👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Equipment policies break when you hire globally

Deel’s latest policy template on IT Equipment Policies can help HR teams stay organized when handling requests across time zones (and even languages). This free template gives you:

Clear provisioning rules across all countries

Security protocols that prevent compliance gaps

Return processes that actually work remotely

This free equipment provisioning policy will enable you to adjust to any state or country you hire from instead of producing a new policy every time. That means less complexity and more time for greater priorities.

Interested in sponsoring these emails? See our partnership options here.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

BitGo in one minute

BitGo is building the foundational infrastructure for institutional digital asset adoption—delivering custody, trading, and blockchain services that power how banks, asset managers, and crypto-native companies secure and manage billions in digital holdings. In a market where most providers offer fragmented point solutions or rely on third-party infrastructure, BitGo delivers end-to-end digital asset operations from self-custody wallets through qualified trust services, establishing itself as the infrastructure layer institutions require while processing over $104 billion in assets on platform.

Founded with a singular focus on institutional-grade security, BitGo has systematically advanced digital asset custody capabilities. The company pioneered multi-signature and MPC wallet technology, launched BitGo Trust Companies operating as qualified custodians under U.S. trust law, and achieved bankruptcy-remote asset segregation with up to $250 million insurance coverage. This technical and regulatory foundation now serves over 4,900 clients across 100+ countries, supporting 1,550+ digital assets for financial institutions, technology platforms, and government agencies.

BitGo's market position reflects execution at scale. The platform processes 20+ billion usage events monthly while maintaining SOC 1 Type 2 and SOC 2 Type 2 certifications—performance spanning both enterprise custody deployments and developer infrastructure powering the next generation of digital asset applications.

The company's competitive advantage stems from vertical integration across the digital asset stack: self-custody technology, qualified trust infrastructure, liquidity solutions, and settlement networks operate as a unified system. This enables instant settlement, customized institutional solutions, and regulatory compliance that fragmented approaches cannot match.

Introduction

At its core, BitGo is a digital asset infrastructure company. The company was among the first globally to prove that institutional-grade custody could achieve bank-level security—not through adapted legacy systems, but through purpose-built architecture developed entirely for blockchain networks. Starting with multi-signature wallet technology in 2013, BitGo has constructed a vertically integrated platform spanning self-custody solutions, qualified trust services, prime brokerage and tokenization infrastructure—all built upon its bankruptcy-remote custody framework processing $104 billion in assets. By replacing reliance on exchange-managed custody with end-to-end institutional infrastructure, BitGo aligns with how digital asset adoption should work: independently secured, regulatorily compliant and scalable from retail wallets to enterprise deployments.

This infrastructure powers both security and liquidity. BitGo's incentives are fundamentally aligned with its clients': the company delivers custody without trading against, lending against, or rehypothecating client assets—eliminating conflicts inherent to vertically integrated platforms. With qualified trust licenses across multiple jurisdictions including federal bank charter approval from the OCC, BitGo operates under fiduciary obligations while maintaining up to $250 million insurance coverage and SOC 1/SOC 2 Type 2 compliance. The result is a trust-led flywheel: institutions adopt BitGo's custody for regulatory certainty, crypto-native companies build on its wallet APIs for programmability, and financial platforms integrate its infrastructure across 1.1 million end users supporting 1,550+ digital assets.

The market shift is foundational. Global digital asset market capitalization reached $4 trillion in September 2025—with up to 10% of global GDP potentially tokenized by 2027. BitGo is built for this inflection point: serving 4,900+ clients across 100+ countries, generating $3.1 billion in 2024 revenue with positive profitability, and operating as one of the first federally chartered digital asset banks—using proprietary technology purpose-built to become the custody layer connecting traditional finance and decentralized networks in the next generation of programmable money.

History

BitGo began with a direct challenge to digital asset custody orthodoxy: institutional-grade security could be built natively on blockchain networks, not retrofitted from legacy banking infrastructure. For years before BitGo's founding, cryptocurrency custody operated on risky architectures—exchange-managed wallets vulnerable to hacks, self-custody solutions too complex for institutions, and zero pathways from blockchain innovation to regulatory compliance. Enterprises waited for traditional banks to offer custody. Developers built on compromised security models without institutional safeguards. The ecosystem was fragmented, vulnerable, and incompatible with fiduciary requirements by design.

