- Partner Grow

- Posts

- Smartworks: Workspaces for Enterprises

Smartworks: Workspaces for Enterprises

Smartworks IPO Deep Dive

👋 Hi, it’s Rohit Malhotra and welcome to the FREE edition of Partner Growth Newsletter, my weekly newsletter doing deep dives into the fastest-growing startups and S1 briefs. Subscribe to join readers who get Partner Growth delivered to their inbox every Wednesday morning.

Latest posts

If you’re new, not yet a subscriber, or just plain missed it, here are some of our recent editions.

Partners

Interested in sponsoring these emails? See our partnership options here.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow rocketship.

Previous guests include Guy Kawasaki, Brad Feld, James Clear, Nick Huber, Shu Nyatta and 350+ incredible guests.

IPO Deep Dive

Smartworks in one minute

Smartworks is redefining India’s enterprise office experience—by building fully serviced, tech-enabled managed campuses for the country’s largest employers.

At a time when co-working was focused on freelancers and startups, Smartworks pioneered an enterprise-first model—transforming bare shell spaces in prime city locations into modern campuses equipped with cafeterias, gyms, crèches, sport zones, and smart retail.

Their approach: lease large, empty spaces from landlords, then design, build, and operate high-utility campuses under a single managed services platform. With proprietary tech, plug-and-play infrastructure, and workplace designs tailored for teams of 300 to 4,800+, Smartworks has become the go-to flex space operator for Fortune 500 and Indian corporates alike.

As of March 31, 2024, Smartworks is India’s largest managed office operator by total stock among benchmarked peers, with presence across 13 cities and a footprint of 8.2 million sq. ft.

The broader market opportunity is booming: India’s flexible workspace stock—currently at ~63 million sq. ft.—is expected to nearly double by 2027. With a 17% CAGR forecast, Smartworks is poised to lead this shift as companies demand cost-effective, experience-led, scalable offices.

Introduction

India is one of the fastest-growing office markets in the world—and Smartworks is reshaping how enterprises experience work.

Founded in 2016 by Neetish Sarda, Smartworks set out with a bold vision: to build India’s largest network of fully managed, tech-enabled office campuses designed for the country’s leading enterprises. At a time when flexible workspaces were largely geared toward startups and freelancers, Smartworks pioneered an enterprise-first model focused on scale, service, and experience.

Their approach goes beyond co-working. Smartworks leases large, bare-shell spaces in prime city locations, then transforms them into end-to-end campuses—complete with high-quality design, proprietary technology, and lifestyle-led amenities including cafeterias, crèches, gyms, medical centres, and smart retail. Every space is built in-house to suit companies with team sizes ranging from under 50 to over 4,800 employees.

The result? A platform that combines real estate, hospitality, and technology to deliver fully serviced campuses that meet the evolving needs of modern enterprises. As of March 31, 2024, Smartworks is the largest managed campus operator in India (CBRE Report), with a presence across 13 cities and a portfolio of 8.2 million sq. ft.

With India’s flexible workspace market projected to grow at a 17% CAGR to 116–118 million sq. ft. by 2027, Smartworks is uniquely positioned to lead this transformation—offering a future-ready workplace solution at the intersection of scale, design, and enterprise-grade efficiency.

Smartworks isn’t just building offices—it’s powering the next chapter of how India works.

History

It began in 2016 with a simple observation: India’s offices weren’t built for the future of work.

The traditional leasing model was rigid. Co-working felt too casual for serious enterprises. What was missing was a solution that combined flexibility with scale—offices designed to adapt as businesses grew, without compromising on brand, infrastructure, or privacy.

Smartworks was founded to fill that gap. In a market crowded with startups chasing freelancers and small teams, Smartworks took a different bet: focus exclusively on enterprises. From Day One, it offered managed office spaces built to spec—complete with tech-enabled access, premium amenities, and full-stack services. It wasn’t just real estate. It was an experience platform.

