- Partner Grow

- Posts

- Navan: Travel’s Comeback IPO

Navan: Travel’s Comeback IPO

Navan S1 Deep Dive

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

In Partnership with

AI pricing is fundamentally broken. And no one has figured it out yet.

After months of research and solving billing problems for dozens of AI companies, we've written our first book: "How To Price Your AI in 2025."

Here's what we learned: Every pricing model is evolving in real time. What works today breaks tomorrow. Even OpenAI admits they're losing money on their Pro plan.

This book isn't a template you can copy and paste. Those don't exist anymore in AI. Pricing has become too volatile, too product-specific, too tied to infrastructure costs that spike unpredictably.

Instead, this is our attempt to make sense of the chaos. To show you what companies are trying, where each model fails, and why the industry is still improvising.

If you're building in AI, you need to understand this landscape not to find the "right answer," but to build a system flexible enough to adapt as everything keeps changing.

Here is your copy → https://bit.ly/4mGqqnK

Partners

Startups who switch to Intercom can save up to $12,000/year

Startups who read beehiiv can receive a 90% discount on Intercom's AI-first customer service platform, plus Fin—the #1 AI agent for customer service—free for a full year.

That's like having a full-time human support agent at no cost.

What’s included?

6 Advanced Seats

Fin Copilot for free

300 Fin Resolutions per month

Who’s eligible?

Intercom’s program is for high-growth, high-potential companies that are:

Up to series A (including A)

Currently not an Intercom customer

Up to 15 employees

Interested in sponsoring these emails? See our partnership options here.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

S1 Deep Dive

Navan is redefining corporate travel and expense management, bringing simplicity, intelligence, and connectivity to a historically fragmented industry. In a world where business travel is more than logistics—it's the foundation of relationships, innovation, and growth—Navan delivers an end-to-end platform that empowers road warriors, executives, finance teams, and suppliers alike.

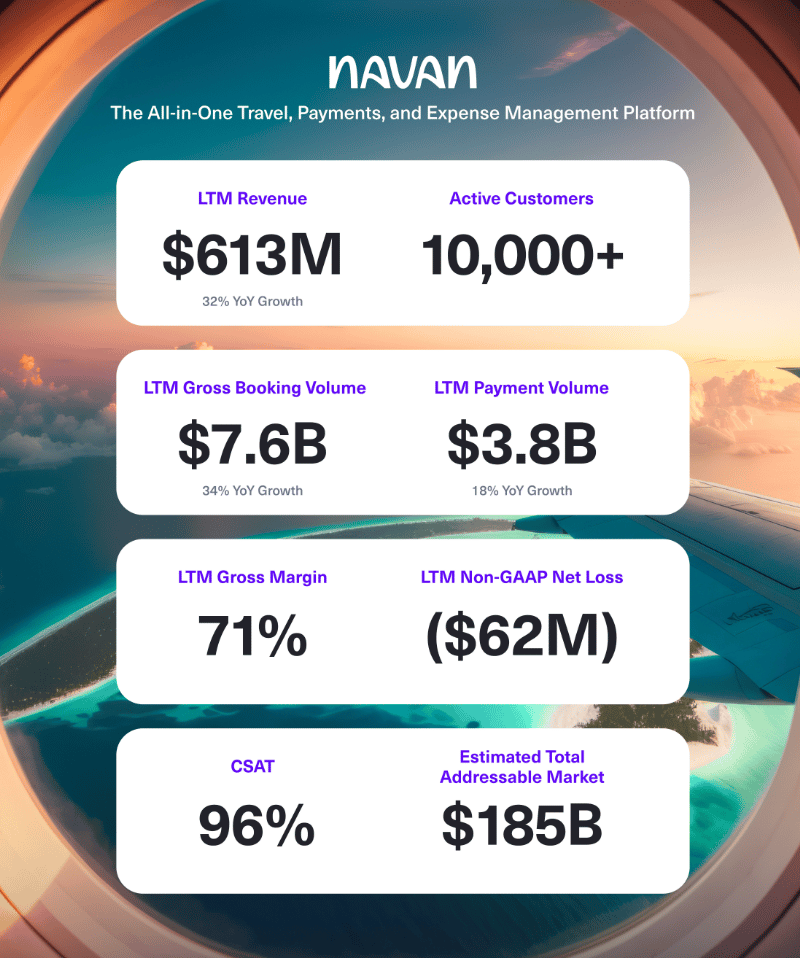

Since its founding, Navan has built a global ecosystem that unifies travel booking, payments, expenses, meetings, and events under one AI-powered platform. With more than 10,000 active customers and a CSAT score of 96%, Navan is trusted by organizations to deliver delightful user experiences, financial control, and supplier access—all within a single system.

At the heart of Navan’s strategy is its proprietary AI framework, Navan Cognition. This infrastructure powers intuitive booking, real-time policy guidance, and virtual agent support that resolves most issues in minutes. In fiscal 2025, 90% of bookings were made online or via mobile, and users booked trips in just seven minutes on average—far faster than the industry’s 45-minute benchmark. By integrating these efficiencies, Navan delivers a level of speed and personalization unmatched by legacy players.

Navan’s model creates a powerful flywheel: satisfied travelers drive higher adoption, which increases visibility and savings for customers, attracting more suppliers who want direct access to high-value business travelers. This self-reinforcing ecosystem strengthens margins, enhances loyalty, and scales efficiently across industries and geographies.