The founding team, veterans of cryptocurrency infrastructure, saw an opening. After years observing exchange collapses and custody failures, they recognized that institutions needed purpose-built custody technology aligned with blockchain's decentralized ethos. In 2013, BitGo launched with a thesis that multi-signature wallet architecture could power institutional adoption end-to-end, achieving bank-grade security while maintaining client control over assets. The model was intentionally contrarian: build cryptographic security rather than adapt centralized custody, replace exchange-dependent storage with bankruptcy-remote segregation, and create unified infrastructure where trust compounds with every secured transaction.

What started as wallet technology evolved into vertically integrated digital asset infrastructure. BitGo pioneered multi-sig wallets commercially, then launched BitGo Trust Company in 2018—becoming one of the first qualified custodians purpose-built for digital assets. Product expansion accelerated: from cold storage to prime brokerage (2020), stablecoin-as-a-service, and tokenization platforms—with institutional customers growing to 4,900+ by September 2025.

By 2024, BitGo's platform reached an inflection point as unified custody infrastructure connecting traditional finance, crypto-native institutions, and decentralized networks. More assets under custody generated regulatory credibility, which enabled broader service offerings, which attracted institutional mandates, which deepened client relationships. The infrastructure compounded: clients adopted for security, expanded for liquidity solutions, and scaled across tokenization workflows as the platform demonstrated regulatory alignment and operational reliability.

Risk factors

BitGo operates in a highly volatile digital asset market, where regulatory uncertainty, operational complexity, and cyclical price movements can materially impact growth trajectory and profitability. Below are the primary risks associated with BitGo's business model.

Revenue Volatility Driven by Digital Asset Price Cycles

BitGo's financial performance fluctuates significantly with digital asset market conditions. Total revenue increased 233% to $3.1 billion in 2024 driven by rising crypto prices, yet declined 63% in 2023 during market downturns. Assets on Platform dropped 22% from Q3 to Q4 2025 as prices fell. Digital asset sales represent 82.5% of revenue, creating direct exposure to Bitcoin and Ethereum price volatility. Prolonged bear markets reduce trading activity, slow client acquisitions, and compress revenues across custody, staking, and prime services—potentially requiring expense reductions or delayed growth investments.

Operational Risk and Client Asset Loss Exposure

Transferring digital assets involves inherent security and execution risks. Errors in blockchain address management, private key handling, transaction processing, or third-party staking platform failures could result in permanent client asset loss. BitGo has previously recorded customer accommodation charges for inaccurately processed transactions. Smart contract failures, slashing penalties on proof-of-stake networks, cybersecurity breaches, or employee misconduct could trigger client disputes, litigation, regulatory enforcement, and reputational damage that materially impacts business operations.

Regulatory Evolution and Compliance Complexity

Digital asset regulation remains fragmented and rapidly changing. While recent U.S. developments—including SAB 121 rescission, OCC guidance, and the GENIUS Act—provide clarity, future regulatory actions could restrict product offerings, impose costly compliance requirements, or limit supported digital assets. BitGo must navigate multi-jurisdictional licensing across the U.S., Europe, Asia, and the Middle East. Adverse regulatory changes, enforcement actions, or loss of qualified custodian status could constrain revenue growth and increase operational costs.

Competition from Traditional Financial Institutions

Following SAB 121's rescission, global custodians including BNY Mellon and State Street have launched digital asset custody platforms. These institutions possess established client relationships, diversified service offerings, and substantial capital reserves. If cross-sell rates from traditional custody disappoint or BitGo fails to differentiate through technology and regulatory positioning, competitive pressure could erode market share and pricing power.

Market Opportunity

The digital asset infrastructure landscape is experiencing a structural inflection point. BitGo addresses a multi-trillion dollar projected market opportunity—delivering custody, prime services, staking, and tokenization infrastructure through a vertically integrated platform spanning traditional financial institutions, crypto-native companies, and decentralized networks.

Displacing Fragmented Custody Solutions

BitGo's primary opportunity lies in replacing disconnected point solutions across institutional digital asset adoption—a market that reached $4 trillion in September 2025, representing only a fraction of $141 trillion in global equities. Traditional approaches burden institutions with exchange-managed custody exposing counterparty risk, self-custody complexity incompatible with fiduciary requirements, fragmented trading relationships, and regulatory uncertainty discouraging participation.

BitGo collapses these barriers into unified infrastructure delivering bankruptcy-remote custody, qualified trust licenses, and conflict-free prime services. Despite serving 4,900+ clients with $104 billion in Assets on Platform, BitGo captures a fraction of institutional demand—leaving substantial expansion room as traditional finance adopts digital assets, spot Bitcoin ETFs scale beyond $147.5 billion, and enterprises consolidate custody into regulated infrastructure.

