- Partner Grow

- Posts

- DeepSky Acquisition Story in 4 months

DeepSky Acquisition Story in 4 months

Deepsky-Airtable acquisition deep dive

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Effortless Tutorial Video Creation with Guidde

Transform your team’s static training materials into dynamic, engaging video guides with Guidde.

Here’s what you’ll love about Guidde:

1️⃣ Easy to Create: Turn PDFs or manuals into stunning video tutorials with a single click.

2️⃣ Easy to Update: Update video content in seconds to keep your training materials relevant.

3️⃣ Easy to Localize: Generate multilingual guides to ensure accessibility for global teams.

Empower your teammates with interactive learning.

And the best part? The browser extension is 100% free.

Interested in sponsoring these emails? See our partnership options here.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

Deepsky acquisition

Introduction

The DeepSky-Airtable deal isn't your typical acqui-hire—it's a masterclass in building something so differentiated that a platform company moves before anyone else can. Airtable absorbed all three founders and 12 team members just four months after public launch. Not as a feature. As a standalone product line.

On the surface: Stanford MBAs using it organically, immediate product-market fit, a new CTO from OpenAI arriving at Airtable the same month. But look closer, and it gets more interesting.

DeepSky didn't win by building better prompts or flashier demos. It won by owning the layer nobody else was fighting for—the judgment layer. The messy work that happens before execution: turning ambiguous questions into research-backed decisions.

While every AI startup raced to generate answers faster, DeepSky built a system that plans, researches across parallel threads, synthesizes findings, and produces boardroom-ready outputs. Not drafts. Finished work.

