👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

The Future of AI in Marketing. Your Shortcut to Smarter, Faster Marketing.

Unlock a focused set of AI strategies built to streamline your work and maximize impact. This guide delivers the practical tactics and tools marketers need to start seeing results right away:

7 high-impact AI strategies to accelerate your marketing performance

Practical use cases for content creation, lead gen, and personalization

Expert insights into how top marketers are using AI today

A framework to evaluate and implement AI tools efficiently

Stay ahead of the curve with these top strategies AI helped develop for marketers, built for real-world results.

Interested in sponsoring these emails? See our partnership options here.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Medline in one minute

Medline is rebuilding America's healthcare supply chain from the ground up using vertical integration—transforming how medical supplies are manufactured, distributed, and delivered to every point of care. In a world where hospitals still navigate fragmented supplier networks and inefficient procurement systems built decades ago, Medline delivers an integrated platform that combines manufacturing and logistics, cutting costs by up to 30% and enabling next-day delivery to 95% of U.S. customers.

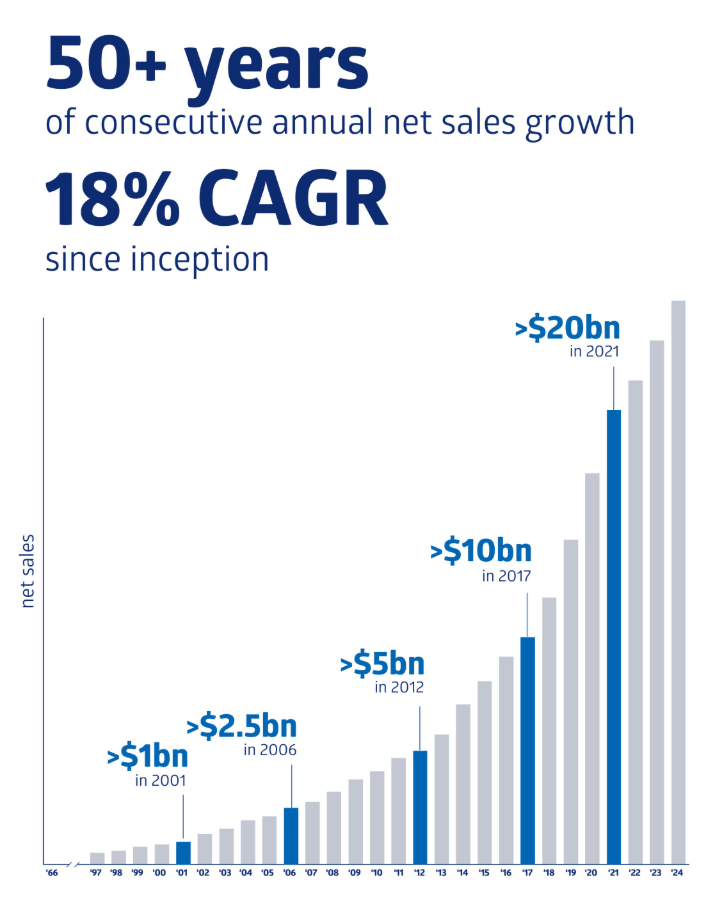

Since its founding in 1966 by the Mills family, Medline has pioneered the real-world application of vertical integration in healthcare—proving that owning both production and distribution can deliver measurable efficiency gains beyond traditional models. By growing revenue every year since inception at an 18% compound annual growth rate and serving as the largest provider of medical-surgical products in the U.S., Medline has emerged as the dominant infrastructure layer connecting manufacturers, hospitals, surgery centers, and post-acute facilities. With 335,000 products across 69 global distribution centers and 2,000 owned trucks, Medline holds the leading position across multiple end markets.

At the core of Medline's model is radical operational efficiency: a Prime Vendor flywheel that locks in customers with 98% retention rates over five years, then systematically converts their third-party purchases to higher-margin Medline Brand products. This is achieved through supply chain audits, standardization programs, and manufacturing ownership—eliminating intermediaries, redundancies, and procurement bottlenecks. The result is a frictionless experience for healthcare providers, driving approximately 14% year-over-year growth over the past decade with nearly 90% organic expansion.

