- Partner Grow

- Posts

- Ambiq Micro: Ultra-Low Power Chips

Ambiq Micro: Ultra-Low Power Chips

Ambiq Micro S1 Deep Dive

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Interested in sponsoring these emails? See our partnership options here.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Ambiq Micro in one minute

Ambiq is quietly powering a new frontier in AI—where intelligence lives closer to us, embedded in everyday devices, and optimized for ultra-low power performance. Founded to tackle one of AI’s biggest bottlenecks—energy efficiency—Ambiq designs semiconductor solutions that make it possible to run powerful algorithms on the tiniest of devices.

From smartwatches and health monitors to AR glasses and factory automation systems, Ambiq’s chips are already inside more than 270 million devices, with over 40% of units shipped in 2024 running on-device AI. Its full-stack systems-on-chip (SoCs) deliver 2–5x better power efficiency than traditional designs—enabling real-time compute in edge environments where power constraints have historically made AI impractical.

Ambiq’s growth is accelerating as demand for edge AI explodes across healthcare, smart homes, and industrial IoT. In 2024, it generated $76.1M in revenue at a 48% gross margin, with a 94% YoY sales jump in the U.S., Europe, and Asia (ex-China). And the opportunity is massive: AI is projected to drive $23 trillion in global spend by 2040—but much of that depends on getting AI to work where we live, move, and interact.

At the heart of Ambiq’s innovation is SPOT (Sub-threshold Power Optimized Technology), a chip-level breakthrough that dramatically reduces power usage without the cost or complexity of exotic manufacturing processes. Paired with tightly integrated software, SPOT enables edge AI features like speech recognition, gesture control, and health sensing on tiny batteries—and with minimal cloud dependence.

As the world shifts from cloud-only AI to real-time, privacy-first, and energy-efficient intelligence at the edge, Ambiq is becoming a foundational layer for what’s next. With a mission to bring intelligence everywhere, it’s not just building chips—it’s building the infrastructure for a smarter, more connected world.

Introduction

Ambiq’s mission is simple: enable intelligence everywhere. That starts with silicon. Its proprietary SPOT® (Sub-threshold Power Optimized Technology) platform redefines what’s possible in energy efficiency, allowing processors to run 2–5x more efficiently than traditional chips. This power advantage is not theoretical—over 270 million devices already rely on Ambiq, from smartwatches and smart rings to industrial sensors, health monitors, and AR glasses. In 2024 alone, Ambiq shipped 42M+ units, 40% of which ran AI models directly on-device.

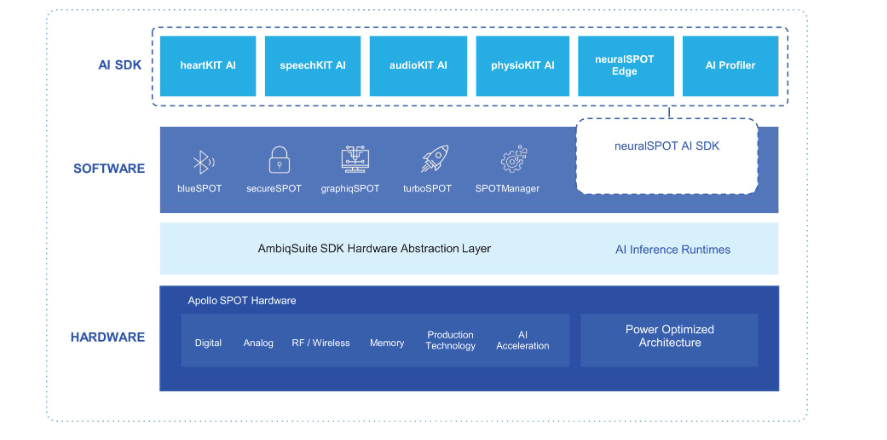

But Ambiq is more than chip innovation. Its full-stack approach brings software and hardware together to unlock true edge AI. The Apollo product family enables vector-accelerated AI inference with integrated peripherals for sensing, security, graphics, and wireless communication. The upcoming Atomiq family is designed for even greater edge compute needs, with a dedicated NPU and next-gen memory optimized for high-performance, low-power AI execution. These SoCs are tightly integrated with proprietary software modules like blueSPOT (for Bluetooth), secureSPOT (for security), and neuralSPOT (for cross-platform AI development).

This pairing of silicon and software is what allows customers to build AI features that were once only possible in the cloud—voice commands, gesture controls, health tracking, local language models—directly into devices that fit in your pocket or on your wrist. In a world where latency, connectivity, and energy costs are growing constraints, Ambiq is making on-device intelligence not only feasible, but foundational.

Ambiq’s growth is driven by real-world demand for AI at the edge, where decisions need to happen instantly and energy budgets are tight. In Q1 2025, net sales outside Mainland China surged 94% YoY, with 53% gross margins. Across 2024, sales reached $76.1M, up from $65.5M in 2023—reflecting global adoption across North America, Europe, and Asia.

At the heart of Ambiq’s differentiation is its belief that AI doesn’t belong in distant data centers—it belongs in the devices we use every day. And to get there, energy efficiency is the unlock. Ambiq isn’t just building chips. It’s building the foundation for the next wave of ubiquitous, intelligent computing—one that works everywhere, runs in real time, and lasts all day.

