Turo’s financial performance reflects both resilience and strategic growth within a highly competitive market. Despite ongoing investments in technology and market expansion, Turo’s revenue trajectory remains robust, indicating a healthy adoption rate and scaling capability.

Revenue Growth: Turo's net revenue increased from $141.7 million in 2019 to $149.9 million in 2020, showing adaptability in a challenging environment. For the nine months ending September 30, 2021, revenue surged to $330.5 million—a 207% increase from the same period in 2020. This remarkable growth underscores Turo’s success in scaling its marketplace and increasing its appeal to both hosts and guests.

Net Losses: The company reported a net loss of $129.3 million in the first nine months of 2021, primarily due to investments in technology and geographic expansion. As Turo works to capture market share and solidify its brand, these expenses reflect a strategic push to grow, though they underscore the capital-intensive nature of scaling a peer-to-peer marketplace.

Adjusted EBITDA: Turo’s adjusted EBITDA for the nine months ending September 30, 2021, reached $69.9 million, reflecting operational efficiencies as the company expanded its user base. This positive EBITDA signals that, despite net losses, Turo is building a more sustainable business model with efficient operations and improving margins.

Turo’s financial performance reveals a company poised for growth, buoyed by strong market demand for flexible, alternative car access. Key initiatives, such as expansion into new regions and a commitment to product innovation, will likely play a critical role in the company’s ability to scale further. By continuously refining its booking, pricing, and insurance structures, Turo can strengthen its revenue base and increase value for users.

Additionally, as Turo focuses on increasing host engagement through tools like dynamic pricing and personalized analytics, the platform is fostering an environment where hosts can turn car-sharing into a meaningful revenue stream. This, in turn, expands Turo's appeal to a broader demographic of vehicle owners who may not have previously considered renting out their personal cars.

Overall, Turo's multifaceted revenue model and recent financial trends underscore its adaptability in a rapidly evolving mobility market. As the platform grows, Turo’s ability to balance investment in growth with operational efficiency will be crucial to achieving sustained profitability. The company’s success in creating a unique marketplace driven by flexibility, convenience, and user control suggests it is well-positioned to capitalize on consumer shifts toward shared mobility, potentially positioning Turo as a leading player in the future of transportation.

Management Team

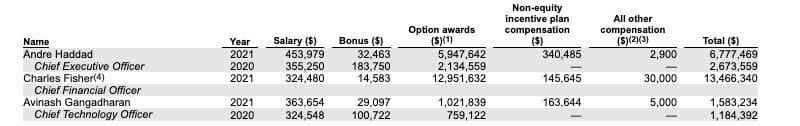

Andre Haddad, CEOAt Turo’s helm since 2016, Andre Haddad is an outspoken advocate for the shared economy, particularly in transforming personal vehicle ownership into on-demand access. His vision is evident in Turo’s platform growth, where he has championed broadening vehicle options, enhancing the app’s user experience, and expanding into international markets. Notably, Haddad is an active Turo host himself, offering a unique user-aligned perspective that shapes his strategic decisions.

Michelle Fang, Chief Legal Officer (CLO)Leading Turo’s legal and regulatory operations, Michelle Fang is instrumental in navigating the complex insurance and liability frameworks across U.S. and international jurisdictions. Her expertise is crucial as Turo scales its offerings amid evolving legal landscapes, and her proactive approach to regulatory challenges has helped Turo establish a trusted reputation in the shared mobility space.

Andrew Mok, Chief Marketing Officer (CMO)Andrew Mok’s data-centric strategy has propelled Turo’s brand to resonate strongly with millennial and Gen Z demographics. His initiatives have expanded Turo’s social media footprint, resulting in over 40% of new users arriving through organic channels. Mok’s focus on brand visibility and community engagement has been pivotal in positioning Turo as a market leader in the car-sharing industry.

Leadership Strategy

With extensive industry expertise and a strong commitment to data-driven decisions, Turo’s leadership team is well-prepared to drive international expansion and solidify the company’s role as a disruptor in the transportation sector. Under Haddad’s leadership, the executive team is leading the cultural shift from personal vehicle ownership to shared access, a transformation poised to reshape global mobility patterns.

