- Partner Grow

- Posts

- Figure Technology: The Crypto-Native Fintech

Figure Technology: The Crypto-Native Fintech

Figure S1 Deep Dive

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

How to pick the right global payroll mode

Find your fit: Deel’s free guide breaks down 3 global payroll models with key benefits and tradeoffs for HR and finance teams.

Interested in sponsoring these emails? See our partnership options here.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

Housekeeping

📢 Exciting news — my next ebook, Valuation Matters, is almost here!

It’s a practical, no-fluff playbook for investors to truly understand what drives value. Inside, you’ll find frameworks, checklists, and traps to avoid—everything from mental models to stage-by-stage valuation methods.

Join the waitlist for early access + 50% off ($19 → $9):

👉 https://eu.makeforms.co/erij7ui/

S1 Deep Dive

Figure in one minute

Figure is rebuilding capital markets from the ground up using blockchain technology—transforming how loans are originated, traded, and settled in real time. In a world where financial infrastructure still runs on fragmented legacy systems built decades ago, Figure delivers a vertically integrated platform that replaces manual processes with automated smart contracts, cutting costs by 90% and accelerating transactions from weeks to days.

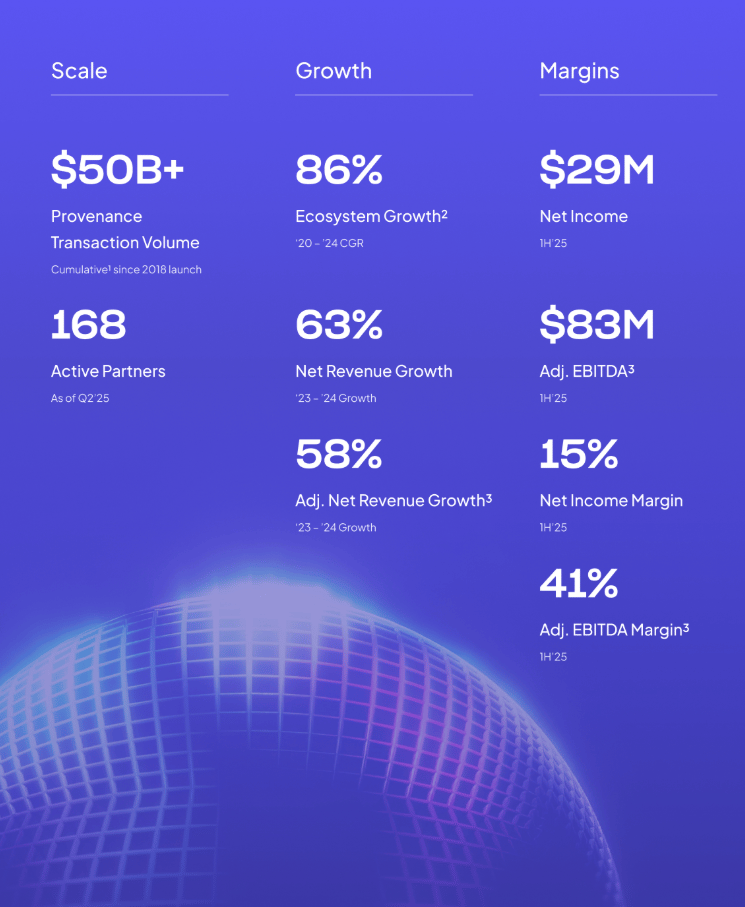

Since its founding in 2018 by SoFi co-founder Mike Cagney, Figure has pioneered the real-world application of blockchain in finance—proving that distributed ledger technology can deliver measurable efficiency gains beyond speculation. By recording over $50 billion in transactions on Provenance Blockchain and capturing 75% of the tokenized private credit market, Figure has emerged as the dominant infrastructure layer connecting loan originators, institutional buyers, and digital asset traders. With 168 active partners and $6 billion in home equity lending facilitated in the last twelve months, Figure holds the #1 market share in non-bank HELOC origination.

At the core of Figure's model is radical operational efficiency: loans funded in a median of 10 days versus the industry average of 42 days, at a production cost of $730 per loan versus the mortgage industry average of $11,230. This is achieved through automated income verification, digital lien matching, algorithmic property valuations, and blockchain-based title registry—eliminating intermediaries, paperwork, and human underwriting bottlenecks. The result is a frictionless experience for borrowers and partners alike, driving 29% year-over-year growth in lending volume.

Figure's proprietary technology stack is engineered for scale and profitability. With 80% of partner-originated loans now utilizing its DART blockchain registry, Figure has built network effects that compound with every transaction. This infrastructure enabled the company to achieve profitability early: in the first half of 2025, Figure generated $191 million in revenue with 47% adjusted EBITDA margins and $29 million in net income—demonstrating that blockchain-based finance is not just faster and cheaper, but structurally more profitable than legacy systems.

The opportunity ahead is transformational. Figure operates at the intersection of two massive markets: the $2 trillion consumer credit market and the $4 trillion cryptocurrency and digital asset market. With private credit capital projected to reach $3 trillion by 2028 and less than 1% of real-world assets currently tokenized, Figure is positioned to capture the infrastructure layer of the next generation of capital markets—where assets are liquid, transparent, and natively digital from origination to settlement.

Introduction

At its core, Figure is an infrastructure company. We were among the first to prove that blockchain technology could solve real-world problems in finance—not through speculation, but through radical operational efficiency. Starting with home equity lending in 2018, we've since built a vertically integrated platform spanning loan origination, secondary market trading, digital asset exchange, and blockchain-based settlement—all recorded immutably on Provenance Blockchain. By replacing manual underwriting, paper-intensive title searches, and fragmented loan registries with automated smart contracts and digital lien matching, we align with how capital markets should work: fast, transparent, and frictionless from application to funding to sale.

This infrastructure powers scale and profitability. Our incentives are fundamentally aligned with our partners': we earn usage-based fees only when transactions flow through our platform. With no legacy systems to maintain and technology that automates what historically required armies of underwriters and processors, we operate at a fraction of industry costs while delivering superior speed and accuracy. The result is a network-led flywheel: partners adopt our loan origination system for efficiency, transact on Figure Connect for liquidity, and record ownership on DART for transparency. In the first half of 2025 alone, 80% of partner-originated loans utilized our blockchain registry—up from just 2% in 2024—demonstrating rapidly accelerating platform adoption and deepening network effects.

The market shift is foundational. The consumer credit and digital asset markets we serve represent over $6 trillion in current activity, yet less than 1% of real-world assets are tokenized and private credit remains fragmented across bilateral, one-off relationships. Figure is built for this inflection point: as of June 30, 2025, we've recorded over $50 billion in blockchain transactions, hold 75% market share in tokenized private credit, and operate as the #1 non-bank HELOC originator—using proprietary technology and a regulatory framework purpose-built to become the infrastructure layer connecting borrowers, originators, and institutional capital in the next generation of capital markets.