History

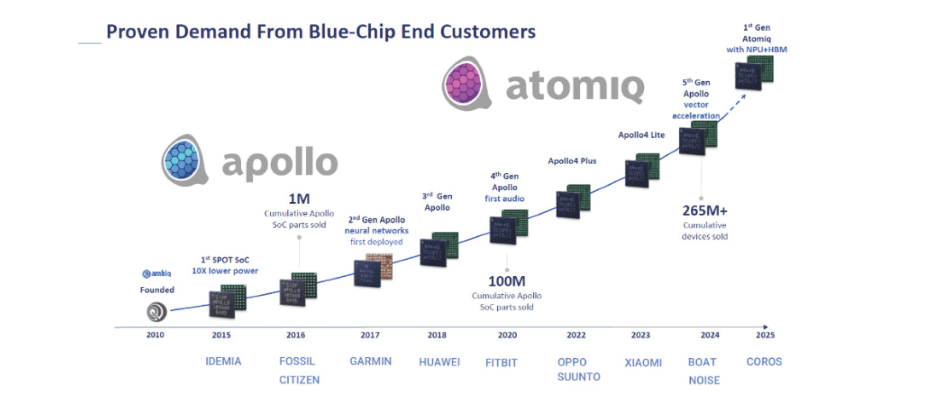

Ambiq began in 2010 with a transformative vision: to solve the power bottleneck holding back the next generation of intelligent devices. At a time when semiconductors prioritized speed and scale, Ambiq focused on something different—radically lowering power consumption to unlock AI at the edge.

Born out of pioneering research in sub-threshold circuit design, Ambiq was built on a core belief: that the future of computing wouldn't just happen in the cloud, but everywhere around us—in our homes, on our wrists, in our factories, and throughout our cities. That vision drove the development of SPOT® (Sub-threshold Power Optimized Technology), a platform that challenged conventional wisdom in chip architecture by enabling standard transistors to operate at much lower voltages, without sacrificing performance or cost efficiency.

For the first few years, Ambiq focused on proving its technology in deeply embedded systems. Its initial chips were adopted in wearables and medical devices where battery life was a critical constraint. These early wins demonstrated the commercial viability of SPOT and validated the company’s belief that ultra-low power design wasn’t just a technical breakthrough—it was a market advantage.

By the mid-2010s, Ambiq had expanded into consumer electronics, building a reputation for chips that could power weeks-long battery life in devices like smartwatches, fitness trackers, and health monitors. The release of the Apollo product line marked a turning point—pairing advanced peripheral sets with processors optimized for edge compute. These chips quickly found their way into millions of devices that demanded both performance and energy efficiency.

In 2020, Ambiq expanded its scope again—this time toward enabling AI directly on edge devices. As large language models and machine learning transformed the AI landscape, Ambiq doubled down on its mission to bring intelligence closer to the data source. The SPOT platform evolved to support AI-specific workloads, and the company introduced software tools to help developers build models that could run efficiently on constrained edge environments.

By 2024, Ambiq had shipped over 270 million chips globally, with more than 40% of its 42 million units that year running on-device AI. These chips powered everything from smart rings and AR glasses to industrial sensors and livestock trackers—delivering features like speech recognition, real-time decision-making, and biometric sensing with minimal power draw.

Today, Ambiq operates as a full-stack edge AI platform company—combining ultra-low power SoCs, edge-optimized software, and a growing product family including Apollo and Atomiq. Its solutions are increasingly deployed in critical applications across healthcare, manufacturing, smart homes, and mobility, where every milliwatt matters.

Throughout its history, Ambiq has remained focused on a single, bold ambition: to enable intelligence everywhere by removing power as a limiting factor. As edge AI adoption accelerates and power becomes the defining constraint of the compute era, Ambiq’s founding insight continues to guide its trajectory—and its opportunity is only just beginning.

Risk factors

Ambiq operates at the intersection of ultra-low power hardware, edge AI, and embedded intelligence—an emerging yet volatile market segment defined by technical complexity, supply chain fragility, and shifting global demand. As the company enters the public markets, several key risks could materially impact its growth trajectory, financial performance, and competitive positioning.

1. Limited Profitability Track Record

Despite powering over 270 million devices, Ambiq has not yet achieved profitability. In 2024, the company reported a net loss of $39.7M, following a $50.3M loss in 2023. Continued investment in R&D, market expansion, and public company infrastructure will likely drive ongoing operating losses, making future profitability uncertain.

2. High Customer Concentration Risk

Ambiq’s revenue is heavily concentrated. In Q1 2025, one customer made up 38% of sales, and the top ten accounted for 98%. This leaves the company vulnerable to demand shifts, procurement pauses, or strategic pivots by a small number of partners—especially as many end customers purchase on a purchase-order basis without long-term commitments.

3. Exposure to Mainland China Volatility

Historically, Mainland China contributed a majority of Ambiq’s revenue—66% in 2023 and 50% in 2024. With geopolitical tension, pricing pressure from subsidized domestic competitors, and a strategic shift away from wearables, Ambiq is intentionally reducing its exposure. But replacing this revenue with new customer segments in new geographies remains an execution risk.

4. Unpredictable Design Win Cycles

Revenue generation depends on winning design slots in customer products—a process that requires upfront engineering investment with no guarantee of payoff. Losing a key design bid or failing to convert early-stage wins into sustained volume could materially impact revenue and margin forecasts.

5. Inventory and Forecasting Uncertainty

Ambiq must make supply chain commitments based on expected demand—yet customer orders remain variable and non-binding. Mistimed or inaccurate forecasts could lead to excess inventory, write-offs, and working capital inefficiencies, especially given the long lead times in semiconductor production.

6. Gross Margin Compression Risk

Ambiq’s ASPs are under pressure from local competitors, especially in price-sensitive markets like China. In 2024, the company sold certain SKUs at substantial discounts to clear inventory. Rising input costs, including wafers and packaging, also threaten gross margins—unless offset by new product introductions or manufacturing efficiencies.

7. Strategic Execution in New Markets

Ambiq’s future growth hinges on expansion into healthcare, industrial edge, automotive, and data centers. These markets are complex, often regulated, and dominated by larger incumbents with entrenched relationships. Winning new customers will require significant investment in vertical-specific features and go-to-market execution—with no guarantee of success.