By 2019, the model had taken off. Smartworks crossed ₹100 crore in revenue, expanded across Tier-1 cities, and attracted institutional capital from Singapore-based Keppel Land. Even the pandemic couldn’t slow it down. While others downsized, Smartworks doubled down—rolling out its proprietary workplace app, upgrading its technology stack, and launching the first IoT-powered, touchless flex office ecosystem in India.

Then came scale.

In 2022, Smartworks signed its largest property—Vaishnavi Tech Park in Bengaluru at 0.7 million sq. ft. In 2023, it expanded into Tier-2 cities and onboarded global investors like Deutsche Bank A.G. In 2024, it hit ₹1,000 crore in revenue and entered Southeast Asia through Singapore, becoming the only Indian flex space brand to go international.

Today, Smartworks manages 41 centres across 13 cities and 8.2 million sq. ft. It serves over 600 organizations—from unicorns to Fortune 500s—and offers the highest average seat count per client in the industry. With a capital-light, asset-efficient model and deep focus on enterprise needs, Smartworks isn’t just reshaping office space—it’s defining a new asset class in India’s commercial real estate.

What started as a contrarian bet is now a category-defining business. And with its IPO on the horizon, Smartworks is ready to flex on a whole new stage.

Risk factors

Smartworks has pioneered a new model for enterprise-grade flex workspaces—but it isn’t without risks.

1. Concentrated customer profile.

While Smartworks serves 600+ clients, a significant portion of revenue comes from large enterprise accounts. Client churn, contract renegotiations, or delayed expansions from these key customers could materially impact financial performance.

2. Lease obligations and occupancy risk.

Smartworks signs long-term leases and invests in fit-outs upfront. This asset-light but capex-heavy model demands consistently high occupancy (currently 90%) and sustained demand. Any economic downturn or shift in office demand could leave centers underutilized.

3. Market competition.

India’s flex office sector is heating up. While Smartworks leads in enterprise focus, global players like WeWork and local operators like Awfis are scaling aggressively. Sustaining differentiation in service quality, tech, and turnaround time will be key.

4. Expansion and execution.

Smartworks is entering new geographies like Sri Lanka and Tier 2 cities. These markets come with regulatory, operational, and demand-side uncertainties. Rapid scale without process depth could strain service delivery or margins.

5. Macroeconomic exposure.

Being tied to the commercial real estate cycle, Smartworks is vulnerable to broader macro trends: global slowdown, rising interest rates, tech layoffs, or geopolitical volatility—all of which can affect enterprise capex and workspace demand.

6.Enterprise concentration.

Smartworks primarily serves large enterprise clients. While this focus has driven scale and occupancy, it also creates dependence. Contract cancellations, delayed expansions, or defaults from anchor clients could significantly impact revenue visibility and asset utilization.

7.Long-term lease obligations.

The company leases properties under long-term agreements but earns revenue from shorter-term client contracts. This structural mismatch exposes Smartworks to lease liability risk in the event of demand slowdown or rising vacancy.

8.Cyclical demand and macro exposure.

Flex workspace demand is closely linked to economic cycles. A slowdown in commercial real estate, tech layoffs, or global macro uncertainty could delay office expansion plans, impacting occupancy and pricing power.

9.Competitive intensity.

The flex space sector is rapidly evolving, with aggressive moves from both local and global players. Sustaining differentiation in service quality, speed of delivery, and client retention will be critical to protect market share and margin.

10.Execution and expansion risk.

With operations across 13 cities and upcoming international expansion (e.g., Sri Lanka), Smartworks faces execution complexity. Any delay in new center ramp-ups, fit-out overruns, or regulatory hurdles could weigh on financial performance.

Market Opportunity

Supply Tailwind

India’s office market is massive—and fragmented. As of March 2024, India had 841M+ sq. ft. of commercial stock, expected to cross 1B sq. ft. by 2027, growing at a 6.7% CAGR. Nearly 74% of this stock is non-institutionally owned, offering Smartworks a scalable partnership path with passive landlords.