History

Figure began with a direct challenge to capital markets orthodoxy: real-world finance could run on blockchain, not just trade speculative tokens. For decades before Figure's founding, loan origination and trading operated on fragmented legacy systems built in the analog era—manual underwriting, paper title searches, bilateral loan sales, and error-prone ownership databases. Borrowers waited weeks for approvals. Originators paid thousands per loan in friction costs. Investors struggled to access quality assets at scale. The infrastructure was expensive, slow, and opaque by design.

Mike Cagney, co-founder and former CEO of SoFi, saw an opening. After building one of the first digital-native lenders, he recognized that blockchain's immutable ledger could do more than enable peer-to-peer payments—it could become the system of record for trillions in real-world assets. In 2018, Figure launched with a thesis that smart contracts could automate loan origination end-to-end, cutting costs by 90% while recording every transaction transparently on-chain. The model was intentionally contrarian: build proprietary infrastructure rather than license legacy systems, replace human underwriters with algorithmic credit decisioning, and create a two-sided marketplace where liquidity compounds with every transaction.

What started as a direct-to-consumer HELOC product evolved into vertically integrated capital markets infrastructure. Figure launched its blockchain-based Loan Origination System (LOS) in July 2018, funding its first loans in under 10 days versus the industry median of 42 days, at $730 per loan versus the mortgage industry average of $11,230. By 2021, the company had proven the technology worked at scale and pivoted from competing with lenders to empowering them—launching a Partner-branded strategy that turned banks, credit unions, and mortgage originators into customers. Partners adopted rapidly: from 3 at year-end 2021 to 168 by mid-2025, with Partner-branded originations surging from $149 million (twelve months ended June 2022) to $4.3 billion (twelve months ended June 2025).

In June 2024, Figure launched Figure Connect, an electronic marketplace that directly connects loan sellers and buyers using blockchain for instant settlement. This completed the vertical integration—from application to underwriting to secondary market trading—all recorded immutably on Provenance Blockchain. In its first 12 months, Figure Connect facilitated $1.3 billion in HELOC volume and onboarded 27 marketplace participants, with transaction fees contributing 22% of revenue by mid-2025. The infrastructure compounded: more partners generated more standardized loans, which attracted more buyers, which deepened liquidity, which pulled in more partners.

Across credit cycles—tightening in 2022, regional bank stress in 2023, and volatility in 2024–2025—Figure's blockchain-native model proved resilient. When traditional lenders pulled back, Figure's automated underwriting and transparent on-chain ownership records attracted institutional capital seeking quality assets. When rate regimes shifted, the platform's usage-based fee model scaled with volume rather than balance sheets, insulating profitability from duration risk. By mid-2024, 80% of partner-originated loans utilized DART, Figure's blockchain-based lien registry—up from just 2% in 2024—marking an inflection point in network adoption.

Partners arrived for faster origination, stayed for lower costs, and scaled on liquidity. Ecosystem Volume—total transaction flow across the platform—grew at an 86% compound annual rate from 2020 to 2024. As of June 2025, Figure had facilitated over $16 billion in cumulative loan originations, recorded $50 billion in total blockchain transactions, and captured 75% market share in tokenized private credit and #1 share in non-bank HELOC origination. The company achieved this while reaching sustained profitability: $341 million in revenue and $101 million in adjusted EBITDA in 2024, with net income of $29 million in the first half of 2025.

Risk factors

Figure operates in a capital-intensive, highly regulated, and rapidly evolving capital markets infrastructure landscape, where execution risk, partner concentration, credit quality, and technological adoption can materially impact growth, profitability, and competitive positioning. Below are the primary risks associated with Figure's business model.

1. History of Losses and Uncertain Path to Sustained Profitability

While Figure achieved net income of $20 million in 2024 and $29 million in the first half of 2025, the company has an accumulated deficit of $292 million as of June 2025. Substantial investments in product development, technology infrastructure, sales and marketing, and public-company compliance will continue to pressure margins.

2. Revenue Concentration in HELOCs Creates Market Sensitivity

Over 99% of loan originations in the first half of 2025 were HELOCs, making Figure acutely vulnerable to fluctuations in the home equity lending market. Macroeconomic conditions—interest rate volatility, housing price movements, mortgage refinancing dynamics, regulatory changes, or competitive pricing pressures—could rapidly depress HELOC demand. If the company cannot successfully diversify into personal loans, auto loans, or other asset classes, revenue growth and partner retention could be materially impaired.

3. Partner Concentration and Non-Exclusive Relationships

Figure's top 10 partners contributed 57% of origination volume in the first half of 2025. These partners have no long-term contractual commitments, pay primarily usage-based fees, and can terminate relationships without material penalty. Loss of a major partner—due to consolidation, competitive pressure, regulatory intervention, or internal strategy shifts—could cause sudden volume declines.

4. Limited Operating History and Forecasting Difficulty

Figure's rapid growth trajectory and relatively short operating history make forward planning inherently uncertain. The company must accurately forecast loan volume, partner adoption, secondary market liquidity, and new product uptake (Figure Connect, Figure Exchange, YLDS, Democratized Prime) while navigating volatile credit markets and evolving blockchain adoption.

5. Scaling Systems, Controls, and Blockchain Infrastructure

Managing an 86% compound annual growth rate in ecosystem volume from 2020 to 2024 places extreme demands on Figure's technology stack, risk management frameworks, and operational controls. The Provenance Blockchain must maintain performance, security, and uptime as transaction volume scales. Failure to upgrade infrastructure, strengthen internal controls, or manage partner integrations could result in service disruptions, blockchain consensus issues, data integrity problems, or regulatory control deficiencies

6. New Product Execution Risk and Unproven Revenue Models

Figure Exchange, Figure Connect, YLDS, and Democratized Prime are nascent products launched between March 2024 and June 2025, generating minimal revenue to date. These initiatives require substantial investment in engineering, compliance, and go-to-market resources while introducing complex regulatory obligations (SEC registration for YLDS, ATS compliance for Figure Exchange). If adoption lags expectations, unit economics prove unfavorable, or products fail to integrate seamlessly with existing infrastructure, returns on R&D investment will be diluted and management focus will be diverted from core lending operations.