8. Platform Licensing Model is Early and Unproven

Ambiq plans to evolve SPOT from a proprietary chip platform into a licensable IP ecosystem. While potentially lucrative, this model shift requires new partner integrations, pricing structures, and business development capabilities. Failure to scale this initiative could limit SPOT’s reach and dilute the company’s broader vision.

9. Lack of Long-Term Purchase Commitments

The majority of Ambiq’s business is conducted on a purchase order basis. Customers may cancel, reduce, or delay orders without penalty—leading to revenue volatility, supply-demand mismatches, and operational inefficiencies, especially in periods of macroeconomic uncertainty.

10. Global Macroeconomic and Supply Chain Sensitivity

Semiconductor demand is inherently cyclical. Interest rates, inflation, transportation costs, and global conflicts (e.g., Russia-Ukraine, Israel-Hamas) continue to disrupt trade routes and supply availability. Any sustained turbulence could impact component availability, customer demand, and Ambiq’s ability to scale efficiently.

Market Opportunity

Ambiq operates at the center of a fast-growing, high-impact, and technically demanding segment of the semiconductor market: ultra-low power compute and AI processing at the edge. As AI workloads proliferate beyond data centers into consumer devices, medical wearables, and industrial systems, demand is surging for chips that can deliver intelligence locally—with minimal energy consumption and maximum integration.

Today, Ambiq's Apollo-class SoCs power more than 270 million devices, with a core focus on 32-bit microcontrollers (MCUs) tightly integrated with wireless connectivity, sensor interfaces, graphics, and lightweight AI accelerators. But the opportunity is rapidly expanding. As AI becomes table stakes for edge compute, Ambiq is moving beyond microcontrollers into dedicated AI processors and embedded application processors—purpose-built for inference at the edge.