Medline's integrated business model is engineered for scale and profitability. With Medline Brand products generating 84% of EBITDA despite representing only 49% of sales, the company has built network effects that compound with every Prime Vendor contract. This infrastructure enabled remarkable resilience: revenue grew 17% during the 2008-2009 financial crisis and 11% annually during the COVID-19 pandemic—demonstrating that vertically integrated healthcare supply is not just more efficient, but structurally more durable than fragmented legacy systems.

Introduction

Medline operates as a healthcare infrastructure company. The company proved that vertical integration could solve real-world problems in medical supply chains—not through consolidation alone, but through radical operational efficiency. Starting with medical-surgical manufacturing in 1966, Medline has built a vertically integrated platform spanning product manufacturing, global sourcing, distribution logistics, and supply chain optimization—all supported by 69 distribution centers and 2,000 owned trucks. By replacing fragmented supplier networks, inefficient procurement processes, and duplicative logistics with its Prime Vendor model and next-day delivery capabilities, Medline aligns with how healthcare supply chains should work: fast, cost-effective, and frictionless from hospital requisition to bedside delivery.

This infrastructure powers scale and profitability. Medline's incentives are fundamentally aligned with its customers': the company earns higher margins only when hospitals achieve cost savings by converting third-party products to Medline Brand alternatives. With 33 manufacturing facilities and 500 global sourcing partners delivering superior quality at lower prices, Medline operates at margins that allow continuous reinvestment in customer value while maintaining profitability. The result is a network-led flywheel: hospitals adopt Prime Vendor agreements for logistics efficiency, purchase Supply Chain Solutions for breadth, and convert to Medline Brand products for savings. In typical acute care relationships, Medline Brand starts at 10% of product mix but reaches 60% over time—demonstrating steadily accelerating adoption and deepening customer lock-in reinforced by a 98% retention rate.

The market shift is foundational. The medical-surgical products and supply chain markets Medline serves represent $375 billion in global opportunity, yet healthcare providers remain underserved by fragmented suppliers and face ongoing margin pressure requiring cost optimization. Medline is positioned for this inflection point: the company has grown revenue every year since inception at an 18% compound annual growth rate, holds leading positions across key product categories, and serves all 100 largest U.S. health systems—using proprietary logistics and a customer-centric culture purpose-built to become the infrastructure layer connecting manufacturers, distributors, and care providers across the entire healthcare continuum.

History

Medline began with a direct challenge to healthcare supply chain orthodoxy: hospitals could be served by a single, vertically integrated partner rather than a fragmented network of manufacturers and distributors. For decades before Medline's founding, medical-surgical procurement operated on inefficient legacy systems—hospitals navigating dozens of supplier relationships, manual inventory management, delayed deliveries, and opaque pricing. Healthcare providers waited days for critical supplies. Procurement teams paid premium prices for basic products. The infrastructure was expensive, slow, and fragmented by design.

Jim and Jon Mills, starting in Evanston, Illinois in 1966, saw an opening. After recognizing that hospitals needed more than just products—they needed supply chain solutions—the Mills family built Medline with a thesis that vertical integration could transform healthcare logistics end-to-end, cutting costs by up to 30% while maintaining quality and service levels. The model was intentionally contrarian: manufacture proprietary products rather than simply distribute third-party brands, replace fragmented supplier networks with consolidated Prime Vendor relationships, and create a flywheel where efficiency compounds with every customer conversion.

What started as a medical-surgical manufacturer evolved into vertically integrated healthcare supply infrastructure. Medline opened its first manufacturing facility in 1968, establishing direct production capabilities. By 1997, the next generation—Charles N. Mills, Andrew J. Mills, and James D. Abrams—accelerated transformation by adopting the Prime Vendor model twenty-eight years after founding. Customers adopted rapidly: from a focused hospital manufacturer to serving all 100 largest U.S. health systems, with Prime Vendor relationships reaching over 1,300 by 2024 representing $16 billion in annual sales.

In October 2021, Medline entered a new chapter with majority investment from Blackstone, Carlyle, and Hellman & Friedman—one of the largest leveraged buyouts since the financial crisis. Across economic cycles—the 2008-2009 financial crisis, COVID-19, and ongoing healthcare margin pressure—Medline's integrated model proved resilient. Revenue grew every year since inception at an 18% compound annual rate. As of December 31, 2024, the company had built 69 global distribution centers, owned 2,000 trucks, and cataloged 335,000 products—generating $25.5 billion in revenue with Medline Brand products delivering 84% of segment EBITDA on just 49% of sales.