7. Intense and Multi-Dimensional Competition

Figure competes across three distinct arenas: HELOC origination (against banks, non-bank lenders, and fintech platforms), private credit marketplaces (against direct lending platforms and bilateral originator-investor relationships), and digital asset trading (against Coinbase, Robinhood, offshore exchanges, and DeFi protocols). Many competitors operate with lower compliance costs, broader product suites, stronger brand recognition, deeper capital reserves, or more permissive regulatory environments.

8. Stablecoin Market Dynamics and YLDS Competitive Position

YLDS holds approximately $20 million in market capitalization versus $170 billion (USDT) and $72 billion (USDC) for dominant stablecoins. The market exhibits extreme winner-take-most dynamics driven by network effects, liquidity, and established integrations. YLDS's SEC-registered security status—while providing yield and regulatory clarity—also limits distribution, adds compliance costs, and may deter adoption by users seeking permissionless transfers.

9. Credit Quality and Balance Sheet Risk

Figure originates and temporarily holds loans on its balance sheet before securitization or sale. If underwriting algorithms prove inadequate—particularly as the company expands into new asset classes or borrower segments—default rates could exceed historical levels (currently under 1% loss rate). Rising delinquencies would impair Figure's ability to sell loans at attractive prices, reduce partner confidence in loan quality, and strain the company's capital position.

10. Blockchain Adoption Uncertainty and Technical Dependencies

Figure's competitive advantage depends on widespread adoption of blockchain-based loan origination, DART registry usage, and Provenance Blockchain as the system of record. While DART adoption surged from 2% (2024) to 80% (H1 2025) of partner-originated loans, this growth must accelerate and sustain. Partners may resist integration complexity, prefer legacy systems, or face regulatory pressure to avoid public blockchain exposure.

Market Opportunity

The capital markets infrastructure landscape is experiencing a structural inflection point. Figure addresses a $185 billion annual revenue opportunity by delivering blockchain-based loan origination, secondary trading, and tokenized settlement through a vertically integrated platform.

Displacing Legacy Consumer Credit Infrastructure

Figure's primary opportunity lies in replacing fragmented, manual loan origination across the $2 trillion annual consumer credit market—HELOCs, mortgage refinancing, personal loans, credit cards, and auto loans. Legacy systems remain burdened by 42-day timelines and $11,230-per-loan costs (MBA data).

Figure collapses timelines to 10 days median and reduces costs to $730—a 93% reduction creating compelling unit economics. With a targeted 4% take rate (4.2% actual in 2024, 3.9% in H1 2025), Figure's addressable revenue in consumer credit totals $80 billion annually.

Despite $6 billion in home equity lending facilitated (twelve months ended June 2025) and #1 non-bank HELOC market share, Figure penetrates less than 0.3% of the $2 trillion market—leaving substantial expansion room as partners adopt blockchain workflows and the company extends beyond HELOCs.

Structural tailwinds persist: U.S. households hold $35 trillion in home equity (Federal Reserve, March 2025); high-FICO, high-income borrowers (average 755 FICO, $186K income in H1 2025) demand speed and convenience that reward automated platforms.

Unlocking Tokenized Asset Trading

Figure's second opportunity is tokenization—digital representation of real-world assets enabling instant ownership transfer and frictionless trading. Industry forecasts project tokenized assets reaching $16 trillion by 2030, up from less than 1% on-chain today.

Traditional loan trading relies on bilateral negotiations, manual assignments, and multi-day settlement—constraining liquidity. Figure's blockchain infrastructure eliminates friction: immutable recording on Provenance, instant token-based ownership transfer, smart contract automation without reconciliation errors.

With a 0.5% take rate, Figure's addressable revenue in tokenization totals $80 billion annually at $16 trillion volume by 2030.

Figure holds dominant early positioning: 75% market share in tokenized private credit, $11 billion in on-chain assets (August 2025). Figure Connect facilitated $1.3 billion in first 12 months with 27 participants onboarded and 22% of revenue (mid-2025). DART adoption accelerated from 2% (2024) to 80% (H1 2025)—positioning Figure as the infrastructure layer across consumer credit, private credit, and eventually corporate debt and structured products.

Capturing Stablecoins and Digital Assets

Figure's third opportunity targets stablecoins, which Citigroup forecasts reaching $5 trillion by 2030 from $275 billion (June 2025). Only 4% currently yield interest (CoinGecko)—a structural gap.

YLDS, Figure's SEC-registered stablecoin paying SOFR - 50 bps, combines blockchain transferability with regulatory clarity. Use cases: yielding collateral, cross-border payments, Figure Exchange settlement, margin lending—all compliant with securities laws and AML requirements.

With a 0.5% take rate, addressable revenue totals $25 billion annually at $5 trillion market size by 2030.

YLDS remains nascent ($20M market cap versus $170B USDT, $72B USDC), but Figure's regulatory-first approach and vertical integration create differentiated distribution as institutions demand compliant, yield-bearing digital dollars.

Expanding into Institutional Private Credit

Figure's platform is designed for portability across asset classes. The company is expanding into third-party loan trading, residential transition lending, and Democratized Prime—enabling institutional private credit access with on-chain ownership transparency.

Global private credit capital grew at 17% CAGR (2018-2023) reaching $1 trillion, projected to hit $3 trillion by 2028. Yet access remains fragmented with bilateral sourcing and opacity around collateral.

Figure's marketplace creates standardized assets with uniform underwriting, common documentation, and instant blockchain settlement. As third-party originators onboard via validator layers, network effects compound: more originators → more standardized loans → more buyers → deeper liquidity → more originators.

Building the Infrastructure Layer

Figure's long-term vision: becoming the central infrastructure layer for capital markets as blockchain adoption reaches critical mass. Every loan recorded on Provenance, every smart contract settlement, and every partner integration strengthens Figure's moat and expands addressable markets into corporate credit, structured finance, and multi-asset platforms spanning trillions in annual volume.

Product

Figure is building a vertically integrated, blockchain-native capital markets platform—spanning origination, funding, trading, and investing—designed to replace manual, fragmented workflows with a single, software-driven stack.

All-in-one finance rail: Consumer credit origination (HELOC-first), loan distribution, registry, digital asset exchange, and a yield-bearing stablecoin.

Blockchain as system of record: Assets and lifecycles are immutably recorded on the public Provenance Blockchain, improving speed, standardization, and liquidity.

Aligned economics: Usage-based, volume-tied fees across the stack with a focus on positive unit economics per product.