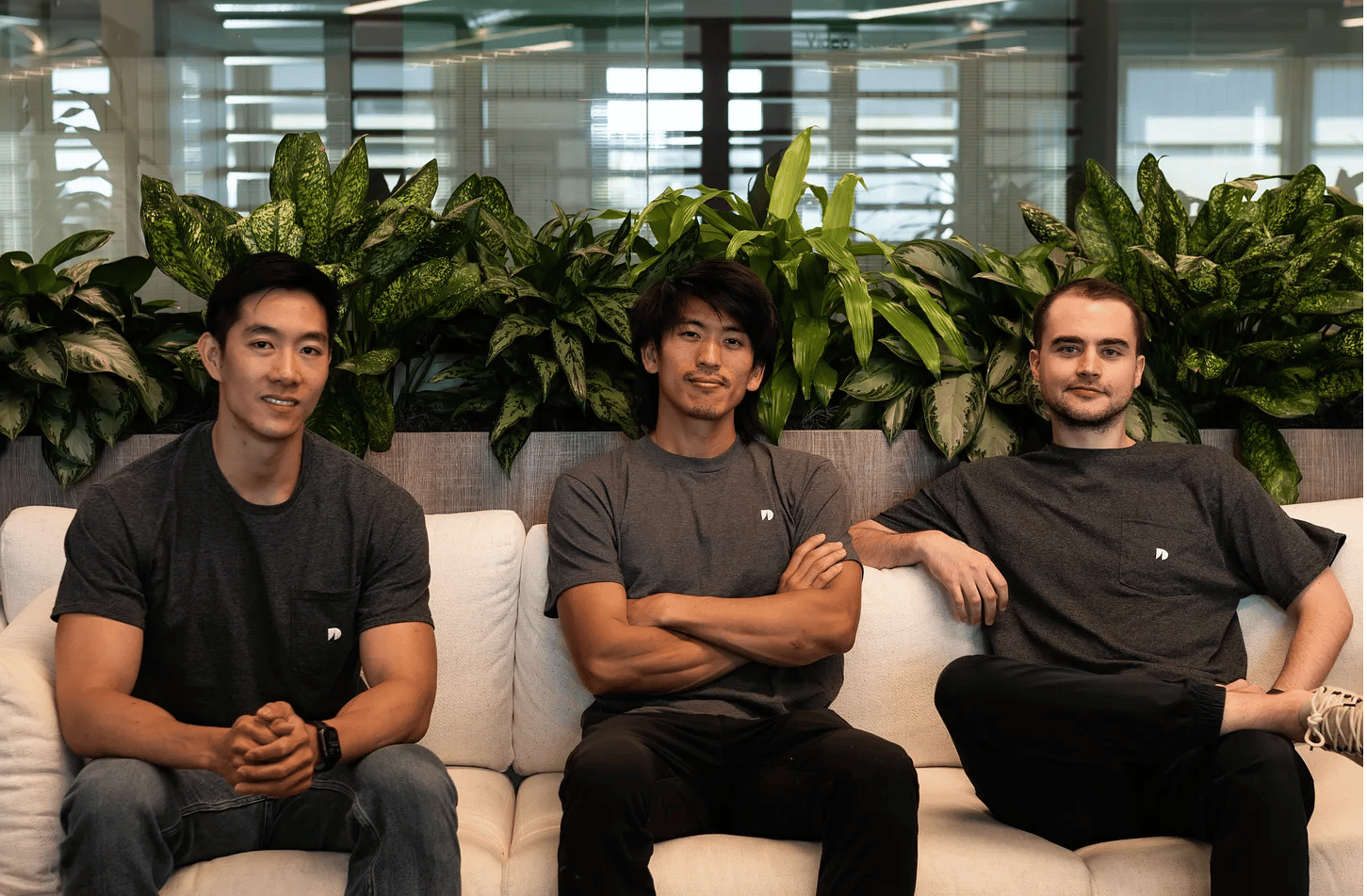

The founders—Chris Chang (Netflix, Pinterest), Mark Kim-Huang (quant finance, Splunk), Forrest Moret —had lived inside high-stakes AI. Chang ran systems that help deploy Netflix's $10B+ content budget. Kim-Huang shipped ML infrastructure where bad predictions cost real money. Moret built some of the earliest million-token context models.

They'd all seen the same problem: organizations drowning in fragmented data, most AI optimizing for "wow" instead of "what actually runs the business," and the highest-leverage work being synthesis, not typing.

