- Partner Grow

- Posts

- Voyager: Space Station Ambitions

Voyager: Space Station Ambitions

Voyager S1 Deep Dive

👋 Hi, it’s Rohit Malhotra and welcome to Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Interested in sponsoring these emails? See our partnership options here.

Quick, hard-hitting business news.

Morning Brew was built on a simple idea: business news doesn’t have to be boring.

Today, it’s the fastest-growing newsletter in the country with over 4.2 million readers—thanks to a format that makes staying informed both easy and enjoyable.

Each morning, Morning Brew delivers the day’s biggest stories—from Wall Street to Silicon Valley and beyond—in bite-sized reads packed with facts, not fluff, and just enough wit to keep things interesting.

Try the newsletter for free and see why busy professionals are ditching jargon-heavy, traditional business media for a smarter, faster way to stay in the loop.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Voyager in one minute

Voyager Technologies is on a mission to redefine how America defends, explores, and advances in space. In a global environment marked by rising threats and accelerating investment in space and defense, Voyager was built from the ground up to deliver transformative, mission-critical technologies that serve both national security and humanity’s future beyond Earth.

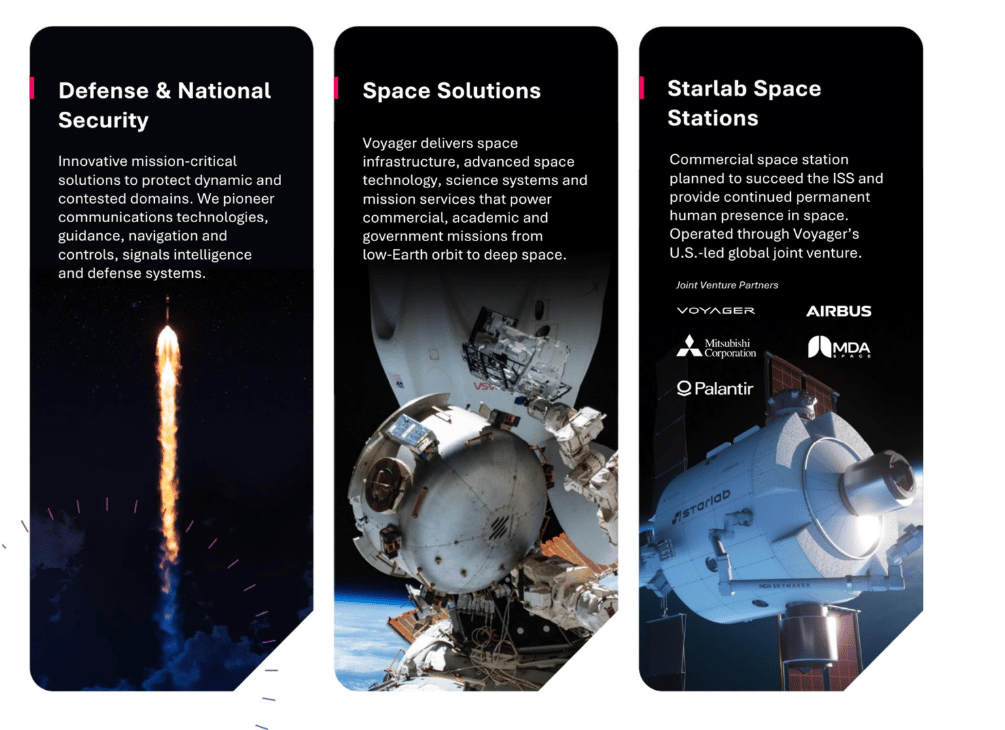

Founded in 2019, Voyager has quickly become a key player across three segments: defense and national security, space solutions, and Starlab space stations. From maneuvering missile defense systems to AI-driven intelligence platforms, Voyager delivers advanced capabilities across land, air, and orbit. Its work isn’t just theoretical—NASA selected Voyager to design Starlab, the commercial space station that will replace the ISS, and the company has already deployed first-of-their-kind space technologies through government and commercial programs.

Voyager operates with a dual-model structure: as a prime contractor that leads full-scale programs, and as a merchant supplier that delivers critical technology across a wide swath of partners—including Lockheed Martin, Palantir, and the U.S. Air Force. This flexible approach gives Voyager the agility to play where it can drive the most impact.

In just six years, Voyager has completed seven acquisitions, grown to $144 million in 2024 revenue, and secured nearly $800 million in contracts and agreements. With a total addressable market of $179 billion across defence and space, the opportunity is immense—and Voyager is positioned to lead the charge, backed by a world-class team, cutting-edge tech, and a bold vision for Earth and beyond.

Introduction

Voyager operates across three core business segments: defense and national security, space solutions, and Starlab space stations. Its offerings span advanced missile defense systems, communications and intelligence platforms, AI-powered edge computing, and next-generation space infrastructure. From supporting frontline defense initiatives to leading space commercialization efforts, Voyager’s solutions are designed to operate at scale and with speed.

The company employs a dual business model—acting as both a prime contractor and a merchant supplier. This flexibility allows Voyager to lead full-scale programs for clients such as NASA and the U.S. Air Force, while also supplying differentiated technologies to industry leaders like Lockheed Martin and Palantir. This approach enables Voyager to participate in the most attractive programs based on strategic fit, financial return, and probability of success.