Instead of competing for prime assets, Smartworks unlocks value from large bare-shell or soon-to-be-vacant properties. Properties like Golf View Towers (Gurugram) and Maple Corporate Park (Noida)—once home to global consulting and IT firms—now operate under Smartworks’ managed leasing model. This shift highlights a growing preference among landlords for turnkey, platform-led solutions over traditional leases.

Demand Shift

India’s economic rise, deep talent pool, and cost advantages are making it a global hub for GCCs and MNCs. These enterprises now seek more than just space—they want flexibility, experience, and efficiency.

Flex penetration in non-SEZ stock jumped from 7–9% (pre-2020) to 12–14% by end-2023

59% of occupiers expect 10%+ of their portfolio to be flex by 2026 (vs. 42% in 2024)

75–85% of demand now comes from enterprise-scale deals (100+ seats)

Tier 1 flex stock is growing at 21% CAGR, but Smartworks’ footprint is growing 2.1x faster

With pan-India scale, mid-to-large enterprise focus, and a proven full-building model, Smartworks is uniquely positioned to capture this dual tailwind of landlord interest and enterprise demand.

Asia-Pacific's Office Space Boom

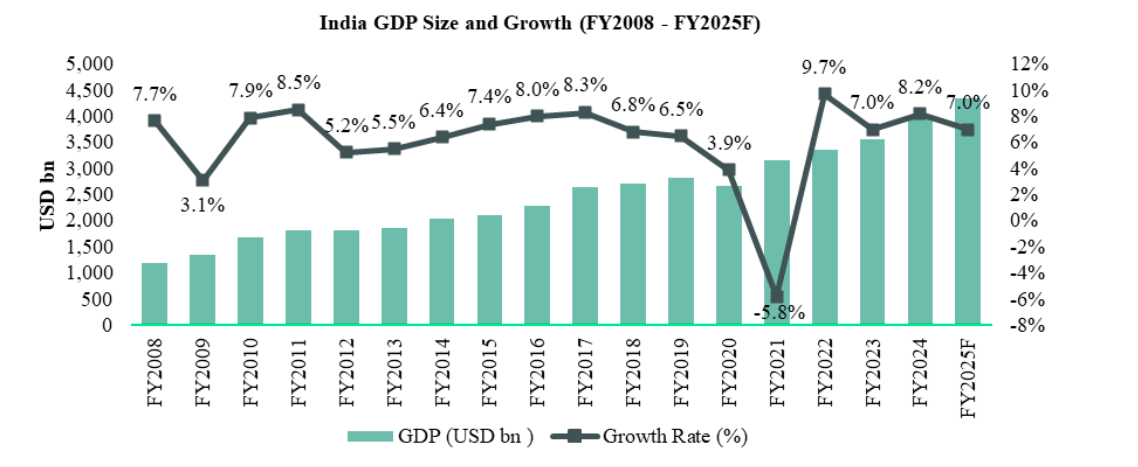

The Asia-Pacific region accounts for 35% of global GDP and over half the world’s population, making it a powerful engine of global growth. With a projected 4.4% GDP growth in 2024 (vs. 3.2% globally), APAC is outpacing the world—driven by resilient domestic demand, services exports, and rapid digitalization.

At the heart of this surge is India, forecasted to grow 7.0% in FY25, fueled by private consumption, infra investment, and tech adoption. India also leads the world in offshoring, with 5.4M people employed in tech services and a commanding 57–58% share in global sourcing.

This tech-led expansion is reshaping office demand:

Hiring in APAC tech hubs is surging, enabled by wage arbitrage and deep talent pools.

Singapore and India rank among the easiest places to do business, attracting global HQs and satellite offices.

Businesses are scaling fast across APAC, creating a strong tailwind for flexible, premium, ready-to-move-in workspaces.

Product

Smartworks is India’s leading enterprise-focused flexible workspace platform, offering scalable, tech-enabled, and fully serviced office campuses tailored to the needs of large and mid-sized enterprises.

