- Partner Grow

- Posts

- Wealthfront: The PLG Fintech

Wealthfront: The PLG Fintech

Wealthfront S1 Deep Dive

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Bank Boldly. Climb Higher.

Peak Bank offers an all-digital banking experience, providing all the tools and tips you need to make your way to the top. Take advantage of competitive rates on our high-yield savings account and get access to a suite of smart money management tools. Apply online and start your journey today.

Member FDIC

Interested in sponsoring these emails? See our partnership options here.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

Housekeeping

📢 Excited to share that my new book is out!

Lenskart: From Blurry Vision to Big Bets – IPO Deep Dive

This IPO Deep Dive unpacks how Lenskart turned a fragmented, offline-first market into one of Asia’s fastest-growing direct-to-consumer success stories. From local disruption to global expansion, it’s the story of a company transforming vision into lifestyle.

➡️ Find it on Amazon: https://www.amazon.com/dp/B0FTSR3XFR

S1 Deep Dive

Wealthfront in one minute

Wealthfront is redefining personal finance for digital natives—those born after 1980 who are entering the prime wealth accumulation phase of their lives. In a world where wealth-building is increasingly digital-first, automated, and trust-driven, Wealthfront delivers an end-to-end platform designed to turn savings into long-term prosperity.

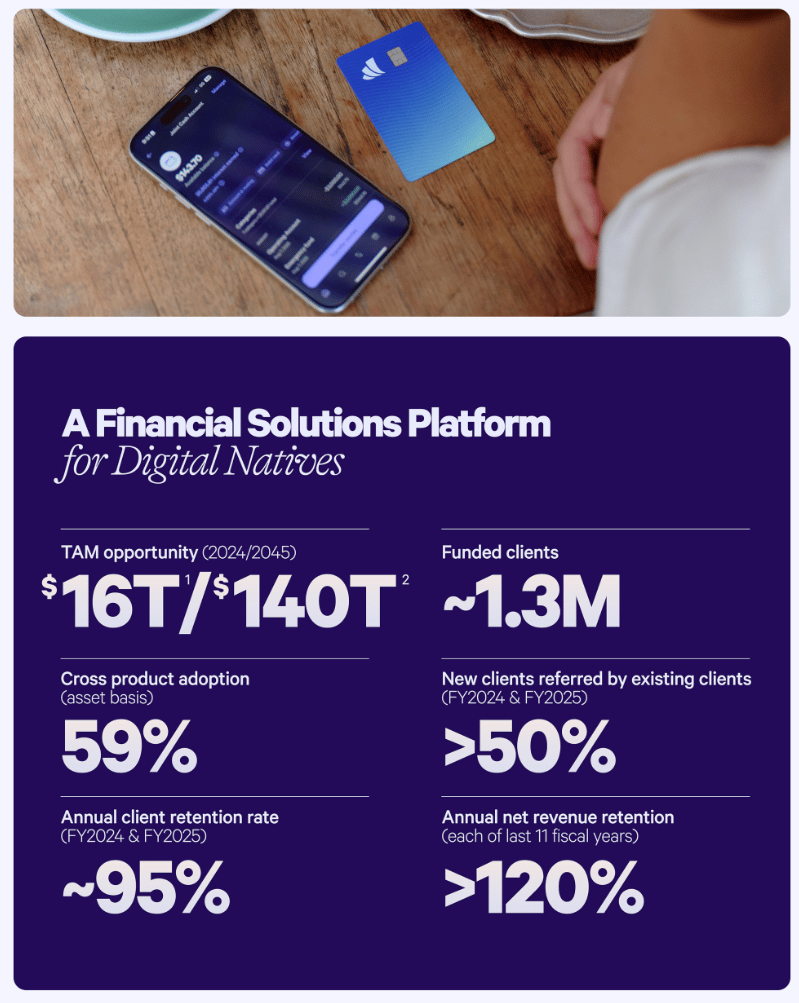

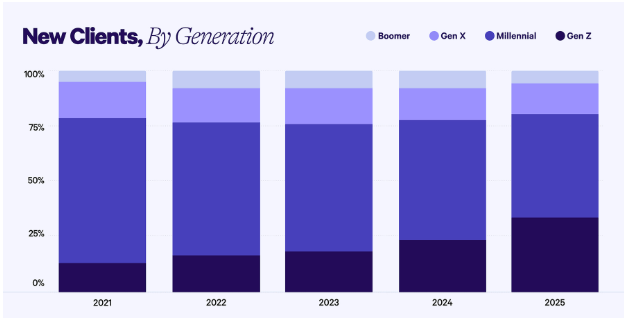

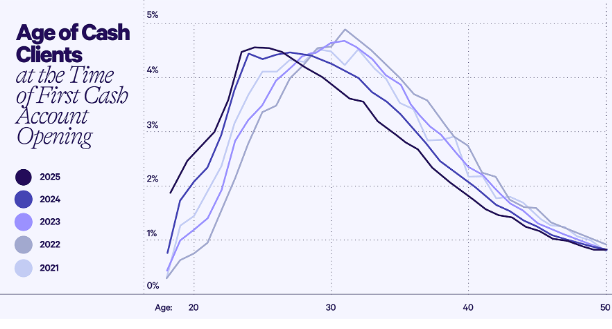

Since inception, Wealthfront has pioneered automation in financial services—eliminating the cost and friction of legacy, advisor-led models. By leveraging software to build diversified portfolios, manage cash, extend credit, and deliver personalized planning, Wealthfront provides a seamless, low-cost, mobile-first experience that aligns directly with the preferences of Millennials and Gen Z. With over 1.3 million funded clients and $88.2 billion in platform assets as of July 31, 2025, Wealthfront has become the platform of choice for digital-native high earners focused on saving, investing, and compounding wealth over decades.

At the core of Wealthfront’s model is a powerful alignment of incentives: the company succeeds only when clients succeed. With no commissioned advisors, hidden fees, or high account minimums, Wealthfront’s technology-driven solutions lower costs while deepening client trust. This trust fuels the company’s product-led growth flywheel: more than 50% of new clients arrive through referrals, while client retention has consistently exceeded 95% in fiscal 2024 and 2025.