Product Suite

Loan Origination System (LOS)

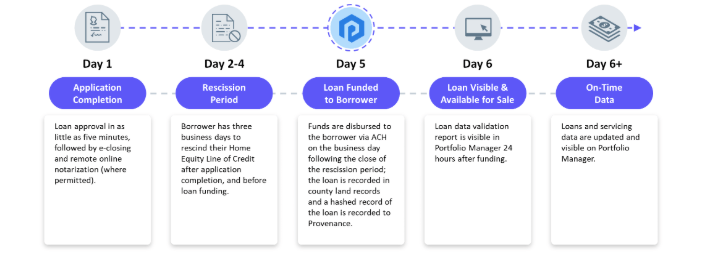

Figure’s proprietary LOS automates application, underwriting, closing, and capital markets takeout—purpose-built for secured consumer credit (HELOCs first) and extensible to other asset classes.

Speed & cost: Median 10 days from application to funding (vs. ~42 days industry) and ~$730 average production cost per loan (vs. $11,230 industry Q4’24).

Automation: AVMs, digital lien matching, automated income verification, remote e-notary (where allowed), redraw capability; 88% of loans fully automated through underwriting (6M ended Jun 30, 2025).

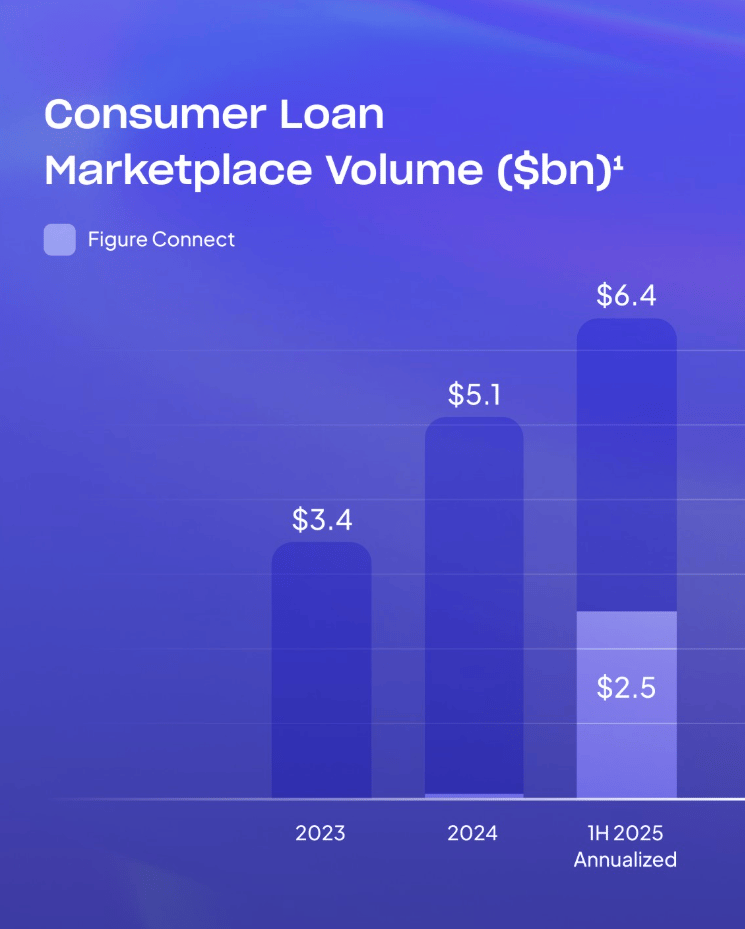

Scale & mix: $5B HELOCs in 2024 (+51% YoY); ~$6B LTM to Jun 30, 2025; 168 active partners; partner-branded originations 77% of 6M’25 volume.

Performance: Disciplined, rules-based underwriting (~28 criteria); loss rates <1% of volume (as of Jun 30, 2025).

DART

On-chain lien & eNote registry that “listens” to Provenance and updates ownership in lockstep with loan lifecycle events.

From paper to programmatic: Reduces manual assignments, reconciliations, and errors; integrates with LOS and servicers.

Adoption: 80% of LOS-originated loans boarded to DART in 6M’25 (vs. 2% in 2024).

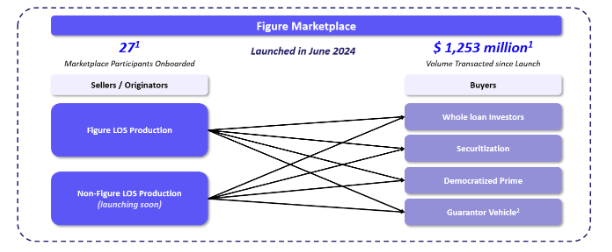

Figure Connect

Electronic marketplace (launched Jun 2024) where standardized LOS assets are sold directly to loan buyers and securitization pipelines.

Liquidity & transparency: Uniform credit policy, docs, reps & warranties; on-chain settlement via DART/Provenance.

Traction: $1.3B HELOC volume transacted in first 12 months; 27 participants onboarded by Jun 30, 2025.

Economics: Sellers see >1% higher per-loan net revenue vs. bilateral sale to an intermediary (6M’25); $45M net revenue in 6M’25 (immaterial in 2024).

Sixth Street JV (Fig SIX Mortgage LLC): Dedicated, well-capitalized buyer to purchase Figure HELOCs on Connect and retain securitization residuals (first-loss). Target commitments $210.5M combined; initial equity funded $25M into a May 2025 securitization residual; purchases via Connect expected as the market scales.

Figure Exchange

Real-time exchange for crypto and tokenized RWAs with self-clearing settlement; designed to interoperate with Figure’s credit rails.

Volume: $1B+ since Aug 2024 launch; $299M in 6M’25; no meaningful marketing to date.

Roadmap: Cross-asset collateralization for margin (planned by end-2025) and deeper RWA listings tied to Figure’s origination & marketplace.

Democratized Prime

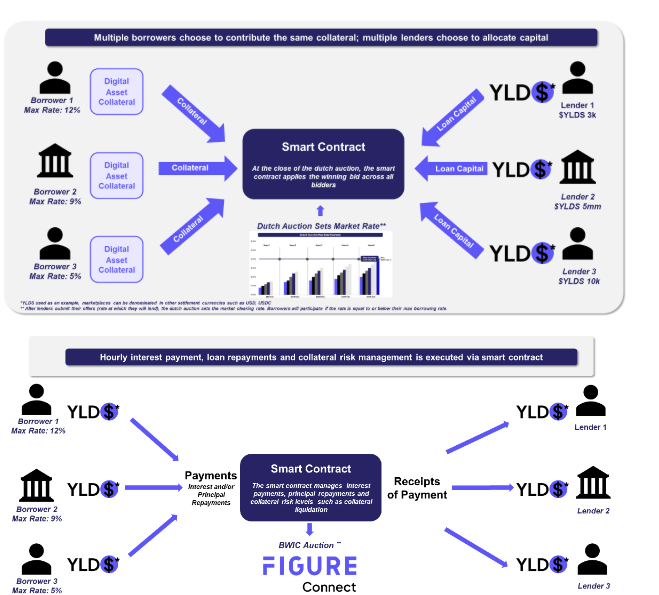

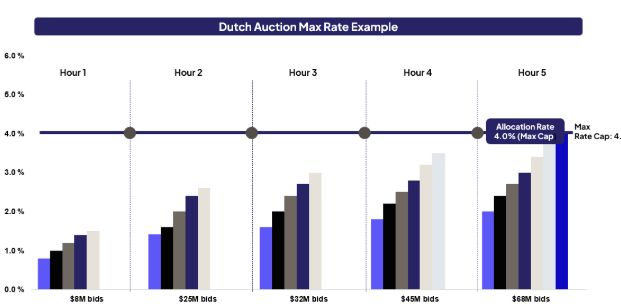

DeFi-style, many-to-many borrowing/lending marketplace where hourly Dutch auctions set market-clearing rates—collateral can include tokenized HELOCs.

