- Partner Grow

- Posts

- Gemini’s Nasdaq Gambit

Gemini’s Nasdaq Gambit

Gemini S1 Deep Dive

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Interested in sponsoring these emails? See our partnership options here.

The back office, built for founders

We’ve worked with over 800 startups—from first-time founders at pre-seed to fast-moving teams raising Series A and beyond—and we’d love to help you navigate whatever’s next.

Here’s how we’re willing to help you:

Incorporating a new startup? We’ll take care of it—no legal fees, no delays.

Spending at scale? You’ll earn 3% cash back on every dollar spent with our cards.

Transferring $250K+? We’ll add $2,000 directly to your account.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Gemini in one minute

Gemini is quietly unlocking the next era of financial, creative, and personal freedom—building a trusted bridge between traditional finance and the cryptoeconomy. Founded in 2014 by Cameron and Tyler Winklevoss, Gemini set out to make crypto simple, secure, and regulated. Today, it is one of the leading gateways into a decentralised future that promises greater choice, independence, and opportunity.

From retail investors buying their first bitcoin to hedge funds executing complex strategies, Gemini’s platform powers engagement across the spectrum. Its exchange has evolved into a full-stack cryptoeconomy hub: derivatives trading, staking services, OTC markets, institutional-grade custody, a NYDFS-regulated stablecoin, a U.S. credit card, and even a Web3 studio for NFTs. Users can start with $1—or $1 million—and access over 60 countries through Gemini’s seamless apps and institutional products.

As of June 30, 2025, Gemini serves 523,000 monthly transacting users and 10,000 institutions, holding $18B in assets, facilitating $285B in lifetime trading volume, and processing $800B in transfers. Its regulated infrastructure—money transmission licenses across all 50 U.S. states and a New York trust company for custody—anchors Gemini as one of the most compliant and trusted names in crypto.

Gemini’s strength lies in its crypto-native technology stack. Built in-house for speed, scale, and security, it supports complex blockchain integrations while running 24/7/365. Every product launch—from derivatives to stablecoins—feeds a flywheel: security attracts users, users drive volume, and volume fuels reinvestment into innovation.

The opportunity ahead is vast. Crypto has grown from a $10B niche market at Gemini’s founding to a $3T global asset class today. With stablecoins settling trillions annually, tokenization projected to reach $10T by 2030, and adoption mirroring the early internet’s trajectory, the cryptoeconomy is still in its infancy. Against a $100T global equities market, crypto’s upside remains largely untapped.

In 2024, Gemini generated $142.2M in revenue (70% from transactions), underscoring its scale, though investments in growth led to net losses. By mid-2025, revenue hit $68.6M in six months, even as Gemini ramped new products to diversify beyond trading fees. Over the long term, derivatives, stablecoins, custody, and Web3 services are expected to reduce volatility in its revenue mix.

As the world shifts from traditional rails to decentralized networks, Gemini is positioning itself as the infrastructure layer for the cryptoeconomy. Its mission: not just to list coins, but to reshape how money, markets, and the internet itself operate—open, fair, and secure.

Introduction

Gemini’s mission is clear: unlock the next era of financial, creative, and personal freedom. That begins with trust. Gemini was built to be the most secure and regulated gateway into the cryptoeconomy—bridging traditional finance with a decentralized future that is more open, fair, and secure.

Today, Gemini operates at global scale. As of June 30, 2025, the platform serves 523,000 monthly transacting users and 10,000 institutions across 60+ countries, with $18B in assets under custody, $285B in lifetime trading volume, and $800B in transfers processed. From its roots as a spot exchange, Gemini has expanded into a full-stack platform: derivatives trading, staking, OTC markets, institutional-grade custody, a NYDFS-regulated stablecoin, a U.S. credit card, and a Web3 studio for NFTs.

But Gemini is more than an exchange. For retail investors, it’s often the first step into crypto—providing a seamless, regulated on-ramp accessible from $1 to $1M. For institutions, it delivers robust trading infrastructure, custody, and liquidity through an integrated, compliance-first platform. Its crypto-native technology stack and proprietary custody solutions enable Gemini to serve the demands of a 24/7/365 global market while maintaining the highest security standards.

The opportunity is massive. Crypto has grown from a $10B market at Gemini’s founding to more than $3T today—still a fraction of the $100T global equities market. With stablecoins settling trillions annually, tokenization projected to reach $10T by 2030, and adoption mirroring the early internet, the cryptoeconomy is only beginning to scale. Gemini is uniquely positioned as one of the most trusted on-ramps into this transformation.

At the heart of Gemini’s differentiation is its foundation of security, regulation, and compliance. Licensed to operate in all 50 U.S. states, and backed by Gemini Trust Company in New York, Gemini ensures every customer asset is held 1:1 on-platform. This approach has created a loyal user base, a powerful innovation flywheel, and a reputation as one of crypto’s most reliable brands.

As money, markets, and the internet converge on decentralized rails, Gemini is building the infrastructure for the next era of global finance—where access is universal, systems are transparent, and users are truly in control.