Risk factors

Medline operates in a capital-intensive, highly regulated, and consolidated healthcare supply landscape, where operational complexity, customer concentration, competitive pressure, and global sourcing dependencies can materially impact growth, profitability, and market positioning. Below are the primary risks associated with Medline's business model.

Global Sourcing and Trade Exposure Create Cost Volatility

Medline imports a significant percentage of products from outside the United States, including 8% of cost of goods sold from China in 2024. Tariffs, trade restrictions, currency fluctuations, port congestion, and geopolitical disruptions—including ongoing conflicts in Ukraine and the Middle East—directly impact freight costs and product availability. Rising shipping expenses in 2022 already pressured margins, and Red Sea shipping disruptions demonstrate ongoing vulnerability to global logistics instability.

Customer and GPO Concentration Amplifies Revenue Risk

The top five U.S. customers represented 10.4% of 2024 net sales, while 67% of consolidated revenue flowed through three major Group Purchasing Organizations (Vizient, Premier, HealthTrust). Loss of a major healthcare system or GPO contract—due to consolidation, competitive displacement, or contract non-renewal—could cause sudden revenue declines. Healthcare industry consolidation creates larger enterprises with greater negotiating power, intensifying pricing pressure and margin compression.

Prime Vendor Conversion Depends on Execution and Customer Acceptance

Medline's flywheel assumes systematic conversion of third-party products to higher-margin Medline Brand alternatives, targeting $4 billion in conversion opportunity representing $1 billion in incremental gross profit at 100% adoption. Execution risk is substantial: hospitals may resist standardization, clinical preferences may favor incumbent brands, or quality issues could stall adoption. Conversion timelines extend over years, and achieving historical 10% to 60% penetration rates requires sustained operational excellence and customer trust.

Competitive Pressure from Online Commerce and Technology Shifts

Traditional distribution models face disruption from Amazon and online commerce platforms, where Medline forfeits pricing control and pays platform fees. Failure to adapt to e-commerce, anticipate technology changes, or maintain data governance capabilities could erode competitive positioning. Additionally, labor shortages, unionization efforts, and employee retention challenges threaten operational continuity across 33 manufacturing facilities, 69 distribution centers, and 2,000-truck logistics networks.

Market Opportunity

The healthcare supply chain infrastructure landscape is experiencing a structural inflection point. Medline addresses a $375 billion annual revenue opportunity by delivering vertically integrated manufacturing, distribution, and supply chain optimization across the full continuum of care.

Displacing Fragmented Medical-Surgical Infrastructure

Medline's primary opportunity lies in replacing fragmented, inefficient procurement across acute and non-acute care settings. The U.S. represents $175 billion in addressable market spanning hospitals, surgery centers, physician offices, dental practices, animal health, and post-acute facilities. International markets add $200 billion, with Medline currently capturing only 6.9% of sales outside the United States—leaving substantial expansion room as global healthcare systems adopt Prime Vendor models and consolidated supply chain partnerships.

Legacy procurement systems remain burdened by dozens of supplier relationships, manual inventory management, delayed deliveries, and opaque pricing. Medline collapses complexity through next-day delivery to 95% of U.S. customers and systematic conversion from third-party products to higher-margin Medline Brand alternatives—creating compelling unit economics for both hospitals and the company.

Despite serving all 100 largest U.S. health systems and holding over 1,300 Prime Vendor relationships representing $16 billion in 2024 sales, Medline penetrates a fraction of the total opportunity. The $4 billion conversion opportunity in existing Prime Vendor accounts alone represents $1 billion in incremental gross profit at full adoption, demonstrating embedded growth without new customer acquisition.