Mechanics: Smart contracts manage collateral, interest accrual, redemptions, and liquidation routing (to Figure Connect for HELOCs).

Rates: ~1%–30% observed in Q2’25 (weighted avg ~10%); early AUM ~$1.5M as of Jun 30, 2025; fees of 50 bps (borrower-paid) expected as distribution scales.

YLDS

An SEC-registered, interest-bearing stablecoin native to Provenance; digital representation of Figure Certificates issued by SEC-registered Figure Certificate Company.

Yield: Pays SOFR – 0.50%; backed by cash & cash equivalents (money-market-like profile).

Transferability: 24/7 peer-to-peer to KYC’d wallets; operational on Provenance with S-1 enabling multi-chain minting (e.g., Solana, Ethereum, Avalanche).

Usage: Intended exchange currency and yielding collateral across Figure’s ecosystem; outstanding ~$4M (as of Jun 30, 2025). Revenue contribution currently de minimis.

Monetization Model

Usage-based platform fees: Volume fees for partners using LOS, DART, and Figure Connect; marketplace economics target positive unit margin per transaction.

Asset economics: Origination, gain-on-sale, servicing, and interest income from LOS assets.

Mix shift: LOS-driven revenue ~82% of total in 2024; ~76% in 6M’25 as Figure Connect and new products grow.

By the Numbers

Profitability: Net income $29M and Adjusted EBITDA $83M (6M ended Jun 30, 2025); net income $20M and Adj. EBITDA $101M (FY2024).

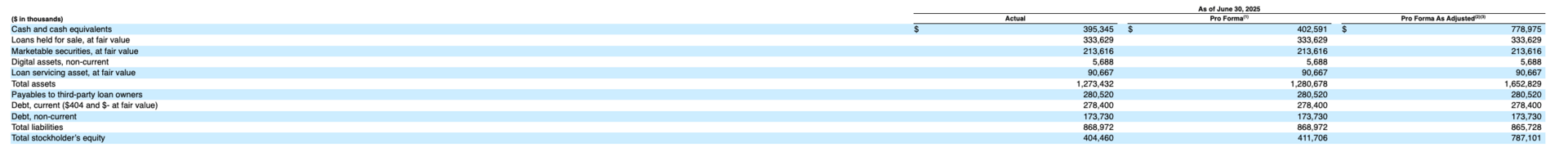

Balance sheet: Accumulated deficit $292M; stockholders’ equity $404M (Jun 30, 2025).

Throughput: $5B HELOCs in 2024; ~$6B LTM to Jun 30, 2025; #1 non-bank HELOC share in 2024 (Home Equity Lending News).

Efficiency: Median 10-day funding; ~$730 per-loan production cost; 80% of LOS loans on DART (6M’25).

Ecosystem volume: RWA TVL ~$11B (Aug 1, 2025) with ~75% share of tokenized private credit.

Business Model

Figure's model is vertically integrated, blockchain-native, and usage-based—built as low-cost infrastructure that shares efficiency gains with partners while compounding network effects.

Platform-Led, Multi-Engine Revenue

1) Origination and Distribution

Economics: Targeted 4% take rate on loan volume (ecosystem fees, origination fees, gain on sale, capitalized servicing rights). Actual: 4.2% (2024), 3.9% (H1 2025). Figure Connect sellers pay higher fees but earn 1%+ better net revenue versus selling to Figure as intermediary. Figure maintains 2%+ margin between revenue and costs.

Why it matters: Core engine tied to origination volume and secondary liquidity. Usage fees compound without proportional cost increases. Mix: 76% of Adjusted Net Revenue (H1 2025), including 22% from Figure Connect.

2) Servicing and Interest Income

Scope: Capitalized MSRs valued quarterly via third-party DCF; recurring servicing fees on outstanding loans; interest income on loans held temporarily pre-sale. Mix: 24% of revenue (H1 2025). Provides stable cash flow though MSR valuation creates quarterly volatility.

3) Tokenization, Trading & Stablecoins

Figure Exchange: Trading fees on $299M volume (H1 2025); Democratized Prime charges 50 bps on borrowed balances. Currently zero revenue but high-margin optionality.

YLDS: FCC earns fees from investment securities backing stablecoin. Less than $1K revenue (H1 2025) on $4M outstanding, but positioned to scale as institutional adoption grows.

Mix: Immaterial today; represents long-term expansion into $80B+ tokenization/trading and $25B+ stablecoin TAMs.

Low-Cost, Blockchain-First Operating Model

Automation replaces manual work: 88% of loans fully automated application-to-underwriting (H1 2025). AVMs replace appraisals; digital verification eliminates manual income checks. Result: $730 cost per loan versus $11,230 industry average (93% reduction).

Blockchain eliminates reconciliation: Provenance Blockchain as single source of truth; smart contracts automate collateral, interest, liquidations. Near-zero marginal cost (~$0.026 HASH per transaction).

Partner self-service: API-driven onboarding in one week. 168 partners supported without proportional headcount—generating 185% net volume retention (2024).

Result: 47.2% adjusted EBITDA margin (H1 2025), though MSR valuation creates volatility. $29M net income (H1 2025), $20M (2024), following $52M loss (2023) and $292M accumulated deficit.

Partnered Infrastructure

Provenance Blockchain: Independent Layer 1 proof-of-stake; ~4.4 sec/block. Provenance Foundation governs; Figure pays minimal HASH gas fees.

Securitization: 15 rated HELOC securitizations since April 2023 (all AAA tranches). Guarantor Vehicle (Fig SIX with Sixth Street: $210.5M commitment, 95/5 equity split) provides standing bid on Figure Connect.