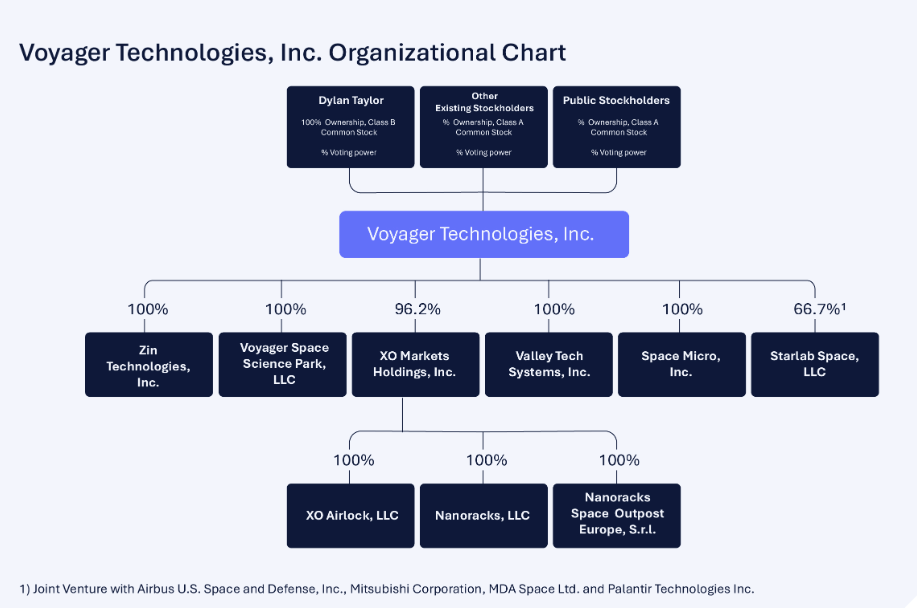

Growth has been driven by a blend of organic innovation and strategic acquisition. Since its founding, Voyager has completed seven acquisitions and expanded revenue to $144 million in 2024. Its flagship project, Starlab—a commercial space station designed to replace the ISS by 2030—is backed by a $217.5 million NASA grant. Voyager leads the project through a U.S.-led joint venture with equity partners Airbus, Mitsubishi, MDA Space, and Palantir.

Voyager’s cross-segment collaboration is a key differentiator. Technologies developed in one division often support or enhance others, enabling cost efficiencies, shared innovation, and faster deployment. For instance, the company is developing AI-enabled edge computing units that integrate Palantir’s software with Voyager’s analytics platforms to deliver real-time intelligence for both terrestrial and orbital applications.

Operating within a combined addressable market of $179 billion, Voyager is positioned to benefit from both sustained government spending and rising commercial demand. The U.S. defense budget alone continues to see bipartisan growth, while the global space economy—projected to exceed $820 billion by 2032—is increasingly driven by commercial players seeking infrastructure and services beyond Earth.

Voyager’s operational track record includes more than 1,000 supported missions and over 220 delivered spacecraft subsystems. The company was the first to attach a permanently integrated, privately-owned module—the Bishop Airlock—to the ISS, a milestone that showcased Voyager’s capabilities and strengthened its public-private partnership with NASA.

Led by co-founders Dylan Taylor and Matthew Kuta, Voyager’s leadership team brings together experience from the military, private equity, and Fortune 1000 sectors. The company is supported by strategic advisory boards composed of former generals, astronauts, and agency leaders, ensuring both deep domain expertise and operational excellence.

As global security threats increase and demand for space access accelerates, Voyager Technologies stands out as a next-generation contractor—built for speed, aligned with mission outcomes, and equipped to lead in an increasingly complex and contested global landscape.

History

Voyager Technologies began its journey in 2019 with a clear purpose: to transform how the United States approaches national security and space exploration. At a time when legacy defense contractors were struggling to adapt to the pace of technological change, Voyager was founded to bring speed, agility, and innovation to industries defined by complexity and scale.

From the outset, Voyager focused on delivering mission-critical solutions that could operate across domains—air, land, sea, and space. The company began building its foundation by acquiring and integrating highly specialized businesses with deep technology heritage. These acquisitions helped Voyager assemble a robust portfolio of capabilities, from missile guidance systems and communications technologies to spacecraft subsystems and AI-powered intelligence platforms.

Early on, Voyager’s approach stood out. Instead of relying solely on traditional government contracts, it pursued a dual model—serving as both a prime contractor and merchant supplier. This gave Voyager the flexibility to either lead large-scale programs or supply key technologies to established defense and space companies. The model proved effective, enabling Voyager to participate in marquee programs and deepen relationships with major players like NASA, Lockheed Martin, and Palantir.

A defining moment came in 2020 when Voyager, through its subsidiary Nanoracks, became the first company to attach a permanently integrated, privately-owned commercial module—the Bishop Airlock—to the International Space Station. It marked the beginning of Voyager’s leadership in public-private collaboration and laid the groundwork for its most ambitious project to date: Starlab, the commercial space station designed to succeed the ISS. Backed by a $217.5 million NASA grant, the Starlab project positioned Voyager as a central player in shaping the next era of low-Earth orbit infrastructure.

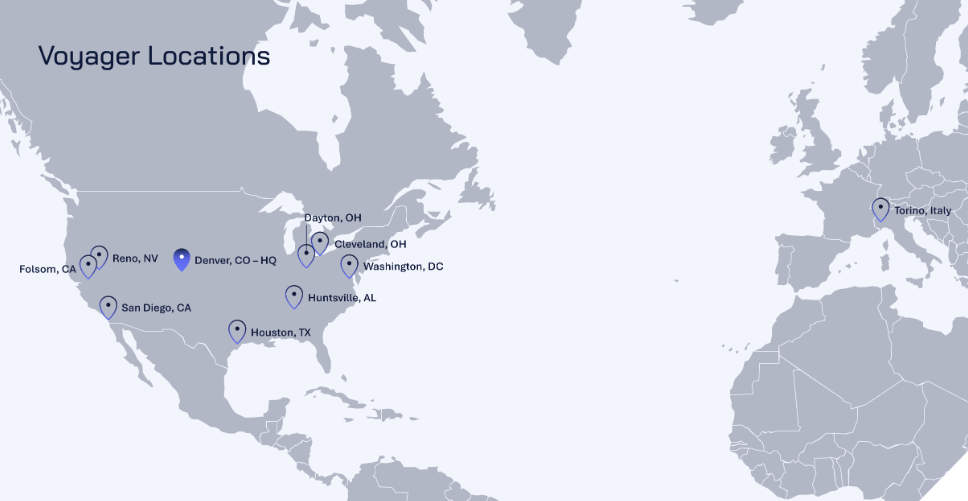

As Voyager expanded, so did its ambitions. By 2024, the company had completed seven acquisitions and grown revenue to $144 million—demonstrating its ability to scale both vertically and horizontally. Its workforce grew to more than 500 employees across 10 locations, all focused on a shared mission: to protect critical assets, strengthen national security, and unlock new frontiers for human progress.