Structural tailwinds persist: U.S. spot-bitcoin ETFs achieved record growth trajectories, SAB 121's rescission removes balance sheet obstacles for banks, the GENIUS Act establishes federal stablecoin frameworks, and MiCA provides European regulatory clarity. These dynamics reward platforms delivering measurable security through fiduciary obligations, technological independence via proprietary wallet architecture, and scalable deployment across jurisdictions.

Expanding Across Asset Classes and Services

BitGo's second opportunity is cross-sell expansion across tokenized real-world assets, stablecoins, and institutional prime services. Clients adopt for custody security, then systematically expand across staking ($28.6 billion Assets Staked), prime brokerage, and tokenization infrastructure as the platform demonstrates regulatory alignment.

Tokenized RWAs address programmable securities, with BlackRock's BUIDL surpassing $2.5 billion and McKinsey projecting $2 trillion by 2030. Stablecoin-as-a-Service enables compliant issuance under federal frameworks. Prime services deliver institutional liquidity without rehypothecation conflicts.

Building the Custody Layer

BitGo's long-term vision: becoming the foundational custody infrastructure for the digital economy as 10% of global GDP tokenizes by 2027. Every institutional deployment, stablecoin issuance, and tokenized asset strengthens BitGo's moat—spanning organizations requiring integrated capabilities across custody, settlement, liquidity, and compliance.

Product

BitGo's infrastructure delivers four service layers unified by bankruptcy-remote custody architecture—a proprietary foundation connecting self-custody wallets, qualified trust services, prime brokerage, and tokenization infrastructure. This platform eliminates the fragmented point solutions that burden institutions with exchange counterparty risk, incompatible custody models, and regulatory uncertainty.

Self-Custody and Qualified Custody: Proprietary Security at Scale

Launched with multi-signature wallet technology in 2013, BitGo's custody solutions are engineered for institutional-grade security with broad blockchain compatibility. The platform supports 1,550+ digital assets across cold storage structured for bankruptcy-remote segregation. Multi-layer protection—patented multi-sig and MPC cryptography, offline storage, SOC 1/SOC 2 Type 2 audits—ensures consistent security across custody, staking, and settlement operations. The architecture maintains fiduciary obligations under federal bank charter, enabling seamless scaling from crypto-native wallets to traditional financial institution deployments with up to $250 million insurance coverage.

Liquidity and Prime Solutions: Capital Efficiency Without Conflicts

BitGo's prime services extend custody capabilities into trading, staking, and lending infrastructure. BitGo Prime delivers agency execution connecting clients to global liquidity providers—generating $2.5 billion in digital asset sales revenue for 2024, up 220.6% year-over-year. Staking infrastructure manages $28.6 billion in Assets Staked without offering liquid staking, earning commission on client rewards. Borrowing and lending services generated $5.8 million in 2024, providing over-collateralized loans without rehypothecation—transforming static custody into systems that generate yield and optimize capital efficiency.

Infrastructure-as-a-Service: From Custody to Issuance

BitGo's newest layer enables institutions to launch digital assets rather than merely custody them. Stablecoin-as-a-Service delivers token issuance, smart contract management, reserve custody with daily reconciliation, and regulatory infrastructure including federal bank licenses—supporting compliant USD-backed stablecoin launches under the GENIUS Act framework. Crypto-as-a-Service provides modular access to wallets, custody, trading rails, and settlement infrastructure for fintechs and financial institutions. Token Management facilitates on-chain and off-chain settlement through the Go Network, reducing counterparty risk and settlement times.

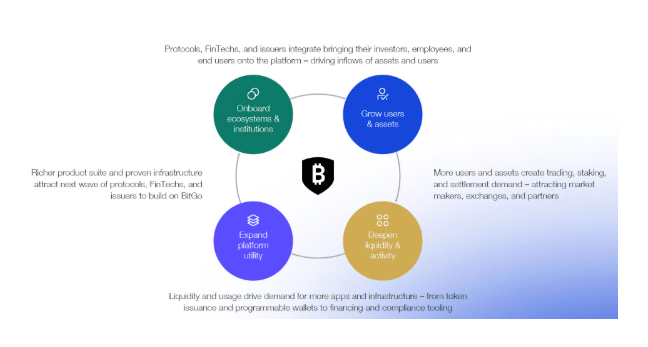

Recursive Network Effects

Over 4,900 institutional clients and 1.1 million end users generate continuous asset flows. Multiple qualified trust licenses across jurisdictions expand the regulatory feedback loop. This compounding advantage creates barriers competitors cannot replicate: proprietary multi-sig architecture, diverse custody deployment data, and integrated prime services driving platform expansion as customers adopt custody, expand into staking and trading, and scale across tokenization workflows.