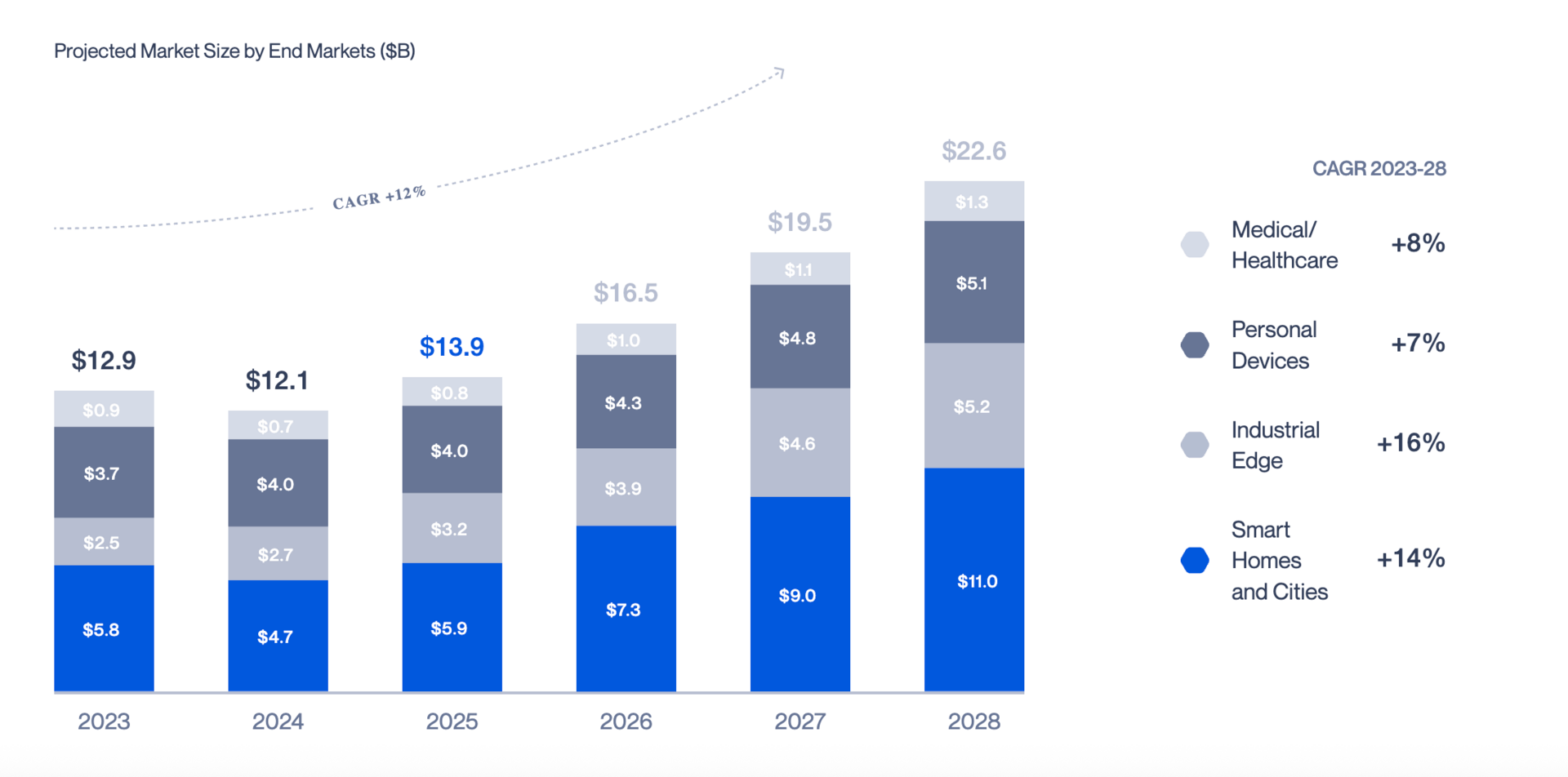

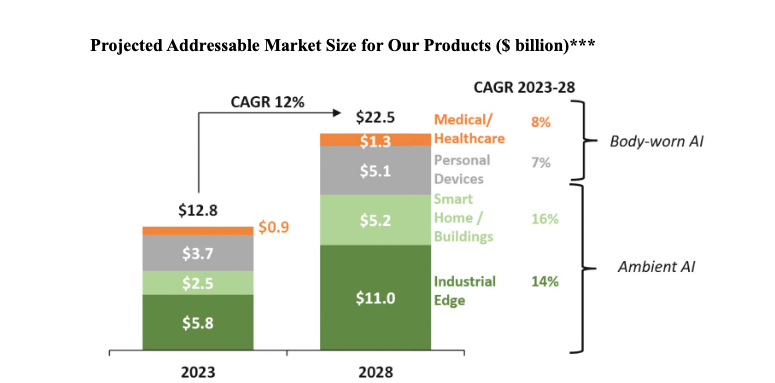

$22.5 Billion Addressable Market

As of 2023, Ambiq defines its total addressable market (TAM) across four core product categories—32-bit MCUs, discrete application processors, wireless connectivity chips, and AI processors—at $12.8 billion, expected to grow to $22.5 billion by 2028, representing a compound annual growth rate (CAGR) of 11%.¹

This market spans both Body-Worn AI and Ambient AI applications, including consumer wearables, digital health devices, smart homes, industrial IoT systems, and factory automation.

Key Market Segments (2023–2028 CAGR):

32-bit MCUs: $4.7B → $6.0B (5%)

Wireless connectivity: $2.4B → $4.7B (15%)

Application processors: $5.7B → $10.2B (12%)

Discrete AI processors: $152M → $1.6B (60%)

As AI becomes embedded in general-purpose chips, an additional $6.8B market for AI-enabled MCUs and application processors is emerging—growing at a 54% CAGR through 2028.²

Where the Opportunity Lives

Ambiq’s current strength lies in personal devices, which accounted for 98% of revenue in Q1 2025. Smartwatches, rings, hearables, and AR glasses all demand ultra-small form factors, all-day battery life, and always-on AI features—areas where Ambiq’s low-power SoCs have become a standard. According to Gartner, this $3.7B market is growing to $5.1B by 2028 (7% CAGR).³

But personal devices are only the beginning.

Digital Health: The healthcare sector is integrating AI into wearables and remote monitoring tools. Devices like glucose monitors, heart rate sensors, and sleep trackers are transitioning from basic sensing to predictive analytics and diagnosis—creating a $1.3B opportunity by 2028.⁴

Industrial Edge: Manufacturers, logistics operators, and utility providers are embedding intelligence into edge devices for anomaly detection, predictive maintenance, and asset tracking. Ambiq’s energy efficiency and compute-on-sensor capabilities are well suited to this $11.0B market.⁵

Smart Homes and Buildings: From biometric locks to voice-controlled systems, energy-efficient AI in the home is increasingly expected, not optional. This vertical is expected to double from $2.5B to $5.2B by 2028.⁶

While Ambiq does not yet operate in the automotive or data center segments, its long-term roadmap includes extending its SPOT platform to wall-powered environments where energy efficiency is still a bottleneck. This includes electric vehicles, EV infrastructure, and next-gen data centers optimized for AI workloads—markets worth tens of billions, where Ambiq’s core IP could deliver differentiated performance-per-watt gains.

Age of Edge AI

As edge devices grow more intelligent and more power constrained, a generational shift is underway in how compute is designed and deployed. Ambiq’s strategy—to build the most energy-efficient compute platform for embedded AI—is purpose-built for this moment.

With a proven presence in high-volume consumer markets, early traction in medical and industrial verticals, and a roadmap that stretches from wearables to wall-powered AI, Ambiq is positioned to lead in a world where intelligence needs to happen everywhere—and battery life still defines what’s possible.

Product

Edge AI is not merely a feature—it is a paradigm shift in how intelligence is embedded, delivered, and executed. From wearable health devices and smart home assistants to industrial sensors and augmented reality systems, the next generation of products must process data locally, respond instantly, and operate within strict power envelopes.

Ambiq’s product portfolio is designed to meet this challenge.

At the heart of the company’s offering is SPOT® (Sub-threshold Power Optimized Technology), Ambiq’s proprietary platform that enables unprecedented energy efficiency across system-on-chip (SoC) design. SPOT powers both hardware and software solutions that allow intelligence to run closer to the data source—enabling edge devices that are smarter, faster, and longer-lasting.

SoC Products

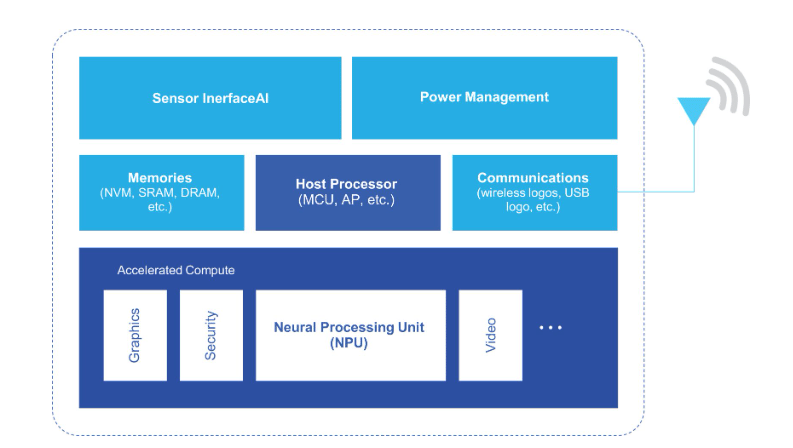

Ambiq’s SoCs are built from the ground up for ultra-low power operation. Each chip integrates a host processor, power management, communication modules, security, memory, and acceleration engines—allowing a full edge AI pipeline to run efficiently on-device.