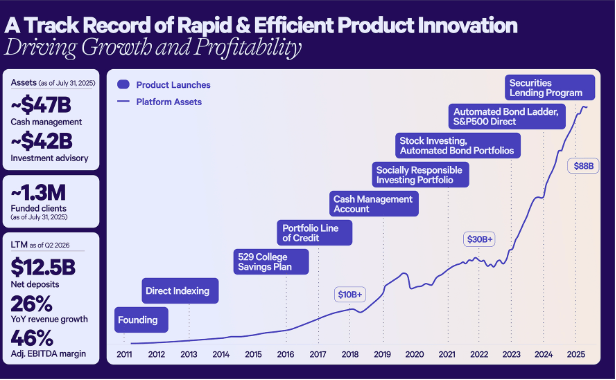

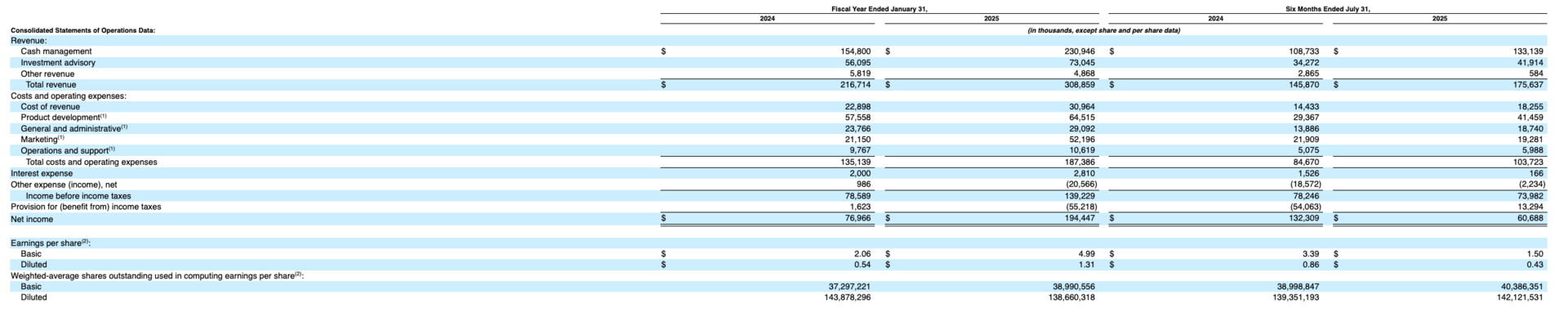

Wealthfront’s proprietary infrastructure is engineered for scale and efficiency. With 50% of employees dedicated to engineering and no traditional sales force, the company continuously reinvests in automation—accelerating product innovation, lowering support costs, and enhancing client experience. This foundation has enabled Wealthfront to achieve industry-leading profitability: in fiscal 2025, the company generated $308.9 million in revenue, 43% year-over-year growth, with a net income margin of 63% and Adjusted EBITDA margin of 46%.

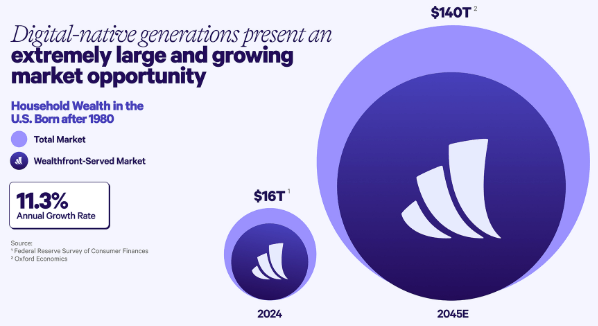

The opportunity ahead is unprecedented. According to Oxford Economics, digital natives’ wealth is projected to grow from $12 trillion in 2022 to $140 trillion by 2045, compounding at 11.3% annually. Unlike their parents, these generations prefer self-directed, software-driven solutions and are skeptical of traditional institutions shaped before the Global Financial Crisis. Wealthfront is purpose-built to capture this generational shift, combining trusted relationships, automation, and scale to meet the needs of the largest wealth-accumulating population in history.

Introduction

At its core, Wealthfront is a technology company. We were among the first digital-only platforms to use automation to deliver diversified portfolios and have since expanded into cash management, borrowing and lending, and integrated financial planning—all within a mobile-first experience. By removing high minimums, opaque fees, and in-person friction, we align with how digital natives already live: they stream, shop, and move through apps; they expect their money to work the same way.

This alignment powers trust—and growth. Our incentives are fundamentally the same as our clients’: we succeed when they do. With no commissioned advisors and a relentless focus on building rather than buying, we automate at a depth uncommon in finance, lowering client costs while improving speed and reliability. The result is a product-led flywheel: clients come for a specific need, stay for performance and experience, and refer others. Over the last two fiscal years, more than 50% of new clients joined via referral, and annual retention was ~95% in both fiscal 2024 and 2025.

The market shift is structural. Digital natives are entering their prime accumulation years and are projected—per Oxford Economics—to grow net wealth from $12T (2022) to $140T (2045) at 11.3% annually. Shaped by the Global Financial Crisis, they demand transparency and software-driven control. Wealthfront is built for this moment: as of July 31, 2025, we serve 1.3 million funded clients with $88.2B in platform assets, using proprietary infrastructure and an engineering-led culture to ship faster, operate leaner, and compound client outcomes over decades.