Core Offering

Smartworks specializes in leasing large, bare-shell properties in prime business districts and transforming them into modern, fully managed campuses. These spaces are designed to deliver:

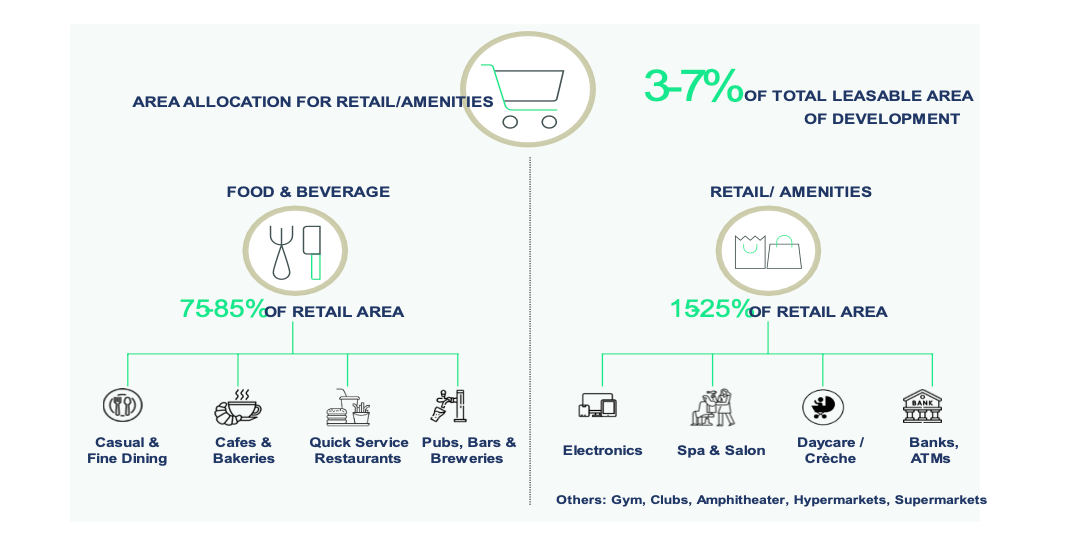

Aspirational and daily-life amenities such as cafeterias, gyms, crèches, convenience stores, and more.

Enterprise-grade fit-outs, tailored to reflect each client’s branding and team structure.

Tech-enabled services, including IoT access, digital workspace management, and real-time analytics via a proprietary app.

The company offers turnkey delivery within 45–60 days, enabling clients to move in with zero capex and minimal operational friction. Seat configurations range from under 50 to over 4,800, with a specific focus on clients needing 300+ seats.

Proprietary Design & Tech Stack

Smartworks uses modular and reusable fit-outs and leverages its integrated, proprietary technology to standardize design, accelerate build-outs, and operate centers efficiently. This allows the platform to offer a one-stop, cost-efficient solution—spanning design, facility management, and IT infrastructure—while delivering financial and capital efficiencies to clients.

Strong Enterprise Traction

Smartworks' product has consistently attracted top-tier enterprise clients. In Fiscal 2024, 89.64% of its ₹9,870M rental revenue came from enterprise clients, with enterprise rental revenue growing from ₹3,062M in FY22 to ₹8,847M in FY24. This reflects strong product-market fit and continued demand from clients with multi-city presence and complex infrastructure needs.

Value-Added Services (VAS) & FaaS

In FY23, Smartworks launched Value-Added Services (VAS) via revenue-sharing partnerships with brands like Chaipoint, Park+, and ClearTax—enhancing the workspace experience through food courts, sport zones, medical centers, and more.

In FY24, Smartworks introduced Fit-out-as-a-Service (FaaS). Leveraging its extensive vendor network and design IP, it now provides tailored workspace build-outs with advance payments, unlocking a high-margin, asset-light monetization channel.