History

Gemini began in 2014 with a bold vision: to build the most trusted bridge into the cryptoeconomy. At a time when crypto was still seen as a fringe experiment, Gemini charted a different path—focusing on security, compliance, and regulation as the foundation for mass adoption.

The early milestones reflected this conviction. In 2016, Gemini became the first licensed exchange to list ether, setting the stage for mainstream access to what would become one of the most important blockchains in the world. In 2018, it launched the Gemini Dollar (GUSD)—one of the world’s first regulated stablecoins—bringing fiat-backed stability to the digital asset space. By 2020, Gemini was the first crypto exchange to support hardware security keys on mobile apps, reinforcing its identity as a platform where safety was never optional.

The company continued to pioneer. In 2021, Gemini became one of the first custodians and exchanges to achieve SOC 1 Type 2 and SOC 2 Type 2 compliance, cementing its reputation as an institutional-grade platform. In 2022, it broke new ground again with the launch of the Gemini Credit Card®, in partnership with Mastercard—delivering instant crypto rewards to consumers every time they spent.

Today, Gemini’s platform spans far beyond spot trading. Its offering includes institutional-grade custody, an OTC desk, derivatives, staking, a U.S. dollar-backed stablecoin, the Gemini Credit Card®, and Nifty Gateway Studio, its NFT marketplace. Collectively, these products diversify revenue streams, reduce reliance on volatile trading fees, and deepen engagement across retail and institutional users alike.

As of June 30, 2025, Gemini supports over 80 assets for trading and more than 130 through Gemini Custody—spanning bitcoin, ether, stablecoins, DeFi tokens, governance assets, and staking networks. Each addition undergoes rigorous evaluation across maturity, liquidity, utility, regulatory standing, and cybersecurity risks. This selective approach has kept Gemini aligned with its mission: expand access to the latest innovations without ever compromising trust.

From its first ether listing to its leadership in regulated stablecoins and custody, Gemini has consistently stayed ahead of the curve—pioneering products that make crypto more secure, more usable, and more accessible. As the cryptoeconomy evolves, Gemini continues to innovate at the frontier, shaping how individuals and institutions engage with the decentralized future.

Risk factors

Gemini operates at the intersection of crypto trading, custody, and financial services—an innovative but highly volatile market shaped by regulation, technology shifts, and macroeconomic uncertainty. As the company enters the public markets, several key risks could materially impact its growth trajectory, financial performance, and long-term positioning.

1. Dependence on Digital Asset Adoption

Gemini’s core business is tied directly to the growth and acceptance of blockchain networks and digital assets. If adoption slows due to regulatory barriers, lack of mainstream utility, or consumer preference for alternative payment systems, demand for trading, custody, and NFTs could decline—materially impacting revenue and growth prospects.

2. Revenue Concentration in Volatile Assets

A large share of transaction revenue comes from trading in bitcoin, ether, and solana. Sharp price swings, declining volumes, or loss of confidence in these assets could significantly reduce platform activity. Past cycles of boom and bust in crypto markets have led to steep declines in trading revenue, and similar downturns remain a constant risk.

3. Extreme Market Volatility

Digital assets are prone to “black swan” events—unexpected shocks with outsized consequences. Hacks, forks, protocol failures, or sudden price crashes can erode user confidence, disrupt liquidity, and reduce trading activity. Since 2023, bitcoin alone has ranged from ~$16,000 to above $100,000, underscoring the unpredictability of the market Gemini depends on.

4. Regulatory and Legal Uncertainty

The legal treatment of digital assets continues to evolve across jurisdictions. Changes in securities law classification, taxation, or mining/staking restrictions could limit Gemini’s ability to list assets, expand products, or operate in certain markets. Heightened scrutiny also invites enforcement actions, fines, or licensing hurdles, each of which could constrain growth.

5. Technology and Security Risks

Blockchain protocols remain experimental. Bugs, vulnerabilities, validator centralization, or failures in consensus mechanisms can disrupt networks and impair asset values. Gemini also depends on secure custody and transaction systems; breaches, downtime, or loss of customer assets would damage trust and could trigger significant financial liability.

6. Banking and Liquidity Constraints

Crypto businesses often face resistance from traditional banks. Reduced access to fiat rails, wire transfers, or payment processing could limit Gemini’s ability to serve customers or expand internationally. Market-wide liquidity shocks—similar to prior exchange failures—could also reduce trading volumes and undermine confidence in the sector.

7. Competitive Pressure

The crypto exchange landscape is highly competitive, with both established players and new entrants vying for volume. Larger competitors may leverage scale, product bundling, or regulatory advantages to capture market share. At the same time, decentralized exchanges (DEXs) continue to grow, offering lower fees and disintermediation of centralized platforms like Gemini.

8. Operating Results Volatility

Gemini’s revenues fluctuate with crypto asset prices and trading volumes, making quarterly results inherently unpredictable. Net income losses of $(158.5)M in FY2024 and $(282.5)M in 1H2025 highlight the challenge of achieving profitability in a cyclical, sentiment-driven market. Any downturn in prices or activity can quickly translate into operating losses.