History

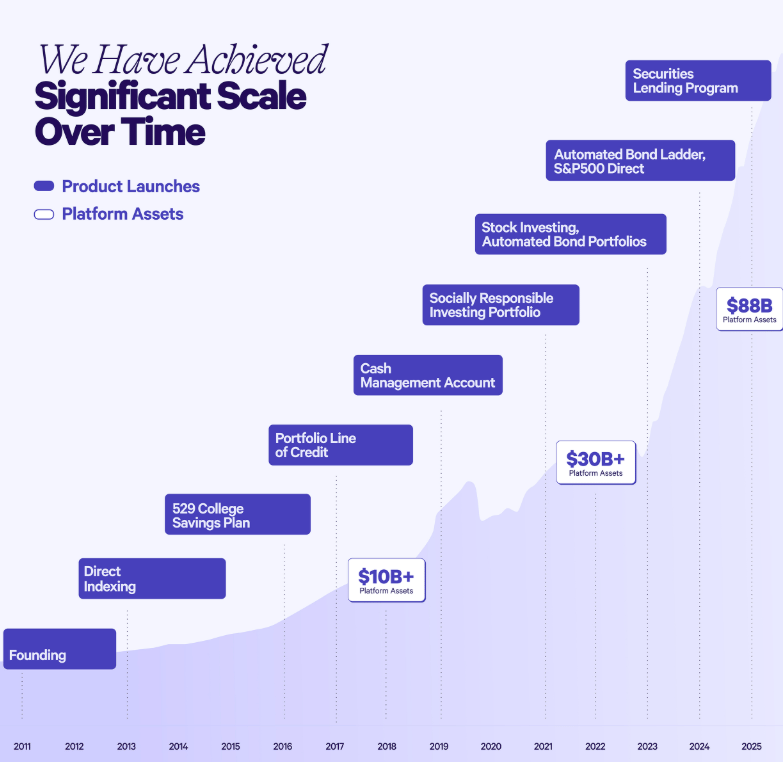

Wealthfront began with a simple conviction: modern wealth is built by software, not branch networks. For decades before the Global Financial Crisis (2007–2009), incumbents optimized for older clients in wealth preservation, relying on in-person advisors, high minimums, and opaque fees. Younger consumers—those in the wealth-accumulation phase—were priced out or poorly served by clunky software and analog workflows.

A generation that came of age amid job losses, housing instability, and shattered trust looked for alternatives rooted in transparency and control. At the same time, software reshaped every category—from media to mobility—and financial services followed. Automated investing emerged, removing human gatekeeping and lowering barriers to entry. Wealthfront leaned into this shift early: digital-only, mobile-first, and automation-led.

What started as algorithmic, low-cost diversified portfolios expanded into a broader platform—cash management, investment advisory, borrowing and lending, and integrated financial planning—delivered entirely through web and mobile. The model was intentionally contrarian: build rather than buy, automate instead of adding headcount, and align incentives so the company wins only when clients do. No commissioned advisors. No branches. Just software compounding advantages over time.

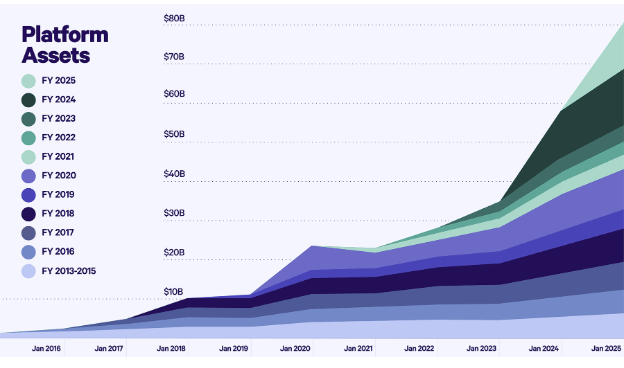

Across market corrections in 2015, 2018, 2020, and 2025—and through rate-regime whiplash from 2013 onward—clients stayed long-term oriented. During the pandemic shock (March 2020), deposits into investment accounts accelerated and platform assets rebounded to prior highs in under 13 months. In the 2022–2025 higher-rate environment, cash management surged—from $2.4B (Apr 30, 2022) to $46B+ (Jul 31, 2025)—a natural hedge that showcased the breadth of the platform. Even through the regional bank stress of 2023 (SVB and First Republic), the model held: program-bank expansions and elevated pass-through FDIC coverage reinforced trust and attracted assets.

Digital-native high earners arrived for a specific need, linked third-party accounts, and deepened engagement as automation removed friction. Referrals compounded—over 50% of new clients in the last two fiscal years—and retention stayed high at ~95% in fiscal 2024 and 2025. As of July 31, 2025, Wealthfront served 1.3M+ funded clients with $88.2B in platform assets.

Risk factors

Wealthfront operates in a dynamic, highly regulated, and intensely competitive financial services landscape, where internal execution and external market forces can materially impact growth, profitability, and long-term positioning. Below are the primary risks associated with Wealthfront’s business model.

Ability to Sustain Growth and Forecast Accurately

The company’s historical revenue expansion may not persist as the business matures. If planning assumptions prove inaccurate, spending and headcount could become misaligned with demand, creating volatility in operating results.Scaling Systems, Controls, and Operations

Rapid growth increases complexity across engineering, security, finance, and client support. Failure to upgrade infrastructure, strengthen controls, or manage change effectively could lead to outages, performance degradation, or control deficiencies.Limited Operating History of New Offerings

Recently launched products and features may not achieve expected adoption, unit economics, or integration quality. Underperformance would dilute returns on R&D and marketing investments and could slow asset and revenue growth.Profitability May Not Be Maintained

Although profitability has been achieved, rising public-company costs and continued investment in product, infrastructure, and brand could pressure margins. Periods of lower or negative profitability may occur if revenue growth lags expense growth.Sensitivity to Platform Assets and Market Conditions

Revenue depends heavily on the level and mix of platform assets. Equity drawdowns, rate shifts, yield-curve changes, or competitive rate dynamics can reduce assets under management and fee income.Macroeconomic and Geopolitical Volatility

Inflation, interest-rate volatility, banking stress, recessions, trade restrictions or tariffs, geopolitical conflict, sanctions, pandemics, and currency movements can depress investing activity and increase client caution, impacting deposits and engagement.Seasonality and Quarterly Variability

Cash movements around U.S. tax deadlines and other calendar effects create seasonal patterns. Product launch timing, market swings, and policy events add unpredictability, increasing the risk of missing internal plans or external expectations.Intense and Evolving Competition

The company competes with robo-advisors, brokers, banks, and fintechs—many with stronger brands, larger budgets, and broader distribution. Aggressive pricing, higher deposit rates, or superior features could pressure margins and slow client acquisition.Client Acquisition, Retention, and Engagement Dependence

Sustained performance requires attracting new clients and deepening engagement with existing ones. Investment performance, rate competitiveness, user experience, brand perception, and macro conditions all influence deposits, assets, and churn.Regulatory, Legal, and Ecosystem Dependencies

Operating under complex securities, banking, and consumer-finance regimes creates compliance and litigation risk. Dependence on banking partners, program banks, data providers, and other counterparties adds operational and integration risk that could affect service quality and reputation.

Market Opportunity

The wealth management landscape is experiencing a generational inflection point, and Wealthfront is strategically positioned to capture this transformation. By delivering automated investing, high-yield cash management, and comprehensive financial planning through a unified digital platform, Wealthfront addresses a multi-trillion-dollar market opportunity that extends well beyond traditional wealth advisory models.