Client Ecosystem

Smartworks creates a mutually reinforcing ecosystem involving landlords, service providers, client companies, and employees. Its business model delivers value to all stakeholders:

Landlords benefit from stable long-term leases and upgraded real estate.

Clients receive capital-efficient, brand-aligned, fully managed workspaces.

Employees enjoy enhanced productivity and well-being in aspirational campuses.

Service partners gain embedded distribution through Smartworks’ footprint.

This network effect enhances retention, drives wallet share, and strengthens Smartworks' position as the partner of choice for India’s enterprise real estate needs.

Smartworks’ client roster includes marquee names such as:

Google IT Services India Pvt. Ltd.

Philips Global Business Services LLP

L&T Technology Services Ltd.

Persistent Systems Ltd.

Groww

MakeMyTrip

Bridgestone India Pvt. Ltd.

Many of these clients have long-term, multi-city relationships with Smartworks, validating the strength and stickiness of its product offering.

Business Model

Smartworks operates a full-stack, asset-light platform transforming large, bare-shell commercial properties into fully serviced, tech-enabled office campuses tailored for enterprise-grade requirements. The company’s model is designed to deliver capital efficiency, design flexibility, and speed-to-market for clients—while creating compounding network effects across stakeholders.

Commercial Real Estate

Smartworks typically leases entire or large floor plates in prime locations under long-term agreements with landlords. These properties are then rapidly converted—within 45 to 60 days—into modern, aesthetically pleasing, and fully managed work environments. Leveraging modular, reusable fit-outs and an integrated proprietary technology stack, the company standardizes design and operations across centers while ensuring flexibility to meet enterprise-specific needs.

Enterprise-Centric Leasing Model

The company primarily serves mid-to-large enterprises with seat requirements of over 300, scaling up to over 4,800 seats. Rental revenue from enterprise clients accounted for 89.6% of total rental income in FY24, underscoring Smartworks’ focus on long-term, high-value B2B relationships. Rental revenue from enterprise clients has grown at a 3-year CAGR of ~60%, rising from ₹3,062 million in FY22 to ₹8,848 million in FY24.

Ancillary Monetization

Smartworks introduced Value-Added Services (VAS) in FY23 and Fit-out-as-a-Service (FaaS) in FY24 to further monetize its existing client base and attract new customers. VAS offerings—delivered via revenue-share partnerships with brands like Chaipoint, Park+, ClearTax, Nutritap, and CloudKitch—include cafeterias, gyms, crèches, convenience stores, and medical centers. FaaS enables customized, advance-paid design-and-build solutions using Smartworks’ extensive design library and vendor ecosystem. Both VAS and FaaS are asset-light, high-margin verticals that complement the core leasing business.

A Reinforcing Flywheel Ecosystem

Smartworks’ model benefits multiple stakeholders:

Clients receive turnkey, tech-enabled campuses with high design quality and wellness-focused amenities—supporting employee engagement, rapid scale-up, and capital-light expansion.

Landlords gain high occupancy, long-term rental income, and property upgrades through a professional operator.

Service partners access a high-density enterprise user base for consistent footfall and monetization.

Employees of clients benefit from enhanced work-life infrastructure, improving satisfaction and retention.

This integrated ecosystem creates reinforcing demand and supply-side network effects—leading to high client stickiness, multi-location expansion, and operating leverage at scale. With a diversified client base including Google IT Services, L&T Technology Services, Groww, MakeMyTrip, Bridgestone, Philips, and Persistent Systems, Smartworks is positioned as the workspace partner of choice for India’s leading enterprises.

Management Team:

Neetish Sarda – Founder & Managing Director

Neetish Sarda founded Smartworks in 2015 and serves as its Managing Director. He oversees the company’s critical operational and growth functions, directing leadership across sales, business development, operations, product, and technology. A science graduate from the University of London, Neetish has been recognized with multiple awards including Co-Working Young Achiever of the Year (Realty+ 2023) and Dynamic Entrepreneur of the Year (Entrepreneur Awards 2023). With over nine years of experience in the flexible workspace sector, he continues to lead Smartworks’ mission to redefine India’s enterprise office experience.

