- Partner Grow

- Posts

- NVIDIA’s Relentless AI Boom

NVIDIA’s Relentless AI Boom

Nvidia earnings

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Interested in sponsoring these emails? See our partnership options here.

Top Publishers Hand-Selecting Amazon Brands to Promote this Holiday Season

This holiday season, top publishers are actively sourcing brands to include in their gift guides, newsletters, listicles, reviews, and more to drive high-intent shoppers straight to Amazon storefronts.

Here’s why it matters:

Amazon brands are seeing a 5:1 conversion rate compared to their DTC site

Millions of shoppers discover products through trusted publishers

Levanta is working directly with these publishers to introduce them to a small number of 7–9 figure brands.

If you qualify, your products could be featured in high-traffic placements that deliver predictable CAC and directly measurable sales.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

Nvidia Q2 FY26 earnings

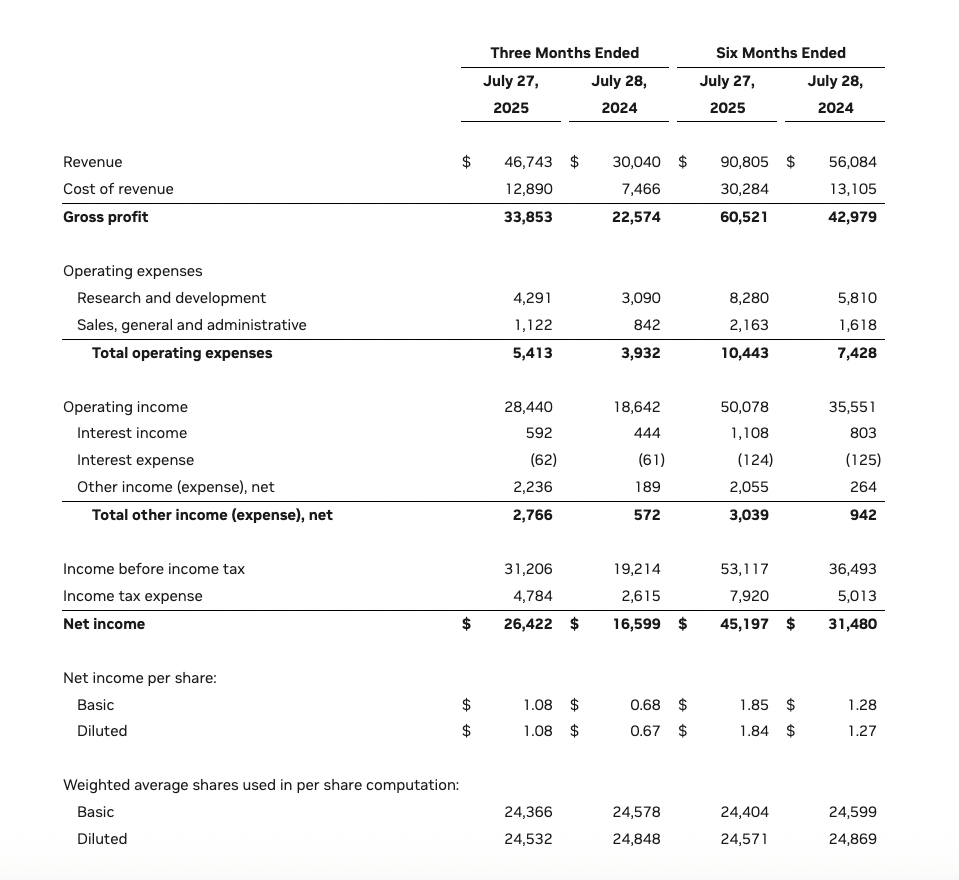

In late summer 2025, NVIDIA once again reminded markets why it has become the single most important company in the AI era. The chipmaker posted record Q2 FY26 revenue of $46.7 billion, guided for an even larger Q3 at $54 billion, and showcased a roadmap that stretches from hyperscale data centers to sovereign AI factories and robotics at the edge.