Business Model

BitGo's model is custody-native, regulatorily proven, and asset-compounding—built as integrated infrastructure that delivers measurable security outcomes while reinforcing customer retention through multi-service expansion and the digital asset custody flywheel.

Dual Revenue Architecture

1) Asset-Based Revenue Streams

Economics: 82.5% of 2024 revenue from digital asset sales representing trading volume across BitGo Prime's agency execution platform. Revenue scales directly with Assets on Platform ($104 billion as of September 2025) and crypto market conditions.

Mix: Crypto-native companies, traditional financial institutions, technology platforms requiring institutional liquidity across 4,900+ clients in 100+ countries.

Why it matters: High-volume engagements with customers demanding conflict-free prime services. Trading spreads and transaction fees create variable revenue tied to market activity while establishing deep platform dependencies through integrated custody-to-execution workflows. Staking revenue (14.9% of 2024 revenue) compounds through commission on client rewards from $28.6 billion Assets Staked.

2) Subscription and Infrastructure Services

Economics: 2.5% of revenue from recurring custody fees, wallet subscriptions, and infrastructure-as-a-service deployments. Stablecoin-as-a-Service contracts recognize fees from reserve management interest; Crypto-as-a-Service generates platform access and usage-based charges.

Why it matters: Strategic land-and-expand mechanism providing predictable recurring revenue while reducing dependence on crypto price volatility. Infrastructure services drive enterprise adoption—enabling clients to issue stablecoins under federal frameworks or embed digital asset functionality into existing platforms—generating incremental revenue as customers scale transaction volume and expand across service layers.

Recursive Custody and Trust Flywheel

Connected deployments replace fragmentation: Over 4,900 institutional clients and 1.1 million users generating continuous asset flows across custody, staking, trading, and settlement unified through BitGo's platform. More assets under custody improve security credibility—institutional mandates reinforcing qualified custodian positioning, regulatory licenses expanding addressable markets.

Proprietary architecture ensures independence: Full-stack infrastructure combining patented multi-sig/MPC technology, bankruptcy-remote trust structure, federal bank charter, and conflict-free prime services. Result: Fiduciary obligations differentiating BitGo from exchange-based custody while maintaining positive net income despite crypto market volatility.

Multi-Service Adoption Flywheel Compounds Customer Value

Land with custody (demonstrate security and regulatory compliance) → expand into staking ($28.6B Assets Staked) → cross-sell prime brokerage (trading creates immediate liquidity) → capture expansion revenue through tokenization infrastructure → reinvest in product development and regulatory licenses → deepen retention through integrated platform dependencies and measured asset protection.

Management Team:

Mike Belshe – Co-Founder, Chief Executive Officer and Chief Technology Officer

Mike Belshe has served as CEO and CTO since co-founding BitGo in 2013. He previously held software engineering positions at Google, Microsoft, Lookout Software, Good Technology, Remarq Communities, Netscape Communications, and HP. His vision to build institutional-grade custody natively on blockchain networks established BitGo's foundational strategy: developing proprietary multi-signature architecture and bankruptcy-remote trust infrastructure as the security layer for digital asset adoption. He serves on BitGo's Board of Directors. Belshe holds a B.S. in Computer Science from California Polytechnic State University, San Luis Obispo.

Edward Reginelli – Chief Financial Officer

Edward Reginelli has served as CFO since May 2021. He previously served as CFO of Cargomatic from August 2018 to May 2021, with earlier finance roles at RhythmOne, Purple Communications, Burke Industries, Compass Aerospace, PPG Industries, and Nestle. His financial leadership underpins BitGo's regulatory compliance infrastructure spanning federal bank charter, qualified custodian licenses, and SOC 1/SOC 2 Type 2 certifications. He holds a B.S. in Business Administration and Accounting from John Carroll University and is a licensed CPA in Illinois.