Harsh Binani – Co-Founder & Executive Director

Harsh Binani co-founded Smartworks in 2017 and is the Executive Director. He is responsible for finance, investor relations, marketing, and support functions including HR and accounts. Harsh holds a BA in Economics from Shri Ram College of Commerce and an MBA in Finance from Kellogg School of Management, Northwestern University. He previously worked at McKinsey & Company in Chicago and brings over 14 years of experience in management consulting and the workspace industry.

Atul Gautam – Chairman & Non-Executive Director

Atul Gautam serves as Chairman and Non-Executive Director at Smartworks. He holds degrees in Science and Western History from the University of Lucknow. With over 42 years in banking, including senior roles at Punjab National Bank and the Indian Banks’ Association, he brings deep expertise in financial services and governance to the board. He joined Smartworks in 2024.

V.K. Subburaj – Independent Director

Dr. V.K. Subburaj is an Independent Director at Smartworks. A PhD in Agriculture, he has served as an IAS officer for 33 years, including a tenure as Secretary, Department of Pharmaceuticals, Government of India. He was also a technical member of the National Company Law Tribunal in New Delhi. He joined the Smartworks board in 2024.

Rajeev Rishi – Independent Director

Rajeev Rishi is an Independent Director at Smartworks, with more than 37 years of experience in Indian banking. He holds degrees in Arts and Law from Panjab University and an advanced HR diploma from the University of Michigan. He has previously held leadership roles at Central Bank of India, Oriental Bank of Commerce, and the Indian Banks’ Association. He joined Smartworks in 2024.

Investment

Smartworks’ journey from a single center in Delhi NCR to India’s largest provider of managed office spaces has been shaped by the support of long-term capital partners who share its vision: transforming how India’s enterprises work through fully-serviced, tech-enabled, and scalable workspace solutions.

With two funding rounds to date, Smartworks has attracted a mix of blue-chip private equity investors, global property developers, and high-conviction growth funds—each aligned around a singular thesis: India’s office sector is shifting from fixed, owned assets to flexible, premium managed experiences built for enterprise agility and scale.

Institutional Investors

Series A – Strategic Real Estate Alignment

In October 2019, Singapore-based Keppel Land led Smartworks’ Series A round. As one of Asia’s largest property developers with a strategic focus on commercial real estate and co-working investments, Keppel’s participation brought not just capital but deep sectoral expertise. The partnership supported Smartworks in accelerating its pan-India expansion and standardizing its product experience across Tier-1 cities.

Venture Round – Growth Capital for a Category Leader

On June 11, 2024, Smartworks closed its second institutional funding round led by Ananta Capital, a consumer and enterprise-focused private equity firm. The round saw participation from a syndicate of value-aligned investors including Lendlease, Kili Ventures, and Plutus Capital. Collectively, the capital raised is enabling Smartworks to:

Expand its footprint across new micro-markets and Grade A properties

Invest in its tenant experience layer and integrated technology platform

Strengthen balance sheet capacity to meet rising enterprise demand

Notably, Ananta Capital’s anchor role underscores institutional confidence in Smartworks’ hybrid-flex business model, operating leverage, and ability to serve India’s top corporates at scale.

Competition

India’s flex workspace market is undergoing a strategic shift—from fragmented coworking setups catering to startups and freelancers to enterprise-focused platforms delivering managed office experiences at scale. In this evolving landscape, Smartworks occupies a distinct position.

Smartworks’ primary differentiation lies in its enterprise-first model, full-stack execution capabilities, and asset-light scale strategy. Unlike coworking players that rely on dense seat utilization and short-term leases, Smartworks signs long-term contracts with large corporates—often customizing entire floors or buildings to their specifications.