The results are clear. Revenue grew 33% year-over-year to $537 million in fiscal 2025, while net losses narrowed by 45% as margins improved from 60% to 68%. With $7.6 billion in gross booking volume and $3.7 billion in payments processed, Navan is emerging as the category leader in AI-powered travel and spend management.

Navan is not just modernizing corporate travel—it is building the future of global business connections, where technology transforms every interaction into an experience that benefits users, customers, and suppliers alike.

Introduction

Navan is redefining corporate travel and expense management with a mission to simplify and elevate the global business travel experience. Built on a foundation of connectivity and intelligence, Navan brings together travelers, finance teams, and suppliers on one integrated platform—replacing clunky, fragmented systems with speed, transparency, and AI-powered personalization.

At its core, Navan is designed to deliver meaningful impact for every stakeholder in the ecosystem. For travelers, the platform reduces booking times from an industry average of 45 minutes to just seven, while automating policy guidance, expense reporting, and trip changes through its proprietary AI framework, Navan Cognition. For finance teams, Navan offers real-time visibility, cost control, and compliance oversight. And for suppliers, it creates direct access to high-value corporate travelers through a seamless, global distribution network.

This integrated approach has fueled strong adoption and loyalty. As of fiscal 2025, Navan supported more than 10,000 customers, with 36% using three or more products. Gross booking volume reached $7.6 billion, while revenue grew 33% year-over-year to $537 million. At the same time, disciplined execution reduced net losses by 45% and expanded gross margins from 60% to 68%, powered in part by AI-driven virtual agents that now resolve nearly half of all support interactions.

Navan’s model creates a powerful flywheel: satisfied travelers drive greater engagement, which strengthens cost control for companies and expands access for suppliers. This virtuous cycle not only enhances customer experience but also reinforces Navan’s competitive advantage at scale. With Navan Cloud providing global, real-time inventory and Navan Cognition powering automation and personalization, the platform is built to scale across industries and geographies.

Navan is not just modernizing corporate travel—it is building the future of business connection. By aligning the needs of users, customers, and suppliers, and embedding AI at its core, Navan is creating a smarter, more rewarding ecosystem where every participant benefits.

History

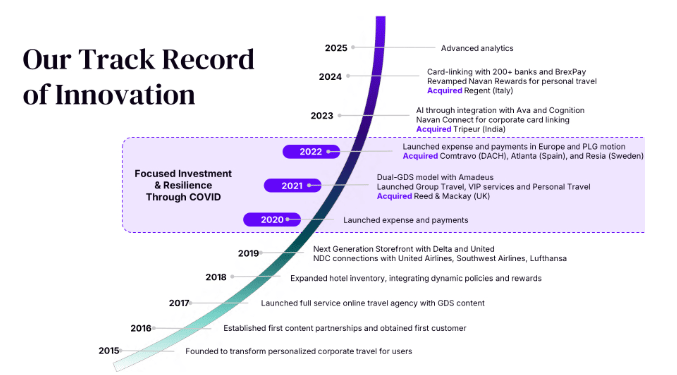

Navan, Inc. (formerly TripActions) is a privately held American corporate travel and expense management company headquartered in Palo Alto, California, founded in May 2015 by Ariel Cohen and Ilan Twig.

Navan began its journey with a simple conviction: business travel shouldn’t be a maze of legacy systems, phone queues, and after-the-fact expense pain. Founded to serve the people who make business happen—road warriors, executives, finance teams, EAs, and program admins—Navan set out to build a modern, end-to-end platform that treats travel as a strategic advantage, not an operational burden.

In the early years, the focus was clear: reimagine corporate travel from first principles. What started as a better way to search and book quickly evolved into a comprehensive travel stack with real-time inventory, policy-aware workflows, and mobile-first experiences. Along the way, the company embraced a new identity—Navan—reflecting its broader ambition to unify travel, payments, and expenses on a single, global platform.

The inflection came during the most difficult chapter for the industry. As travel slowed, Navan went back to the lab and built the expense and payments foundation that customers had long wanted but legacy vendors couldn’t deliver. The result was a full spend platform that pairs intuitive booking with next-generation expense management—eliminating receipt chasing, shrinking reconciliation cycles, and giving finance teams real-time visibility and control.

From day one, Navan believed AI would be central to compressing time and elevating service. That belief led to Navan Cognition—its proprietary AI framework—and the deployment of specialized virtual agents that now handle a significant share of user interactions. Booking times dropped to minutes, policy compliance moved in-line and in-context, and support scaled without sacrificing quality. Customer love followed: a 96% CSAT overall, a virtual-agent CSAT on par with human agents, and an NPS of 43 for the six months ended July 31, 2025.

As adoption deepened, a flywheel emerged. Delighted travelers used Navan more, which expanded visibility and savings for customers and attracted suppliers eager to reach high-value corporate demand. With Navan Cloud aggregating global supply—over 600 airlines via GDS/NDC/LCCs and more than two million lodging properties—choice and competitiveness improved, reinforcing the network effect across users, customers, and suppliers.

Today, Navan’s platform spans travel, payments, and expense, with 36% of customers attached to three or more offerings. The company’s financial profile reflects disciplined scale: revenue growth alongside improving margins and narrowing losses, powered by automation and AI-driven service. The mission remains unchanged: connect every stakeholder in business travel on one integrated, AI-first platform—and make the experience so fast, precise, and rewarding that everyone wins.