Regulatory apparatus: 180+ lending/servicing licenses, 48 money transmitter licenses, SEC broker-dealer with ATS authority. Compliance overhead differentiates from unregulated offshore competitors but adds cost.

Network-Led Flywheel

Land with LOS (speed, cost) → expand to Figure Connect (liquidity) → deepen with DART (80% adoption in H1 2025 vs 2% in 2024) → extend to Democratized Prime (margin lending).

Partner retention compounds: 93% of partners (97% of 2023 volume) remained active in 2024; 185% net volume retention. Rising switching costs as partners integrate underwriting, buyer relationships, and blockchain history.

Cross-platform synergies: YLDS as settlement currency for Figure Connect and collateral for Democratized Prime; tokenized HELOCs tradeable on Figure Exchange.

Unit Economics

Operating leverage: Blockchain infrastructure and automation reduce marginal cost as volume scales. $1.3B Figure Connect trading (first 12 months) with minimal incremental expense beyond platform build.

Alignment: Usage-based pricing (pay only when transacting) ties Figure's success to partner origination. Higher Figure Connect fees offset by superior originator net revenue—positive-sum dynamics reinforce adoption.

Volatility: MSR valuation swings (prepayment, default, discount rate assumptions) create EBITDA lumpiness. Gain-on-sale fluctuates with secondary pricing and Figure's intermediation choices.

Regulatory Complexity as Moat

Compliance barrier: 180+ licenses and SEC registrations create cost overhead but deter competition. Offshore competitors avoid costs but face enforcement risk and institutional skepticism.

Evolving landscape: January 2025 executive order establishes Digital Asset Markets working group; GENIUS Act under Congressional consideration. YLDS exempt from proposed bills; BTC/ETH may face new requirements. Uncertainty creates risk but also opportunity for compliant-first players.

Enforcement exposure: Financial services face class actions, state AG actions, federal enforcement, and discrimination claims. Figure's proactive licensing and registered products (YLDS, ATS) position as regulated alternative but don't eliminate risk.

Management Team:

Michael Tannenbaum – Chief Executive Officer

Michael Tannenbaum has served as CEO since April 2024 and as a member of the Board since July 2024. He previously served at Brex as Chief Operating Officer (2021–2024) and as Chief Financial Officer & Chief Business Officer (2017–2021). Earlier, he held senior leadership roles at SoFi (2014–2017), including Chief Revenue Officer, and prior roles at Hellman & Friedman and JPMorgan’s investment banking division. Michael graduated summa cum laude from Columbia University with a B.A. in Economics and Urban Studies.

Macrina Kgil – Chief Financial Officer

Macrina Kgil has served as CFO since December 2024. She was previously Head of Finance at Flow.life (2023–2024) and CFO of Blockchain.com (2018–2022) while concurrently serving as CFO of Blockchain Venture Fund (2018–2023). Earlier in her career, she held roles at PricewaterhouseCoopers, Fortress Investment Group, and OneMain Financial. Macrina holds a bachelor’s degree in Mineral and Petroleum Engineering from Seoul National University.

Todd Stevens – Chief Capital Officer

Todd Stevens has served as Chief Capital Officer since November 2023. He was previously Head of Capital Markets at Inveniam Capital Partners (2021–2023). From 2004 to 2020, Todd held roles at Deutsche Bank, most recently as Global Head of Key Client Partners; he served on the Global Wealth Management Executive Committee and led a 70-person team across seven countries. He began his career at PricewaterhouseCoopers. Todd graduated magna cum laude with general honors from the University of Georgia with a B.B.A. in Accounting.

Investment

Figure's financing trajectory signaled methodical validation—from blockchain thesis to scaled infrastructure platform. Seed capital in early 2018 reached a $100 million post-money valuation, followed by Series A at $150 million later that year, establishing founder Mike Cagney's credibility after SoFi and proving initial demand for blockchain-based HELOC origination.

Momentum accelerated through 2019. A Series B round raised over $65 million at a $380 million valuation, funding LOS automation and partner onboarding infrastructure. By year-end, Figure closed a Series C generating over $100 million at nearly $1.2 billion valuation—demonstrating product-market fit as loan originations scaled and blockchain adoption proved viable for real-world finance.

The inflection arrived in May 2021, when Figure raised $200 million Series D at a $3.2 billion valuation. Co-led by 10T Holdings and Morgan Creek Digital, the round brought strategic capital from Apollo Global Management, DST Global, Ribbit Capital, Digital Currency Group, and others spanning crypto-native and traditional finance. Apollo simultaneously entered a strategic collaboration to develop blockchain-based initiatives through Provenance, validating Figure's infrastructure thesis among institutional asset managers. This capital fueled expansion beyond direct-to-consumer HELOCs into Partner-branded strategies, Figure Connect marketplace development, and regulatory licensing across 180+ jurisdictions.

In February 2025, Figure and Sixth Street formed Fig SIX Mortgage LLC, a joint venture where Sixth Street committed $200 million equity (95% ownership) alongside Figure's $10.5 million (5% ownership) to provide standing liquidity on Figure Connect. Structured as a Guarantor Vehicle that purchases HELOCs and retains first-loss residual equity in securitizations, the partnership addressed a critical infrastructure gap: execution certainty for originating partners and recycling capital to support private credit marketplace scale. Sixth Street's participation—a mainstream institutional credit investor backing blockchain-native loan trading—marked validation that tokenized asset infrastructure had crossed from experimental to essential.

With total institutional backing spanning crypto-native funds, global asset managers, and strategic credit partners, Figure financed a vertically integrated, blockchain-first stack powering origination, trading, and settlement across consumer and private credit markets. The result is a capital-efficient, usage-based operating model aligned to network effects and long-term infrastructure dominance.

Competition

The consumer credit and capital markets infrastructure landscape is dominated by incumbent banks, non-bank lenders, and legacy technology vendors - organizations built on manual underwriting, bilateral loan sales, and fragmented databases. Figure takes a different approach: a vertically integrated platform unifying origination, registry, secondary trading, and settlement on blockchain infrastructure.

The Obvious Competition:

Loan Origination Tech — Blend, ICE Mortgage Technology, Encompass offer digital origination to banks and lenders. Similar automation goals but no blockchain registry, integrated secondary marketplace, or tokenized infrastructure. Partners still face bilateral sales and manual ownership transfers.

Consumer Lenders — Banks (Wells Fargo, BofA) and non-bank lenders (Rocket, LoanDepot) compete for borrowers with stronger brands and balance sheets, but 42-day timelines, $11,230 costs, and limited liquidity versus Figure's 10-day median, $730 cost, and Figure Connect marketplace.