Voyager’s journey has not been without its challenges. Competing against much larger incumbents and navigating evolving government procurement processes required both discipline and innovation. But Voyager’s focused strategy—rooted in technical excellence, customer intimacy, and cross-sector integration—enabled it to keep moving forward.

Risk factors

Voyager Technologies operates in a complex and rapidly evolving landscape, where growth, profitability, and long-term sustainability depend on navigating a wide range of operational, strategic, and external risks. Below are the primary risks associated with its business model and future trajectory:

1. Limited Operating History in a Rapidly Changing Industry

Voyager is a young company operating in a dynamic sector defined by defense modernization and the commercialization of space. With just a few years of operating history, accurately forecasting revenue, scaling operations, and planning for future growth remains challenging. Much of Voyager’s revenue growth to date has come through acquisitions, which adds further uncertainty around consistency and repeatability in organic performance.

2. Reliance on Continued Revenue Growth and Operational Scaling

The company’s ability to scale hinges on expanding sales, R&D, customer success, and manufacturing—all while managing increasingly complex supply chains and administrative functions. Any misstep in scaling these operations or managing costs effectively could result in delays, inefficiencies, or financial underperformance.

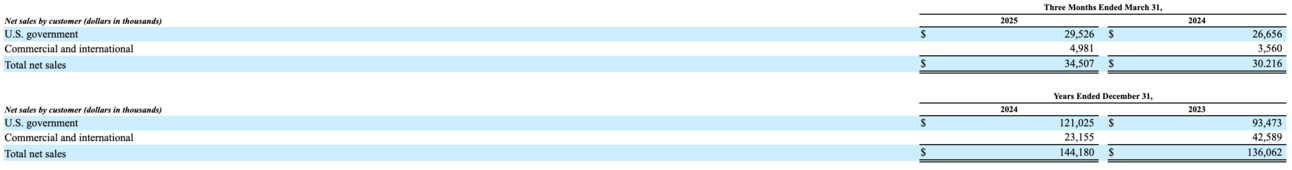

3. High Dependency on U.S. Government Contracts

A substantial share of Voyager’s revenue is derived from U.S. government contracts, including with NASA and the Department of Defense. Shifts in political priorities, budget reallocations, or policy changes could materially impact Voyager’s revenue. The risk is compounded by Voyager’s fixed-price contract structure, which puts the company at financial risk if actual costs exceed estimates.

4. Extended Timelines and Uncertain Returns for Projects Like Starlab

Starlab, Voyager’s most ambitious project, will require between $2.8 and $3.3 billion in capital investment and is not expected to generate revenue until 2029. The company’s reliance on non-dilutive capital, pre-purchase agreements, and public funding introduces significant financing risk. Delays in manufacturing, launch schedules, or regulatory approvals could materially alter the business case for the project.

5. Execution Risks with Joint Ventures

Starlab is operated through a joint venture with Airbus, Mitsubishi, MDA Space, and Palantir. While this structure helps distribute risk and responsibility, it also reduces Voyager’s control over key project decisions. Disagreements, misalignments in strategy, or the withdrawal of partners could disrupt timelines, dilute value, or increase costs.

6. Profitability Pressures and History of Operating Losses

Voyager has yet to achieve profitability and continues to report substantial net losses—$65.6 million in 2024 and $27.9 million in Q1 2025. Future success depends on its ability to significantly scale revenue, improve cost structure, and manage expenses across an increasingly diversified business. There is no guarantee that Voyager will reach or sustain profitability.

7. Vulnerability to Macroeconomic and Supply Chain Disruptions

As a hardware-intensive business, Voyager is exposed to risks related to inflation, raw material costs, and supply chain reliability. Any cost overruns—especially under fixed-price contracts—can materially affect margins. Prolonged inflation or procurement delays could also disrupt delivery schedules and erode customer confidence.

8. Technology Integration and Innovation Risk

Voyager’s value proposition relies on integrating advanced technologies like artificial intelligence, autonomous systems, and in-space computing. Failing to keep pace with rapid industry innovation, or missteps in integrating new technologies into products or platforms, could result in underperformance or obsolescence. Additionally, AI-related regulatory scrutiny or ethical missteps could introduce legal or reputational risk.

9. Financial Exposure from Development Contracts

A significant portion of Voyager’s revenue comes from development-stage contracts that involve tight milestones and technical performance obligations. Missing a milestone or encountering technical setbacks could lead to renegotiated terms, financial penalties, or even contract terminations. These risks are magnified under fixed-price structures where Voyager bears the full cost burden.

10. Capital Requirements and Funding Uncertainty

Voyager will require significant external capital to support growth, especially for projects like Starlab. While it plans to rely on government grants, customer prebuys, and project-based financing, the availability and timing of this capital are not guaranteed. Failure to secure sufficient funding on favorable terms could delay or derail high-priority initiatives.

Market Opportunity

Voyager Technologies operates within a rapidly expanding industry, where advances in technology, increasing public-private collaboration, and geopolitical imperatives are reshaping the role of space in national defense, scientific research, and commercial innovation.

According to Euroconsult, the global space economy is projected to grow from $508 billion in 2023 to $820 billion by 2032. This $312 billion expansion is driven by several long-term structural trends: dramatically reduced launch costs, increasingly capable small satellite platforms, and rising government demand for space-based capabilities. Space is no longer the exclusive domain of large governments—it is becoming an infrastructure layer for global innovation.

Space has never been more accessible. Launch costs have fallen by over 95% since the first space shuttle missions, and reliability has improved significantly. This shift has broadened access to space for commercial enterprises, academic institutions, and research agencies. The result is a surge in orbital activity: approximately 37,000 satellites are projected to launch between 2024 and 2033—more than triple the total from the prior decade.

This new generation of space activity creates a foundational need for advanced technology—launch systems, satellite servicing, in-orbit computing, and autonomous operations—all of which sit at the core of Voyager’s capabilities. Every new satellite launched represents not just payload capacity, but also a long-term need for data processing, communications infrastructure, propulsion, and servicing—products that Voyager is purpose-built to deliver.