Risk factors

Navan operates in a dynamic, competitive, and highly sensitive industry, where multiple internal and external risks could materially affect growth, profitability, and long-term market positioning. Below are the primary risks associated with its business model:

1. Challenges of Sustaining Rapid Growth

Navan has experienced rapid expansion in recent years, but these growth rates may not continue indefinitely. Scaling operations has increased costs across the organization, and failure to manage growth effectively could strain infrastructure, talent, and controls. As Navan expands into new markets and offerings, execution risk remains high.

2. Dependence on Travel Management Offerings

A substantial portion of Navan’s revenue is tied to its Travel Management products. Any prolonged downturn in global travel—driven by macroeconomic conditions, pandemics, geopolitical conflicts, or climate-related disruptions—would directly impact revenue and platform usage. Even short-term systemic disruptions, such as flight cancellations or airport delays, increase operating costs and harm margins.

3. Exposure to Macroeconomic Instability

Factors outside Navan’s control—rising interest rates, inflation, currency fluctuations, banking instability, or recessions—have already led to demand fluctuations in T&E budgets. Political unrest, visa restrictions, terrorism threats, or wars (such as in Ukraine or the Middle East) further create volatility in global travel patterns. These uncertainties make forecasting difficult and could hinder Navan’s strategic initiatives.

4. Shifts in Business Travel Behaviour

The rise of remote and hybrid work models has permanently changed travel dynamics. While in-person meetings have rebounded, some companies continue to favor virtual conferencing tools, particularly smaller businesses with limited T&E budgets. Any lasting shift toward reduced business travel would weaken demand for Navan’s offerings and slow adoption of additional products like Meetings, VIP, and Bleisure.

5. Market Fragmentation

Navan competes against both large, entrenched players with significant resources and newer, digital-native entrants leveraging AI. Customers may choose alternative platforms that offer lower pricing, broader inventory, or deeper integrations. Intense competition could pressure margins, increase marketing spend, and limit Navan’s ability to expand wallet share across existing customers.

6. Expansion Risks

Navan’s growth strategy relies on landing new customers with Travel Management and then expanding wallet share through Expense Management, Payments, and other offerings. If adoption of these additional solutions lags—particularly among cost-sensitive SMBs in the unmanaged travel market—Navan’s growth flywheel could slow. Non-renewal of subscriptions, reduced travel budgets, or IT spend scrutiny may further impact retention.

7. Operational and Integration Risks

As Navan scales and pursues acquisitions or partnerships, operational complexity increases. Managing multiple supplier, banking, and technology relationships adds execution risk. Systems integration, internal controls, and employee training may lag behind business growth, leading to inefficiencies, compliance issues, or customer dissatisfaction.

8. Technology and AI Execution Risks

Navan’s differentiation hinges on Navan Cognition and its AI-driven virtual agents. While adoption has been strong, failures in AI accuracy, security, or reliability could erode customer trust. Continued investment in AI capabilities is required to stay ahead of competitors, and delays or underperformance in these initiatives would weaken the platform’s value proposition.

9. Regulatory and Sustainability Risks

Corporate travel is increasingly impacted by regulatory oversight, climate change policies, and sustainability initiatives. Governments and enterprises may impose stricter reporting or travel restrictions tied to environmental goals. Failure to adapt to evolving regulatory and ESG requirements could reduce Navan’s competitiveness and limit supplier or customer partnerships.

10. Dependence on and Customer Experience

Navan’s success is built on simplifying a historically frustrating process. Any data breach, system outage, policy misalignment, or decline in service quality could undermine its reputation. In an industry where trust and reliability are paramount, even isolated negative incidents risk customer churn, reputational harm, and long-term adoption challenges.