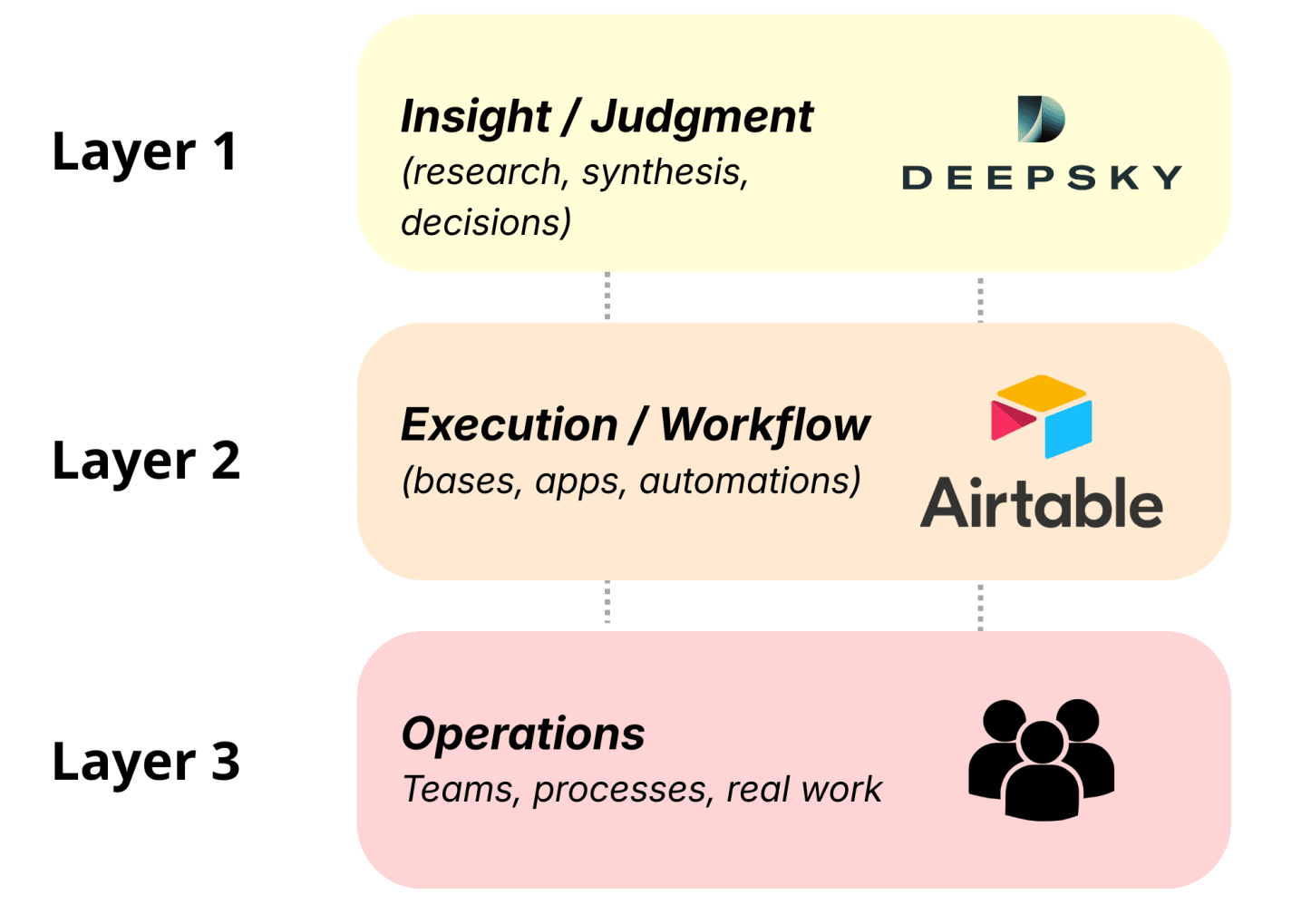

And here's the brutal efficiency: Airtable already owned execution. They power workflows across 80% of the Fortune 100. But they had a gap. Work doesn't start with "build me an app." It starts with "I don't understand this problem yet."

DeepSky plugged directly into that gap. Four months from launch to acquisition. Not because they raised the most or had the best PR. Because they solved the hardest part of knowledge work—and made it reliable enough that people trusted the output.

History

DeepSky didn't start as the AI superagent that got acquired by Airtable. It started as something far less sexy: enterprise AI infrastructure for people who couldn't afford to be wrong.

The company was originally called Gradient, founded by three engineers who'd already lived inside high-stakes AI. Chris Chang had spent years running machine-learning products at Pinterest, then led Studio AI at Netflix—the systems that help allocate $10 billion in content spend. Mark Kim-Huang came out of a decade in quant finance, then senior ML roles at Box and Splunk, shipping anomaly detection and forecasting into real enterprise environments.

They'd all seen the same problem: organizations drowning in fragmented data, and most AI demos optimizing for "wow" instead of "what actually runs the business."

So they built for the people who needed reliability. First came Preemo: a fine-tuning and deployment platform for financial and healthcare customers. They open-sourced parts of it. This was pure infrastructure—give enterprises better models and better ways to deploy them.

Then Gradient: an agentic system specifically for financial services. Investment teams, trading desks, risk and compliance operations. Not "ask a chatbot," but "give an analyst a mandate." Multi-step workflows around research, evaluation, and monitoring in environments where mistakes cost real money.

The company raised roughly $40 million under the Gradient name. The thesis stayed constant: AI should help people understand problems and make decisions, not just generate text.

DeepSky was the generalization of that belief. Instead of building for one vertical, they built a reasoning system that worked across domains. It focused on one thing: turning complex, messy questions into clear, well-reasoned, execution-ready work.

By summer 2024, Stanford MBAs were using it organically. Four months after public launch, Airtable moved. All three founders and 12 team members joined as a standalone unit.

Deepsky GTM plan

DeepSky's go-to-market wasn't about being the fastest AI or the cheapest—it was about being the only tool solving the problem before the work starts. While competitors chased better text generation and slicker demos, DeepSky built for the moment when someone stares at a blank page and thinks: "I don't even know what I don't know yet."

It's a strategy built on owning the judgment layer, not the execution layer. And it worked fast enough to get acquired in four months.

The Positioning: Research, Not Responses

DeepSky's entire GTM hinges on a simple reframe: AI shouldn't just answer questions—it should help you understand what questions to ask. The product doesn't start generating immediately. It plans. It researches across parallel branches. It synthesizes conflicting sources. It reasons through tradeoffs. Only then does it produce an output—and that output looks like something an analyst would deliver, not something ChatGPT spit out.