Corporate Culture

Employee Growth and MissionTuro’s workforce has grown to over 300 employees across four global offices, each fostering a mission-driven culture that emphasizes community impact and environmental sustainability. Recognized as a “Best Place to Work” by Glassdoor in 2021, Turo’s internal culture prioritizes inclusivity and innovation, creating an environment where employees feel empowered to contribute to the company’s goals.

Investors

Series A (May 18, 2011)Amount Raised: $5.31 million | Post-Money Valuation: $11.8 millionKey Investors: August Capital, Fontinalis Partners, Google Ventures (GV)

Series A-2 (September 10, 2013)Amount Raised: $13.22 million | Post-Money Valuation: $39.9 millionKey Investors: Expansion Venture Capital, Norwest Venture Partners, Webb

Series B (August 13, 2014)Amount Raised: $34.2 million | Post-Money Valuation: $109.44 millionKey Investors: Trinity Ventures, Canaan Partners, Maniv Mobility, August Capital, GV, Shasta Ventures

Series C (November 3, 2015)Amount Raised: $44.81 million | Post-Money Valuation: $294.84 millionKey Investors: Kleiner Perkins Caufield & Byers, August Capital, Canaan Partners, GV, MassChallenge

Series D (September 6, 2017)Amount Raised: $112.96 million | Post-Money Valuation: $695.2 millionKey Investors: Daimler, SK Group, Liberty Mutual Strategic Ventures, Founders Circle Capital

Series D-1 (March 12, 2018)Amount Raised: $5 million | Post-Money Valuation: $695.2 millionKey Investors: Daimler, SK Group, Liberty Mutual Strategic Ventures, Founders Circle Capital

Series E (February 5, 2020)Amount Raised: $240.52 million | Post-Money Valuation: $1.24 billionKey Investors: IAC, Manhattan Venture Partners, Allen & Co.

Series E-1 (February 5, 2020)Amount Raised: $41.5 million | Post-Money Valuation: $1.24 billionKey Investors: IAC, Manhattan Venture Partners, Allen & Co.

Competition

The car-sharing and rental industry has grown increasingly competitive, with Turo positioned as a differentiated leader within this landscape. Turo’s primary competitors fall into three main categories: traditional rental services, other peer-to-peer and digital car-sharing platforms, and vertical market solutions focused on specialty or short-term rentals.

Traditional Car Rentals

Turo’s closest parallels in the industry are traditional rental giants like Hertz and Avis. These companies dominate airport rentals and serve travelers looking for point-to-point mobility. In contrast, Turo’s decentralized model provides more flexibility, with vehicle options located in neighborhoods and rural areas, catering to both local and destination needs. Offering over 1,300 makes and models, Turo provides a range of options that surpasses the relatively limited selection of standard rental companies, which are often constrained by vehicle categories rather than specific models.

Digital Car-Sharing and Peer-to-Peer Platforms

Platforms like Getaround and Zipcar offer direct competition within the digital car-sharing space but target shorter, hourly rentals. Turo differentiates itself with options for long-term rentals, extended booking flexibility, and specialty vehicles, from luxury models to rugged SUVs. As of 2021, Turo commands approximately 30% of the U.S. peer-to-peer car-sharing market, with its extensive network of hosts, making it a preferred platform for those seeking unique, tailored rental options over a broader duration.

Vertical Market Solutions

In the broader automotive and mobility market, specialized solutions focus on particular customer needs or workflows. Platforms like Silvercar by Audi or Kyte offer premium, luxury-only rentals, aiming to serve high-end clients with a specific brand experience. These companies target a narrow segment and lack the community-driven, scalable model that Turo provides to both individual hosts and entrepreneurial fleet owners. While these vertical solutions offer specialized services, they lack Turo’s flexibility and range in serving various customer segments, from budget-conscious travelers to those seeking luxury or utility vehicles for unique use cases.