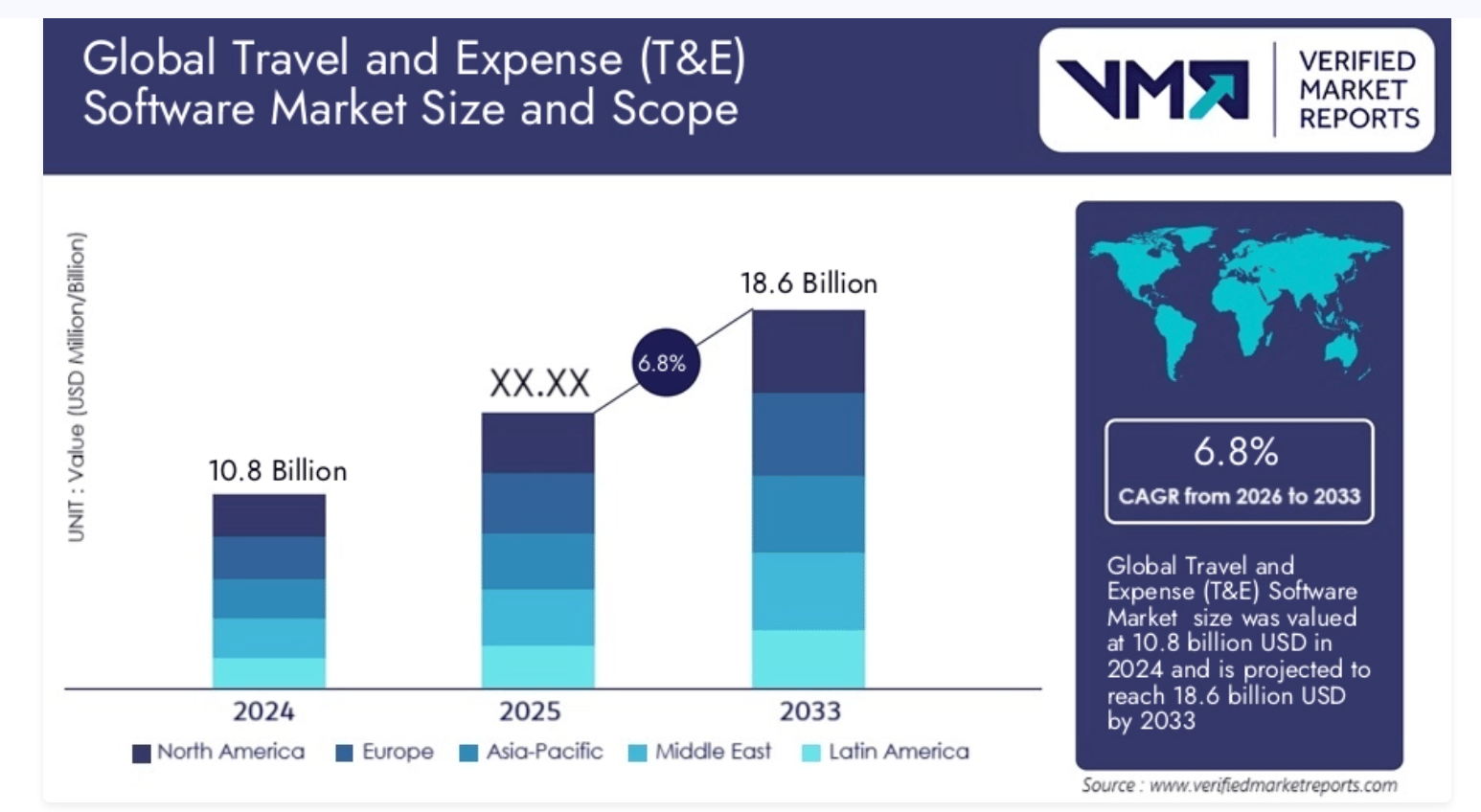

Market Opportunity

The global travel and expense (T&E) landscape presents a vast opportunity for disruption, and Navan is strategically positioned to lead this transformation. By unifying travel, expense management, payments, and bleisure under one AI-powered platform, Navan addresses a multi-layered market opportunity that extends well beyond traditional travel management models.

Expanding Market Leadership

Navan’s current market opportunity is rooted in its ability to serve organizations of all sizes with a modern, integrated platform. The company estimates its Serviceable Addressable Market (SAM) at $185 billion in annual revenue across four categories:

Business Travel Management: $86 billion revenue opportunity across both managed and unmanaged categories.

Bleisure Travel: $24 billion revenue opportunity, derived from a $324 billion serviceable market with a 7% usage yield in fiscal 2025.

Expense Management: $39 billion revenue opportunity based on global SMB adoption and average revenue per customer.

Payments: $37 billion revenue opportunity, calculated from $3.1 trillion in commercial card spend with Navan’s estimated net interchange yield.

Despite significant traction, Navan penetrates only a fraction of this market today, leaving substantial room for expansion across industries and geographies.

Validating Market Resilience

Even in the face of macroeconomic uncertainty, business travel demand has remained resilient. The Navan Business Travel Index (BTI)—a proprietary measure based on spend and booking activity—indicates that business travel grew at an annualized rate of 15% between April 1, 2025 and June 30, 2025 compared to the same period in 2024. This proprietary data underscores that travel remains a strategic priority for global enterprises, reinforcing Navan’s relevance.

Addressing Additional Corporate Needs

Navan’s growth strategy extends beyond travel management into broader T&E workflows, positioning the company to capture adjacent revenue pools. Opportunities include:

Corporate Payments: Expanding Navan’s footprint in the $3.1 trillion corporate card market through deeper partnerships and new card solutions.

Expense Automation: Increasing adoption of Navan’s software-driven expense management tools to streamline reporting and compliance.

Meetings & Events: Unlocking spend categories beyond individual travel by digitizing group travel, conferences, and corporate events.

VIP & Bleisure: Serving high-value travelers with premium support while tapping into the growing demand for blended leisure and business travel.

Each of these categories creates incremental revenue opportunities while strengthening Navan’s flywheel of user adoption, customer visibility, and supplier participation.

Broadening Global Reach

Navan’s long-term vision extends far beyond its current customer base. With operations already spanning multiple continents, the company is positioned to scale its platform globally. As travel becomes increasingly digital and enterprises seek unified platforms for spend visibility, Navan’s AI-driven infrastructure provides the agility to win share across managed and unmanaged travel markets worldwide.

According to industry data and Navan’s internal estimates, the company’s $185 billion Total Addressable Market represents only the beginning. By expanding into new product categories and capturing a greater share of global T&E spend, Navan envisions itself as the central hub for enterprise travel and expense—redefining how organizations manage mobility, payments, and productivity at scale.

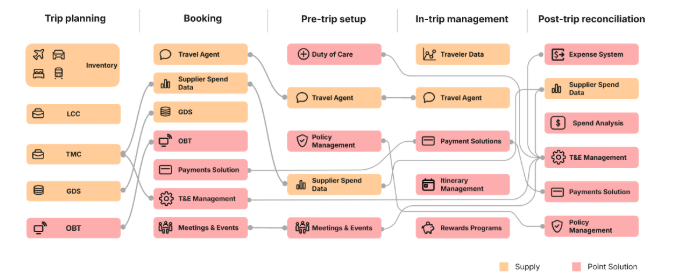

Product

Navan has built an end-to-end, AI-powered platform that unifies global travel booking, expense management, and payments—giving enterprises real-time visibility and control over T&E while delivering a consumer-grade experience to travelers. At the core is Navan Cognition, a proprietary AI framework that powers intelligent automation and decisions from pre-trip planning to post-trip reconciliation.