The pitch writes itself: ChatGPT is for brainstorming. DeepSky is for decisions you'll defend in a boardroom.

This positioning immediately separates DeepSky from the noise. Every AI tool promises speed. DeepSky promises trust. You can see where information comes from. You can trace how conclusions form. You get charts, structured analysis, and citations—not vibes and slop content.

The Wedge: High-Intent Users Who Can't Afford to Be Wrong

DeepSky didn't start broad. It started with people making high-stakes decisions: founders building business plans, consultants producing client deliverables, MBAs researching market entry strategies. These users don't need an AI that writes fast—they need an AI that gets it right.

The company's early traction came organically. Stanford MBAs started using it over summer 2024. Not because of aggressive sales outreach, but because the product solved a real problem better than anything else: turning a fuzzy idea into a polished, presentation-ready document without spending 40 hours on research.

This is classic product-led growth in a new category. Give smart, demanding users a tool that actually works, and let them spread it.

The Expansion: From Individuals to Enterprises

The natural progression was always enterprise. Individuals pay for speed and convenience. Enterprises pay for systems that reduce risk and improve decision quality across teams. DeepSky's roadmap pointed directly at that: integrate with company data, connect to internal knowledge bases, turn research into workflows that feed execution tools.

That's where Airtable saw the fit. Airtable already owned execution—workflows, apps, automations across 80% of the Fortune 100. But enterprises don't start with workflows. They start with messy questions, fragmented data, and unclear priorities. DeepSky met users at that exact moment of uncertainty and turned it into structured, actionable intelligence.

The GTM became: sell the insight layer to Airtable's install base. Let DeepSky handle research and synthesis. Let Airtable + Omni handle what happens next—building apps, triggering automations, operationalizing decisions.

What Airtable Bought

Airtable didn't acquire DeepSky for revenue scale or customer counts. They acquired it because the GTM was complementary, not competitive. DeepSky wasn't trying to replace Airtable—it was trying to make Airtable more valuable by solving the problem that comes before anyone opens a base.

The product roadmap was already pointing toward deeper integrations: agents reading and writing structured data, outputs that trigger workflows, decisions that connect directly to operational systems. Airtable just accelerated the timeline.

Four months from launch to exit. Not because they sold hard. Because they built something enterprises couldn't easily replicate—and positioned it exactly where the market had a gap.

Why Airtable bought Deepsky

Airtable didn't buy DeepSky for its revenue or customer base. They bought it because DeepSky solved the one problem Airtable couldn't—and did it in a way that made Airtable's platform exponentially more valuable.

Here's the gap: Airtable owns execution. They power workflows across 80% of the Fortune 100. They built Omni, their AI app builder, to turn ideas into automated processes. But here's what they couldn't fix—most work doesn't start with "build me an app." It starts with "I don't fully understand this problem yet."

That's where DeepSky lived. While every AI tool raced to generate answers faster, DeepSky built a reasoning system that meets users at the point of uncertainty. It plans what needs to be understood. It runs parallel research threads across market data, competitors, risks, and opportunities. It synthesizes conflicting sources. It produces presentation-ready outputs—business plans, research reports, strategy memos—that look like they came from a senior analyst, not a chatbot.

DeepSky was the insight layer. Airtable was the execution layer. Together, they form a complete loop: messy question → structured decision → operational workflow.

The speed of the deal—four months from public launch to acquisition—tells you everything. By the time Airtable moved, DeepSky was already going viral with Stanford MBAs. The product had organic traction. The founders—veterans from Netflix, Pinterest, Google, and quant finance—had built something legitimately hard to replicate: planning-aware reasoning, multi-branch research orchestration, synthesis pipelines, and high-quality structured outputs.

Airtable didn't absorb it as a feature. All three founders and 12 team members joined as a standalone unit. DeepSky became Airtable's second core AI product alongside Omni.

The calculus was simple: DeepSky helps users understand problems. Airtable turns those decisions into workflows and apps. Separately, they're good products. Together, they're the full stack—from uncertainty to execution.

And Airtable couldn't build that fast enough without slowing down everything else. So they bought the only team that had already figured it out.