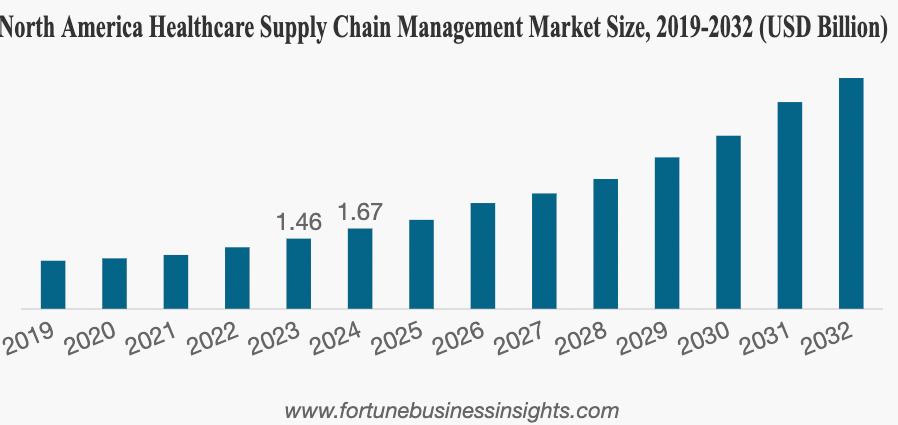

Structural Tailwinds Persist

Healthcare demand is uniquely insulated from macroeconomic cycles—U.S. healthcare spending has increased every year for six decades and is projected to grow 5.6% annually through 2032, outpacing GDP growth. Demographic forces compound: aging populations and rising chronic disease prevalence drive elevated procedure volumes and sustained expenditure growth regardless of economic conditions.

Market dynamics enhance opportunity: hospitals operating at razor-thin margins urgently need cost reduction; procedures migrating from high-cost hospitals to lower-cost ambulatory settings expand addressable sites of care; healthcare consolidation creates larger purchasing entities seeking integrated supply partners; and recent supply chain disruptions validate demand for resilient, in-stock inventory with short delivery timeframes.

Building the Infrastructure Layer

Medline's long-term vision: becoming the central infrastructure layer for healthcare supply as vertical integration reaches critical mass across all care settings globally—every product manufactured or sourced, every Prime Vendor contract, and every Medline Brand conversion strengthening network effects and expanding addressable markets into international acute care, specialized non-acute segments, and adjacent healthcare categories spanning hundreds of billions in annual volume.

Product

Medline operates a vertically integrated, manufacturing-native healthcare supply platform—spanning product development, global sourcing, distribution, and supply chain optimization—designed to replace fragmented, high-cost procurement with a single, efficiency-driven stack.

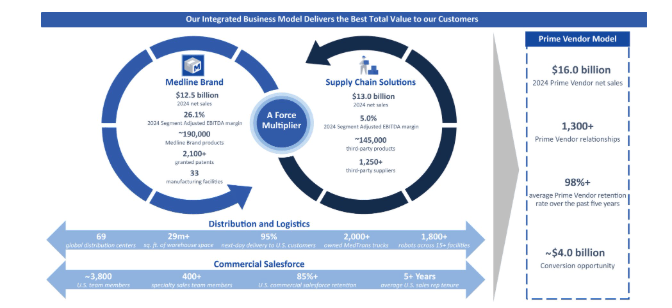

Two-Segment Model: Manufacturing Meets Distribution

Medline Brand generates 49% of sales but 84% of segment EBITDA through 190,000 products across Front Line Care (gloves, protective apparel, incontinence care), Surgical Solutions (procedure kits, surgical drapes, wound care), and Laboratory and Diagnostics. Supply Chain Solutions delivers 51% of sales and 16% of EBITDA by distributing 145,000 third-party products from 1,250 suppliers alongside supply chain optimization services—consulting, warehouse management, put-away-ready packaging, inventory rationalization, and AI-powered demand forecasting through a Microsoft partnership announced October 2024.

Manufacturing as Competitive Moat

Medline produces one-third of Medline Brand products through 33 facilities (26 in North America), focusing on automation-driven categories where technology delivers superior quality at lower cost. The company is the largest surgical kitting manufacturer in the United States, producing 900,000 procedure trays daily across facilities in Nuevo Laredo and Mexicali, Mexico—employing over 9,300 people. These trays streamline surgical workflows by pre-packaging supplies, reducing waste and prep time while locking in customer relationships through clinical integration.

For the remaining two-thirds, Medline leverages 500 global sourcing partners across 40 countries with 300 exclusive relationships—some spanning 30 years. No single supplier exceeds 4% of total spend, ensuring supply chain resilience. A 2,400-person quality team embedded across manufacturing and sourcing locations maintains a 99.99% complaint-free rate while launching 268 new products over three years based on direct customer feedback.