9. Dependence on Institutional and Retail Users

Gemini must simultaneously serve two very different customer bases—retail traders and institutional investors. Retail activity is sensitive to sentiment and price trends, while institutional clients require scale, compliance, and custody depth. Weakness in either segment could disrupt revenue and slow adoption across the platform.

10. Macroeconomic and Geopolitical Exposure

Interest rates, inflation, banking instability, and geopolitical events can influence investor appetite for risk assets like crypto. In downturns, transaction activity typically contracts, reducing Gemini’s core revenue streams. Global instability or restrictive policies in key markets could further constrain growth opportunities.

Market Opportunity

Based on market activity and independent estimates, Gemini defines a multi-trillion-dollar total addressable market (TAM) for the cryptoeconomy over the coming decade. While exchange-traded crypto assets reached a peak value of $3.3 trillion in 2024, this still represents a fraction of the $100 trillion global equities market, highlighting vast headroom for growth as adoption accelerates.

Key market vectors include:

Spot and Derivatives Trading:

$18 trillion in spot trading volume (2024)

$53 trillion in futures trading volume (2024)

CAGR of ~50% from 2020–2024

Stablecoins and Payments:

$10.8 trillion settled in 2023, of which $2.3 trillion tied to organic activity (payments, remittances)

Compared to Visa’s $12.3 trillion payments volume in 2023

Tokenisation of Assets:

Estimated to reach $10 trillion market value by 2030 as real-world assets move on-chain

Consumer Payments & Credit:

U.S. card payments exceeded $9 trillion in 2024, representing a large adjacency for Gemini’s credit card with crypto rewards

Digital Goods and Culture:

Expansion of NFTs, in-game tokens, and collectables

Growth of decentralised finance (DeFi) protocols and smart contracts

Where the Opportunity Lives

The cryptoeconomy creates multiple expansion vectors for Gemini:

Retail Participation: Billions of consumers worldwide are expected to engage with crypto—whether as investors, payment users, or collectors—expanding the retail TAM far beyond today’s base.

Institutional Adoption: Financial institutions are accelerating entry into crypto trading, custody, and tokenization. Gemini’s SOC-compliant custody and regulated stablecoin offerings provide enterprise-grade infrastructure to capture this demand.

Payments and Stablecoins: Stablecoins are gaining traction as a medium for payments, remittances, and settlements. With Visa-sized transaction volumes in sight, Gemini is positioned to play a key role in this transformation.

Asset Tokenization: Moving real-world assets—equities, bonds, real estate, and commodities—onto blockchains represents one of the largest secular growth opportunities in global finance.

Credit and Consumer Finance: Gemini’s Mastercard-powered credit card positions the company at the intersection of crypto and traditional payments—tapping into trillions in annual card volume.

Capturing the Cryptoeconomy

By converging trading, custody, stablecoins, NFTs, and payments into one platform, Gemini is addressing one of the most durable transitions in global finance. With a peak market capitalization already in the trillions, accelerating institutional adoption, and expanding consumer use cases, the cryptoeconomy is poised for decades of growth. Gemini’s history of innovation and regulatory firsts positions it to lead in capturing this generational opportunity.

Product

A single, crypto-native platform that unifies education, trading, custody, rewards, and digital collectibles—designed to make the cryptoeconomy simple, secure, and regulated for retail, protail, and institutions alike. Every product runs on the same compliance, security, and data foundation, eliminating tradeoffs between ease of use and institutional-grade controls.

Licensing & Compliance

NYDFS-licensed exchange and stablecoin issuer; MTL coverage across all required U.S. states; robust KYC, market surveillance, and transaction monitoring; ongoing BSA/AML training.Security & Custody

Geographically distributed HSMs, cold storage, MPC; SOC 1 Type 2, SOC 2 Type 2, ISO 27001; 1:1 custody of customer assets via Gemini Trust (NY limited purpose trust company).Technology & Data

Proprietary matching, risk, and custody stack; enterprise analytics for product decisions; AI-assisted support and ACH fraud models integrated into operations.

Five Core Elements

→Cryptopedia & Crypto News

Curated education spanning fundamentals → advanced strategies.

Data-informed content roadmaps; segmentation and coaching via in-app journeys.

Outcome: Faster, safer onboarding; informed participation for retail and institutions.

→Gemini Exchange® & ActiveTrader®

Intuitive spot trading for beginners; pro UI with advanced charting, order types, and multi-market monitoring for sophisticated users.

Gemini Derivatives: Perpetuals with risk tools (e.g., cross-collateralization).

APIs: WebSocket, REST, FIX for real-time data and automated trading.

GILP (Gemini Instant Liquidity Provider): Firm quotes sourced from the central limit order book; standard price/time priority and instant settlement.

Outcome: One venue for casual, programmatic, and institutional flows.

→Gemini Custody

Segregated wallets, institutional controls, and auditability.

Cold + MPC architecture with geographically distributed HSMs.

Outcome: Bank-grade safekeeping with crypto-native flexibility.

→Gemini Credit Card® (WebBank, Mastercard)

Instant crypto rewards (BTC, ETH, SOL, 50+ assets) deposited at purchase.

No trading fees on rewards; integrate with hold/trade/stake flows.