Capturing Generational Wealth Transfer

Wealthfront's current market opportunity is rooted in its ability to serve digital-native generations—Millennials and Gen Z—with a purpose-built, technology-first platform. In 2024, these generations held $16 trillion in household wealth, representing approximately 10% of total U.S. household wealth according to the Federal Reserve. Within this cohort, the top 20% of earners—knowledge workers who represent Wealthfront's core demographic—control over $11 trillion in serviceable addressable market.

Despite capturing meaningful traction, Wealthfront penetrates only a fraction of this market today, leaving substantial room for expansion as digital natives enter their peak earning years.

Even as financial markets fluctuate, digital-native wealth accumulation has remained remarkably resilient. According to Oxford Economics, digital natives have outpaced the national savings rate by 4.9 percentage points over the past decade—nearly double the Baby Boomer differential during comparable life stages. These projections indicate digital natives will further accelerate their savings rate as they mature, peaking at a 14-percentage-point advantage around age 50.

This unprecedented savings behavior has enabled Millennials and Gen Z to eclipse preceding generations in inflation-adjusted household wealth by age 34—a milestone that reinforces Wealthfront's strategic relevance. Oxford Economics forecasts digital-native household wealth will grow at over 11% annually through 2045, reaching $140 trillion and creating a multi-decade growth runway.

Addressing Untapped Financial Behaviors

Wealthfront's growth strategy extends beyond traditional investment management into broader wealth-building workflows, positioning the company to capture adjacent revenue pools. According to FIS research, 42% of Millennials still hold funds in traditional bank checking accounts rather than higher-yielding products—a massive opportunity for displacement. In fiscal 2025, clients transferred over $40 billion to Wealthfront via ACH, a 34% year-over-year increase, with the majority coming directly from legacy bank accounts.

Additional opportunities include:

Banking Displacement: Capturing the trillions sitting idle in low-yield checking accounts through superior cash management products.

Life-Stage Expansion: Developing mortgage, credit, and specialized investment products that align with clients' evolving financial needs.

Platform Deepening: Increasing wallet share as digital natives accumulate wealth and require more sophisticated financial planning tools.

Each category creates incremental revenue while strengthening Wealthfront's flywheel of client acquisition, asset growth, and product engagement.

Building the Financial Operating System

Wealthfront's long-term vision extends far beyond its current product suite. As digital natives enter their highest earning and wealth accumulation years, the company is positioned to become the central financial hub for an entire generation—redefining how ambitious professionals build, manage, and preserve wealth at scale.

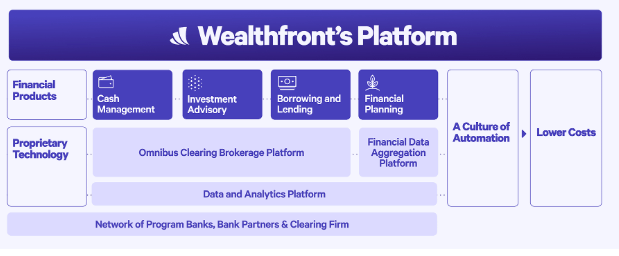

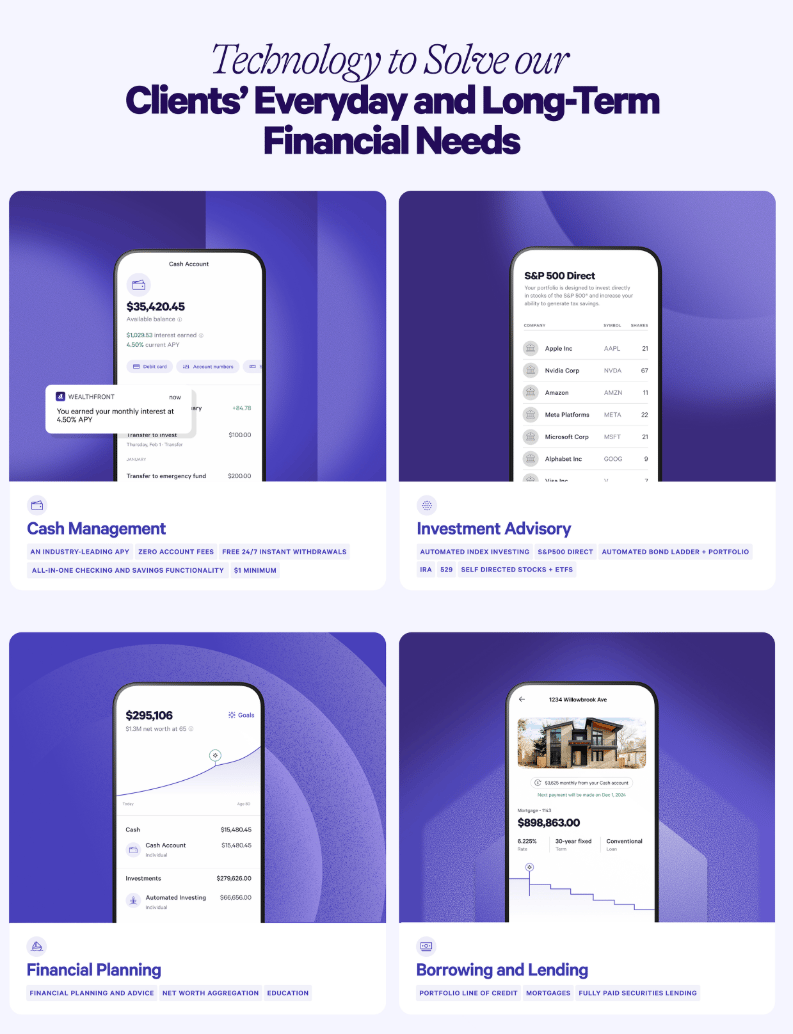

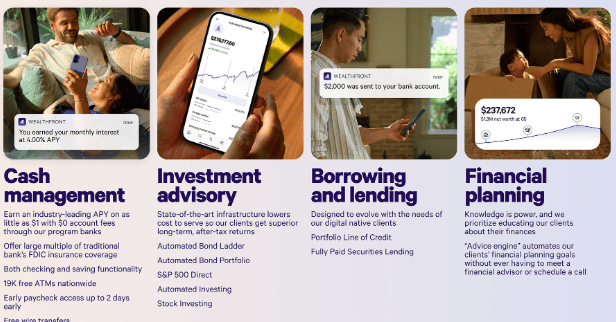

Product

Wealthfront has built an automation-led, end-to-end platform that helps digital natives build long-term wealth on their terms. The suite spans cash management, investment advisory, borrowing & lending, and software-based financial planning—covering a broad risk spectrum from cash to direct stock investing. Products are designed for both “delegators” who want fully managed solutions and “do-it-yourself” investors who want granular control.