Prime Vendor Flywheel

The business model compounds through long-term Prime Vendor agreements (typically five-year terms) where hospitals consolidate med-surg purchasing through Medline. Contracts begin at 65% Supply Chain Solutions and 35% Medline Brand but systematically convert toward 60% Medline Brand over time—expanding from 10% penetration in acute care relationships. This conversion unlocks $4 billion in existing customer opportunity representing $1 billion in incremental gross profit at full adoption, driving higher margins while delivering 20-30% cost savings to hospitals through standardization and pricing efficiency.

Business Model

Medline's model is vertically integrated, manufacturing-native, and margin-compounding—built as low-cost infrastructure that shares efficiency gains with healthcare providers while reinforcing customer lock-in through the Prime Vendor flywheel.

Two-Segment, High-Margin Architecture

1) Medline Brand

Economics: 27% adjusted EBITDA margin driven by owned manufacturing (33 facilities producing one-third of products) and exclusive sourcing relationships (300 of 500 partners). Customers pay 20-30% less versus third-party alternatives while Medline captures margin that traditionally flows to external suppliers. Mix: Front Line Care, Surgical Solutions, Laboratory and Diagnostics across 190,000 SKUs. Why it matters: Profit engine that funds reinvestment in distribution infrastructure and customer value. Conversion from third-party to Medline Brand is the core value creation mechanism—existing Prime Vendor accounts hold $4 billion in conversion opportunity representing $1 billion in incremental gross profit at full adoption.

2) Supply Chain Solutions

Economics: 5% adjusted EBITDA margin distributing 145,000 third-party products from 1,250 suppliers with contractual distributor markups. Low margin but strategically essential—provides one-stop-shop breadth that wins Prime Vendor contracts and creates visibility into customer purchasing patterns. Services include consulting, warehouse management, put-away-ready packaging, and AI-powered inventory optimization (Microsoft partnership, October 2024). Mix: 24% of Adjusted Net Revenue. Provides customer acquisition mechanism and data foundation for Medline Brand conversion.

Low-Cost, Scale-Driven Operating Model

Distribution replaces fragmentation: 69 global facilities spanning 29 million square feet, 2,000 owned MedTrans trucks delivering 80% of U.S. volume, next-day delivery to 95% of customers. Route density improves with scale—more customers per route lowers per-unit delivery cost. Result: 99% service levels and $4.5 billion inventory enable reliable fulfillment while competitors struggle with stockouts.

Manufacturing eliminates intermediaries: Largest U.S. surgical kitting manufacturer producing 900,000 trays daily. Automation and technology focus drives quality improvements and cost reductions impossible for third-party suppliers. 2,400-person quality team maintains 99.99% complaint-free rate while launching 268 products over three years based on direct customer feedback.

Prime Vendor Flywheel Compounds Customer Value

Land with logistics efficiency (consolidate fragmented suppliers) → audit total spend and identify conversion opportunities → convert third-party to Medline Brand (10% to 60% penetration over relationship lifecycle) → capture margin expansion while delivering 20-30% customer savings → reinvest in distribution, quality, innovation → deepen lock-in (98% retention over five years).

Management Team:

James M. Boyle – Chief Executive Officer

James M. Boyle has served as CEO since 2023 and as a member of the board of directors since 2023. He previously served as Executive Vice President (2018–2023), managing Medline's customer base across the continuum of care with responsibility for strategic direction and execution of all commercial functions, distributed products business, operations, and logistics. Boyle's 29-year tenure began in 1996 as a sales representative in San Antonio, Texas, progressing through roles including Sales Trainer, Senior Account Manager, Division Vice President, and Senior Vice President. His deep operational experience and customer-facing background position him to execute Medline's Prime Vendor flywheel and Medline Brand conversion strategy. James graduated from Texas A&M University with a B.S. in Industrial Distribution.

Michael B. Drazin – Chief Financial Officer

Michael B. Drazin has served as CFO since 2018. He previously held senior finance roles at Illinois Tool Works Inc., including Vice President of Global FP&A and Investor Relations (2016–2018), Vice President of Global Financial Planning & Analysis (2014–2018), and Group Controller (2008–2014). Earlier, Drazin served as Group Controller at Click Commerce, CFO at Presutti Laboratories and Silicon Valley Internet Capital, Controller at CloudShield Technologies, and Senior Auditor at Arthur Andersen LLP. His multi-industry finance leadership and public company experience support Medline's return to public markets following the 2021 leveraged buyout. Michael holds a B.S. from the University of Illinois at Urbana-Champaign and an M.B.A. from Northwestern University's Kellogg School of Management.