Chen Fang – Chief Revenue Officer and Director

Chen Fang has served as CRO since January 2025 and as Board member since August 2022. He previously served as COO (August 2022 to March 2025), Chief Product Officer (February 2020 to August 2022), and Interim CISO of BitGo New York Trust Company (August 2022 to April 2024). Prior to BitGo, Fang co-founded and served as CEO of Lumina (January 2018 to February 2020), Senior Director of Product Management at Zenefits (February 2015 to January 2018), and Senior Product Manager at Microsoft (July 2010 to January 2015). Fang holds a B.A. in Economics and Computer Science from Harvard University.

Jody Mettler – Chief Operating Officer and President of BitGo Trust

Jody Mettler has served as COO since September 2021 and President of BitGo Trust since August 2022. She previously spent 22 years at Citibank, including as Senior Vice President of Operations and Transformation (October 2012 to January 2021) and Director of Global Service and Operations Transformation (February 2020 to October 2021). Mettler studied Accounting and Business Management at the University of South Dakota.

Investment

BitGo's financing trajectory signaled methodical validation—from Bitcoin wallet pioneer to America's leading institutional digital asset custody platform. Founded in 2013 as cryptocurrency infrastructure matured beyond retail adoption, the company raised a $2 million seed round led by Founders Fund to build secure multi-signature wallet technology, establishing cryptographic security differentiation in Bitcoin's nascent institutional market.

Momentum accelerated through custody evolution. Series A ($12 million, 2014, Redpoint Ventures) financed wallet expansion and security engineering. Series B ($42.5 million, 2017, Valor Equity Partners) scaled enterprise adoption. Series C ($100 million, 2021, Goldman Sachs and DRW Venture Capital) at approximately $2 billion valuation funded regulated custody services, global licensing across jurisdictions, and integrated platform development connecting self-custody wallets, qualified trust infrastructure, and prime brokerage. Strategic extension capital ($15 million, 2022) supported operational expansion as Assets on Platform scaled toward $104 billion.

The inflection arrived as BitGo demonstrated institutional traction: 4,900+ clients across 100+ countries, $3.1 billion revenue in 2024 with positive net income, and federal bank charter approval validating qualified custodian positioning.

With institutional backing from Goldman Sachs (global financial infrastructure), Valor Equity Partners (technology-enabled services), Redpoint Ventures (enterprise security), DRW Venture Capital (market infrastructure), and Founders Fund (disruptive innovation), BitGo built bankruptcy-remote custody architecture aligned to network effects—positioning the platform to capture the multi-trillion dollar opportunity as traditional assets tokenize and 10% of global GDP moves on-chain by 2027.

Competition

The digital asset custody market divides between qualified custodians and exchange-integrated providers—traditional financial institutions entering crypto versus pure-play custody companies built natively around blockchain security. BitGo takes a different approach: a custody-native, vertically integrated platform unifying self-custody wallets, qualified trust services, prime brokerage, and tokenization infrastructure under proprietary multi-signature and MPC architecture.

The Obvious Competition:

Exchange-Integrated Platforms — Crypto exchanges offering custody hold significant market share, with established retail user bases, integrated trading liquidity, and substantial balance sheets. However, institutional clients resist custody solutions where providers trade against, lend against, or rehypothecate client assets—creating conflicts of interest that favor independent qualified custodians offering fiduciary obligations.

Traditional Financial Institutions — Global custodians like BNY Mellon and State Street launched digital asset platforms following SAB 121's rescission, competing with established client relationships, regulatory credibility, and diversified financial services. BitGo competes through decade-long blockchain-native infrastructure, bankruptcy-remote trust structure, and purpose-built custody technology versus adapted legacy systems.

Custody-First Competitors — Emerging digital asset custodians compete for institutional adoption with varying approaches to security architecture, regulatory licensing, and service breadth. BitGo maintains differentiation through federal bank charter, 1,550+ supported assets, and integrated prime services—but competition for enterprise mandates remains intense.

Brokerage and Stablecoin Specialists — Point solution providers offer specific services like prime brokerage or stablecoin issuance, but lack qualified custody foundations, multi-jurisdictional licensing, or vertically integrated infrastructure versus BitGo's unified platform.

How BitGo Competes

BitGo's moat is built around proprietary custody architecture and multi-service expansion:

Full-stack infrastructure: Patented multi-sig/MPC technology → bankruptcy-remote segregation → federal bank charter → SOC 1/SOC 2 Type 2 compliance

Integrated platform: Connects custody, staking, prime brokerage, tokenization—enabling conflict-free institutional services impossible with exchange-based models

Expansion economics: Positive net income; 4,900+ institutional clients; $104B Assets on Platform; 233% revenue growth (2023-2024)

Competition remains intense from well-capitalized exchanges and traditional financial institutions, but BitGo's custody-native, fiduciary-obligated, multi-service platform converts market fragmentation into sustainable competitive advantage through trust differentiation and regulatory positioning.