A Government-Led Flywheel

The public sector remains a foundational source of funding and demand. NASA’s FY25 budget request stands at approximately $25 billion, a 2% increase over FY24. More importantly, there is a clear shift toward public-private partnership models across the U.S. and allied governments—a structure that Voyager has already successfully tapped across its defense and space projects.

This model is especially relevant to Starlab, Voyager’s commercial space station project. With the International Space Station (ISS) set to deorbit in 2030, governments are expected to redirect roughly $5 billion per year in ISS-related spending to commercial station operators. As a U.S.-led replacement to the ISS, Starlab is positioned to capture a meaningful portion of this reallocated spend while offering a broader platform for commercial and scientific activity.

$16 Billion Addressable Market

Voyager’s near-term focus includes two core segments: Space Infrastructure and Starlab Space Station. Based on data from Novaspace, these segments represent a total addressable market (TAM) of $16 billion, with a $1 billion serviceable market within Voyager’s current reach. As the industry evolves and private enterprises expand their in-orbit ambitions, this serviceable market is expected to grow meaningfully over time.

What happens in space increasingly matters on Earth. Satellite constellations and on-orbit research have direct applications in healthcare, semiconductors, climate monitoring, and national security. Microgravity environments enable breakthrough innovation in areas such as biotech, materials science, and pharmaceuticals—offering results that cannot be replicated on Earth. Technologies developed for space—robotics, filtration, imaging—are being commercialized terrestrially at growing scale.

In this context, Voyager’s capabilities extend beyond hardware. The company is building the tools that will support this broader space-to-Earth innovation cycle, enabling the next generation of applications in AI, advanced manufacturing, and autonomous systems.

Next Chapter of Space Commercialization

The strategic imperative for Western governments is clear: maintain independent human presence in Low Earth Orbit (LEO) and avoid reliance on rival state actors. With China’s Tiangong space station already operational, the United States and its allies are committed to funding a successor to the ISS—an opportunity Voyager is pursuing through Starlab.

At the same time, private-sector use of space is accelerating. Industries including agriculture, energy, and pharmaceuticals are exploring on-orbit R&D, materials testing, and autonomous assembly. Commercial station ownership opens the door to secure, proprietary operations—an important distinction for companies seeking IP protection or private datasets.

Voyager is at the intersection of defense readiness, space commercialization, and terrestrial innovation. The company’s vertically integrated approach—spanning AI, in-space hardware, communications, and mission autonomy—positions it to serve the full lifecycle of orbital operations.

With a clear market tailwind, strong government partnerships, and a first-mover position in next-generation infrastructure, Voyager is well positioned to capture a disproportionate share of the space economy’s future growth.

Product

Voyager Technologies delivers a suite of advanced solutions designed to meet the growing demands of defense systems, intelligence, and national security missions. Representing over half of the company’s revenue, this segment combines decades of expertise with next-generation capabilities across propulsion, signal intelligence, communications, navigation, and AI-enabled edge computing.

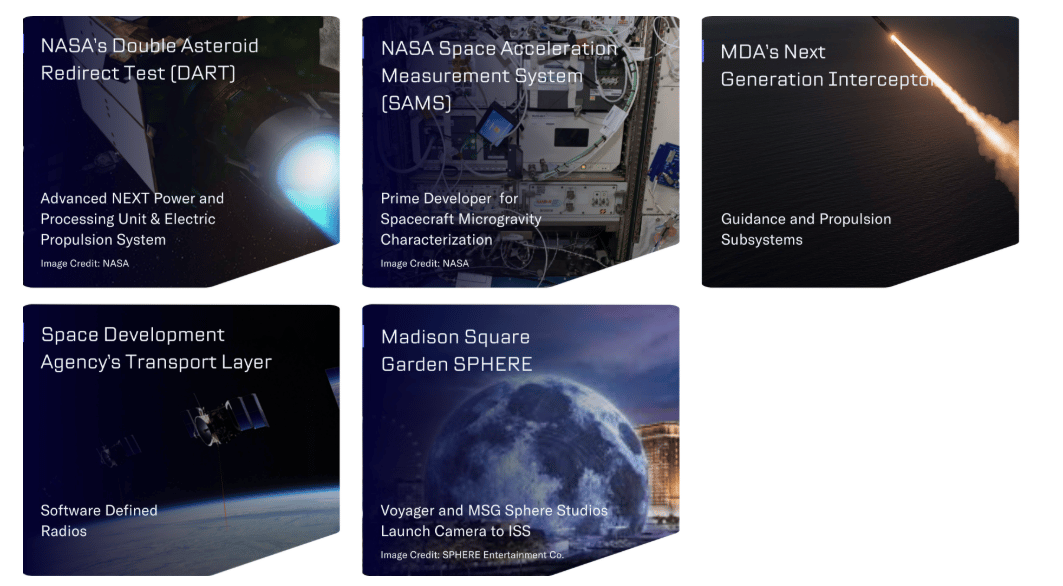

Solid Propulsion Systems

Voyager Technologies provides controllable solid propulsion systems essential to modern missile defense. These systems offer precision thrust and durability for applications ranging from hypersonic vehicles to strategic interceptors. Unlike liquid or cold-gas systems, solid propulsion solutions are cost-effective, maintenance-free, and long-lasting. Voyager currently supports Lockheed Martin’s NGI contract through a $78 million agreement, with further opportunities across civil, military, and commercial launch programs.

Signals Intelligence Platforms

The company’s intelligence analytics platform integrates signal processing, geolocation, and AI-driven analysis to convert raw data into real-time, mission-critical insights. By combining proprietary software with Palantir’s operating system, Voyager enhances operational visibility and intelligence processing for national security missions. Its solutions are trusted by top government agencies and defense primes.

Communications Systems

Voyager Technologies offers a robust portfolio of radiation-hardened RF and laser communication systems that have supported space missions since 2002. With a cumulative 275 flight-years of failure-free operations, these transceivers and data-handling systems serve deep space, LEO, and new use cases like on-orbit computing and orbital infrastructure.