Outcome: Everyday spend becomes seamless crypto exposure.

→Nifty Gateway Studio®

Full-service, onchain creative studio for brands and creators.

Fiat on-ramps, custodial wallets, and compliance review for primary sales; curated discovery for secondary markets.

Outcome: Frictionless access to digital goods with mainstream UX.

Institutional Stack

eOTC & Voice OTC

Large-block execution with delayed net settlement and best-price routing across top liquidity providers; real-time pricing and status.

Outcome: Capital-efficient, low-slippage access to deep liquidity.

Custody at Scale

Qualified custodian with segregated accounts, attestations, and reporting.

Outcome: Enterprise-grade controls for asset managers, hedge funds, corporates.

Stablecoin & Staking

Gemini Dollar (GUSD)

NYDFS-regulated, U.S. dollar-backed (cash & cash equivalents, U.S. T-bills, specified repo, and government MMFs), 1:1 redeemable at par; monthly/annual attestations.

Gemini Staking & Staking Pro

Retail/institutional staking (ETH, SOL, MATIC; more as supported), proportional rewards with a transparent 15% fee; Staking Pro offers dedicated validators (32 ETH) in the U.K.

Platform Advantage

Unified Foundation

One security/compliance/data plane across Learn, Invest, Store, Earn, and Collect.

Faster Deployment

Retail to institutional onboarding with the same rails (mobile, web, APIs).

Lower Complexity

Consolidates fragmented point solutions (custody, trading, stablecoin, rewards, NFTs) into one stack.

Higher Trust

Independent audits and certifications; regulated entities; 1:1 asset custody.

Future-Readiness

MPC roll-out, self-custody enhancements, token support expansion, and EU tokenized equities (1:1 backed) extend the platform to new use cases and jurisdictions.

Monetization Framework

Transaction Fees: Exchange & OTC fees calibrated to venue and user tier.

Custody Fees: Annualized ~0.1% on AUC (as of Jun 30, 2025).

Interest Income: On USD balances and GUSD reserves (blended rates vary by mix).

Withdrawal Fees: Fiat wires and on-chain withdrawals.

Credit Card: Interchange, interest, and fees on receivables.

Nifty Gateway Studio: Blended primary/secondary take rates.

Growth Flywheel

Education accelerates activation (first trade, recurring buys).

Interconnected products (Credit Card, Staking, Custody) lift LTV and retention.

Data-driven engagement (alerts, cohorts, recommendations) increases breadth of participation without compromising safety.

Business Model

A vertically integrated bridge into the cryptoeconomy that unifies exchange, OTC, custody, stablecoin, staking, credit, and digital collectibles. By owning the critical rails—matching, market data/APIs, custody, and compliance—Gemini captures value across the onchain stack while delivering a regulated, consumer-grade experience for retail and institutional users.

This full-stack approach lets Gemini monetize both high-velocity transactions and balance-sheet/engagement adjacencies (custody, interest, credit, NFTs), compounding LTV and reducing reliance on a single cycle.

1) Exchange & Derivatives (Core)

Spot trading via Gemini Exchange® (retail-first UX) and ActiveTrader® (pro/institutional tools), plus perpetuals with risk features like cross-collateralization.

How it earns: Transaction fees on volume.

Retail: ~1.0%–1.3% avg monthly (2025 YTD); 1.0%–1.4% (2024).

Institutional: ~0.02%–0.03% (2025 YTD); 0.03%–0.05% (2024).

Scale: 2024 exchange rev $95.8M; 1H’25 $43.8M.

Moat enablers: GILP (instant quotes from Gemini’s CLOB), instant settlement, and programmable access via WebSocket/REST/FIX.

2) OTC Liquidity (eOTC & Voice)

Block execution with delayed net settlement and smart routing to top liquidity providers.

How it earns: Transaction fees; tight spreads at size.

Scale: 2024 OTC rev $2.4M; 1H’25 $0.7M.

Value: Capital efficiency for institutions; minimal market impact.

3) Custody (AUC-Linked)

Qualified, institutional-grade custody via Gemini Trust (segregated wallets; HSM + MPC).

How it earns: ~0.1% annualized fee on assets under custody (as of Jun 30, 2025).

Role: Stabilizer through cycles; prerequisite for institutional flows.

4) Interest Income (USD & GUSD Reserves)

Interest on user USD balances and GUSD reserves.

How it earns: Blended rates ~1%–2% (1H’25); ~1.8% USD and 1.2% GUSD (as of Jun 30, 2025).

Value: Non-trading revenue tied to balances, not price action.

5) Withdrawals

Fiat wires and on-chain crypto withdrawals.

How it earns: Fee per withdrawal.

Scale: $1.0M (1H’25); $4.2M (2024); $2.9M (2023).

6) Credit Card (WebBank, Mastercard)

Gemini Credit Card® with instant crypto rewards (BTC/ETH/SOL/50+).

How it earns: ~2.1% interchange on volume + interest/fees (APR 17.24%–29.25%).

Scale: 58k+ active accounts; $1.3B lifetime volume; $93.5M receivables (as of Jun 30, 2025). 2024 volume $375M, $5.5M in crypto rewards distributed.