Stephen L. Miller – Chief Operating Officer

Stephen L. Miller has served as COO since January 2025. He joined Medline in 2022 as Executive Vice President of Supply Chain. Previously, Miller served as Walmart's Senior Vice President of Fulfillment Operations (2020–2022) and Vice President of People for U.S. Supply Chain (2018–2020). Earlier roles included supply chain, manufacturing operations, corporate strategy, and human resources positions at Goodyear (four years) and Kimberly-Clark (19 years). His extensive logistics and operations expertise strengthens Medline's 69-facility distribution network and 2,000-truck fleet. Stephen holds a B.S. in Business Logistics from Penn State University.

Investment

Medline's path to public markets signals institutional validation—from family-owned manufacturer to private equity-backed infrastructure leader targeting the largest IPO since 2021. The Illinois-based company set terms to offer 179 million shares on Nasdaq with an indicative price range of $26 to $30 per share. If fully subscribed at the upper end, the offering would raise $5.37 billion at a $55 billion valuation, with pricing scheduled for December 16, 2025.

The inflection arrived in October 2021, when Blackstone, Carlyle, and Hellman & Friedman acquired majority control in a $34 billion leveraged buyout—the largest LBO since the 2007-2009 financial crisis and the fourth-largest LBO financing of all time. The consortium brought institutional capital and operational expertise to accelerate global expansion, infrastructure investment, and manufacturing scale while preserving Medline's customer-centric culture under Mills family leadership. Over four years, private equity ownership delivered: revenue grew roughly $5 billion since the buyout, Prime Vendor relationships expanded to over 1,300 representing $16 billion in annual sales, and the company maintained profitability through economic volatility.

Morgan Stanley, Bank of America, and JPMorgan are leading the transaction, positioning Medline among the largest U.S. healthcare listings on record—rivaling HCA Healthcare's 2011 debut of 126.2 million shares at $30 per share. The scale validates Medline's thesis: vertically integrated healthcare supply infrastructure has crossed from family business to essential capital markets-grade platform. With total institutional backing spanning global private equity and Wall Street underwriters, Medline exits the LBO cycle as a capital-efficient, Prime Vendor-led operating model aligned to healthcare consolidation trends and long-term infrastructure dominance across a $375 billion global addressable market.

Competition

The medical-surgical supply landscape is dominated by incumbent manufacturers, distributors, and legacy procurement models—organizations built on fragmented supplier relationships, manual inventory management, and bilateral pricing negotiations. Medline takes a different approach: a vertically integrated platform unifying manufacturing, global sourcing, distribution logistics, and supply chain optimization under the Prime Vendor model.

The Obvious Competition:

Pure Manufacturers — 3M, Becton Dickinson, and Surgical Solutions providers make high-margin products but lack direct distribution relationships. Strong brands and clinical trust, but no logistics infrastructure, Prime Vendor contracts, or ability to deliver next-day across 335,000 SKUs versus Medline's integrated stack.

Pure Distributors — McKesson, Cardinal Health, and Owens & Minor move boxes at scale with established hospital relationships, but low margins (5% segment EBITDA), no proprietary manufacturing, and limited product differentiation versus Medline's 27% Medline Brand margins and conversion flywheel.

Self-Distribution Models — Large health systems building internal supply chains to capture distributor margins. Capital-intensive infrastructure, lack of purchasing scale, and complexity managing 1,250+ supplier relationships versus Medline's consolidated model.

Online Commerce Platforms — Amazon Business and digital marketplaces challenge traditional relationships. Broader consumer reach and technology infrastructure, but Medline forfeits pricing control, pays platform fees, and loses product placement differentiation when selling through third parties.

Group Purchasing Organizations — Vizient, Premier, HealthTrust aggregate hospital buying power to negotiate prices. Medline competes through these channels (67% of 2024 sales flow through top three GPOs) but faces pricing pressure as organized buying groups leverage scale to compress margins.