Navigation and Guidance Technologies

Voyager’s navigation suite—featuring sun sensors, star trackers, and inertial measurement units—delivers precision for spacecraft maneuvering, satellite constellations, and formation flying. These high-reliability systems are deployed on missions such as NASA’s Magnetospheric Multiscale Mission and support both defense and commercial programs.

AI-Enabled Edge Computing

To enhance decision-making at the source, Voyager is building AI-powered edge computing platforms for space applications. By embedding radiation-hardened GPUs and integrating advanced analytics with Palantir’s software, Voyager enables satellites to process intelligence in orbit—minimizing transmission risk and enabling real-time insights in contested environments.

Space Solutions

Voyager Technologies is a leader in commercial space innovation, offering mission-ready infrastructure, hardware, and engineering services to agencies and private enterprises worldwide. This segment powers operations from orbit servicing to full-scale mission management and space science research.

Advanced Spaceflight Systems

Voyager provides propulsion, control, and integrated software systems for orbital servicing, space manufacturing, and deep space exploration. Its technology powered NASA’s DART mission—an asteroid deflection test—highlighting the company’s engineering credibility for high-impact space programs.

Space Infrastructure

The Bishop Airlock, designed and operated by Voyager, is the first privately-owned module on the International Space Station. It enables efficient payload transfers, robotics testing, and in-space maintenance. Currently under contract with NASA and ESA, the Bishop Airlock established the viability of public-private space infrastructure and serves as a foundation for future platforms like Starlab.

Space Science & Mission Management

Voyager manages one of the largest portfolios of commercial science missions on the ISS. With more than 330 satellite deployments and 1,000+ missions across 35 countries, its services support biopharma research, STEM education, military experiments, and materials testing. Systems like SAMS, which monitors microgravity impacts, have collected over a trillion data points, informing both space research and Starlab development.

Starlab Commercial Space Station

Starlab is Voyager’s flagship venture into the next era of orbital infrastructure. As the lead and majority partner in the Starlab joint venture, Voyager is building a permanent low Earth orbit space station designed for global access. With support from Airbus, Mitsubishi, MDA Space, and Palantir Technologies, Starlab will serve government agencies, scientific institutions, and commercial users. Its mission is to ensure continuity of microgravity research after the ISS and catalyze a new era of sustainable space-based commerce.

Partners

Amplify Labs partners with founders, CEOs, and busy professionals to build authority, generate leads, and grow audiences across LinkedIn, X (formerly Twitter), and newsletters.

We specialize in crafting high-performing written content tailored to your unique voice, goals, and niche—helping you stand out and become a go-to expert in your industry. One of our clients generated 50+ qualified leads from a single post. Another landed inbound interest from a multibillion-dollar company.

Interested in sponsoring these emails? See our partnership options here.

Business Model

Voyager Technologies operates a flexible and resilient business model designed to capture value across both prime contractor and merchant supplier roles. This dual-channel structure allows the company to serve a wide spectrum of mission-critical programs across U.S. and allied defense and space initiatives—either by leading engagements directly or supporting prime contractors with specialized subsystems and technologies.

In its prime contractor role, Voyager owns customer relationships and delivers end-to-end capabilities. Notable examples include the Starlab commercial space station program and the NASA HUNCH initiative, which fosters space-focused STEM engagement in U.S. high schools. These programs reinforce Voyager’s ability to deliver turnkey solutions aligned with national priorities in education, space infrastructure, and innovation.

In parallel, Voyager’s merchant supplier model allows it to deliver precision subsystems—such as star trackers, propulsion systems, and software-defined radios—across a broad portfolio of defense and aerospace programs. Unlike traditional subcontracting, the merchant supplier strategy allows Voyager to serve multiple prime contractors simultaneously, often under favorable commercial terms. This model enhances margin potential, diversifies program exposure, and strengthens Voyager’s position within multi-billion-dollar government and commercial ecosystems.

By maintaining optionality across both contracting pathways, Voyager can prioritize projects with the strongest return on capital while sustaining long-term alignment with major public and private sector partners.

Voyager’s business model is underpinned by a robust backlog of awarded programs and a well-qualified pipeline of future opportunities. As of March 31, 2025, the company had secured multiyear commitments across key defense programs—including Hypersonic Interceptor DACS, Next Generation Interceptor, and the Trident II D5 Life Extension II—each offering line-of-sight to stable, near- and medium-term revenue.

Beyond current backlog, Voyager is actively pursuing over $3 billion in potential contract opportunities through programs like Exo-ACS (U.S. Navy and Air Force), the Golden Dome (formerly Iron Dome America), SM-3 Block IIA / Block IB, and other advanced missile defense platforms. Many of these projects are tied to U.S. strategic deterrence initiatives expected to run through 2040 and beyond, providing structural growth tailwinds amid escalating geopolitical tensions.

This high-conviction pipeline, paired with Voyager’s historical execution track record, provides investors with visibility into sustained future growth.

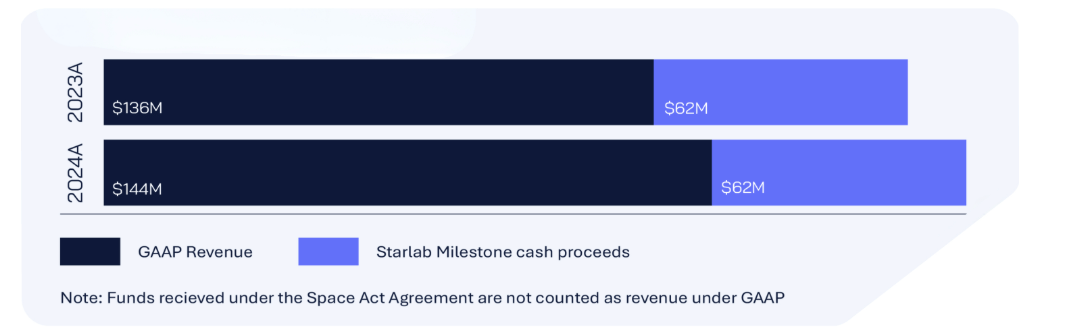

Starlab and NASA Grant Funding

Voyager’s space infrastructure segment—anchored by the Starlab commercial space station—represents a significant strategic and financial upside to its core defense portfolio. Backed by a $217.5 million development grant from NASA’s Commercial Destinations Free Flyer (CDFF) program, Voyager has already received $82.2 million in milestone-based payments, with an additional $70.3 million in eligible proceeds remaining as of March 31, 2025.