What it means for founders

The DeepSky acquisition exposes a brutal truth about AI startups: everyone's building in the wrong layer.

Most founders are fighting over execution—better answers, faster responses, cleaner outputs. It's the most obvious place to compete, which makes it the most crowded. You're racing against OpenAI's next model release, fighting on price against free tiers, and praying your feature stays defensible for six months.

DeepSky went one level earlier: the judgment layer. Research, synthesis, and decision-making before execution starts. They didn't build a better ChatGPT. They built the thing you use when ChatGPT isn't enough—when you need to actually understand a problem, not just generate text about it.

That positioning made them complementary, not competitive. Airtable couldn't see DeepSky as a threat because DeepSky made Airtable more valuable. They sat above execution tools and alongside decision-makers. That's why the acquisition happened in four months.

The lesson is clear: there's more leverage in systems that clarify decisions than systems that accelerate work. The hardest problems in business aren't "write this faster"—they're "help me figure out what to do." That's where the money is. That's where defensibility lives.

If you're building AI, ask yourself: are you competing in the execution layer where everyone else is, or are you solving the problem that comes before anyone knows what to execute?

How will DeepSky work with Airtable

Post-acquisition, DeepSky doesn't disappear into Airtable's codebase. It remains a standalone product—same team, same self-serve access, same reasoning engine. But now it plugs directly into Airtable's infrastructure, and that's where it gets interesting.

The integration creates a complete workflow loop. DeepSky handles the front end: you ask a messy question, it runs deep research, synthesizes findings, and produces structured intelligence—market analysis, competitive mapping, strategic recommendations. But instead of stopping at a PDF report, that output feeds directly into Airtable.

The research becomes structured data in Airtable bases. Insights trigger automations. Recommendations turn into tasks, projects, and workflows built through Omni. Agents can read and write across both systems—DeepSky reasons, Airtable executes.

For users, it means decisions don't live in documents anymore. They live in operational systems. You research a market entry strategy with DeepSky, and Airtable immediately spins up the project plan, assigns owners, tracks milestones, and monitors KPIs.

Closing thoughts

The DeepSky story isn't about luck or timing. It's about recognizing where the real leverage sits—and building there before anyone else realizes it matters.

Four months from public launch to acquisition. Not because they raised the most capital, hired the fastest, or had the slickest marketing. Because they solved a problem most founders don't even see: the gap between "I have a question" and "I know what to do."

Everyone's obsessed with making AI faster, cheaper, prettier. DeepSky made it trustworthy. They built a reasoning system that plans, researches, synthesizes, and produces outputs you'd actually present to a board. Not because it generates better prose—because it does the thinking that comes before the prose matters.

That positioning made them impossible to ignore. Airtable couldn't build it fast enough without derailing their roadmap. They couldn't let a competitor grab it. So they moved. All three founders, 12 team members, standalone product line. Not a feature tuck-in. A strategic pillar.

Here's what founders should take from this: stop competing where everyone else is fighting. The execution layer is saturated. The judgment layer—research, synthesis, decision-making—is wide open. That's where enterprises actually struggle. That's where they'll pay.

And here's what makes DeepSky's exit so clean: they didn't need to convince Airtable they were the future. They just needed to prove they solved a problem Airtable's customers had right before they opened Airtable. Complementary beats competitive. Every time.

The founders came from Netflix, Pinterest, Google, quant finance—places where bad decisions cost real money. They didn't build an AI tool. They built the system they wished existed when they were making those decisions themselves.

Four months later, Airtable wrote the check.

That's not a fluke. That's just what happens when you solve the hardest problem in the room—and make it reliable enough that people bet their credibility on your output.

Here is my interview with Marcos Rivera,the founder and CEO of Pricing I/O, where he helps B2B SaaS companies capture the value they’ve built. Former Head of Pricing at Vista Equity Partners, he’s priced over 400 SaaS products and has authored Street Pricing.

In this conversation, Marcos and I discuss:

-Why do so many SaaS companies treat pricing as a “once every couple of years” event when their product is changing monthly?

-How should SaaS companies think about pricing new AI features they’re building?

-If a founder is listening right now and can only do one thing differently with their pricing this quarter, what should it be?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Buy my NEW book: Buy my book on How to value a company

And that’s it from me. See you next week.

Reply