Financials

BitGo's financial profile reflects institutional custody infrastructure scaling toward sustained profitability: accelerating revenue growth driven by digital asset price appreciation, expanding client penetration across traditional finance and crypto-native institutions, and achieving positive net income despite crypto market volatility. Ongoing exposure to asset price cycles influenced revenue variability, but the business added enterprise customers, deepened multi-service adoption, and demonstrated path to sustainable unit economics through platform expansion.

Growth at Scale

Revenue: $3.1B (2024), +233% YoY from $926M; -63% to $926M (2023) from $2.5B (2022). Nine months 2025: $10.0B, +415% YoY from $1.9B.

CAGR: Volatile due to crypto cycles, but nine-month 2025 performance demonstrates commercial traction during bull markets.

Mix: Digital asset sales 82.5% of 2024 revenue; staking 14.9%; subscriptions and services 2.5%—reflecting prime brokerage dominance with growing recurring revenue streams.

Profitability: Net income $156.6M (2024) versus $(2.1)M (2023); $35.3M in nine months 2025. Adjusted EBITDA $3.2M (2024) versus $(29.7)M (2023); $20.3M (nine months 2025)—achieving positive operating performance.

Ecosystem Momentum

Customer Expansion: Institutional clients grew to 4,988 (September 2025) from 1,367 (December 2023)—97% CAGR over two years spanning financial institutions, crypto companies, technology platforms, and government agencies.

User Reach: 1.17 million users across custody, staking, and trading—demonstrating institutional-scale deployment.

Market Position: Leading qualified custodian with federal bank charter; $104B Assets on Platform (September 2025); $28.6B Assets Staked.

Capital Structure

Assets on Platform: 106.9% CAGR through September 2025—concentrated in Bitcoin (42.8%), Sui (18.9%), Solana (8.6%), XRP (5.9%), Ethereum (4.1%).

Revenue Correlation: AoP directly impacts trading volume, staking rewards, and custody fees—demonstrating platform leverage.

Volatility Exposure: AoP declined 22% Q3-Q4 2025 due to crypto price declines—reflecting market-dependent revenue sensitivity requiring evaluation across full cycles rather than quarterly periods.

Closing thoughts

BitGo's financial performance and strategic positioning underscore its potential to redefine how institutions operate in an era of digital asset transformation, tokenization acceleration, and programmable money infrastructure. With a custody-native, vertically integrated platform, BitGo has differentiated from exchange-dependent custody and legacy banking adaptations while building infrastructure spanning proprietary multi-signature architecture, bankruptcy-remote trust services, and conflict-free prime brokerage.

Bull Case: BitGo's qualified custodian positioning provides runway for sustained growth. The company serves 4,900+ institutional clients, manages $104B Assets on Platform, and achieved positive net income while generating 233% revenue growth in 2024. Federal bank charter—among the first purpose-built digital asset banks—validates regulatory differentiation. Addressable market scales toward multi-trillion dollar tokenization opportunity with 10% of global GDP moving on-chain by 2027, creating substantial penetration headroom.

Bear Case: Intense competition from traditional financial institutions (BNY Mellon, State Street) entering post-SAB 121 rescission. Revenue volatility exposed to crypto price cycles—22% AoP decline Q3-Q4 2025 demonstrates market dependency. Asset concentration risk in Bitcoin (42.8%), Sui (18.9%), and limited digital assets creates operational exposure. Regulatory evolution across jurisdictions may impose compliance burdens.

Success hinges on maintaining security leadership as competition intensifies, executing multi-service expansion across staking and tokenization infrastructure, deepening traditional finance adoption, and sustaining profitability through crypto market cycles. If executed, BitGo is positioned to capture custody economics as the financial system consolidates around bankruptcy-remote, fiduciary-obligated, institutionally-compliant digital asset platforms connecting traditional finance with decentralized networks.

Lars Leckie is a Partner at Aspenwood Ventures, bringing a rare founder-turned-investor perspective to early-stage investing. He co-founded AutoFarm (now Novariant), pioneering GPS and robotics in agriculture, where he built sales teams across three continents

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Buy my NEW book: Buy my book on How to value a company

And that’s it from me. See you next week.