Strengths and Differentiators

Dynamic and Accessible PricingTuro offers competitive pricing with an average daily rental rate of $44, positioning it 15-25% lower than traditional rentals. Leveraging a data-driven dynamic pricing model, Turo helps hosts optimize rates based on demand and seasonality, typically boosting host earnings by an estimated 15% while meeting the price expectations of guests.

High Customer RetentionTuro’s platform has a strong retention rate, with around 41% of bookings from repeat users, demonstrating robust customer loyalty. This retention rate reflects Turo’s ability to foster long-term relationships with both guests and hosts, in contrast to other car-sharing platforms that struggle to maintain repeat bookings.

Exclusive and Diverse InventoryTuro hosts a vast selection of over 160,000 active vehicles, achieving 88% growth year-over-year. From budget sedans to classic cars and exotic luxury models, Turo’s platform offers vehicle choices that traditional rental agencies and competing car-sharing platforms typically lack, allowing guests to tailor their experience to exact preferences.

Marketplace Density and Geographic ReachUnlike traditional rental services limited to airports and city centers, Turo operates a decentralized model with vehicles widely available in urban, suburban, and rural locations. This approach enables Turo to offer thousands of options across the regions it serves, making it easier for guests to find and book cars nearby, wherever they are.

Value AdvantageThe cost of renting on Turo is highly competitive, with an average per-mile cost of approximately $0.23, compared to $0.58 for traditional vehicle ownership (factoring in fuel, insurance, and depreciation for a medium-sized sedan driven 15,000 miles annually). This pricing model appeals to budget-conscious consumers and those who want flexibility without long-term ownership costs.

Custom-Built, Data-Driven PlatformTuro’s platform is uniquely designed to support both hosts and guests, with tools to help hosts manage listings, optimize prices, and build their car-sharing businesses. The platform gathers and analyzes proprietary data from billions of miles and millions of trips, using machine learning to continuously improve personalization, risk assessment, and fraud prevention, which in turn enhances the user experience and safety.

Strong Brand Loyalty and Organic GrowthTuro’s brand resonates with its target audience, evidenced by the 88% organic traffic rate and high repeat booking rates. Turo’s community-driven model and focus on trust and safety foster a strong network effect, making it the go-to platform for users seeking a reliable, flexible alternative to car ownership or traditional rentals.

Mission-Driven Culture and Experienced LeadershipTuro’s leadership team, which includes hosts like CEO Andre Haddad, brings a mission-driven focus to the company’s operations, emphasizing sustainability, community, and customer experience. This culture has helped Turo attract top-tier talent in areas like product, engineering, and marketing, building a team committed to driving innovation in car-sharing and redefining the automotive rental industry.

Financials

Turo operates with a product-led growth strategy, much like other marketplace giants, and its financials reflect that. Unlike traditional car rental services, Turo’s peer-to-peer model has allowed it to capture significant demand in the travel and car-sharing sectors.

2019: Turo generated $141.7 million in revenue, a solid foundation as the company continued to scale.

2020: Revenue increased modestly to $149.9 million (+6% YoY), showcasing resilience amid the pandemic. This stability, despite travel restrictions, underscores the growing appeal of decentralized car-sharing models.

2021 (First nine months): Revenue jumped to $330.4 million, driven by pent-up travel demand post-pandemic, marking an impressive 213% YoY increase.

2022: Revenue growth remained strong at $746.6 million (+59% YoY), though the pace began to normalize.

2023: Revenue reached $879.7 million, with a more moderate 18% growth as Turo’s user base expanded and the company faced regional market saturation.

2024 (H1): Revenue showed 11% growth YoY, indicating steady but tempered growth as Turo continues scaling internationally.

Sales and Marketing (S&M) Spend

To drive growth and customer acquisition, Turo has strategically ramped up its S&M expenses, particularly post-pandemic.

2019: S&M expenses were $57.8 million, establishing a baseline for customer acquisition and brand-building.

2020: S&M spend dropped to $20 million due to the pandemic, reflecting a conservative approach amid uncertain travel trends.