Platform Overview

All-in-one wealth stack: Cash, investing, credit, and planning in a single, mobile-first experience.

Automation-first: Software replaces manual workflows to lower costs, improve after-tax outcomes, and scale support.

Aligned economics: Low fees and transparent pricing reinforce trust and drive product-led growth.

Cash Management

A brokerage Cash Account that sweeps deposits to multiple program banks, delivering high yield and expanded deposit insurance—plus full checking functionality.

Yield & safety: Industry-leading APY (generally among the top offerings over 2022–2025); SIPC protection at the brokerage, then pass-through FDIC coverage up to $8M for individual and $16M for joint accounts via up to 32 program banks.

Everyday money features: Debit card, account & routing numbers, direct deposit (with early pay), bill pay, mobile check deposit, 19k+ fee-free ATMs, free wires to external accounts, and no account fees.

Automated saving: Recurring transfers, automated savings plans, categories and goals, joint views of combined net worth and shared goals.

How it works: Deposits are swept via an intermediary to program banks; R&T administers the sweep. Green Dot powers card/ATM/mobile deposit; UMB provides ACH capabilities.

Monetization: Program banks pay on deposits; a portion is passed to clients as interest and the remainder is Wealthfront’s cash management fee. Modest interchange from debit spend.

Mix: Cash management contributed ~71% (FY24), 75% (FY25), 76% (6M ended Jul 31, 2025) of revenue.

Investment Advisory

Passive, diversified, and tax-aware—optimize the three levers clients can control: fees, taxes, and diversification.

Portfolios & tools:

Diversified, index-based ETF portfolios

U.S. Direct Indexing and S&P 500 Direct for direct stock ownership and enhanced tax-loss harvesting

Automated Bond Portfolios and treasury bond ladders

Discovery and investing in individual stocks

Tax optimization: Automated tax-loss harvesting across ETFs (using correlated pairs) and direct indexing (balancing loss harvesting with index characteristics).

Pricing & costs: Advisory fee typically 0.25% of assets (net of waivers). Costs include clearing/execution, money movement, tax reporting, account maintenance, and IRA custodial expenses.

Mix: Advisory contributed ~26% (FY24), 24% (FY25), 24% (6M ended Jul 31, 2025) of revenue.

Borrowing & Lending

Access a Portfolio Line of Credit (PLOC) for eligible accounts ($25k+ balance), typically up to 30% of eligible securities.

Structure: Omnibus margin lending with RBC Clearing & Custody; Wealthfront Brokerage extends loans to clients secured by their portfolios.

Rates: Among the lowest in the category (e.g., ~EFFR + 1.08% as of Sept 1, 2025).

Securities lending (FPSL): Clients can opt in to lend fully paid securities via Sharegain (launched Feb 2025); clients receive 50% of net interest from loans to third-party institutions.

Mix: Revenue currently immaterial (~1% FY24; ~0% FY25 and 6M ended Jul 31, 2025).

Financial Planning

Personalized projections for net worth, home affordability, early retirement, time off, and college savings. Insights leverage linked third-party accounts and platform activity. (No direct revenue; planning deepens engagement and drives multi-product adoption.)

Client Experience

Superior value at lower cost: High APY on cash, 0.25% advisory fee, and low PLOC rates—plus premium features at no extra fee (e.g., excess SIPC coverage, automated tax-loss harvesting, free wires).

Instant money movement: 24/7/365 free instant withdrawals to eligible external accounts via RTP/FedNow (subject to risk-based limits and receiving bank policies).

No phone tag: Digital-first by design; clear UX from onboarding to ongoing guidance.

High-leverage support: Product Specialists (many with CFP/CFA) focus on solving root causes and informing roadmap—serving ~55,000 clients per Specialist (as of Jul 31, 2025).

Proprietary Technology

Omnibus Brokerage Platform: Foundation for cash and investing—enables rapid product delivery, automated trading, direct indexing, tax-loss harvesting, and PLOC.

Integrated Cash + Brokerage: Instant transfers and interest accrual on idle cash inside one system.

Data Aggregation & Analytics: Cleans and unifies external account data; powers holistic planning, tailored recommendations, and continual UX improvements.