The primary headwind is procurement inertia: hospitals have invested in existing supplier relationships; administrators resist standardization; clinical staff prefer incumbent brands. Medline overcomes this with superior unit economics—20-30% cost reduction, 99% service levels, next-day delivery to 95% of customers, and Prime Vendor consolidation unavailable elsewhere.

How Medline Competes

Medline's moat is built around vertical integration and Prime Vendor lock-in:

Manufacturing + Distribution stack: 33 facilities producing proprietary products → 500 global sourcing partners → 69 distribution centers → 2,000 owned trucks—one ecosystem versus fragmented vendors

Prime Vendor operating system: Consolidates procurement, audits total spend, converts third-party to Medline Brand at 20-30% savings—eliminating supplier complexity

Aligned economics: Medline Brand earns 27% margins enabling reinvestment in customer value; hospitals save 20-30% while Medline captures margin expansion

Standardization: Surgical kitting (900,000 trays daily), put-away-ready packaging, AI-powered inventory optimization eliminate workflow inefficiencies

Retention infrastructure: 98% Prime Vendor retention over five years; 10% to 60% Medline Brand penetration trajectory demonstrates deepening lock-in

Competition remains intense—from specialized manufacturers, scaled distributors, self-distribution models, and e-commerce platforms—but Medline's vertically integrated, Prime Vendor-led, manufacturing-native model converts procurement fragmentation into sustainable competitive advantage.

Financials

Financial Performance and Operating Metrics

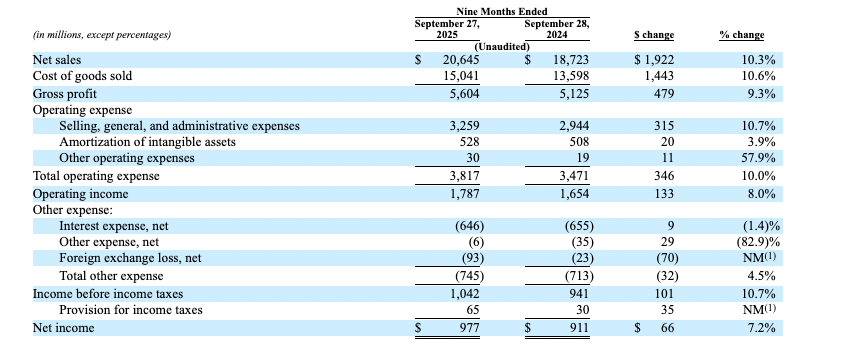

Medline's financial profile reflects vertically integrated infrastructure scaling profitably: consistent topline growth, expanding Prime Vendor penetration, and margin improvement powered by Medline Brand conversion. Tariff headwinds and investment in growth infrastructure influenced recent profitability mix, but the business added Prime Vendor contracts, deepened customer relationships, and maintained structural cash generation.

Growth at Scale

Topline: Revenue rose 9.8% YoY to $25.5B (2024) from $23.2B (2023). 9M 2025: $20.6B (+10.3% YoY).

Mix: Medline Brand 49% of 2024 sales ($12.5B) but 84% of segment EBITDA ($3.3B at 26.1% margin); Supply Chain Solutions 51% of sales ($13.0B), 16% of EBITDA ($647M at 5.0% margin).

Profitability: Net income $1.2B in 2024 (4.7% margin) versus $234M (2023); $977M in 9M 2025 (4.7% margin). Adjusted EBITDA $3.4B in 2024 (13.2% margin), $2.7B in 9M 2025 (12.9% margin).

Ecosystem Momentum

Volume: Prime Vendor sales grew to $16.0B (2024) from $14.5B (2023), reaching $13.1B in 9M 2025 (+12.1% YoY).

New relationships: $664M incremental 2024 sales from contracts signed; $8B in annual contract value added over six years.

Existing relationships: $1.1B growth from deepening penetration (10% to 60% Medline Brand conversion trajectory).

Lost relationships: $258M attrition (98% retention rate maintained).

Customer base: Over 1,300 Prime Vendor relationships (December 2024); all 100 largest U.S. health systems served.

Geographic mix: U.S. acute care $17.5B (2024, +10.0% YoY); U.S. non-acute $6.3B (+6.1%); International $1.8B (+23.0%, including $247M from acquisitions).