Key Competitors:

WeWork India

Backed by Bengaluru-based Embassy Group, WeWork India operates in a similar flex space category but focuses on a mix of SME and enterprise clients. Its brand-driven approach and high-end interiors appeal to aspirational tenants, though its global parent’s past financial volatility has led to cautious market perception.Awfis

Recently listed on the stock exchange, Awfis targets a broader segment including SMEs, freelancers, and mid-sized enterprises. It operates with smaller centers in Tier 2/3 cities and follows a slightly different economics model—more focused on volume and utilization than full-floor enterprise mandates.IndiQube & 91Springboard

These players maintain a strong presence in startup-heavy corridors but lack the scale or capital intensity to compete head-on for multi-year enterprise contracts or fully managed campuses.Traditional Developers (DLF, Prestige, RMZ)

While legacy landlords offer Grade-A properties, they lack the tech-enabled services, rapid delivery capabilities, and O&M integration that Smartworks brings to the table. In many cases, Smartworks partners with these developers to lease and manage assets, making them ecosystem collaborators rather than direct competitors.

📊 Financial Comparison (FY23/FY24)

Company | FY24 Revenue (₹ Cr) | EBITDA Margin | Net Profit/Loss | Locations (FY24) | Key Client Focus |

|---|---|---|---|---|---|

Smartworks | ₹713.9 Cr | 15.6% | ₹(35.5) Cr | 41 centers | 100% enterprise |

Awfis | ₹616.6 Cr (FY23) | 14.0% (FY23) | ₹(46.6) Cr (FY23) | 150+ centers | SME + Enterprise mix |

WeWork India | ₹1,300+ Cr (FY23) | ~17% (est.) | Loss (est.) | 50+ centers | Enterprise + startup |

IndiQube | ₹500–600 Cr (est.) | NA | NA | 100+ centers | Mid-market companies |

Differentiation

Smartworks

Targets 100% enterprise clientele with longer lease tenures, improving revenue visibility and reducing churn risk.

Owns fully-managed spaces, ensuring brand consistency and control over experience.

Awfis

Operates a hybrid asset-light model, catering to both SMEs and enterprises, offering affordability and scale but with a higher client churn profile.

Operated under an IPO-light strategy with listing in 2024, but with lower profitability metrics than Smartworks.

WeWork India

Backed by Embassy Group, focused on premium spaces and MNC clients. Largest player by revenue, but burdened by legacy brand risks from its US parent and high operational costs.

Heavy focus on brand, design, and urban presence—at a cost to profitability.

IndiQube

Strong presence in Tier 1 & Tier 2 cities, focused on cost-effective, functional spaces for mid-size teams.

Not publicly listed; limited transparency on financials but growing aggressively in southern metros.

Financials

Smartworks has demonstrated robust top-line growth, improving unit economics, and a clear trajectory toward profitability—all driven by its differentiated enterprise-first model and disciplined cost structure.

Revenue Growth

Revenue from operations increased from ₹178.99 crore in FY21 to ₹713.88 crore in FY24, reflecting a 3.99x growth over three years.

The growth was driven by increased occupancy, expansion across metro cities, and long-term contracts with enterprise clients.

Profitability Metrics

Despite being in a capital-intensive category, EBITDA improved steadily, with FY24 EBITDA at ₹111.45 crore, marking a significant leap from ₹(9.23) crore in FY21.

EBITDA margins expanded from (5.2%) in FY21 to 15.6% in FY24, signaling strong operational leverage and cost optimization.

Net Losses Narrowing

Loss after tax decreased from ₹(115.72) crore in FY21 to ₹(35.49) crore in FY24, showing a ~70% reduction in net losses over three years.

This improvement reflects increased revenue, lower finance costs, and better operating efficiencies.

Cash Flow & Liquidity

Net cash from operating activities improved from ₹(32.78) crore in FY21 to ₹127.26 crore in FY24, indicating stronger cash generation and working capital discipline.

The company held ₹94.41 crore in cash and cash equivalents as of FY24-end, ensuring liquidity to support growth and capex.