The company’s two flagship product lines are:

Apollo Family

Introduced in 2015, the Apollo family has evolved into one of the leading SoC platforms for ultra-low power applications. The latest generation, Apollo5 (launched in 2024), includes vector-accelerated compute blocks that support faster AI inference at a fraction of the power. Earlier generations (Apollo3 and Apollo4) continue to serve a wide range of edge applications with host processors capable of running software-based AI. Apollo devices offer rich peripheral support and are optimized for performance, efficiency, and cost—all key requirements for volume edge deployments.

Atomiq Family

Currently under development, the Atomiq line represents Ambiq’s most advanced SoC design. Targeted at high-performance edge AI applications, Atomiq will feature an integrated neural processing unit (NPU) and memory innovations to deliver high-throughput model execution with industry-leading power efficiency. This next-generation product is expected to set a new benchmark for compute performance at the edge.

Software Stack: Enabling Development at Scale

Ambiq’s software ecosystem complements its hardware by accelerating product development and reducing engineering complexity. The company provides a complete stack of software tools and enablement modules:

AmbiqSuite SDK offers low-level drivers and firmware for optimal SoC operation.

Feature Modules such as graphiqSPOT (graphics), blueSPOT (Bluetooth), and secureSPOT (security) allow developers to rapidly build fully featured applications.

AI Tools, including model factories, optimized inference engines, and the neuralSPOT SDK, support efficient deployment of AI models in resource-constrained environments.

Together, these tools enable faster time-to-market and better utilization of Ambiq’s silicon capabilities—while helping customers unlock new use cases across health, fitness, industrial, and consumer applications.

Customer Value Proposition

Ambiq’s platform delivers a step-change in energy efficiency that redefines what is possible at the edge. By dramatically reducing the power required for sensing, computing, communications, and AI, Ambiq enables its customers to:

Shift AI processing from the cloud to the device, improving speed, privacy, and cost.

Run larger, more sophisticated models on smaller batteries.

Increase inference frequency or sensor sampling rates without sacrificing longevity.

Extend device lifespans from hours to days—or days to weeks.

Minimize battery size for compact industrial or consumer designs.

This flexibility allows Ambiq customers to build smarter products, deliver better user experiences, and enter markets where traditional SoCs fall short.

Business Model

Ambiq operates a capital-efficient, full-stack semiconductor business model built around proprietary ultra-low power design IP, scalable silicon manufacturing partnerships, and deep integration with global OEMs. By combining its SPOT® platform with energy-efficient SoCs and edge AI software, Ambiq delivers differentiated silicon solutions that power billions of edge devices—wearables, hearables, health sensors, and beyond.

This vertically integrated approach allows Ambiq to capture value across the edge AI stack—from foundational chip architecture to software tools that accelerate time-to-market.

Ambiq generates revenue through two primary channels:

SoC Sales to Device Manufacturers

Ambiq’s core revenue stream comes from high-volume shipments of its Apollo and Atomiq system-on-chips (SoCs) to OEMs and ODMs across consumer, industrial, and medical sectors. These devices embed Ambiq chips to unlock longer battery life, always-on sensing, and AI-at-the-edge functionality in compact, power-constrained form factors.Over 270 million units shipped to date

High retention and multi-generational adoption from top brands like Garmin, Suunto, and Google

Software and IP Licensing (Emerging)

In parallel, Ambiq is expanding into licensing its SPOT® platform and AI software stack. This includes:SPOT as a licensable low-power design methodology for broader chip classes (e.g., AI accelerators, GPUs, networking)

AI model libraries, compilers, and runtime tools that simplify deployment for customers

Strategic partnerships to embed SPOT into third-party silicon for data center and automotive use cases

This dual structure—product-led today, platform-led tomorrow—enables Ambiq to monetize both silicon and the software that drives adoption.

Competitive Strengths

Ultra-Low Power Leadership

Ambiq’s exclusive focus on sub-threshold and near-threshold computing gives it a sustainable edge in power efficiency. Its SPOT® platform, honed over 15 years, enables chips that consume 2x to 5x less power than traditional approaches—without sacrificing performance or cost.

Extensible Technology Platform

SPOT is not a single product—it’s a foundational platform extensible across MCUs, MPUs, AI accelerators, and complex SoCs. The company continues to expand its portfolio across new categories and use cases, including medical wearables, robotics, and edge vision.

Robust IP Moat

With 62 issued patents and 30 pending globally, Ambiq’s technology is protected across circuit design, system architecture, and edge compute software. Its Apollo product line, now in its fifth generation, reflects years of validated commercial performance.

High-Stickiness OEM Relationships

Ambiq partners with top-tier device manufacturers that integrate its chips deeply into hardware and firmware. Switching costs are high due to multi-year design cycles, tight hardware-software coupling, and shared roadmaps. These relationships generate long-term visibility and expansion potential.

Scalable Manufacturing Model

Ambiq’s SoCs are built on proven TSMC nodes (180nm to 22nm) and assembled by back-end leaders like ASE. This model avoids capital-intensive fab investment while achieving high-volume scale with low power budgets.

Technical Talent at the Core

With 66% of employees in engineering and a management team of semiconductor veterans, Ambiq’s culture is built on continuous innovation. The team has received multiple industry recognitions for chip and AI design excellence across IoT, embedded, and edge AI categories.

Growth Levers

1. Deepen penetration in existing verticals

Ambiq plans to release new SoCs with enhanced performance-per-milliwatt—meeting rising demand for always-on AI in personal electronics, health monitoring, and AR devices.

2. Expand into adjacent markets

By tailoring its Apollo and Atomiq families to industrial, medical, automotive, and smart infrastructure markets, Ambiq can enter new verticals with minimal incremental R&D spend.