Conversion Economics

Medline Brand segment grew 7.8% to $12.5B (2024), driven by:

Surgical Solutions: $4.5B in 9M 2025 (+12.9% YoY); kitting volume +$296M, OR products +$136M (including acquisitions).

Front Line Care: $4.8B in 9M 2025 (+5.5%); ReadyCare +$51M, environmental services +$29M, wound care +$25M.

Lab & Diagnostics: $751M in 9M 2025 (+7.4%); lab products +$43M.

Medline Brand Segment Adjusted EBITDA margin compressed from 26.6% (9M 2024) to 25.4% (9M 2025), primarily driven by 115 basis points from tariff-related import cost increases, partially offset by 36 basis points from lower freight costs.

Operating Discipline

Gross margin: 27.3% (2024) versus 25.3% (2023); driven by 270 bps from sourcing savings, offset by 67 bps from labor costs. 9M 2025: 27.1% versus 27.4% (9M 2024); 56 bps tariff headwind partially offset by 38 bps sourcing gains.

SG&A: $4.1B in 2024 (+6.2% YoY); $160M higher compensation (9M 2025) for headcount investments, $68M from acquisitions, $40M distribution expenses.

Interest: $864M in 2024 (-11.5% YoY) from refinancing activities; $646M in 9M 2025 (-1.4%).

Closing thoughts

Medline's financial performance and strategic positioning underscore its potential to redefine how healthcare supply chains operate in an era of consolidation and margin pressure. With a vertically integrated, manufacturing-first platform, Medline has differentiated from pure-play manufacturers and commodity distributors while building infrastructure spanning product development, global sourcing, distribution logistics, and supply chain optimization. Its end-to-end offering—33 manufacturing facilities, 500 sourcing partners, 69 distribution centers, Prime Vendor model, and systematic Medline Brand conversion—creates a flywheel that strengthens as more hospitals consolidate procurement, standardized products replace third-party alternatives, and vertical integration reaches critical mass.

Bull Case: Medline's manufacturing-native, Prime Vendor-led model provides a foundation for sustained growth. The company serves over 1,300 Prime Vendor customers generating $16B in annual sales (2024), holds leading positions across key product categories, and maintains profitability with $3.4B Adjusted EBITDA (2024) and 13.2% margins. Its serviceable market spans $375B globally across acute and non-acute care settings. The $4B conversion opportunity in existing Prime Vendor accounts alone represents $1B in incremental gross profit—demonstrating embedded growth without new customer acquisition. Prime Vendor retention above 98% over five years validates structural customer lock-in.

Bear Case: Medline faces intense competition from specialized manufacturers (3M, Becton Dickinson) with superior clinical brands, scaled distributors (McKesson, Cardinal Health) with established relationships, and e-commerce platforms (Amazon) disrupting traditional procurement. Tariff exposure (8% of COGS from China) creates margin volatility—115 bps compression in 9M 2025 demonstrates vulnerability. Customer and GPO concentration—67% of sales through three GPOs, top five customers representing 10.4%—amplifies revenue risk if major contracts terminate. Healthcare consolidation creates larger buyers with greater negotiating power, intensifying pricing pressure.

Medline's combination of manufacturing scale, distribution infrastructure, and Prime Vendor economics provides structural advantage in a fragmented, margin-pressured industry. Success hinges on maintaining Prime Vendor retention as competition intensifies, executing systematic Medline Brand conversion (10% to 60% penetration over relationship lifecycles), expanding internationally (6.9% of 2024 sales versus $200B opportunity), and navigating tariff volatility while sustaining profitability. If executed, Medline is positioned to capture infrastructure economics as healthcare systems consolidate procurement and vertically integrated supply partners become essential infrastructure across the continuum of care.

Dallas Price is a Venture Builder at Forum Ventures, where he helps launch and scale six B2B SaaS startups every year through their AI Studio.

In this conversation, Dallas and I discuss:

-When Dallas looks at AI adoption, what early indicators separate real defensibility from hype-driven “wrapper” companies?

-With GPT-5 and other frontier models coming, does Dallas expect a true “platform shift,” or are most startups overestimating the impact?

-How does Dallas balance “founder chaos” vs. “studio structure”? Can a venture studio allow chaos to scale, or does structure always win?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Buy my NEW book: Buy my book on How to value a company

And that’s it from me. See you next week.