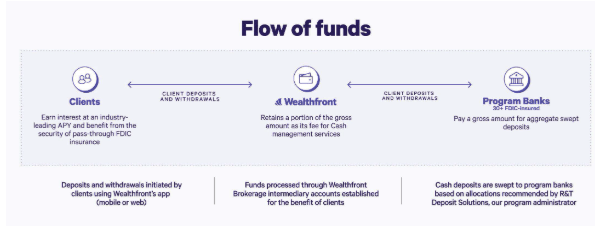

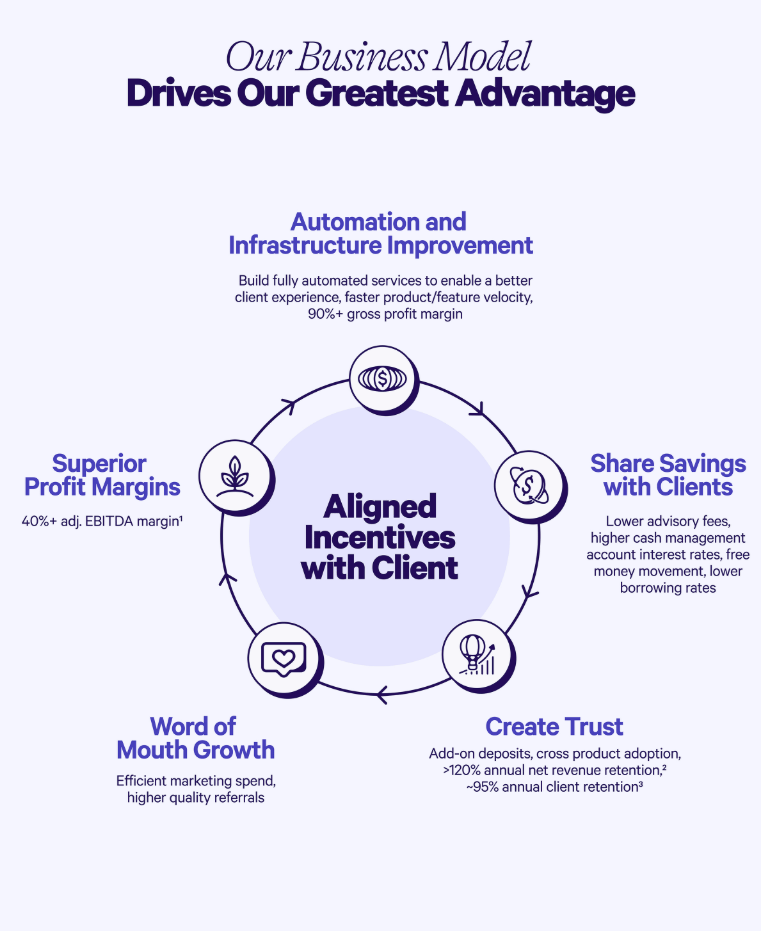

Business Model

Wealthfront’s model is clean, transparent, and automation-first—built to be a low-cost producer and to share those savings with clients. Profits are reinvested into automation, compounding the flywheel.

Platform-Led, Multi-Engine Revenue

1) Cash Management (Interest Income)

How it works: Client cash is swept from the brokerage to multiple program banks. Each bank pays a gross rate (typically benchmarked to Fed Funds or SOFR plus a spread).

Economics: A portion of that gross is passed through to clients as APY; the remainder is Wealthfront’s fee for cash management services. Rates are variable and periodically renegotiated.

Why it matters: In higher-rate environments, this engine is a major contributor. Mix: ~71% (FY24), 75% (FY25), 76% (6M ended Jul 31, 2025) of revenue. Wealthfront is not a bank; it partners with program banks and vendors to deliver these services.

2) Investment Advisory (AUM-Based Fees)

Pricing: Flat 0.25% advisory fee on managed assets. No performance fees, no tiers.

Scope: Diversified ETF portfolios, Direct Indexing (U.S. & S&P 500 Direct), automated bond portfolios/treasury ladders, plus tools for DIY investors.

Mix: ~26% (FY24), 24% (FY25), 24% (6M ended Jul 31, 2025) of revenue. Passive, tax-aware automation (e.g., automated tax-loss harvesting) improves after-tax outcomes while keeping fees low.

3) Lending & Securities Lending

Portfolio Line of Credit (PLOC): For eligible accounts, typically up to 30% of eligible securities; omnibus margin lending via RBC Clearing & Custody. Wealthfront earns the client rate minus its wholesale cost.

Fully Paid Securities Lending (FPSL): Opt-in; loans collateralized in cash; clients receive 50% of net interest on lent shares (via Sharegain).

Mix: Currently immaterial (~1% FY24; ~0% FY25 and 6M ended Jul 31, 2025) but high-margin optionality as adoption scales.

Low-Cost, Automation-First Operating Model

Automation lowers cost-to-serve (trading, rebalancing, tax, service), speeds shipping, and improves reliability—supporting ~90% gross margins and mid-40s Adjusted EBITDA margins in recent periods.

Product Specialists (many with CFP/CFA) focus on root-cause fixes and feed the roadmap—serving ~55k clients per Specialist.

Partnered Financial Rails

Program bank admin: R&T for sweep operations; intermediary accounts at Wells Fargo.

Payments & checking: Green Dot (debit/ATM/mobile deposit) and UMB (ACH).

Clearing & margin: RBC Clearing & Custody.

Securities lending: Sharegain.

Land-and-Expand Flywheel

Land with Cash (yield + convenience) → expand to Investing, PLOC, and Planning.

Trust and transparency drive word-of-mouth: >50% of new clients via referrals; ~95% annual retention (FY24 & FY25).

Linked external accounts and in-product telemetry power personalized, automated guidance, raising engagement and wallet share over time.

Unit Economics

Revenue mix: Cash management dominant; advisory stable; lending optionality.

Operating leverage: Automation + proprietary brokerage infrastructure reduce unit costs as assets grow.

Alignment: Simple pricing (0.25% AUM, transparent cash yield sharing) reinforces trust—clients keep more, stay longer, and refer friends.

Management Team:

David Fortunato – Chief Executive Officer & President; Director

David Fortunato has served as CEO and a member of the Board since March 2021 and as President since July 2019. He previously served as Wealthfront’s Chief Technology Officer (2009–2019) after beginning his career as a software developer at Ning (2008–2009). He holds a B.S. in Computer Science and Economics from Amherst College. David brings deep product and engineering leadership to an automation-first operating model.

Alan Imberman – Chief Financial Officer & Treasurer

Alan Imberman has served as CFO and Treasurer since April 2021. He joined Wealthfront in 2015 and most recently served as VP of Finance (2019–2021). Earlier, he was a Senior Manager at Crowe LLP (2014–2015) and at KPMG US LLP (2006–2014). Alan holds a B.S. in Finance from the University of Texas at Dallas, an M.B.A. from the University of Texas at Austin, and is a CFA charterholder.

Kal Iyer – Vice President, Engineering

Kal Iyer has led Engineering since June 2018. He brings 15+ years of senior leadership in mobile and consumer software, including Global CTO at Glu Mobile (2003–2013), where he scaled international studios across Brazil, China, and Russia; San Francisco Studio Head at Warner Bros. Interactive (2013–2016); and CTO at Fullscreen (2016–2018). Kal earned a B.S. from Jabalpur University, India.

Lauren Lin – Chief Legal Officer, Chief Compliance Officer & Secretary

Lauren Lin has served as CLO, CCO, and Secretary since July 2023 and previously as General Counsel (2020–2023). Before Wealthfront, she was General Counsel and Head of Compliance at First New York (2010–2018) and in-house counsel at Sumitomo Mitsui Banking Corporation. Lauren holds a B.A. in Political Science from Columbia University and a J.D. from Cornell Law School.