Beyond grant funding, Voyager anticipates that Starlab will evolve into a revenue-generating orbital asset post-launch, modeled on the economics of long-lived terrestrial infrastructure. Designed to replace the International Space Station (ISS) ahead of its planned decommissioning in 2030, Starlab will provide sovereign governments, research institutions, and commercial partners with permanent access to microgravity environments.

This platform, jointly developed with Airbus, Mitsubishi, MDA Space, and Palantir, positions Voyager to capture first-mover advantage in the emerging commercial space station market.

Model Designed for Scalability

Voyager’s business model is built for scale, diversity, and capital efficiency. Its ability to operate as both a mission prime and subsystem supplier provides strategic flexibility in navigating defense procurement cycles, program delays, or shifting agency priorities. This dual-structure approach enables Voyager to maximize its relevance across a wide array of national security and space initiatives, while maintaining financial discipline and minimizing concentration risk.

As geopolitical priorities continue to shift toward space exploration, hypersonics, and advanced deterrence technologies, Voyager’s adaptive operating model positions it to become an enduring, system-critical partner to the U.S. government and allied agencies worldwide.

Management Team:

Dylan Taylor – Chief Executive Officer

Dylan Taylor has served as Chief Executive Officer of Voyager Technologies since its founding in August 2019. He previously held multiple leadership roles at Colliers International Group Inc. (NASDAQ: CIGI), including CEO of Real Estate Services, Global President, and Chief Operating Officer. Dylan holds an M.B.A. in Finance and Strategy from the University of Chicago Booth School of Business and a B.S. in Engineering from the University of Arizona.

Matthew Kuta – Co-Founder & President

Matthew Kuta is the Co-Founder and President of Voyager Technologies. He has served on the company’s board since 2019 and brings a unique combination of military and financial experience. Before Voyager, he was part of the private equity team at Goldman Sachs and served as a U.S. Air Force officer and F-15E evaluator pilot. Matthew holds a B.S. from the United States Air Force Academy, an M.B.A. from Duke University’s Fuqua School of Business, and an M.A. in Diplomacy from Norwich University.

Phil De Sousa – Chief Financial Officer

Phil De Sousa has been Chief Financial Officer of Voyager Technologies since October 2022. Prior to Voyager, he was CFO at Transamerican Auto Parts, a Polaris Inc. company, and served as VP of Finance for Xylem Inc. (NYSE: XYL) following its spin-off from ITT Corporation. Phil earned both his B.B.A. and M.B.A. from Iona University and is a Certified Public Accountant in New York State.

R. Marshall Smith – President, Space Solutions

Marshall Smith currently serves as President of Space Solutions at Voyager Technologies, a role he assumed in January 2025. Previously, he served as Chief Technology Officer and VP of Exploration at Voyager. He holds a B.S. in Electrical Engineering from the University of Tennessee and an M.S. in Electrical and Computer Engineering from Virginia Tech.

Investment

Voyager Technologies launched in 2019 with a bold mission to build a vertically integrated space company capable of delivering transformative technologies across defense and space. In its early years, Voyager raised close to $178 million from a strategic mix of investors, including Scout Ventures, Seraphim Space, Jackson Moses, Industrious Ventures, and NewSpace Capital. This initial funding supported Voyager’s early acquisitions, talent expansion, and entry into both commercial and government space sectors.

Strategic Acquisitions (2021–2023)

With growing investor confidence, Voyager pursued an aggressive M&A strategy to consolidate mission-critical space technologies under one platform. Between 2021 and 2023, the company acquired a portfolio of innovative firms including:

The Launch Company (April 2021)

NanoRacks (May 2021)

Valley Tech Systems (October 2021)

Space Micro (January 2022)

Zin Technologies (March 2023)

These acquisitions allowed Voyager to rapidly build capability across launch infrastructure, satellite communications, propulsion systems, and microgravity research, all while strengthening its role as a preferred partner for government and defense agencies.

Investor Momentum (2024–2025)