It would be easy to frame this as another blockbuster quarter from an already dominant company. But NVIDIA’s story is evolving. No longer just a GPU vendor, it is positioning itself as the full-stack infrastructure provider for the coming decade of trillion-dollar AI investment. From its Blackwell GB300 racks ramping at 1,000 units per week to next-gen Rubin chips already in fab, NVIDIA is both supplying today’s demand and laying track for a $3–4 trillion AI infrastructure buildout by 2030.

“We’re not building GPUs. We’re building AI factories,” Jensen Huang said during the call.

The question now: can NVIDIA maintain its extraordinary lead as power constraints, geopolitics, and custom silicon competitors close in?

Record-breaking top line

NVIDIA delivered $46.7 billion in revenue, up 56% year-on-year and 6% sequentially, blowing past Wall Street expectations. Growth was broad-based, with the data center segment contributing the lion’s share thanks to demand for Blackwell GPUs and networking. Gross margins came in at 72.7% on a non-GAAP basis, even after adjusting for a $180 million benefit from previously reserved H20 inventory. Stripping that out, margins were still a robust 72.3%, underscoring the company’s pricing power and efficiency. EPS came in well above consensus, reinforcing NVIDIA’s ability to scale profitability alongside revenue.

Q3 FY26 guide: An even bigger quarter ahead

For the third quarter, management guided to $54 billion in revenue, plus or minus 2%, implying a 16% sequential increase — a staggering growth rate for a company already at this scale. Gross margins are expected to expand further to ~73.5% (non-GAAP), marking yet another all-time high. Importantly, this outlook excludes any contribution from H20 sales to China, which remain entangled in licensing reviews and geopolitics. That means upside of $2–5 billion could materialize if shipments resume, making the guide potentially conservative.

Data Center, Blackwell & Networking

NVIDIA has not just shipped another blockbuster quarter—it has quietly redrawn the map of what an AI data center looks like. The data center segment hit $41.1 billion, or 88% of total revenue, cementing it as the company’s growth engine. Blackwell shipments grew +17% sequentially, with the GB300 now in full production at ~1,000 racks per week and accelerating. The cadence is no longer about chips—it’s about industrial-scale systems delivered at factory rhythm.

Early signals suggest that NVIDIA isn’t chasing incremental GPU sales. Instead, the company is building modular, rack-scale supercomputers designed to anchor the trillion-dollar AI buildout.

This could mean:

A shift from chips to compute factories. With Hopper (H100/H200) still shipping but H20 volumes constrained, Blackwell racks are increasingly the default unit of scale for hyperscalers and sovereigns.

Networking as a profit center. At $7.3 billion (+46% Q/Q, +98% Y/Y), networking is now NVIDIA’s second growth flywheel—spanning NVLink for scale-up, InfiniBand for quantum-scale clusters, and Spectrum X Ethernet for scale-out. The new Spectrum XGS extends that reach to “scale-across,” knitting together entire gigawatt-class superfactories.

Inference economics rewritten. With NVLink72 + NVFP4, Blackwell enables order-of-magnitude improvements in tokens per watt, a direct lever on revenue in power-limited data centers. Customers are no longer just buying performance—they’re buying efficiency curves that dictate ROI at the factory level.

A defensible moat in full-stack design. From compute silicon to networking fabrics to CUDA software, NVIDIA controls the architecture of the AI economy, forcing competitors to play catch-up at every layer.

NVIDIA’s approach echoes the shift from mainframes to cloud in the last computing era: infrastructure, not parts, defines the market. Blackwell racks are not just GPUs in a box—they’re the blueprint for AI factories where power, efficiency, and scale determine who wins.

The China Question

NVIDIA reported zero H20 shipments to China in Q2, but still managed to sell $650 million of H20 units to unrestricted customers outside China, plus release $180 million in inventory reserves, which lifted gross margins by roughly 40 basis points. The company emphasized that Q3 guidance excludes all China-related revenue, setting expectations at $54 billion ±2% with gross margins in the 73.3–73.5% range. That means if licensing approvals accelerate, NVIDIA could see $2–5 billion in upside beyond its current forecast.