3. Launch new chip classes powered by SPOT

SPOT’s methodology is chip-agnostic. Ambiq is developing ultra-low power versions of application processors, AI chips, DSPs, and power management ICs to unlock new design wins.

4. Monetize AI software suite

A growing suite of compilers, model libraries, and developer tools will support edge AI deployment and open up higher-margin software revenue while accelerating customer adoption.

5. License SPOT platform to ecosystem partners

Ambiq aims to make SPOT the industry standard for power-aware chip design—licensing its platform to silicon vendors in domains it does not directly serve (e.g., data centers, ADAS).

6. Drive continuous innovation in SPOT

Ambiq is investing in next-generation sensing, memory, and AI interfaces—enabling new use cases and maintaining its power-efficiency lead as nodes shrink and applications expand.

Management Team:

Fumihide Esaka – Chief Executive Officer

Fumihide Esaka has served as Chief Executive Officer of Ambiq since December 2015. He brings over two decades of global leadership experience in the semiconductor industry, having previously served as CEO of Transphorm Inc. and Nihon Inter Electronics Corporation. Fumihide holds a B.A. in Electrical Engineering and Computer Science from the University of California, San Diego. Under his leadership, Ambiq has scaled from early innovation into a global edge AI platform powering over 270 million devices.

Scott Hanson, Ph.D. – Founder & Chief Technology Officer

Scott Hanson co-founded Ambiq and has served as Chief Technology Officer since 2013. Previously, he held the role of CEO from 2010 to 2013. A recognized expert in ultra-low power circuit design, Scott holds a Ph.D. in Electrical Engineering from the University of Michigan, where he received multiple awards for his research, including the ECE Alumni Rising Star Award. As CTO, he leads Ambiq’s technology roadmap and IP development, including its proprietary SPOT® platform.

Sean Chen – President & Chief Operating Officer

Sean Chen has served as President and COO of Ambiq since November 2016. He previously led the company’s Greater China and global operations. With more than 20 years of semiconductor leadership experience, Sean has held executive roles at mCube, Intel, IDT, TSMC, and multiple startups. He holds an M.S. in Chemical Engineering from National Cheng-Kung University. Sean oversees global operations, product delivery, and business execution.

Jeff Winzeler – Chief Financial Officer

Jeff Winzeler joined Ambiq as Chief Financial Officer in June 2025. He brings extensive financial leadership across the semiconductor and broader technology sectors, including CFO roles at Kandou S.A., Everspin Technologies, and Avnera. Earlier in his career, Jeff held senior finance roles at Intel Corporation. He earned a B.S. in Finance from the University of Idaho and completed the Strategic Finance Leadership Program at Stanford University. At Ambiq, Jeff leads financial strategy, capital planning, and investor relations.

Investment

Ambiq began its funding journey with a bold thesis: ultra-low power semiconductors could unlock a new era of intelligence at the edge. This belief—that AI could be run locally, with minimal energy consumption—has been consistently reinforced by the market’s leading technology investors. Since its founding in 2010, Ambiq has raised over $522 million in capital across several strategic funding rounds, with support from a premier syndicate that includes Austin Ventures, Mercury Fund, Kleiner Perkins, and Arm.

Foundational Rounds (2010–2017)

Ambiq’s initial capital was anchored by Austin Ventures and Mercury Fund, who saw early promise in the company’s proprietary SPOT® platform. This technology, built around energy efficiency at every computing layer, attracted technical and commercial validation in the form of rising customer adoption. By 2017, Ambiq had raised its Series C, positioning the company to bring its Apollo SoC family to broader global markets and build out its software stack.

Strategic Partnerships (2018–2021)

As edge AI adoption accelerated, so did institutional interest. Ambiq’s Series D through Series F rounds brought in new strategic partners, including Arm and Kleiner Perkins, signaling not only investor confidence but also growing ecosystem alignment. These rounds funded Ambiq’s push into AI accelerators, wireless communication integration, and deeper software enablement for edge use cases.

Global Scale-Up (2022–2025)

In 2022, Ambiq closed its Series G financing, marking a new chapter of scale and ambition. The round brought the company’s total funding to $522 million and was aimed at accelerating next-generation SoC development, expanding global production capacity, and commercializing its new Atomiq product line. The investment also supported R&D in memory innovation and advanced AI enablement tools, reinforcing Ambiq’s position as the leading platform for energy-efficient edge AI.

With over 270 million chips shipped worldwide and applications across healthcare wearables, smart homes, and industrial IoT, Ambiq’s vision has gained traction across industries. Backed by deep technical innovation and long-term investor support, the company is now positioned to lead the next wave of compute transformation—from cloud dependency to intelligent endpoints.

Competition

Ambiq competes in a rapidly evolving semiconductor landscape shaped by the convergence of AI, ultra-low power design, and the proliferation of intelligent edge devices. As compute moves from cloud to endpoint, the demand for efficient, AI-enabled microcontrollers has grown—creating both opportunity and pressure for players in this space.

Legacy Giants

Ambiq faces direct competition from semiconductor incumbents with deep market penetration, extensive R&D budgets, and wide product portfolios. Companies like Intel, AMD, and Texas Instruments remain dominant in microprocessor and analog chip markets. Their expansive manufacturing capabilities and established customer bases make them formidable competitors, particularly in industrial and enterprise use cases.

On the specialized side, Ambiq contends with Espressif, a leader in low-cost wireless SoCs for IoT devices. Espressif’s ecosystem-first approach and cost competitiveness have earned it traction among consumer and maker communities, particularly in Asia. Meanwhile, SiTime and Rambus offer differentiated silicon IP and oscillator products that address adjacent needs in the timing and memory segments.

AI-Native Startups

Beyond legacy firms, Ambiq also competes with vertical challengers like Biren Technology and Cornami, both focused on high-performance or AI-dedicated chipsets. These companies often raise large capital rounds—Biren has secured over $900M—to pursue parallel computing and next-gen architectures, often targeting edge inference or datacenter workloads. While different in product scope, these players create competitive tension in AI acceleration and software compatibility.