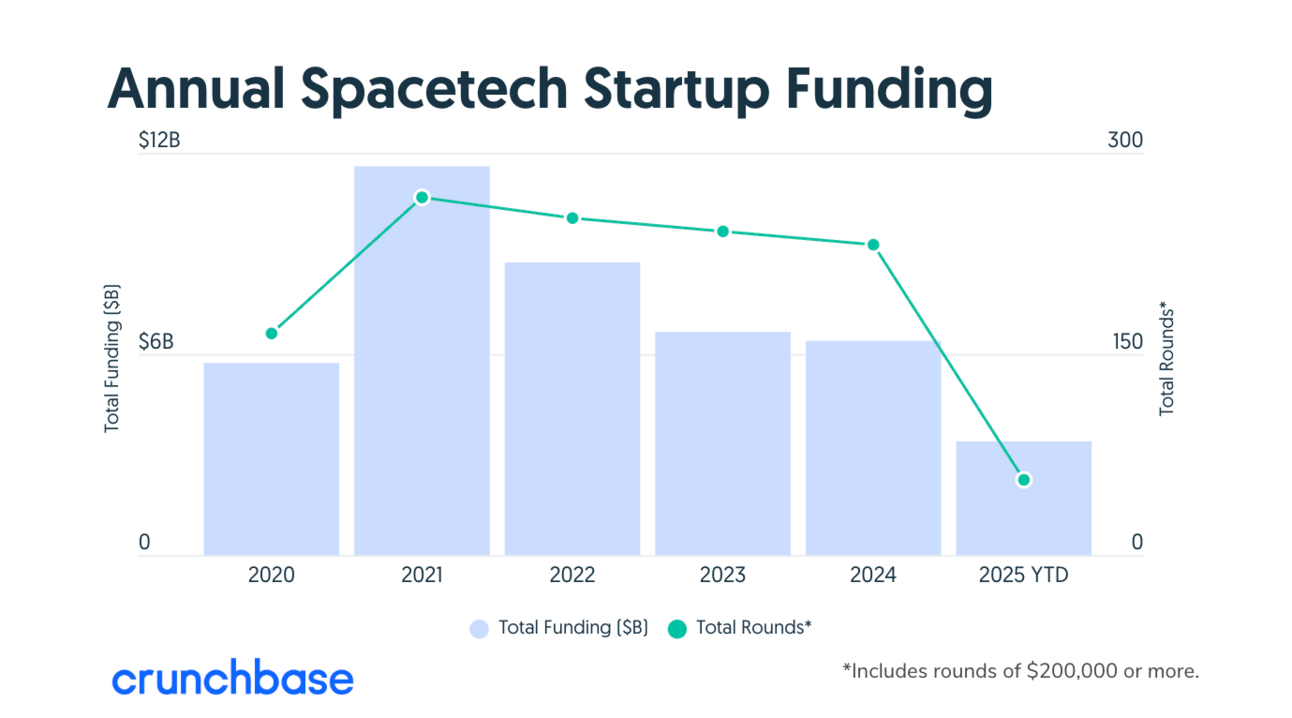

The broader spacetech market has remained resilient, with over $6 billion invested annually in 2023 and 2024—and 2025 tracking toward similar levels. Capital has consistently flowed into startups addressing national security, satellite innovation, and AI-driven geospatial intelligence. According to venture firm Space Capital, investor demand is at an all-time high.

Voyager’s positioning within this landscape has made it a standout. The company has not only attracted long-term institutional capital but has also earned credibility as a builder and integrator in one of the fastest-growing sectors of the global economy. With a strong acquisition track record, deep customer relationships, and a growing product suite, Voyager remains well-capitalized to lead the next wave of commercial and defense space innovation.

Competition

Voyager Technologies operates at the intersection of defense contracting, space exploration, and advanced technology—industries that are not only highly competitive but also dominated by established players with deep-rooted advantages. Incumbents such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, and Boeing have long-standing relationships with government agencies, robust compliance infrastructure, and significantly greater financial and operational resources.

These legacy contractors often benefit from decades of experience and trusted positioning as go-to providers for high-stakes national security and aerospace projects. Their scale allows them to respond faster to evolving market demands, invest aggressively in new capabilities, and absorb regulatory or economic disruptions more easily than emerging players like Voyager.

Dual-Track Competition

Voyager also faces a unique dual-track competitive challenge. As both a prime contractor and a merchant supplier, the company finds itself competing with former partners on certain bids. Subcontractors from past projects may now pursue prime roles, while previous prime contractors may seek to encroach on services Voyager traditionally provides. In government procurement—where contracts are frequently awarded via competitive bidding—this dynamic creates a continuous cycle of repositioning and rivalry.

Government and Global Pressures

The company competes for federal contracts in a highly structured and regulated bidding process, where margins are tight and qualification hurdles are high. Any shift in government funding priorities—toward cybersecurity, for instance, or domestic infrastructure—could concentrate competition even further within Voyager’s core segments.

Internationally, Voyager also contends with foreign competitors that benefit from state-backed subsidies and strategic industrial policies. These rivals often operate with reduced commercial risk due to direct government investment in space and defense technologies, particularly in markets like China, India, and parts of Europe. As the geopolitical environment evolves, the presence of foreign-backed entities is expected to intensify, applying additional pressure on pricing and innovation cycles.

Emerging Players and Consolidation Risks

A new wave of well-funded startups is also reshaping the competitive field. From low-cost satellite manufacturers to companies using AI to revolutionize geospatial data processing, these challengers often move with greater agility and lower overhead than traditional aerospace players. At the same time, industry consolidation—through joint ventures or acquisitions—could lead to the emergence of even larger, more diversified competitors with expansive reach and integrated solutions.

Voyager’s Positioning

Despite these headwinds, Voyager has carved out a defensible niche by combining the responsiveness of a startup with the credibility of a scaled integrator. Its vertically integrated model, proven ability to win federal contracts, and growing list of high-profile partners—ranging from NASA to Palantir—underscore its growing relevance in a fiercely contested market. Still, the company’s ability to invest in new technologies and expand its footprint will remain closely tied to its access to capital and execution against larger, more entrenched competitors.

Financials

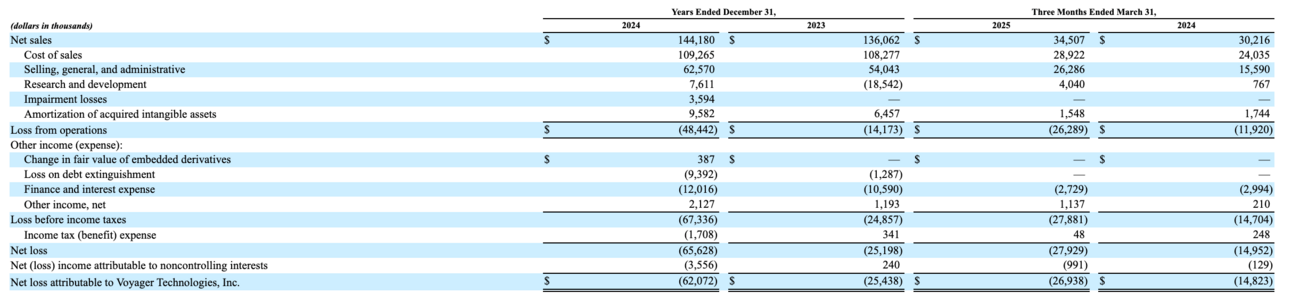

Voyager Technologies’ financial performance over the past three years reflects the company’s rapid growth and expanding footprint across national security and space infrastructure. Its strategic focus on long-term government contracts and dual-use technologies has enabled it to scale operations while positioning for strong forward visibility and monetization.