Licenses are beginning to trickle in, but the U.S. government is weighing a 15% “export tax” on licensed H20 shipments—a proposal not yet codified, but one that could reshape NVIDIA’s China pricing. In parallel, China is doubling down on local AI chip initiatives, from Huawei’s Ascend to startups like Cambricon, but CUDA’s dominance keeps NVIDIA entrenched in global research and enterprise pipelines. The strategic backdrop is clear: Beijing wants independence, Washington wants control, and NVIDIA wants permission to ship Blackwell.

The Singapore Nuance

One detail worth noting: ~22% of NVIDIA’s revenue was invoiced through Singapore, but management stressed that over 99% of the end customers were U.S.-based. In practice, this reflects hyperscalers and integrators using Singapore for operational or tax purposes, not actual geographic diversification of demand.

The Global Expansion Playbook

Even as China remains blocked, NVIDIA is scaling partnerships elsewhere:

Europe: Working with France, Germany, Italy, Spain, and the U.K. to build sovereign Blackwell infrastructure, including the first industrial AI cloud for European manufacturers.

Supercomputers: Collaborating on flagship projects like Doudna (U.S.), JUPITER and Blue Lion (Germany), Isambard (U.K.), and FugakuNEXT (Japan).

Developers: Expanding DGX Cloud Lepton in Europe and supporting open-source model builders with Nemotron and gpt-oss performance benchmarks.

Industry verticals: Partnering with Novo Nordisk (drug discovery), Siemens (factory of the future), and DCAI (quantum fluid dynamics).

Beyond Data Centers

While data center revenue hit $41.1 billion (+56% Y/Y, +5% Q/Q), NVIDIA made sure to show progress across other segments:

Gaming: $4.3 billion (+49% Y/Y) with the launch of GeForce RTX 5060, NVIDIA’s fastest-ramping x60 GPU ever, plus DLSS 4 adoption across 175+ titles.

Professional Visualization: $601 million (+32% Y/Y), fueled by new RTX PRO Blackwell GPUs and Omniverse libraries for physical AI.

Automotive & Robotics: $586 million (+69% Y/Y), powered by Thor SoCs, the new Jetson AGX Thor developer kit, and the Cosmos foundation models for robotics.

NVIDIA’s results underscore a paradox: China accounted for zero dollars in Q2, yet NVIDIA still posted record revenue and raised guidance. Jensen Huang’s message was clear—the demand side is strong enough that China is now optionality, not dependency. If licenses resume, that’s incremental upside; if not, hyperscalers, sovereigns, and BigAI are more than filling the gap.

Moat, Roadmap & Customers

NVIDIA is not just a GPU company anymore—it’s the full-stack empire. CUDA is the religion, the systems are the temples, and the networking fabric is the priesthood. In a world of power-capped data centers, performance per watt is the only currency that matters, and NVIDIA owns the mint.

The cadence is relentless. Blackwell today, Rubin tomorrow. Chips already in fab: the Vera CPU, Rubin GPU, CX9 SuperNIC, NVLink144 switch, and Spectrum X with silicon photonics. The goal isn’t just more speed—it’s higher perf/W and faster cost curves, year after year. Moore’s Law is dead, but Huang’s Law is alive and accelerating.

The demand drivers are equally staggering:

Reasoning and agentic AI that eats 100–1000× more compute than a simple chatbot.

Sovereign AI initiatives with a combined >$20B annual run-rate.

Enterprise AI spreading through industries from pharma to finance.

Physical AI and robotics, powered by Thor chips, Omniverse/Cosmos software, and Siemens partnerships for digital twins of entire factories.

But here’s the catch: nearly 40% of revenue comes from just two customers. Microsoft, Meta, Amazon, Oracle—pick your hyperscaler. BigAI labs like OpenAI, Anthropic, and xAI are lining up too. Capex is still surging, but it’s a highly concentrated bet on a handful of giants who are effectively underwriting NVIDIA’s $4 trillion valuation.