Platform Overview

All-in-one T&E: Integrated travel, expense, and payments in a single workflow.

AI-first: Policy-aware guidance, dynamic personalization, and virtual agents embedded across the journey.

Real-time control: Live budgets, compliance, and analytics for finance; effortless booking and changes for travelers.

Navan Cloud is the company’s proprietary aggregation layer that provides truly global, real-time inventory and pricing.

Direct Supplier Relationships: Curated partnerships with airlines, hotels, and ground suppliers deliver richer content (seating, amenities, fare classes) and, in some cases, better pricing. Navan participates in NDC standards, integrates directly with PSS and supplier APIs, and rapidly adopts new distribution updates.

API Integrations: Advanced APIs enable live availability, pricing, and content. Where APIs aren’t available, direct relationships bridge gaps to maintain breadth of choice.

Payments Ecosystem Partnerships: Deep integrations with major networks (Visa, Mastercard), connections to 200+ banks, and issuing partnerships (e.g., Brex, Rho, Citi, Barclays, Citizens) extend financial capabilities across markets.

Scale & Breadth

600+ airlines via GDS, NDC, and LCCs

2M+ lodging properties globally

Centralized access for human and virtual agents to service any booking worldwide

Why it matters: Travelers get more choice at better value; finance gets accurate, real-time spend capture; suppliers reach high-value corporate demand directly.

Navan Cognition is a third-generation, modular AI framework that combines predictive ML with the reasoning of LLMs in a supervised, graph-based workflow.

Agentic Architecture: Creates, trains, deploys, and supervises specialized virtual agents (including Ava) to execute complex tasks—modifying itineraries, validating payments with hotels pre-arrival, enforcing policy in-context, and guiding self-serve support.

Enterprise Guardrails: Compliance checks, fact validation, and supervisory flows are designed to minimize hallucinations and prevent unintended actions—aligned to a zero–critical-hallucination standard.

Measured Impact: ~50% of user interactions handled by virtual agents; CSAT 96% overall, 78% virtual-agent CSAT (on par with human agents) for the six months ended July 31, 2025.

Why it matters: Faster bookings, fewer touchpoints, higher compliance, and scalable service—at structurally better margins.

Travel

One-place planning across flights, hotels, rail, and car with personalized results based on preferences, history, and policy.

Speed: Average booking time ~7 minutes vs. ~45 minutes through outside channels; 90% of bookings online or mobile.

Proactive assistance: Real-time trip alerts, disruption handling, and self-serve changes via Ava—escalating to live agents when needed.

Expense Management

In-line capture of receipts, per-diems, and policies during the trip; automated categorization and compliance in the flow of work.

Close faster with real-time visibility, audit-ready trails, and direct ERP integrations.

Navan Connect: Bring non-Navan corporate cards into Navan Expense for unified visibility and automated reconciliation.

Corporate Payments

Card programs and issuing partnerships embedded into the travel and expense workflow.

Live budgets & controls: Merchant/category controls, limits, and dynamic policy checks at authorization time.

Global readiness: Multi-currency support and deep network/bank connectivity for smooth international usage.

Meetings & Events

End-to-end workflows for group travel, conferences, and offsites—sourcing, attendee management, and policy-aligned bookings.

Unified data: Consolidate individual and group spend for complete T&E visibility.

Native Apps

Unified apps: Web and mobile apps share a common data layer; admin tools for travel program owners and finance.

Deep integrations: HRIS, ERP, and financial systems for real-time directory sync, policy inheritance, and automated month-end close.

Omnichannel support: Chat, phone, and virtual agents—with white label options where needed.

Policy and Compliance

Real-time dashboards: Company-level benchmarks, trends, traveler-level insights, and predictive budgeting.

Duty of care: Location visibility, alerts, and rapid outreach during disruptions or emergencies.

Global policy engine: Localized rules, tax considerations, and configurable approval flows.

Business Model

Navan’s business model is architected around a unified, AI-powered T&E platform that consolidates travel, payments, and expense into a single system of record. By replacing fragmented point solutions with a modern, automation-first stack, Navan aligns traveler delight with enterprise-grade control—turning T&E from a cost center into a strategic lever.

Platform-Led, Multi-Engine Revenue

Usage-Based Travel Revenue

Monetized through per-transaction economics on travel bookings (air, hotel, rail, car).

~90% of total revenue today; underpinned by a ~7% usage yield (take rate) on travel spend flowing through the platform.

Economics improve with mix shift to direct supplier content, NDC connectivity, and global scale via Navan Cloud.

SaaS Subscriptions (Expense & Platform Modules)

Subscription revenue from Expense Management (standalone or bundled with Corporate Payments) and admin/analytics capabilities.

~10% of total revenue today; growing faster than usage-based revenue as adoption deepens and modules expand.

Payments & Interchange (Corporate Cards and Partners)

Revenue from spend on Navan-issued virtual/physical cards and payment partnerships.

Real-time policy enforcement at authorization drives higher compliant throughput and richer data—improving loss avoidance and reconciliation speed.

Adjacencies (Meetings & Events, VIP, Bleisure)

Fee and service revenue tied to group programs, high-touch executive itineraries, and personal “bleisure” extensions that capture off-platform spend while preserving duty of care.