Role: Everyday spend → recurring crypto exposure → higher LTV.

7) Nifty Gateway Studio

Full-service onchain studio + marketplace with fiat on-ramps and custodial wallets.

How it earns: Blended take rate ~15.1% (1H’25).

Scale: $769.4M lifetime gross sales (as of Jun 30, 2025).

Value: Expands beyond trading into digital IP and culture.

8) Staking & Staking Pro

Retail/institutional staking (ETH, SOL, MATIC; more as supported); Staking Pro with dedicated validators (32 ETH min) in the U.K.

How it earns: 15% fee on rewards.

Role: Engagement flywheel; asset retention; network participation.

Business Mix

Exchange is the engine: Exchange/OTC comprised ~65.5% of revenue (1H’25) and ~69.7% (2024).

Retail-led volume: Exchange revenue was ~95% retail (1H’25) and ~93% retail (2024).

Diversification in progress: Custody, interest, credit, NFTs, and staking add balance-linked and engagement-linked lines that smooth cyclicality.

Platform Advantage

One Stack, Many Monetization Paths: The same regulated rails power spot, perps, OTC, custody, GUSD, card rewards, and NFTs—lowering CAC-to-Revenue payback across products.

Trust as a Growth Multiplier: NYDFS oversight, full MTL coverage, SOC 1/2 Type 2, ISO 27001 → higher institutional confidence and deeper retail adoption.

APIs as Distribution: WebSocket/REST/FIX turn Gemini into market infrastructure for partners, funds, and protail quants—expanding addressable order flow without linear headcount.

Competitive Strengths

Crypto-Native, Vertically Integrated: Matching, risk systems, custody, and stablecoin under one roof—fewer dependencies, faster iteration.

Regulated from First Principles: 1:1 asset custody and audited controls differentiate in a trust-sensitive category.

Broad yet Coherent SKU Map: Exchange, OTC, custody, stablecoin, staking, card, NFTs—covering the full user journey on a single brand.

Growth Levers

Scale MTUs & ADV

Expand retail acquisition, deepen protail/institutional penetration via APIs and derivatives; refine cohort-based activation (alerts, recurring buys, education loops).

Derivatives & Liquidity Depth

Broaden perps, margin/risk tooling; strengthen GILP and liquidity partnerships to increase share of price-sensitive flow.

Balance-Linked Revenues

Grow AUC (custody) and fiat/coin balances (interest income); expand staking networks and Staking Pro footprint.

Payments Flywheel

Accelerate Gemini Credit Card® distribution; integrate rewards with staking/recurring buys to compound LTV.

GUSD & Settlement Use Cases

Drive GUSD in payments/treasury flows; maintain monthly attestations and NYDFS guardrails to reinforce institutional trust.

Geographic & Asset Expansion

Add supported tokens (subject to risk/compliance), deepen EU presence (e.g., tokenized equities 1:1 backed), and broaden product availability where permitted.

Unit Economics

High-Margin Software Rails: Matching engine, APIs, and custody software scale with minimal variable cost.

Cycle Dampeners: Custody fees, interest income, credit interchange, staking fees, and NFT take rates diversify away from pure trading beta.

Engagement Flywheel: Education → first trade → recurring buys → staking/credit card/NFTs → higher retention and LTV; over 60% of MTUs onboarded pre-2022, evidencing durable cohorts.

Gemini’s business model monetizes immediate transaction intent while building durable, balance- and engagement-linked revenue lines. With regulated infrastructure, a crypto-native tech stack, and multi-product attachment, Gemini is structured to capture upside in bull markets—and retain meaningful earnings power through the cycle.

Management Team:

Tyler Winklevoss – Co-Founder, Chief Executive Officer & Director

Tyler Winklevoss co-founded Gemini in 2014 and serves as Chief Executive Officer. He joined the Board of Directors in August 2025 and has been a member of Gemini LLC’s board of managers since November 2021. Tyler is also CEO of WCF, the private investment firm he co-founded in 2012 focused on early-stage startups and multi-asset investments. Earlier, he represented the United States at the 2008 Beijing Olympics, finishing sixth in the men’s pair rowing event alongside his brother, Cameron. Tyler holds a B.A. in Economics from Harvard University and an M.B.A. from the University of Oxford’s Saïd Business School.

Cameron Winklevoss – Co-Founder, President & Director

Cameron Winklevoss co-founded Gemini in 2014 and serves as President. He joined the Board of Directors in August 2025 and has been a member of Gemini LLC’s board of managers since November 2021. Cameron is also COO of WCF, the investment firm he co-founded in 2012 backing early-stage companies across sectors. Cameron earned a B.A. in Economics from Harvard University and an M.B.A. from Oxford’s Saïd Business School, and began investing in bitcoin in 2012.