Cash, Balance Sheet & Returns

NVIDIA exited Q2 with $56.8B in cash and marketable securities against $8.5B of debt, leaving it one of the strongest balance sheets in tech. Operating cash flow reached $15.4B, with free cash flow at $13.5B, even as inventories swelled to nearly $15B to support the Blackwell and Blackwell Ultra ramps.

Operating leverage remains massive: GAAP operating margin came in around 61%, while non-GAAP touched 64.5%, showing NVIDIA can scale profit faster than revenue. The board topped up its buyback program with a fresh $60B authorization, after returning $24.3B to shareholders in the first half of FY26 through repurchases and dividends.

What Could Bend the Curve

In the near term, NVIDIA’s story is still about execution. The GB300 ramp has to hold quality at scale; networking throughput and supply must keep pace with Blackwell racks; and the next MLPerf inference benchmarks will be a litmus test of Blackwell Ultra’s efficiency narrative. On top of that sits the unresolved H20 licensing regime—whether the U.S. codifies a 15% export take, or grants wider approval, could swing billions in quarterly revenue.

Medium term, the cadence of innovation matters more. The Rubin platform is already in fab, but its timing and scale will dictate whether NVIDIA can maintain its annual drumbeat of higher perf/W. Winning sovereign awards in Europe, the Middle East, and Asia will cement the company’s role as default infrastructure provider, while robotics attach (Thor, Cosmos, Omniverse) expands the AI story into the physical world. And somewhere in the background lies software monetization: CUDA, inference optimizations, and agentic AI toolchains that could shift NVIDIA from pure hardware into recurring revenue.

Constraints are no longer technical alone—they’re planetary. Power, land, and water bottlenecks already shape where compute warehouses can be built. Export rules keep China demand uncertain, while in-house ASICs at hyperscalers threaten to shave share if performance gaps narrow. NVIDIA’s reliance on TSMC and advanced packaging is another single point of failure. And for investors, the biggest risk might be valuation itself: can a $4 trillion company grow fast enough to justify another leg higher while spending more on buybacks than R&D?

The arc of the AI buildout bends toward NVIDIA today. But as always in semis, cadence is king.

Stock Paradox

NVIDIA remains one of the most widely held stocks in the world. But paradoxically, now that it makes up nearly 8% of the S&P 500, most top money managers are still underweight relative to the index. That forces them to keep adding exposure on any pullback — a structural tailwind for the stock.

At 41x forward earnings, NVIDIA trades at a premium to Microsoft and Apple. But with EPS up 61% Y/Y and $26B in net income in Q2 alone, you can argue it’s still undervalued. The profits are very real, even with a challenged China business.

NVIDIA’s growth is supply-constrained. Revenue can only rise as fast as the company can ramp GB300 racks and networking throughput. That makes quarter-to-quarter trends noisy, but demand is clearly running hotter than supply.

Here is my interview with Michael Colonnese, the CEO of SV Academy, a pioneering talent platform that helps companies hire pre-trained sales and customer success professionals—with no fees and no catch.

In this conversation, Michael and I discuss:

What’s the biggest myth companies still believe about hiring entry-level sales talent

SV Academy grads increase their income by 2.4x. What’s the magic behind that transformation—curriculum, mentorship, mindset?

Should reps own their own pipeline?

Will We Have More or Fewer Reps in 5 Years?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

An easy way to improve your life:

Stop wishing for outcomes that require you to do work you aren't interested in.

— Justin Welsh (@thejustinwelsh)

12:02 PM • Sep 3, 2025

Hot take: Quitting your worst habit will change your life faster than starting your best habit. Stop the leak before you fill the bucket.

— Sharran Srivatsaa (@sharran)

8:46 PM • Aug 26, 2025

Startups aren’t built in months. They take years just to find product market fit. If you can’t commit a few years, it’s probably not worth starting.

— Andrew Gazdecki (@agazdecki)

1:01 PM • Sep 1, 2025

If you’re selling, your job isn’t to sell, it’s to build trust.

— Naval (@naval)

10:17 PM • Aug 30, 2025

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow like a rocketship.

And that’s it from me. See you next week.

Reply