Low-Cost, AI-First Operating Model

Navan Cognition (Automation & Service Leverage)

Agentic AI and supervised workflows handle ~50% of user interactions, with 96% overall CSAT and 78% VA CSAT (on par with human agents).

Automation compresses time-to-resolution, reduces support burden, and structurally improves margins (LTM gross margin ~71%; most recent FY 68%, up from 60%).

Navan Cloud (Supply & Distribution Advantage)

Direct supplier relationships + NDC/PSS integrations + GDS/LCC coverage ( 600+ airlines, 2M+ lodging properties).

Global, real-time inventory increases choice, lowers content costs, and improves conversion—feeding the usage engine.

Partnered Financial Rails

Deep integrations with major networks and 200+ banks; issuing partners extend card reach without balance sheet intensity.

Open architecture (Navan Connect) lets customers bring third-party cards into Navan Expense—expanding data coverage and stickiness even when Navan is not the issuer.

Land-and-Expand GTM Flywheel

Land with Travel → Expand Across Suite

Travel booking wins the user; embedded policy and delightful UX increase adoption.

Cross-sell into Expense, Corporate Payments, Meetings & Events, VIP, and Bleisure.

As of Jan 31, 2025, 36% of customers are attached to 3+ offerings.

Data → Personalization → Compliance → Savings

More transactions drive better personalization and policy adherence.

Finance gains real-time visibility; suppliers gain more direct, high-value demand.

The network effects improve selection and price competition—driving further usage and revenue density per customer (NDR >110%).

Unit Economics

Take Rate Resilience: ~7% usage yield supported by direct content mix and premium business travel.

Margin Expansion: AI-led service + direct distribution lift gross margins (FY from 60% → 68%; LTM ~71%).

OpEx Efficiency: AI-augmented R&D and support reduce cost-to-serve while increasing ship velocity.

Revenue per Employee: ~$180K today with runway to scale as automation compounds.

Supplier & Partner Economics

Supplier Fees: Per-transaction fees; tiered incentives when volume thresholds are met.

Payments Partners: Interchange participation on Navan-issued spend; no economics on third-party cards connected via Navan Connect (data benefits preserved).

Balanced Concentration: No single customer >2% of revenue; diversified vertical mix across enterprise, mid-market, and SMB.

Why This Scales

More usage → more data → better personalization/compliance → higher savings and satisfaction.

Higher satisfaction → deeper attach (Expense, Cards, M&E) → rising ARPC and NDR.

AI leverage + direct supply → expanding margins at scale.

Management Team:

Ariel Cohen – Co-Founder, Chief Executive Officer & Chairperson

Ariel Cohen co-founded Navan (formerly TripActions) in 2015 and serves as CEO and Chairperson (since September 2022). He previously served as President from 2015 to March 2025. Before Navan, Ariel led product at Jive Software following Jive’s acquisition of StreamOnce, where he was Co-Founder & CEO. He holds a B.A. in Economics from the College of Management Academic Studies and an Executive M.B.A. from Northwestern University’s Kellogg School of Management.

Ilan Twig – Co-Founder & Chief Technology Officer

Ilan Twig co-founded Navan in 2015 and serves as CTO and Board member. Previously, he was EVP/Vice President of Engineering at Jive Software after Jive acquired StreamOnce, where he was Co-Founder & CTO. He also led engineering at RockMelt. Ilan holds a B.Sc. in Computer Science from the Academic College of Tel-Aviv, Yaffo. His deep technical stewardship and platform vision underpin Navan Cloud, Navan Cognition, and the company’s AI-first product roadmap.

Amy Butte – Chief Financial Officer

Amy Butte has served as Navan’s CFO since June 2024, after serving briefly on the Board. She brings extensive public company governance and audit expertise from Bain Capital Specialty Finance and Bain Capital Private Credit (director; audit/comp committees; chair of nom/gov), and prior board roles at DigitalOcean (audit chair) and BNP Paribas USA (audit chair; risk committee). She holds a B.A. from Yale University and an M.B.A. from Harvard Business School. Amy drives disciplined growth, capital allocation, and public-company readiness.

Michael Sindicich – President

Michael Sindicich has served as President since March 2025. He previously built and led Navan Expense as CEO and, earlier, as EVP & GM, after senior go-to-market roles across enterprise and regional sales since joining Navan in 2016. Michael holds a B.S. in Psychobiology from UCLA. He is focused on end-to-end operating execution—accelerating cross-suite adoption across Travel, Expense, and Payments, and scaling Navan’s land-and-expand motion globally.

Investment

Navan’s funding journey reflects a deliberate path of scaling from a disruptive challenger to a global leader in travel and expense management. Early rounds culminated in its Series D financing in January 2020, supported by two key investors. This stage provided the capital to expand Navan’s flagship Travel product while laying the groundwork for Corporate Payments and Expense Management. The momentum continued with multiple debt financings in 2020, including partnerships with Silicon Valley Bank and Greenoaks, which reinforced Navan’s liquidity position during a period of aggressive market expansion. A secondary market transaction led by Akkadian Ventures in mid-2020 further validated early investor conviction.

Navan’s breakout period began with a $155 million Series E round in January 2021, backed by investors such as Addition and Andreessen Horowitz. This round positioned Navan to accelerate its global footprint and double down on AI-driven innovation. Later that year, the company secured a Series F in October 2021, raising additional growth capital from six investors, led by Greenoaks, underscoring continued institutional confidence.