Dual-Front Competitive Dynamics

Ambiq must also navigate a dual-front market dynamic: it competes with established players offering full-stack integration and customer trust, while also responding to nimble, deep-tech startups delivering breakthroughs in edge computing, battery efficiency, or AI workload optimization. These startups may not yet match Ambiq’s commercial scale, but often benefit from focused innovation, investor enthusiasm, and hardware-software co-design.

In parallel, government-backed or acquired entities—like Tsinghua Unigroup or Cavendish Kinetics—bring access to proprietary manufacturing, national subsidies, and specialized IP portfolios, influencing pricing and go-to-market pathways across global regions.

Many of Ambiq’s top competitors enjoy structural moats—whether in the form of dedicated fabs, robust patent portfolios, or integration with OEM channels. Their scale affords greater pricing leverage and higher volume production. Additionally, public-market incumbents like Intel and AMD benefit from cross-subsidizing innovations and absorbing cyclical demand shocks.

Ambiq’s Differentiation

Despite these headwinds, Ambiq has carved out a defensible niche at the intersection of ultra-low power design and AI enablement at the edge. Its proprietary SPOT® platform and Apollo line of SoCs offer best-in-class power efficiency for wearables, smart homes, and industrial IoT—where battery life and inference performance matter most.

Financials

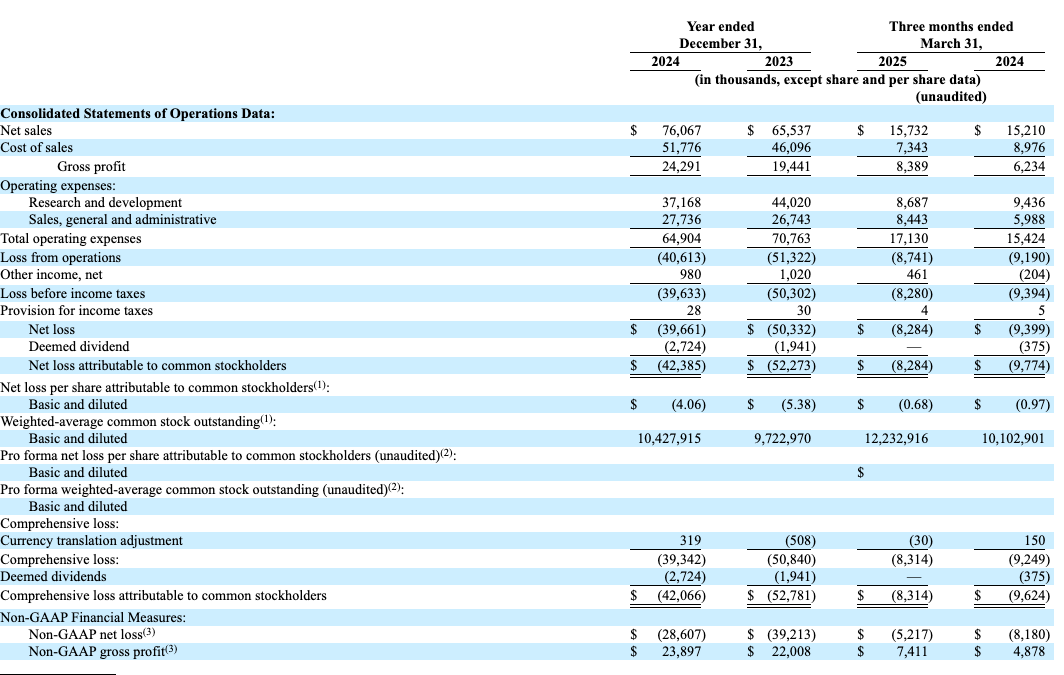

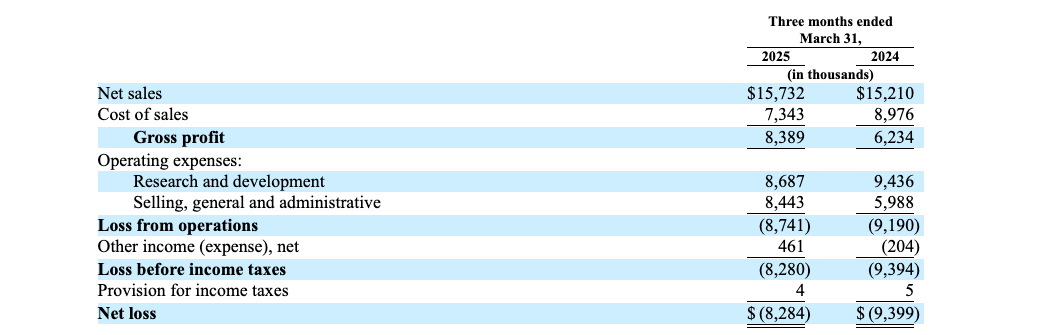

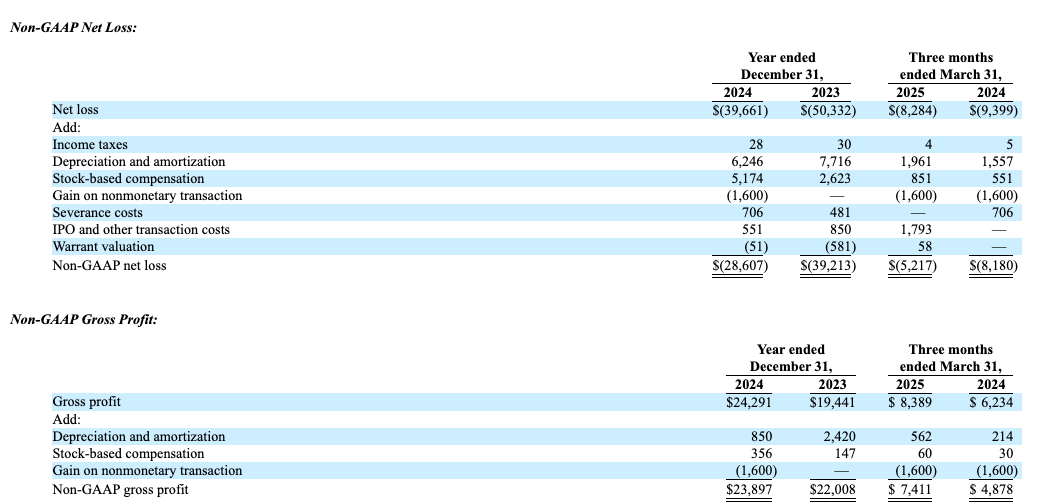

Ambiq’s Q1 2025 revenue showed modest but meaningful acceleration, reflecting its strategic pivot toward non-China markets and a more margin-accretive customer base:

Q1 2024: $15.21 million

Q1 2025: $15.73 million

YoY Growth: +3.4%

The topline was largely supported by strong international expansion. Notably, non-China revenue nearly doubled, while Mainland China sales declined significantly:

Non-China sales: +95% YoY ($7.6M → $14.8M)

China sales: –87% YoY ($7.6M → $1.0M)

This regional transition strengthened revenue quality and improved unit economics, offsetting macro challenges in China.

Gross Profit & Margins

A highlight in Q1 2025 was gross margin expansion, powered by increased pricing discipline and improved customer mix:

Q1 2024: $6.24 million (41.0% margin)

Q1 2025: $8.38 million (53.3% margin)

Gross profit growth: +34.3% YoY

This improvement marks a return to pricing power and reflects operational focus on higher-value product lines and geographic diversification.

Operating Expenses

Ambiq maintained cost discipline while continuing to invest in core innovation and go-to-market activities:

R&D: $8.69M (–7.9% YoY) – supported by a smaller team and focused development

Sales & Marketing: Increased to $3.08M, aligned with international sales push

G&A: Jumped to $5.36M (+49.6% YoY), mainly due to one-off finance and legal costs

The overall opex base grew at a slower pace than gross profit, indicating early signs of operating leverage.

Net Loss Narrowing

Ambiq made progress on its bottom line, narrowing losses despite moderate revenue growth:

Q1 2024: $(9.40)M

Q1 2025: $(8.28)M

Improvement: +12% YoY

This reduction was largely driven by:

Higher gross profit (+$2.14M)

Flat interest expense

No major non-cash surprises

Ambiq’s financial results reflect strong execution amid a geographic repositioning and increased gross margin visibility.

Key signals for investors:

Improved margin profile: Higher-value sales mix driving 1,200+ bps gross margin expansion

Opex restraint: R&D efficiency without compromising innovation

Capital runway: $61.4M in cash supports near-term initiatives without immediate fundraising needs

With strong non-China traction, stable hardware demand, and reduced net loss, Ambiq is increasingly positioned to scale with financial resilience and differentiated silicon innovation.

Closing thoughts

Ambiq’s Q1 2025 results reflect a company in strategic transition—shifting its commercial focus from a legacy China-heavy revenue base toward higher-margin international growth. With gross margins expanding by 1,200bps, net losses narrowing by 12%, and non-China revenue nearly doubling, Ambiq is laying the groundwork for durable, capital-efficient scale.

Bull Case:

Ambiq’s financial profile is stabilizing. Gross margin expansion signals stronger pricing power and improved product-market fit outside of China. With a $61.4M cash buffer, disciplined R&D spend, and growing traction in global IoT applications, the company is positioned to convert its ultra-low-power chip leadership into sustainable revenue growth. The growing global demand for edge AI presents a strong tailwind.

Bear Case:

Despite improved margins, topline growth remains tepid at 3.4% YoY. China demand continues to deteriorate, and sales momentum may take time to rebuild across new regions. G&A inflation, particularly from legal and compliance costs, could challenge margin progress. Competition from legacy giants and newer deep-tech startups remains intense, and customer diversification is still underway.

In sum:

Ambiq is showing signs of a disciplined pivot. Q1 2025 validates its ability to expand margins and cut losses while reorienting its revenue base. If the company can reaccelerate growth through global design wins and maintain operational discipline, it stands to carve out a strong position in the next wave of AI-enabled edge computing.

Here is my interview with Sachit Rajan, who is a Venture Capital Partner at Erez Capital and a Venture Partner at NetworkVC.org, specialising in early-stage startups across SaaS, fintech, and AI. With extensive experience leading multi-market operations at Charter Finco, Sachit has driven strategic growth, business scalability, and global market expansion.

In this conversation, Sachit and I discuss:

How does Sachit evaluate investment opportunities in highly competitive sectors like fintech and AI?

What emerging trends are shaping early-stage investing today?

How does 2025 differ from the investment climate of 2021-2022?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

the reason tech has been able to grow so quickly and create so much wealth is that it ritualized a set of norms around corporate governance that are very distinct from what the law actually requires.

the second someone defects, the whole ship goes down.

— Will Manidis (@WillManidis)

12:40 PM • Jul 13, 2025

Remember startups generally start with a "thin edge of the wedge." The early game is going from zero to one, which means you have to find a set of people willing to use your product & pay. THEN you grow to turn that wedge into a piece of the pie.

Alphabet wasn't built in a day.

— Garry Tan (@garrytan)

2:20 PM • Jul 14, 2025

The best way to manage your emotions is to get a workout every single day.

— Dan Go (@FitFounder)

5:19 PM • Jul 13, 2025

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow like a rocketship.

And that’s it from me. See you next week.

Reply