Dan Chen – Chief Financial Officer

Dan Chen joined Gemini as Chief Financial Officer in March 2025, bringing nearly three decades of experience across fintech, investment banking, asset management, and commercial banking. Prior roles include Head of Capital Markets & Bank Partnerships at Affirm; CFO of Blue Foundry Bank, where he led its IPO; Treasurer of Cross River Bank; Managing Director at MetLife Investments; and Vice President in Capital Markets at Morgan Stanley. Dan began his career in audit at PricewaterhouseCoopers and is a licensed CPA. He holds a B.S. in Economics from the Wharton School (University of Pennsylvania) and an M.B.A. from Columbia Business School.

Marshall Beard – Chief Operating Officer & Director

Marshall Beard serves as Chief Operating Officer and joined the Board of Directors in August 2025. He has led operations at Gemini since November 2023 and previously served as Chief Strategy Officer after joining the company in 2018. Earlier, Marshall was Chief of Staff at Barstool Sports, focusing on corporate strategy and operations; a management consultant in PwC’s M&A Advisory group; and began his career in corporate finance at Prudential Financial. He holds an M.B.A. from the University of Massachusetts and a B.S. in Finance from the University of Southern Maine.

Investment

Foundational Capital (2020–2022)

Gemini’s earliest financings established the groundwork for its exchange and custody infrastructure. A 2020 venture round brought in early backers to validate our product-market fit and regulatory-first approach. By late 2021, Gemini closed its Series A financing, with Morgan Creek Digital leading a 19-investor syndicate. This round provided the resources to scale liquidity, strengthen compliance capabilities, and accelerate global expansion. Early 2022 saw additional venture funding from Draper Dragon, followed by a secondary transaction in June 2022 that enabled broader institutional participation.

Strategic Growth and Debt Financing (2025)

In July 2025, Gemini secured a debt financing facility led by Ripple, marking a strategic milestone in aligning with one of the most established players in blockchain infrastructure. This financing reflects investor confidence in Gemini’s long-term positioning as a trusted gateway to the cryptoeconomy and provides balance-sheet flexibility for continued product and geographic expansion.

Across its funding history, Gemini has attracted leading investors such as Ripple, VanEck, K5 Global, Pantera Capital, and 50T Funds, underscoring the global breadth of conviction in its platform.

Strategic Investments

In parallel to raising capital, Gemini has been an active investor in the broader cryptoeconomy, seeding innovation across infrastructure, DeFi, and digital consumer platforms. To date, Gemini has made 16 investments and completed 6 acquisitions, with a focus on startups building the next generation of blockchain applications.

Notable investments include:

BitVault (2025, Pre-Seed) – A next-generation digital asset security company.

Octane (2025, Seed) – Enabling consumer access to crypto-linked financial services.

Skyfire Systems (2024, Seed) – Blockchain infrastructure for institutional adoption.

Turnkey (2024, Series A) – Developer-first custody and wallet infrastructure.

Ethena (2023, Seed) – Protocol innovation in synthetic stable assets.

reNFT (2022, Seed) – Building financial rails for NFT lending and renting.

Through these strategic investments, Gemini plays a dual role: operator of a regulated, consumer-first exchange and ecosystem builder accelerating innovation across the cryptoeconomy.

Competition

Gemini competes in a rapidly evolving cryptoeconomy defined by the convergence of digital assets, financial infrastructure, and onchain applications. As retail adoption accelerates, institutions enter the market, and new blockchain use cases emerge, demand for trusted, compliant, and user-friendly platforms has surged. This has created both significant opportunity and intensifying competitive pressure across the industry.

Diversified Crypto Platforms

Gemini’s closest competitors are comprehensive platforms that bundle exchange, custody, and crypto-linked financial services. Coinbase and Robinhood represent the largest of these players, leveraging brand recognition, retail user scale, and consumer-friendly interfaces. Both companies benefit from significant liquidity, wide distribution, and large active user bases.

Gemini differentiates through its vertically integrated, crypto-native architecture, institutional-grade custody, and commitment to regulatory compliance across multiple jurisdictions. Unlike many peers, Gemini’s platform is designed from the ground up for trust, security, and resilience across market cycles.

Specialized Product Providers

Beyond end-to-end platforms, competition also comes from focused players with singular product categories. Circle’s USDC stablecoin competes directly with Gemini Dollar (GUSD) in regulated, dollar-backed digital cash, while OpenSea represents the largest standalone NFT marketplace, competing with Gemini’s Nifty Gateway Studio. These companies benefit from specialization and early market traction but often lack the breadth and integration Gemini provides.

Gemini’s advantage lies in offering a diversified suite of products—spanning stablecoins, custody, staking, NFTs, and credit card rewards—that allow users to engage with the cryptoeconomy through a single, secure platform.

Fintech and Adjacent Entrants

Mainstream fintechs and financial institutions are increasingly embedding crypto capabilities into their broader offerings. Payment providers, neobanks, and brokerages view digital assets as an incremental service for customer engagement. Their advantage is distribution and integration with fiat finance rails.

Gemini’s edge comes from being crypto-native yet regulation-first, with infrastructure purpose-built for digital assets rather than retrofitted into legacy financial systems. This allows Gemini to move faster in supporting new tokens, networks, and services without compromising security or compliance.