In 2022, Navan executed a dual capital raise strategy, combining a Series G financing in October 2022 with a concurrent debt financing led by Coatue. These transactions strengthened Navan’s balance sheet to fuel product expansion, with Goldman Sachs Bank USA also stepping in as a debt partner by December 2022.

As the market for integrated T&E solutions matured, Navan continued to enhance its financial flexibility. In April 2025, the company raised capital through a convertible note, reflecting strong investor confidence in its long-term strategy and reinforcing its ability to pursue both organic growth and strategic opportunities.

Across these successive rounds—venture equity, debt facilities, and convertible instruments—Navan has attracted a mix of world-class venture firms, growth equity partners, and top-tier financial institutions. Each stage of financing has fueled the company’s transformation from a managed travel disruptor into a vertically integrated, AI-powered T&E platform.

Competition

The global travel and expense (T&E) management market is dominated by traditional travel management companies (TMCs) such as BCD Travel, Global Business Travel Group, and SAP Concur. These incumbents operate largely as service-based businesses, built on fragmented infrastructure and dependent on third-party agencies. While they maintain strong market presence, legacy providers often struggle to deliver modern user experiences, streamlined operations, and integrated expense management capabilities.

Navan has taken a radically different approach by building a software-first, AI-powered platform on proprietary infrastructure. Unlike legacy competitors, Navan operates a higher-margin model that allows for aggressive reinvestment in product innovation, customer experience, and global expansion. This enables the company to serve a wider range of customers—from startups to large enterprises—while compounding value across its network of users, suppliers, and partners.

Legacy Travel Agencies

In addition to global TMCs, Navan competes with traditional travel agencies and online travel agencies (OTAs) that aggregate bookings for corporate and leisure travel. Players such as Expedia and Booking.com maintain broad inventory but lack the enterprise-grade tools, automation, and expense integration that Navan delivers. Similarly, loyalty programs offered by credit card providers, direct booking platforms from hotels and airlines, and facilitators of alternative accommodations (such as Airbnb) create further competition for traveler attention and wallet share.

Navan differentiates itself with a unified, end-to-end travel and expense management platform. By combining global scale, broad supplier relationships, and a highly intuitive user interface, Navan offers both the choice of OTAs and the control of enterprise-grade platforms—without the inefficiencies of legacy systems.

Expense Management

Navan’s Expense Management and Corporate Payments products face competitive pressure from specialized providers like Expensify, Brex, and Ramp, as well as horizontal enterprise solutions such as Oracle and SAP. These platforms offer discrete expense management features but lack a fully integrated link to corporate travel.

Navan’s strength lies in its ability to unify both workflows into a single platform. Customers gain real-time visibility, tighter policy controls, and automated reconciliation across travel and expense categories. With Navan Connect, the company has extended its reach even further by enabling customers to integrate any enrolled corporate Mastercard® or Visa® card—including those issued by competitors—into its Expense Management solution.

Navan competes favorably on several dimensions that create a defensible moat:

Unified, end-to-end T&E platform with global supplier access.

AI-powered personalization and automation that optimize booking, policy compliance, and support.

Ease of access and deployment, driving rapid adoption across organizations of all sizes.

Actionable analytics and intelligence for real-time spend control.

Scalable cloud infrastructure built from the ground up for speed, reliability, and security.

Customer-centric brand reputation, supported by best-in-class support across human and AI agents.

While Navan expects competition to persist and intensify with new entrants and evolving technologies, its combination of proprietary infrastructure, global scale, and AI-driven user experience positions it as a leading challenger to both legacy travel providers and point-solution fintechs.

Financials

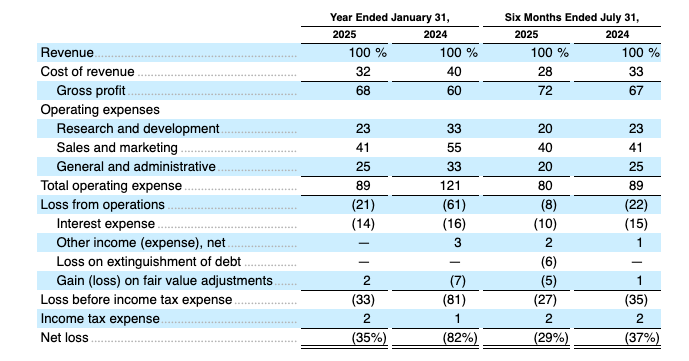

Navan’s financial performance for the year ended January 31, 2025 reflects disciplined cost management, strategic reinvestment, and the scaling of its global platform. While macroeconomic uncertainty weighed on certain areas of the travel industry, Navan continued to demonstrate resilience across operating metrics and improved operating leverage.

Operating Expenses

Research and Development (R&D)

R&D expenses decreased by 8% year-over-year, from $132.4 million in FY2024 to $122.4 million in FY2025. The decline was primarily driven by a reduction in headcount-related costs of $13.4 million, partially offset by higher stock-based compensation of $3.4 million. This reflects Navan’s continued focus on maintaining efficiency while investing in AI-driven automation and product innovation.

Sales and Marketing (S&M)

S&M expenses decreased marginally by 1% year-over-year, from $220.5 million in FY2024 to $218.7 million in FY2025. The decline was largely due to a $13.7 million reduction in sales commissions following changes in sales compensation plans, which increased the capitalization of contract acquisition costs. These savings were offset by higher advertising spend ($6.3 million) and increased personnel-related costs ($6.2 million), underscoring Navan’s ongoing investments in digital marketing and go-to-market expansion.