2021 (First nine months): S&M expenses increased to $30.8 million, signaling Turo’s renewed focus on customer acquisition as travel demand rebounded.

This investment in S&M, while costly, has fueled user growth, especially as Turo expands internationally, allowing it to capture a significant share of the car-sharing market.

Operating Margins and Profitability

Turo’s margins and profitability reflect both the scalability of its model and the costs of expansion.

Gross Margin:

2022: Achieved a robust 54.3% gross margin, showcasing the scalability of Turo's operations.

2023: Gross margin dipped to 51.4% as operational costs increased with expansion efforts.

2024 (H1): Margins saw further compression, down to 44.8%, due to higher operating costs linked to international growth and platform development.

Net Income:

2022: Turo reached profitability with a net income of $154.7 million, a major milestone demonstrating its scalable model.

2023: Net income decreased significantly to $14.7 million due to rising operational costs and market saturation challenges.

2024 (H1): Turo reported $10 million in net income, a recovery from a $22.2 million loss in H1 2023, reflecting improved cost control but also indicating challenges in maintaining profitability during aggressive expansion.

Cash Flow and Liquidity

Turo maintains a strong cash position, with approximately $249 million in reserves. This cash provides the liquidity needed for continued international expansion and technological enhancements. However, managing these reserves carefully is critical, especially as profitability remains under pressure from high operational costs associated with new market entries.

Closing thoughts

Turo’s vision to redefine car ownership through shared access has transformed it into the world’s largest peer-to-peer car-sharing marketplace, offering users the flexibility and convenience that traditional rental companies struggle to match. By converting idle vehicles into revenue-generating assets, Turo empowers individuals to become "rental entrepreneurs," while providing travelers with unique and affordable vehicle options.

Despite competitive pressures and high operational costs, Turo’s growth has been impressive, driven by a product-led approach that emphasizes user experience and community engagement. Revenue surged from $141.7 million in 2019 to $879.7 million in 2023, reflecting both a resilient business model and strong market demand for alternative mobility solutions. Strategic investments in sales and marketing, product development, and international expansion have helped Turo capture a growing share of the $230 billion car-sharing market.

Profitability remains a challenge, as expansion efforts drive up costs. However, Turo’s high gross margins and substantial cash reserves provide a strong foundation for future growth. As the company continues scaling globally, its commitment to innovation and customer satisfaction will be critical in maintaining its competitive edge.

In a world increasingly inclined towards sustainable, flexible solutions, Turo’s model of shared mobility could represent the future of car access. By aligning with shifting consumer attitudes, Turo stands poised not just to disrupt, but to redefine the car rental industry for a new era.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

What a power move by Elon!

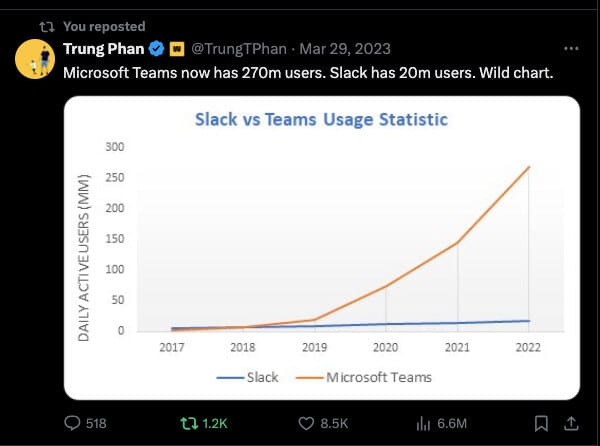

Power of distribution

Not exactly true but launching a podcast has been one of the best things I did

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Get my free sales course: Click here to receive a 5-day educational email course on how to get high-ticket enterprise clients

Subscribe to my YouTube channel: Your Learning Playground with over 350+ podcasts. Previous guests include Guy Kawasaki, Brad Feld, James Clear, and Shu Nyatta.

Sponsor this newsletter: Reach thousands of tech leaders

And that’s it from me. See you on Friday.