Competitive Factors

Across the exchange, custody, and crypto-services landscape, the key factors shaping competition include:

Breadth of products and services meeting both retail and institutional needs

Security and resilience of custody infrastructure

Depth of regulatory compliance and operating licenses

Ease of use, accessibility, and customer trust

Continuous innovation and speed of bringing new assets to market

Ability to endure volatility across crypto market cycles

Brand credibility and crypto-native expertise

Gemini’s Differentiation

Gemini’s defensible moat is its combination of compliance-first principles, product breadth, and institutional-grade security. The platform unites exchange trading, custody, staking, stablecoin issuance, NFT marketplaces, and consumer products like the Gemini Credit Card® under one trusted brand. This integrated model positions Gemini uniquely between retail-first competitors and narrow point-solution providers.

In a market where new entrants will continue to emerge, Gemini’s long-term differentiation is clear: a regulated, diversified, and innovation-driven platform that bridges users to the broader cryptoeconomy with safety and trust at its core.

Financials

Gemini’s financial performance reflects strong user engagement and asset growth, but profitability remains pressured by weaker monetisation and higher operating expenses. Below is a breakdown of profits, losses, and cash flows.

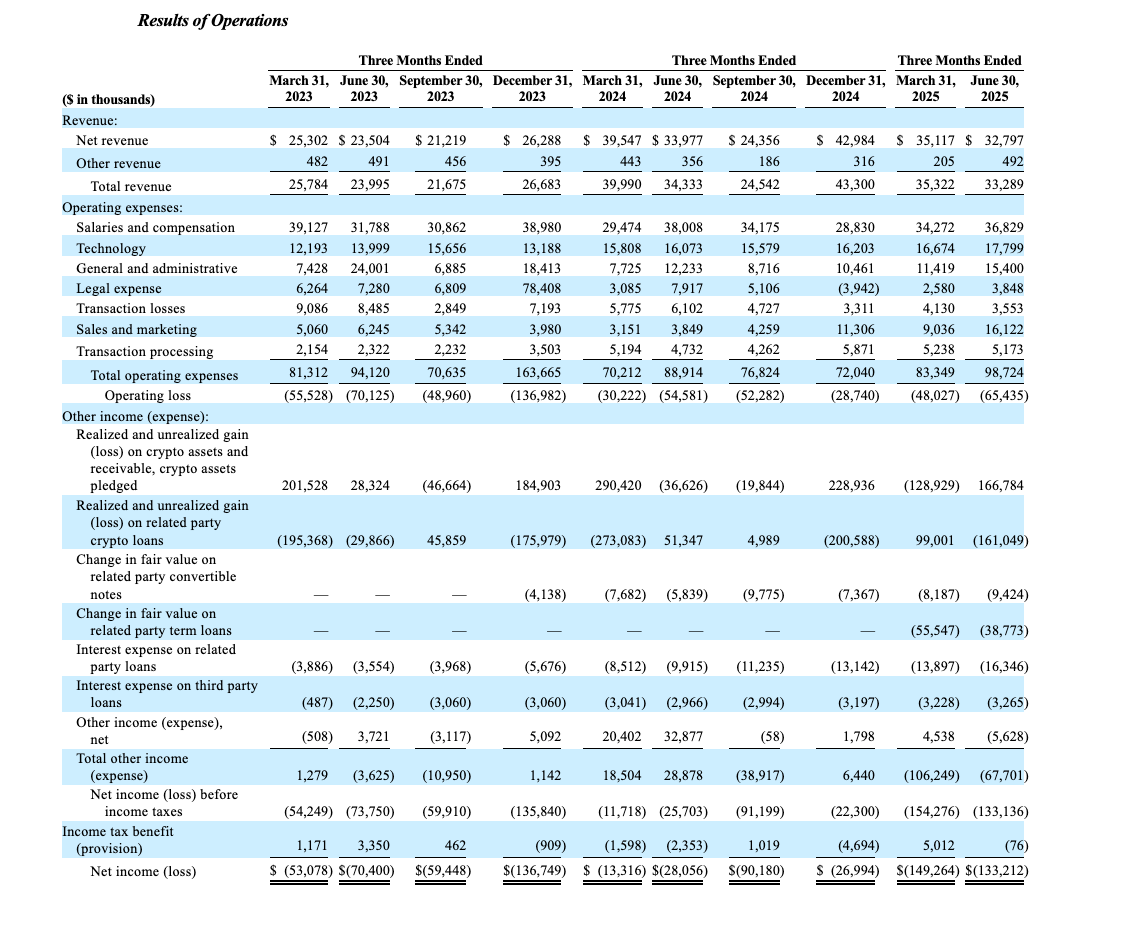

Profit & Loss

Revenue (1H’25): $68.6M, down 7.7% YoY (1H’24: $74.3M).

Transaction revenue fell 14% to $45.0M on take-rate compression despite +49% YoY trading volume.

Services revenue grew 34% to $18.2M (credit card, staking, custody).

Interest income declined to $4.8M (–38% YoY).

Net Loss (1H’25): $(282.5)M vs $(41.4)M in 1H’24.**

Key drivers: lower fee capture, higher go-to-market and G&A, increased interest expense, and adverse fair-value marks on related-party instruments.Adjusted EBITDA (1H’25): $(113.5)M vs $32.0M in 1H’24—reflecting weaker unit economics (lower take rates) and higher operating spend.