Digital Asset Exchanges — Coinbase, Robinhood, Kraken, and offshore platforms (Binance, Bybit) compete with Figure Exchange. Larger user bases and token selection, but no tokenized real-world assets, no Democratized Prime margin lending, and regulatory ambiguity limiting institutional participation.

Stablecoins — USDT ($170B) and USDC ($72B) dominate with network effects. YLDS differentiates via SEC registration, SOFR - 0.50% yield (96% of stablecoins don't yield), and native Figure integration—but faces winner-take-most dynamics where scale compounds adoption.

The primary headwind is infrastructure inertia: originators have invested in existing systems; institutional buyers maintain bilateral relationships. Figure overcomes this with superior unit economics—93% cost reduction, 76% faster funding, transparent on-chain ownership, and marketplace liquidity unavailable elsewhere.

How Figure Competes

Figure's moat is built around network effects and infrastructure leverage:

Vertically integrated stack: LOS → DART registry → Figure Connect marketplace → Democratized Prime—one ecosystem versus fragmented vendors.

Blockchain operating system: Provenance eliminates reconciliation, enables instant settlement, automates collateral management at ~$0.026 per transaction.

Aligned economics: 4% take rate only when partners transact; Figure Connect sellers earn 1%+ better net revenue than intermediated sales.

Standardization: Uniform underwriting, common documentation, blockchain-verified ownership eliminate due diligence burden and enable fungible trading.

Liquidity infrastructure: Guarantor Vehicle ($200M Sixth Street commitment) provides standing bid; 15 rated securitizations; real-time performance data.

Regulatory-first: 180+ licenses, SEC-registered YLDS, broker-dealer with ATS authority differentiate from unregulated competitors—enabling institutional adoption.

Network-led growth: 93% partner retention, 185% net volume retention (2024), DART adoption inflection (2% → 80%)—classic two-sided marketplace flywheel.

Digital Asset Differentiation

Figure Exchange: Self-custody MPC wallets; exclusive tokenized HELOCs; Democratized Prime with hourly Dutch auction pricing (1%-30%); cross-asset collateralization (expected end-2025).

YLDS: SEC-registered security enables institutional holding; SOFR - 0.50% yield versus 0% on dominant stablecoins; 24/7 transferability; native Figure ecosystem integration.

Challenges: Offshore exchanges avoid compliance costs and offer broader tokens; DeFi protocols have lower costs but prohibit institutional participation; USDT/USDC network effects ($242B combined) create winner-take-most dynamics versus YLDS's $4M (June 2025).

Competition remains intense—from loan tech vendors, traditional lenders, offshore exchanges, and dominant stablecoins—but Figure's blockchain-native, vertically integrated, regulatory-first model converts infrastructure inertia into net

Financials

Financial Performance and Operating Metrics

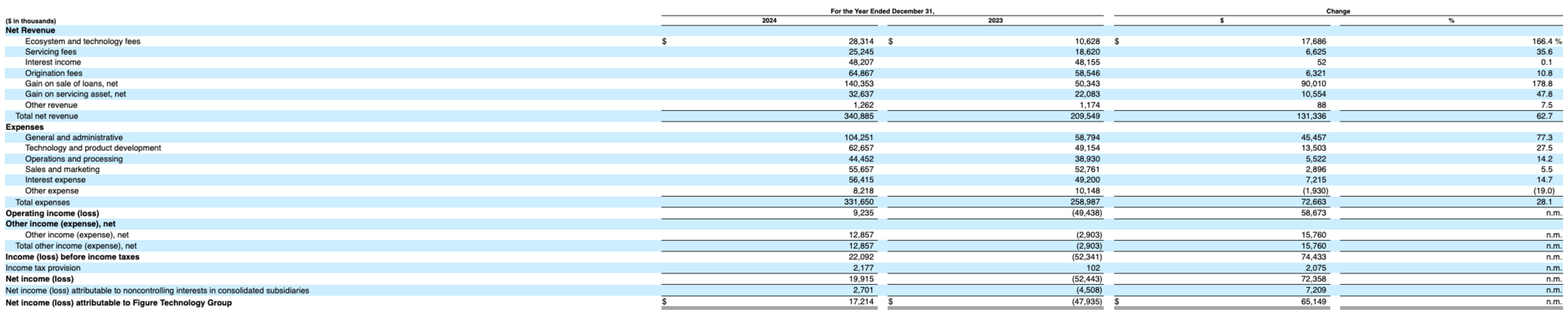

Figure's financial profile reflects blockchain-native infrastructure scaling rapidly: explosive topline growth, expanding network adoption, and improving unit economics powered by automation. Servicing asset valuation volatility influenced profitability mix, but the business added partners, deepened marketplace liquidity, and transitioned toward sustainable cash generation.

Growth at Inflection

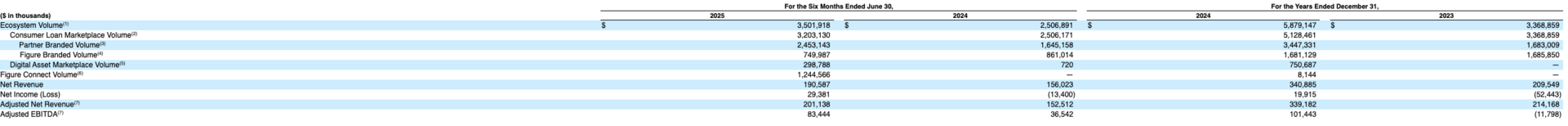

Topline: Revenue rose 63% YoY to $341M (2024) from $210M (2023). H1 2025: $191M (+22% YoY).

Mix: Origination/distribution 76% of H1 2025 Adjusted Net Revenue ($153M), including 22% from Figure Connect ($45M); Servicing/Interest Income 24% ($48M).

Profitability: Net income $20M in 2024 (6% margin) after $52M loss (2023); $29M in H1 2025 (15% margin). Adjusted EBITDA $101M in 2024 (30% margin), $83M in H1 2025 (44% margin). Accumulated deficit: $292M (June 2025).

Ecosystem Momentum

Volume: Ecosystem Volume grew 86% CAGR (2020-2024), reaching $5.9B (2024) and $3.5B in H1 2025 (+40% YoY).

Consumer Loan: $5.1B (2024), $3.2B (H1 2025).

Figure Connect: $1.2B (H1 2025; launched June 2024).

Digital Assets: $299M (H1 2025).

Partners: 3 (Dec 2021) → 168 (June 2025). 93% retention of partners accounting for 97% of 2023 volume; 185% net volume retention (2024).

Volume Mix: Partner-branded surged to 77% of originations (H1 2025) from 50% (2023). Figure Connect captured 39% of Partner-branded volume.