Total Revenue

Voyager’s revenue base is driven primarily by U.S. government and agency contracts, accounting for the majority of its earnings. The company has posted consistent topline growth as its contracts mature and expand in scope:

2022: $89.5 million

2023: $144.0 million

Q1 2025: $34.5 million

This represents a 61% increase from 2022 to 2023, and continued traction in early 2025, driven by scaling activity across its three core segments: national security, space solutions, and commercial space stations.

Contracted Backlog

Voyager’s long-term visibility is anchored by a $798 million cumulative contract backlog across U.S. government, defense, and space programs. Key contracts include:

$217.5 million NASA development agreement for the Starlab commercial space station

Multi-year defense awards across propulsion systems, smallsat communications, and spacecraft engineering

This contract base provides structural revenue durability and positions the company for future operating leverage.

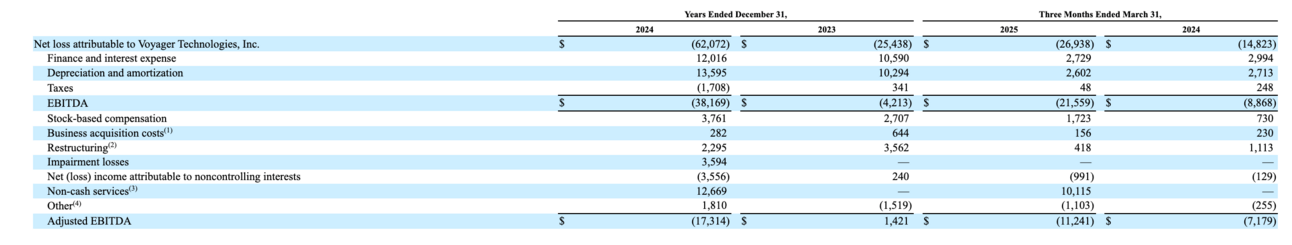

Net Loss

As Voyager continues to invest in engineering talent, R&D, and program execution, the company has posted widening losses:

Q1 2024: $(14.8) million

Q1 2025: $(26.9) million

The increase reflects intentional upfront investment to support future recurring revenue as major programs like Starlab transition from development to operational phases.

Future Outlook

Voyager’s business model is contract-backed, with a high mix of prime contractor revenue and merchant supply sales to Tier 1 partners like Lockheed Martin and Palantir. As these multi-year contracts shift into full-scale deployment, Voyager expects to:

Improve gross margins

Unlock operating leverage

Monetize Starlab’s commercial modules and services

With a growing $179 billion total addressable market across space and defense, Voyager’s forward strategy is focused on high-value execution, continued government alignment, and long-term capital efficiency.

Closing thoughts

Voyager Technologies’ financial performance and strategic posture reflect a company uniquely positioned at the intersection of advanced defense, space infrastructure, and U.S. national security. With revenue growing from $89.5 million in 2022 to $144 million in 2023, and $34.5 million already reported in Q1 2025, Voyager has demonstrated strong contract conversion and expanding program execution. Its $798 million backlog and $217.5 million NASA grant for the Starlab commercial space station provide long-term visibility and validation from marquee institutional partners.

Bull Case:

Voyager’s strength lies in its deep government alignment and contract-first revenue model. With nearly 84% of 2023 revenue sourced from federal contracts and a growing footprint in space station development, propulsion systems, and satellite integration, the company enjoys built-in demand visibility and mission-critical positioning. The IPO, targeting $319 million in proceeds, would provide critical growth capital to accelerate Starlab execution, fund R&D, and strengthen its platform through future acquisitions. Supported by strategic partners like Airbus, MDA Space, and Palantir, Voyager is well-positioned to transition from an engineering-first company to a platform operator with durable recurring revenue.

Bear Case:

Voyager’s rising losses—$26.9 million in Q1 2025—signal the heavy upfront investment required to scale in capital-intensive industries. While its contract base is impressive, execution risk remains, particularly as government procurement cycles lengthen and new competitors—domestic and foreign—enter the market. Additionally, the company’s dependence on government funding may expose it to budgetary or political headwinds, especially amid shifting defense and space priorities.

In sum, Voyager Technologies is building a high-upside, dual-use infrastructure platform at a critical moment in U.S. industrial policy. With a strong contract base, clear go-to-market channels, and a focused growth plan, the company has the building blocks to become a long-term category leader—if it can execute with discipline and scale with capital efficiency.

Here is my interview with Vanessa Larco, who was a Partner at NEA and is now launching a fund called Premise. At NEA, she led investments in breakthrough companies like Cleo, Rocket.Chat, Mejuri, EvidentID, Greenlight Card, Feather, and Lily AI. She also served as a board observer for high-growth startups including Robinhood, Willow Pump, and OmniSci.In

In this conversation, Vanessa and I discuss:

What market signals or trends is Vanessa bullish on when others are pulling back?

What does the next generation of breakout consumer companies look like?

What are the two traits Vanessa consistently sees in the best consumer tech founders?

How important is it for a founder to have lived experience in the problem they’re solving in consumers?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

The mindset that built Tom Cruise's $600 million empire.

— The Driven Man (@The_DrivenMan)

2:01 PM • May 21, 2025

Acquiring knowledge is easy, the hard part is knowing what to apply and when.

That’s why all true learning is “on the job.”

Life is lived in the arena.

— Naval (@naval)

12:24 AM • Jun 4, 2025

Your parents' advice is likely aligned with a world that died 15-20 years ago.

Following it guarantees you'll optimize for problems that no longer exist.

Ignore them with love.

— Justin Welsh (@thejustinwelsh)

1:07 PM • Jun 3, 2025

Every time I talk with @FoundersPodcast (and listening to the podcast of course), I hear new powerful maxims.

I’ve been collecting what he learned from decades of studying founders.

1. Money comes naturally as a result of service.

2. Ordinary things, done with extraordinary— Eric Jorgenson 📚 ☀️ (@EricJorgenson)

6:07 PM • Jun 3, 2025

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Amplify Labs: We help you grow your audience on LinkedIn, X (formerly Twitter), and newsletters.

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

And that’s it from me. See you next week.

Reply