Investment

Wealthfront’s early financing signaled deliberate momentum—from a disruptive, automation-first challenger to a scaled consumer finance platform. Early backing came from Benchmark Capital, DAG Ventures, Index Ventures, and Social Capital, alongside notable angels Marc Andreessen and Jeff Jordan, validating the thesis that software—not branches—would define the next era of wealth building.

The inflection arrived in April 2014, when Wealthfront raised $35 million in a round led by Index Ventures, with participation from Ribbit Capital and Benchmark Capital. This brought total funding to $65.5 million and provided the fuel to expand core investing capabilities, deepen automation, and extend distribution—all while reinforcing the company’s position as a category pioneer in digital-first wealth management.

In early 2022, Wealthfront struck a $1.4B all-cash deal to join UBS—bringing ~470K clients and ~$27B AUM under a global bank’s umbrella. On paper, it was a clean fintech-on-tradfi play. By September 2022, it was over. The parties issued a mutual termination, and reporting pointed to a mix of regulatory pushback, shareholder skepticism (valuation + fit), and rate-regime uncertainty. Instead of a buyout, UBS took a $69.7M convertible note, preserving upside if Wealthfront ever went public.

With a total raise of $274 million, Wealthfront has financed a proprietary, automation-first stack that powers cash management, investing, credit, and planning. The result is a capital-efficient, software-led operating model aligned to long-term, compounding client outcomes.

Competition

The consumer wealth and money management market is dominated by incumbent banks, wirehouse advisors, and large brokerages—organizations optimized for high-touch, advisor-led relationships, minimum balance thresholds, and fee-heavy products. While these providers maintain scale and brand recognition, legacy infrastructure and incentives make it difficult to deliver the fully digital, low-cost, automation-first experience preferred by younger investors.

Wealthfront takes a different approach—a software-first platform that unifies cash, investing, credit, and planning on proprietary infrastructure. By removing commissioned advisors and focusing on automation, Wealthfront operates a lower-cost model, enabling reinvestment into product velocity, trust, and client outcomes.

The Obvious Competition:

Betterment — The OG robo-advisor. Similar DNA (automation, passive portfolios), but with smaller AUM (~$45B) and less diversification into cash and lending. Still private.

SoFi — A Millennial-focused “financial super-app.” Broader surface area and aggressive marketing, but lending-led economics and a bank-centric model create different incentive structures than Wealthfront’s low-fee, automation-first approach.

Robinhood — Public, mobile-native, and trading-centric. Monetizes trading volume and options activity more than long-term wealth building. Targets a similar demographic with a very different product philosophy.

The primary headwind is status-quo inertia: moving money requires effort, switching costs, and confidence. Inertia inherently benefits the incumbents where prospects may already bank or hold investments. Wealthfront’s strategy is to overcome inertia with aligned incentives, a transparent value story, and an experience that’s meaningfully better—yield on cash, automated tax efficiency, instant money movement, and no phone-tag.

Secondary frictions—complacency, risk aversion, and uneven financial literacy—also keep consumers in outdated systems. Wealthfront addresses these with in-product education, clear disclosures, and software that defaults to prudent, long-term behaviors.

Traditional Providers & Point Solutions

Wirehouses & advisors: Strong relationships and brand, but high minimums, higher advisory fees, and in-person workflows that digital natives tend to avoid.

Brokerages & apps: Rich trading tools, yet often optimized for activity rather than passive, tax-efficient accumulation.

Fintech point solutions: Niche features without an integrated stack; harder for clients to manage end-to-end finances in one place.

How Wealthfront Competes

Wealthfront’s moat is built around client alignment and software leverage rather than distribution muscle:

Unified, end-to-end wealth platform across cash, investing, credit, and planning—one mobile-first experience instead of fragmented tools.

Automation as the operating system: proprietary brokerage and sweep infrastructure, automated rebalancing, direct indexing, and tax-loss harvesting at scale.

Aligned economics & low fees: a transparent 0.25% advisory fee and high-yield cash—sharing efficiency gains with clients to maximize net outcomes.

Trust by design: no commissioned advisors, no teaser pricing, published methodologies, and rapid, fee-free money movement.

Engineering-led velocity: build-over-buy culture compounding product speed, reliability, and cost-to-serve advantages.

Product-led growth: high retention and referrals reduce reliance on paid sales, improving unit economics over time.

Focus on digital natives: roadmap tuned to the preferences and life stages of Millennials and Gen Z—where the next decades of wealth will be created.

Competition will remain intense—from banks, robo-advisors, brokerages, and super-apps—but Wealthfront’s automation-first, aligned-incentive model is purpose-built to convert inertia into adoption and to compound trust into long-term share of wallet.

Financials

Wealthfront’s financial profile reflects a software-first model compounding at scale: strong topline growth, expanding platform assets, and durable unit economics powered by automation and low cost-to-serve. While macro conditions influenced net deposit cadence and fee mix, the business continued to add clients, deepen relationships, and generate cash.

Growth at Scale

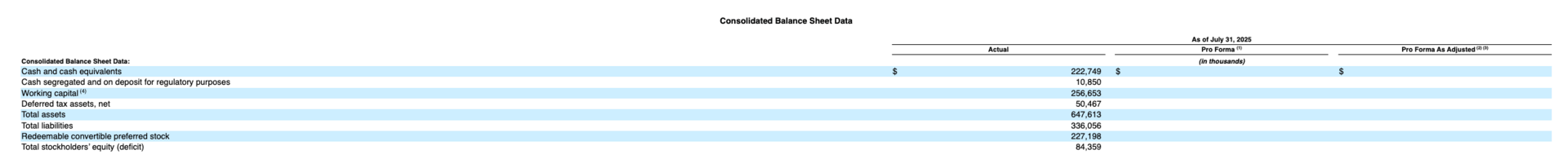

Topline: Revenue rose 43% year-over-year to $308.9M in FY2025 (vs. $216.7M in FY2024). For the six months ended July 31, 2025, revenue grew 20% to $175.6M.

Mix: Cash Management contributed 75% of FY2025 revenue ($230.9M), Investment Advisory 24% ($73.0M), with Other at $4.9M.

Profitability: Net income increased to $194.4M in FY2025 (net margin 63%), aided by a tax valuation allowance release. Adjusted EBITDA was $142.7M (margin 46%), demonstrating operating leverage even as we invested for growth.