Closing thoughts

Smartworks is emerging as a category-defining force in India’s premium flexible workspace segment—delivering a fully managed, tech-enabled office ecosystem tailored to the enterprise. With 8 million sq. ft. under management across 41 campuses and 100% of revenue from large corporates, Smartworks isn’t chasing volume—it’s building the most profitable, scalable, and defensible flex office platform in India.

The bull case rests on structural demand tailwinds, deepening enterprise outsourcing of office infrastructure, and Smartworks’ full-stack execution. Revenue grew 3.6x from FY21 to FY24, gross margins doubled to 34.8%, and the company turned EBITDA-positive in FY24—proof of a disciplined build-to-breakeven model. Smartworks’ asset-light leases, modular fit-outs, and long-term contracts with MNCs offer visibility, margin protection, and low churn. The company’s vertical integration—from space design to tech stack—enables enterprise-grade control and experience, making it India’s answer to Convene or Hana.

The bear case centers on cyclicality and capital intensity. As a lease arbitrage business, profitability hinges on sustained occupancy and prudent expansion. Net losses persist (₹35.5 Cr in FY24), with scale needed to absorb upfront capex and marketing costs. Rising competition from players like Awfis, IndiQube, and WeWork India—some with deeper funding or broader scale—could pressure pricing or limit market share growth. Execution risk remains in expanding into Tier 2 cities and maintaining consistency across properties.

Yet, with Indian enterprises increasingly seeking agile, capex-light office solutions, Smartworks is positioned as the go-to premium partner. Its focus on end-to-end control, operational leverage, and profitability-first scale gives it a defensible edge in a crowded market. As flex space shifts from startup trend to institutional asset class, Smartworks is building a differentiated, long-term platform that could define the future of work for India’s corporate sector.

Here is my interview with Shashank Randev — a seasoned operator turned investor and the Founder & General Partner at 247VC, one of India’s boldest new seed funds. Before launching 247VC, Shashank co-founded 100X.VC, where he backed over 180 startups and helped pioneer the iSAFE note in India.

In this conversation, Shashank and I discuss:

What's one early trait or behaviour in a founder that consistently predicts long-term success?

What’s the one thing most pre-seed founders still get wrong?

Should founders always push for the highest valuation they can get at pre-seed?

How do you handle a situation where a founder wants to raise fast—but the product isn’t ready?

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend.

Tweets of the week

Waymo spent 15 years getting from 90% to mostly autonomous. Companies are about to learn the same lesson..

— Nikunj Kothari (@nikunj)

11:28 PM • Jul 21, 2025

The fastest way to spot a successful person: watch how quickly they make decisions, respond to messages, and turn ideas into action.

Speed is king.

— Leila Hormozi (@LeilaHormozi)

7:00 PM • Jul 21, 2025

I stopped asking people “what do you do?”. I replaced with “what’s your story?” Subtle change of language but leads to a 10x more interesting conversation. You find out what they do and why they do it.

— George Mack (@george__mack)

2:09 PM • Jul 22, 2025

How to increase your luck:

- Read more

- Write more

- Build more

- Meet more people

- Introduce more peopleLuck often comes from putting in more reps.

— Justin Welsh (@thejustinwelsh)

12:02 PM • Jul 20, 2025

Most companies fail at product and distribution but it’s easier to blame distribution.

If you’re failing at distribution, check the product.

— Naval (@naval)

4:40 AM • Jul 20, 2025

Try to be the best version of you

Too many young founders are desperate to be someone else

— Garry Tan (@garrytan)

5:01 PM • Jul 17, 2025

Here are the options I have for us to work together. If any of them are interesting to you - hit me up!

Sponsor this newsletter: Reach thousands of tech leaders

Upgrade your subscription: Read subscriber-only posts and get access to our community

Subscribe to the Life Self Mastery podcast, which guides you on getting funding and allowing your business to grow like a rocketship.

And that’s it from me. See you next week.

Reply