General and Administrative (G&A)

G&A expenses were essentially flat year-over-year, rising slightly from $133.0 million in FY2024 to $133.6 million in FY2025. The increase was driven by $2.5 million in professional services costs tied to public company readiness and recruiting, as well as the absence of a $23.0 million tax reserve release recorded in FY2024. These increases were partially offset by lower salaries and benefits ($10.0 million), reduced facilities and IT costs ($6.9 million), and improved credit management that reduced bad debt expense by $2.1 million.

Interest and Other Items

Interest Expense

Interest expense rose 20% year-over-year, from $63.3 million in FY2024 to $76.0 million in FY2025. The increase was primarily attributable to higher borrowing under Navan’s Warehouse Credit Facility and Trade Loan Facility, reflecting the company’s expanding scale and credit needs.

Other Income (Expense)

Other income shifted from $10.1 million in FY2024 to a net expense of $0.1 million in FY2025. The decline was driven by the absence of a one-time $6.7 million tax reserve release in FY2024, alongside $3.9 million in higher foreign currency losses during FY2025.

Fair Value Adjustments

Navan recorded a $12.2 million gain in FY2025, compared to a $26.6 million loss in FY2024, a favorable swing of $38.8 million. This improvement reflects changes in the fair value of embedded derivative liabilities associated with Convertible Notes.

Income Tax Expense

Income tax expense increased 76% year-over-year, from $5.4 million in FY2024 to $9.6 million in FY2025, due to higher foreign profits and nondeductible expenses.

Navan’s 2025 results reflect meaningful progress in controlling operating expenses, while simultaneously reinvesting in AI-powered platform innovation, global scale, and market expansion. R&D efficiency gains, disciplined S&M allocation, and stabilized G&A costs demonstrate the scalability of Navan’s operating model.

At the same time, higher financing costs highlight the importance of continued growth in travel volume and payments adoption to offset interest expense and foreign currency headwinds. The swing in fair value adjustments and sustained tax-related obligations underscore the complexity of managing a global business at scale.

Navan remains focused on leveraging its high-margin, software-driven model to strengthen operating leverage, expand adoption of its travel, expense, and payments platform, and position itself for long-term profitability.

Closing thoughts

Navan’s financial performance and strategic positioning highlight its potential to redefine the future of business travel and expense management. With a software-first, AI-driven platform, Navan has successfully differentiated itself from legacy travel management companies while expanding into adjacent categories like expense and payments. Its end-to-end offering—spanning travel booking, expense automation, and corporate payments—creates a powerful network effect that strengthens as more customers, travelers, and suppliers join the ecosystem.

Bull Case:

Navan’s scalable, high-margin business model provides the foundation for sustained growth. Its ability to serve customers of all sizes, from startups to global enterprises, broadens its market reach, while its $185 billion TAM across travel, expense, and payments represents a significant expansion opportunity. The company’s proprietary Navan Business Travel Index indicates robust demand, with business travel activity growing 15% year-over-year, even amid macro uncertainty. Continued investment in AI and automation enhances user experience, drives efficiency, and deepens engagement. With strong supply relationships and global scale, Navan is well-positioned to outpace legacy competitors and capture share in fragmented markets.

Bear Case:

Navan faces ongoing competitive pressure from traditional players like BCD Travel and SAP Concur, as well as emerging challengers in expense management and corporate cards such as Brex and Ramp. Rising interest expenses, foreign exchange volatility, and the complexity of operating a global platform could weigh on financial performance. Additionally, macroeconomic slowdowns may constrain travel budgets, testing the resilience of Navan’s growth trajectory. Sustained innovation, cost discipline, and differentiation will be critical to weather these challenges.

Overall:

Navan’s combination of a unified platform, modern infrastructure, and AI-driven automation provides a durable competitive edge in a fragmented, global industry. By continuing to scale its travel, expense, and payments offerings, Navan has the opportunity to become the category-defining platform for business travel and spend management. Its success will hinge on balancing growth with operational discipline, navigating competitive intensity, and leveraging its technology to deliver measurable value for customers. If executed effectively, Navan stands poised to reshape how companies around the world manage travel and expenses.

Shankar Maruwada is the co-founder and CEO of EkStep Foundation, a pioneering non-profit working to improve learning outcomes for millions of children in India through technology and learner-centric platforms.

In this conversation, Shankar and I discuss:

-India’s Aadhaar program and now DPI have become global models. What lessons should other countries learn from India’s journey?

-What role does Shankar see DPI playing in the next decade

-Should young talent still pursue computer science degrees

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Never underestimate the power of a 30-minute walk.

— Johnny Brown (@johnnyxbrown)

11:45 AM • Sep 24, 2025

fun fact: the creator of Barbie and creator of Hot Wheels were husband and wife

— Azia (@goaziago)

10:13 AM • Sep 16, 2025

The best founders aren't chasing exits. They're chasing the chance to build something their grandchildren will use.

— Saba Karim (@sabakarimm)

3:27 AM • Sep 23, 2025

In 2009, Jensen explained CUDA and estimated its market size, $NVDA stock price was at ~$0.2 split adjusted.

$10k investment in NVIDIA would turn into $8.8M

The GOAT.

— The AI Investor (@The_AI_Investor)

12:19 AM • Sep 21, 2025

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Amplify Labs: We help you grow your audience on LinkedIn, X (formerly Twitter), and newsletters.

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

And that’s it from me. See you next week.

Reply