P&L shows healthy engagement (MTUs +6%, AoP +31%) but materially weaker monetization per dollar traded and heavier OpEx, driving a sharp swing from positive to negative Adjusted EBITDA and a wider GAAP loss.

Cash Flow Dynamics

While full cash-flow statements weren’t provided, the components allow a clear read on cash movement:

Operating Cash Flow (OCF)

Headwinds to OCF (cash outflows):

Negative Adjusted EBITDA $(113.5)M—a proxy for core cash burn before non-cash items.

Cash interest: interest expense rose (related-party and third-party) to an annualized run-rate that pressures OCF.

Elevated S&M/G&A to drive growth and public-company readiness.

Tailwinds to OCF (non-cash add-backs):

Depreciation & amortization (~$15.5M in 1H’25).

Stock-based compensation (~$3.2M in 1H’25).

Fair-value changes on loans/notes are largely non-cash and added back in operating cash flow.

Given the scale of the Adjusted EBITDA loss and cash interest, OCF for 1H’25 is likely negative, even after non-cash add-backs and improved transaction-loss performance.

Investing Cash Flow (ICF)

No discrete capex or acquisition cash numbers were provided. Given the crypto-native, software-heavy profile, ICF likely modest unless tied to product expansion or M&A. (If capex remains low, it does not offset OCF burn materially.)

Financing Cash Flow

Debt financing (2025) increases liquidity but also raises cash interest and introduces fair-value P&L volatility (non-cash).

Free cash flow (FCF)—OCF minus capex—likely negative in 1H’25 given OCF pressure and ongoing product investment.

Profitability Path

Restore Take-Rate: rebalance market-maker incentives, optimize retail fee ladders, and shift mix toward higher-yield venues.

Scale Services Mix: keep leaning into credit card, staking, custody—more recurring and less beta-sensitive, improving gross margin and cash conversion.

Lower Cash Interest Drag: evaluate refinancing/structure to reduce coupon burden and dampen valuation-driven P&L noise from fair-value instruments.

ETH/“Other” Monetization: close the gap between strong alt/ETH volumes and fee capture via packaging, order-type utilization, and targeted liquidity programs.

Closing thoughts

Gemini’s latest results reflect a platform in transition—expanding assets under custody and institutional trading volume, but still navigating profitability headwinds. With MTUs climbing to 523k, trading volume up 49% YoY for the first half of 2025, and a diversified product mix spanning custody, staking, and credit cards, Gemini is building toward scale despite persistent net losses.

Bull Case:

Gemini’s deep regulatory focus, trusted custody solutions, and growing institutional adoption provide a foundation for durable growth. Rising Assets on Platform ($18.2B) underscore user trust, while transaction and services diversification can smooth volatility. A strong compliance reputation may position Gemini as a long-term winner as regulation tightens globally.

Bear Case:

Profitability remains elusive, with net losses widening to $282M in H1 2025 and Adjusted EBITDA back in negative territory. Transaction revenue remains heavily tied to crypto market cycles, leaving Gemini exposed to volatility. Competitive pressure from Coinbase, Robinhood, and newer entrants could compress fees further, while legal and compliance costs weigh on margins.

Gemini is at an inflection point. The platform’s regulatory-first approach, expanding institutional base, and product breadth suggest long-term potential. However, sustained losses and cyclical revenue raise questions about the path to profitability. Execution on cost discipline and product innovation will determine whether Gemini evolves into a durable, scaled player in the crypto economy.

Here is my interview with Shane Ray Martin—a venture capitalist who’s rewriting the playbook for what investing can look like. He’s an investor at B Ventures, the first-of-its-kind global peace VC fund that backs tech founders building solutions for both profit and peace.

In this conversation, Shane and I discuss:

What’s the most common mistake founders make in their first pitch?

What’s the founder trait that wins deals even when the numbers aren’t perfect?

Does Shane think machines will out-negotiate humans in our lifetime?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Did you know?

- only 1% create content

- 9% engage with it

- 90% just read itWanna be a founder? Be in the 1%.

— Paul Mit (@pmitu)

9:33 AM • Sep 17, 2025

Sage observation from @pmarca

— David Senra (@FoundersPodcast)

4:47 PM • Sep 14, 2025

Everyone in your company should be on customer calls.

Sales, Support, Product interviews, events -- it all counts.

Even if unstructured, so long as it’s about their lives and interaction with your product & company.

Empathy and insight comes automatically to everyone.

— Jason Cohen (@asmartbear)

5:46 PM • Sep 16, 2025

OpenAI JUST released how people are using chatgpt

each bar in this chart is a billion-dollar wedge if you build the right verticalized, trust-rich AI startup:

1/ tutoring + teaching (10.2%) - people want on-demand teachers more than almost anything else. a personal ai tutor

— GREG ISENBERG (@gregisenberg)

11:50 PM • Sep 15, 2025

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow like a rocketship.

And that’s it from me. See you next week.

Reply