Platform Momentum

Assets: Platform assets reached $80.2B at Jan 31, 2025 (+39% YoY) and $88.2B at Jul 31, 2025 (+24% YoY).

Cash Management assets: $42.4B at FY-end (+44% YoY).

Investment Advisory assets: $37.8B at FY-end (+34% YoY).

Clients: Funded clients grew 42% to 1.212M at FY-end and to 1.318M by Jul 31, 2025 (+24% YoY). Over 17% had recurring/direct deposits; NRR >120% for eleven consecutive fiscal years.

Net Deposits: $17.7B in FY2025 (vs. $20.9B), and $5.5B for the six months ended Jul 31, 2025 (vs. $10.7B), reflecting lower rates and early-2025 market volatility. Mix shift included cross-transfers from cash into new advisory products (e.g., Automated Bond Ladders, S&P 500 Direct).

Revenue Engines

Cash Management: FY2025 revenue up 49% to $230.9M, driven by +81% average asset balances; the annualized fee rate declined from 0.78% → 0.64% after Wealthfront raised client APY in Nov 2023.

Investment Advisory: FY2025 revenue up 30% to $73.0M, with +26% average advisory assets and a modest fee-rate uptick to 0.22%.

Other: Declined to $4.9M FY2025, primarily from a PLOC rate reduction (client benefit) and discontinuation of a product in Nov 2024.

Operating Discipline

Cost of Revenue: $31.0M in FY2025 (10% of revenue), scaling with assets and money movement while improving as a % of revenue over time.

Product Development: $64.5M FY2025 (21% of revenue), up with headcount to support platform and new products—balanced by automation leverage.

G&A: $29.1M FY2025 (9% of revenue), reflecting public-company readiness and professional services.

Marketing: $52.2M FY2025 (17% of revenue), with higher brand and performance spend and referral incentives to amplify efficient, product-led acquisition.

Ops & Support: $10.6M FY2025 (3% of revenue); automation and a Product Specialist model sustain low cost-to-serve at scale.

Cash Flow

Cash & Equivalents: $222.7M as of Jul 31, 2025; $50.0M undrawn revolver (matures Oct 30, 2025).

Operating Cash Flow: $123.2M in FY2025; $77.4M for the six months ended Jul 31, 2025.

Capital Allocation: Modest capex (primarily software capitalization) and selective equity actions; balance sheet positioned to support continued product investment and growth.

What to Watch

Asset Mix & Fee Yield: Continued client-friendly economics (APY, PLOC) may pressure fee rates, but are designed to grow assets, trust, and lifetime value.

Net Deposit Velocity: Sensitive to rates and markets; diversified product suite (cash + advisory) and instant money movement are designed to stabilize inflows across cycles.

Operating Leverage: Automation and proprietary infrastructure remain the core margin engine as funded clients and platform assets scale.

Wealthfront is scaling profitably with a transparent model—sharing efficiencies with clients to drive asset growth, retention, and referrals. The result is a resilient revenue base, strong cash generation, and a platform built for durable compounding as digital natives enter peak earning and saving years.

Closing thoughts

Wealthfront’s financial performance and strategic positioning underscore its potential to redefine how digital-native generations build wealth. With an automation-first, software-driven platform, Wealthfront has differentiated from legacy banks and advisors while expanding into adjacent categories like cash management, direct indexing, automated bond ladders, and low-cost liquidity. Its end-to-end offering—spanning high-yield cash, passive investing, instant money movement, and software-based planning—creates a trust flywheel that strengthens as more clients consolidate assets and refer peers.

Bull Case:

Wealthfront’s scalable, low-cost operating model provides a foundation for sustained growth. The company serves over 1.3M funded clients with ~$88B in platform assets and has delivered >120% annual net revenue retention for eleven consecutive fiscal years alongside profitability. Its serviceable market exceeded ~$11T at 2024 year-end, within a broader digital-native wealth pool of ~$16T today and a projected ~$140T by 2045. Continued investment in automation and product velocity (e.g., S&P 500 Direct, Automated Bond Ladders, instant withdrawals via RTP/FedNow) enhances user experience, reduces cost-to-serve, and deepens engagement. With transparent pricing (0.25% advisory fee), industry-leading APY pass-throughs, and low PLOC rates, Wealthfront is positioned to capture share as digital natives shift away from legacy institutions.

Bear Case:

Wealthfront faces competitive pressure from robo-advisors, brokerages, banks, and super-apps competing on price, features, and brand. Rate sensitivity could compress cash-sweep economics, while equity drawdowns may slow advisory growth and net deposits. Scaling a broader product set increases operational and regulatory complexity; any lapse could impact trust. Client inertia and financial-education gaps may extend conversion cycles, raising acquisition costs in a crowded market.

Wealthfront’s combination of a unified platform, modern infrastructure, and automation-led economics provides a durable advantage in a fragmented, legacy-bound industry. By continuing to scale cash, investing, planning, and lending—while expanding into mortgages and credit—Wealthfront can become the category-defining platform for digital-native wealth management. Success will hinge on balancing growth with discipline, navigating rate and market cycles, and consistently delivering superior, after-tax outcomes. If executed, Wealthfront is poised to reshape how a new generation saves, invests, and builds long-term wealth.

Harvey Liu is the CEO of LeveX Exchange, where he’s building a cutting-edge platform for spot and futures trading in digital assets.

In this conversation, Harvey and I discuss:

What’s the biggest misconception outsiders have about blockchain adoption today?

Are limited partners (LPs) too focused on brand over performance in venture capital?

How does Harvey keep a team focused and motivated when your industry can swing 20% in a week?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

10% of successful investing is finding a great investment. The other 90% is not selling them.

— Compounding Quality (@QCompounding)

9:57 AM • Sep 30, 2025

“The only thing that really matters in life are your relationships to other people.”

That’s the conclusion of Harvard’s Grant Study, the longest-running study of human life ever conducted that tracked men for 80+ years from youth to old age.

— Sam Parr (@thesamparr)

12:24 AM • Sep 29, 2025

Over and over and over again.

— Peter Mallouk (@PeterMallouk)

2:14 PM • Sep 28, 2025

never forget the people who bet on you early

— conor brennan-burke (@conor_ai)

2:48 PM • Sep 27, 2025

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Buy my NEW book: Buy my book on Lenskart IPO Deepdive

And that’s it from me. See you next week.

Reply