Ecosystem and Technology Fees: $44M in H1 2025 (+250% YoY) from:

Technology offering fees: $19M (LOS usage on $2.0B Partner-branded originations; 1.0% weighted-average rate).

Ecosystem fees: $20M (Figure Connect; launched June 2024).

Program fees: $5M (securitization services; +106% YoY).

Operating Discipline

G&A: $35M in H1 2025 (-44% YoY); $25M lower stock-based compensation (Separation-related award modifications in H1 2024), partially offset by $3M headcount growth.

Tech & Product: $33M in H1 2025 (+10% YoY); $3.5M increased equity compensation (FMH warrants), $0.5M headcount growth.

Ops & Processing: $27M in H1 2025 (+24% YoY); $3M higher recording fees (Partner-branded growth), $1M headcount, $0.6M outsourced customer service.

Marketing: $32M in H1 2025 (+23% YoY); $3M increased advertising, $2M headcount.

Interest: $23M in H1 2025 (-14% YoY); $9M lower warehouse exit fees, $2M lower borrowing costs (SOFR decline).

Channel Performance

Figure-branded: $49M revenue in H1 2025 (-1% YoY) despite $111M volume decline; higher sale prices (+1.4%) offset lower originations.

Partner-branded: $92M revenue in H1 2025 (+71% YoY); ecosystem/tech fees $43M (+265%) from $808M increased originations and +69% securitization volume.

What to Watch

MSR Volatility: Servicing gains collapsed from $21M (H1 2024) → $2M (H1 2025) due to fee rate compression. Future volatility from prepayment/default assumptions will create profitability lumpiness.

Figure Connect Scaling: $1.2B volume in first 12 months (39% of Partner-branded). Continued adoption shifts revenue toward higher-margin ecosystem fees; requires Guarantor Vehicle activation for consistent liquidity.

HELOC Concentration: 99%+ of originations remain HELOCs. Diversification into personal loans, DSCR, residential transition lending critical to reduce market cycle exposure.

Digital Asset Monetization: Figure Exchange ($299M volume), YLDS ($4M outstanding), Democratized Prime ($1.5M assets) generating zero meaningful revenue. Must scale to capture $80B+ tokenization and $25B+ stablecoin TAMs.

Operating Leverage: Adjusted EBITDA margin expanded 24% → 44% (H1 2024 to H1 2025) despite 22% revenue growth. Sustained margin expansion depends on limiting G&A while ecosystem fees compound.

Partner Concentration: Top 10 partners = 57% of H1 2025 volume. 168-partner base provides diversification, but loss of major partner could materially impact revenue.

Closing thoughts

Figure's financial performance and strategic positioning underscore its potential to redefine how capital markets operate in the blockchain era. With a vertically integrated, automation-first platform, Figure has differentiated from legacy loan originators and bilateral capital markets while building infrastructure spanning origination, registry, secondary trading, and settlement. Its end-to-end offering—blockchain-based LOS, DART registry, Figure Connect marketplace, Democratized Prime, and YLDS stablecoin—creates a network flywheel that strengthens as more partners originate standardized loans, institutional buyers access transparent on-chain assets, and blockchain adoption reaches critical mass.

Bull Case: Figure's blockchain-native, usage-based model provides a foundation for exponential growth. The company serves 168 partners facilitating $6B in annual lending (twelve months ended June 2025), holds 75% market share in tokenized private credit, and has achieved profitability with $101M Adjusted EBITDA (2024) and 44% margins (H1 2025). Its serviceable market spans $185B in annual revenue opportunity across $2T consumer credit origination, $16T tokenized asset trading (by 2030), and $5T stablecoin issuance (by 2030). Figure Connect's rapid adoption—$1.3B volume in first 12 months and 39% of Partner-branded originations—demonstrates marketplace liquidity inflection. DART registry adoption surged from 2% (2024) to 80% (H1 2025), validating blockchain as infrastructure standard.

Bear Case: Figure faces intense competition from loan tech vendors (Blend, ICE), traditional lenders with balance sheet advantages, offshore crypto exchanges operating without compliance costs, and dominant stablecoins (USDT $170B, USDC $72B) with entrenched network effects. HELOC concentration (99%+ of originations) exposes the business to housing market cycles, interest rate volatility, and credit quality deterioration. Partner concentration—top 10 partners generating 57% of volume—creates revenue vulnerability if major relationships terminate or consolidate. MSR valuation volatility creates profitability lumpiness that obscures operating performance. Regulatory complexity across 180+ state licenses, evolving digital asset frameworks, and offshore competitor arbitrage increase compliance costs and enforcement risk.

Figure's combination of blockchain infrastructure, vertically integrated marketplace, and regulatory-first positioning provides a structural advantage in a fragmented, manual, error-prone industry. By continuing to scale partner adoption, marketplace liquidity, and product diversification—while expanding into personal loans, DSCR lending, institutional private credit, and cross-asset collateralization—Figure can become the category-defining infrastructure for tokenized capital markets. Success will hinge on maintaining partner retention as competition intensifies, activating Guarantor Vehicle liquidity, monetizing digital asset platforms, diversifying beyond HELOC concentration, and navigating MSR volatility while sustaining profitability. If executed, Figure is poised to reshape how loans are originated, assets are traded, and capital markets settle—capturing infrastructure economics as trillions in real-world assets migrate on-chain over the next decade.

Ben Gutkovich is the co-founder of Superlinked, helping AI engineers build information retrieval systems using vector embeddings.

In this conversation, Ben and I discuss:

-What’s the biggest difference between advising on transformation and actually building the technology

-The adoption of usage-based pricing has nearly doubled in the past five years. What’s driving this acceleration right now?

-What are Ben’s biggest predictions for the AI market in the next 18 months

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Two reasons why 99% of seed stage companies don’t make it to Series A:

1. They don’t build something people want.

2. Co-Founder breakup.

Avoid these two and you are the 1%.

— Harry Stebbings (@HarryStebbings)

9:55 PM • Oct 15, 2025

Blame yourself for everything, and preserve your agency.

— Naval (@naval)

11:43 PM • Jan 17, 2025

I always forget that Jensen Huang, the CEO of NVIDIA the #1 GPU company is cousins with Lisa Su, the CEO of AMD, the #2 GPU company

— GREG ISENBERG (@gregisenberg)

2:52 PM • Oct 14, 2025

Valuable lesson Ive learned over the years is that while life might not be fair, you get what you put in. Go work really hard for whatever you want and it will be yours. Most stop right before the finale.

— Nichole Wischoff (@NWischoff)

5:46 PM • Oct 13, 2025

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Buy my NEW book: Buy my book on Lenskart IPO Deepdive

And that’s it from me. See you next week.

Reply